HPF: Financials Exposure Dragging Down Preferred Shares, Avoid

Summary

- The HPF fund holds a portfolio of preferred stocks and corporate bonds.

- The HPF fund holds outsized exposure to preferred shares of financial companies.

- The recent U.S. banking crisis is introducing risk into this seemingly sleepy asset class, as seized regional banks have seen all investors wiped out, including bondholders and preferred shareholders.

- Until the fundamental problem behind regional bank deposit flight is addressed (higher interest rates), regional banks will continue to come under pressure and preferred shares will continue to be sold.

CreativaImages/iStock via Getty Images

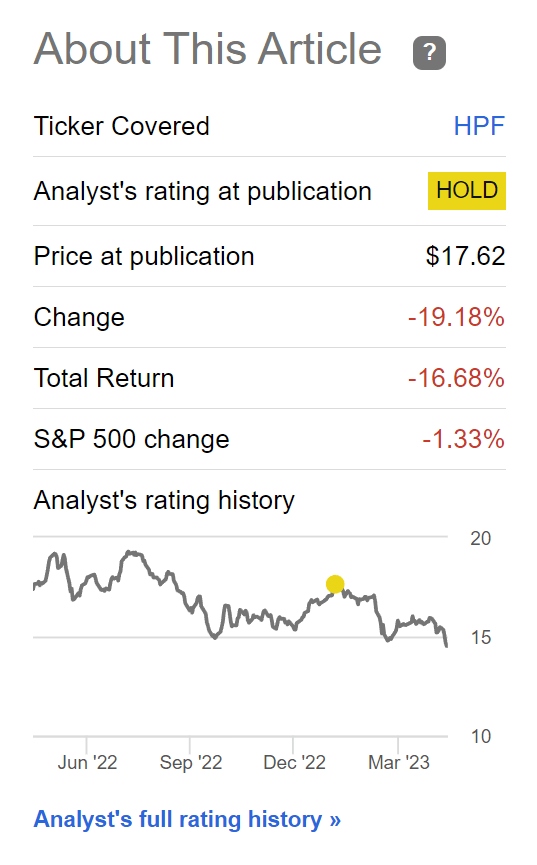

A few months ago, I wrote a cautious article on the John Hancock Preferred Income Fund II (NYSE:HPF), arguing that with modest returns and a high distribution yield, the HPF fund appears to be yet another amortizing 'return of principal' fund. Furthermore, I was concerned about the John Hancock preferred strategies, as they exhibited far higher volatilities compared to peer funds.

While I was cautious on the HPF fund, I was not expecting the fund to plunge by 17% since my article was published (Figure 1).

Figure 1 - HPF fund returns have plunged in last few months (Seeking Alpha)

What happened and is the fund now worth a closer look, after the 17% haircut?

HPF Dragged Down By Financials Exposure

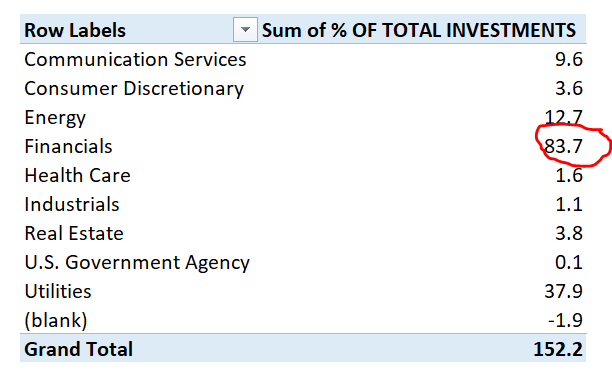

In my opinion, the HPF fund's performance has been dragged down by its outsized exposure in the Financials sector, which accounted for 83.7% of the fund's net investments as of October 31, 2022 (Figure 2. Author's note, although the fund's website claims to have monthly portfolios available for download, the data appears to be from last October).

Figure 2 - HPF sector exposure as of October 31, 2022 (jhinvestments.com)

Assuming no big change in the fund's exposure from October, this suggest that the vast majority of the fund's holdings were securities issued by Financial companies.

Since I wrote my prior article, we have seen an ongoing U.S. regional banking crisis that was sparked by the sudden collapse of SVB Financial in March.

Regional Banking Crisis Explained

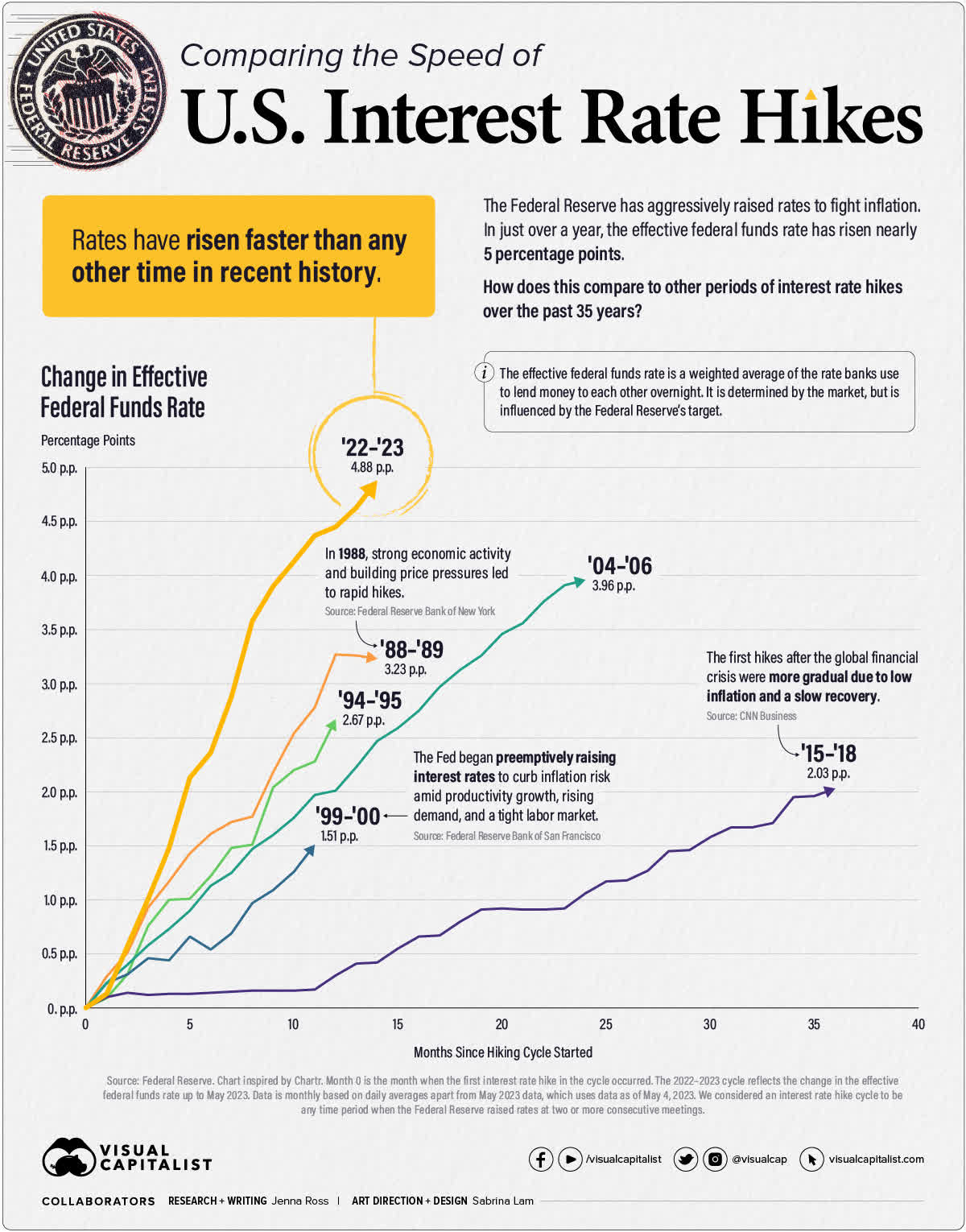

In order to combat soaring inflation, the Federal Reserve embarked on the fastest set of interest rate increases in history, raising the Fed Funds rate by 500 bps in 12 months (Figure 3).

Figure 3 - Recent interest rate hikes have been the fastest in history (visualcapitalist.com)

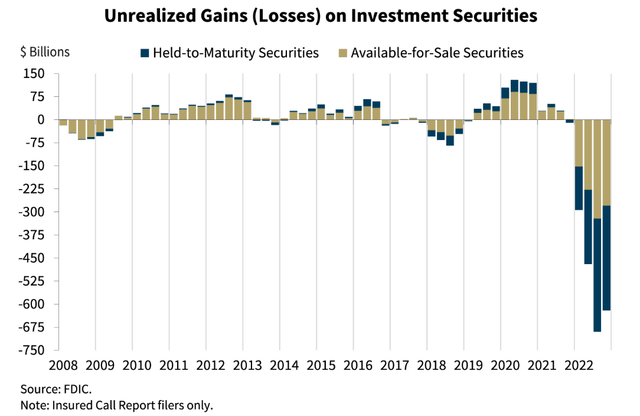

The rapid pace of interest rate increases have caused enormous stress on the balance sheets of regional banks through unrealized losses on fixed income securities like treasuries and mortgage-backed securities ("MBS"). According to data from the FDIC, U.S. commercial banks had a collective $620 billion in unrealized securities losses on their balance sheet as of December 31, 2023 (Figure 4).

Figure FDIC-regulated banks have $620 billion in unrealized losses on securities (FDIC)

In normal times, banks can try to earn their way out of the hole by holding these securities to maturity. Since most of the securities held by banks are of high credit quality (for example, SVB Financial held a lot of agency MBS that have no default risk as they were backed by the U.S. government), these unrealized losses are normally not an issue. The regulators specifically allow banks and other financial institutions to designate securities as 'Available For Sale' and 'Held To Maturity' for this purpose.

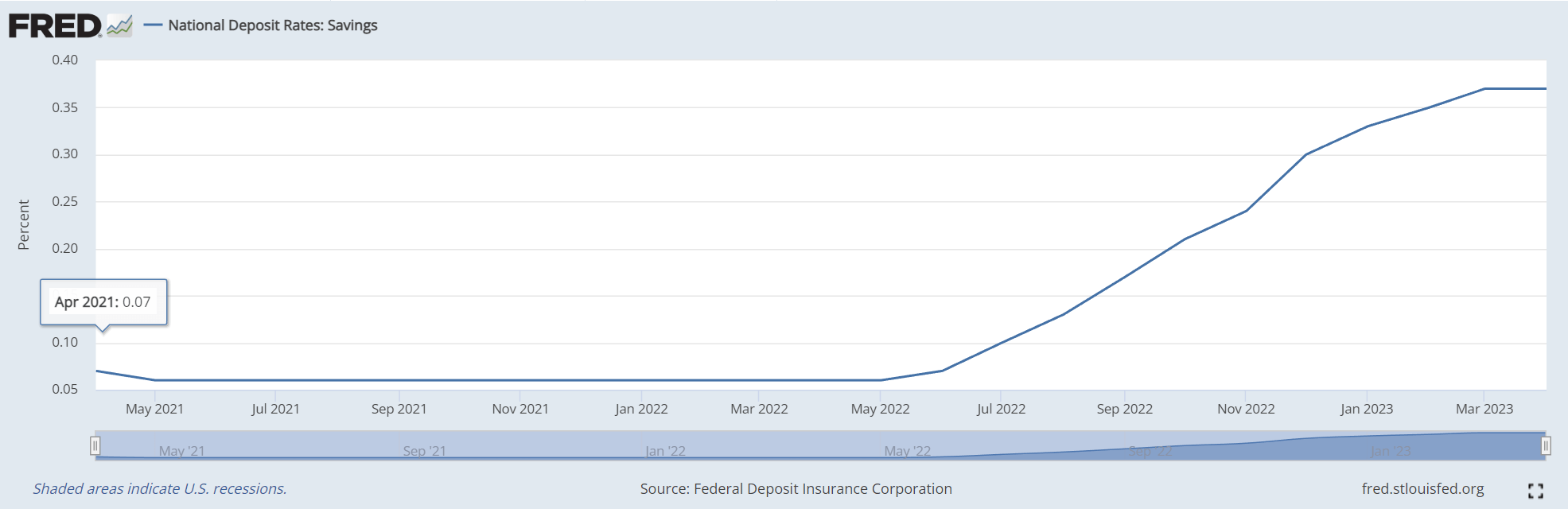

However, the Federal Reserve's interest rate hikes created another set of problems for banks as it boosted the yields on money market funds ("MMF") to levels far above the deposit rates offered by banks. For example, while many MMF are now yielding 4-5%, the average savings deposit rate across U.S. commercial banks is still at 37 bps (Figure 5).

Figure 5 - Average savings deposit rate (St. Louis Fed)

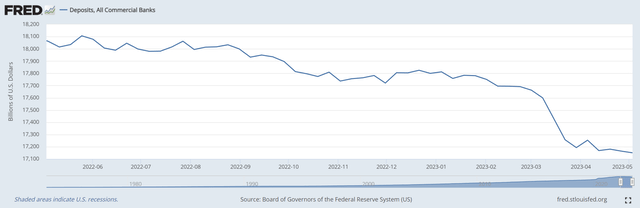

This created an enormous incentive for savvy depositors to take their money out of banks and earn a meaningfully higher yield by buying treasury-backed money market funds. Over the past 12 months, deposits at U.S. commercial banks have declined by close to $1 trillion (Figure 6).

Figure 6 - U.S. commercial deposits have plunged by $1 trillion in past 12 months (St. Louis Fed)

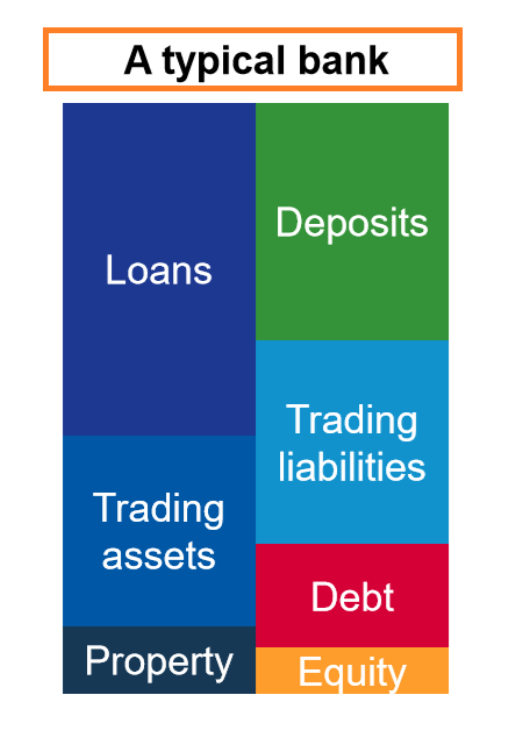

If we look at the balance sheet of banks, when deposits decline, banks can either try to replace the deposits with new liabilities (either higher cost deposits or debt), or they can sell loans and securities (reduce assets) to match the lowered deposit balances (Figure 7).

Figure 7 - Typical bank balance sheet (corporatefinanceinstitute.com)

Unfortunately, with hundreds of billions in unrealized losses, regional banks were in a quandary. If they sell assets, they will have to crystallize the unrealized losses, which will create a massive capital hole requiring new equity to fill. In fact, this is exactly what SVB Financial tried to do initially in March, when it sold a portfolio of securities to Goldman Sachs and tried raise equity. Unfortunately, investors and depositors sensed the bank's weakness and rushed for the exits, creating a bank run that led to receivership by the FDIC.

Another contributing factor to the U.S. regional bank crisis was the fact that the government only insured deposits up to $250,000 through the FDIC. This meant individuals and corporations with account balances above the insurance limit could face a haircut on their deposits if their banks went under. However, money-center banks like JP Morgan, Bank of America, Citigroup, and Wells Fargo are designated Global Systemically Important Banks (G-SIBs) and enjoy an implicit guarantee from the U.S. government as they are 'too big to fail'. This created further incentives for depositors to flee from small regional banks to the money center banks at the first sign of trouble.

Banking Crisis Continues To Simmer

Although the FDIC and regulators appear to have contained the crisis by backstopping all deposits of SVB Financial and Signature Bank, all was not well beneath the surface as many regional banks continued to face deposit outflows.

In fact, as the regional banks started to report their Q1/2023 results, the crisis reignited as some banks saw much larger deposit outflows than analysts and investors were expecting.

For example, First Republic Bank (OTCPK:FRCB), a seemingly well-run regional bank with more than $200 billion in assets, saw an incredible $105 billion YoY decline in deposits when it reported its Q1/23 results. The bank also saw its net interest margin ("NIM") contract from 2.68% in Q1/22 to 1.77% in Q1/23, as it had to raise deposit rates to compete with money market yields.

The disastrous first quarter earnings report sank FRC's shares and the bank frantically tried to find a buyer to stem a bank run. Unfortunately, time ran out for FRC and the bank was seized by the FDIC and sold at an auction to JP Morgan.

How Does Banking Crisis Impact HPF?

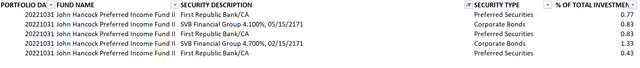

Returning to HPF, the festering regional banking crisis have significantly impacted the fund's holdings. First, according to the October holdings report mentioned above, HPF had 4.2% direct exposure to 2 of the 3 failed banks in preferred shares and corporate bond holdings that are now worthless (Figure 8).

Figure 8 - HPF had exposures to SVB and FRC (jhinvestments.com)

More importantly, preferred shares and corporate bonds of other regional banks have been marked down significantly in the past 2 months, as investors ran for the exits.

Investors have a right to be worried, as in all 3 of the FDIC bank seizures (SVB, Signature, First Republic), all investors, regardless of their seniority in the capital structure (senior debt, subordinated bonds, preferred equity, common equity) were completely wiped out by the FDIC as the government wanted to avoid the appearance of bailing out 'fat cat' investors.

Unfortunately, this creates an environment where anytime a bank shows signs of weakness, investors run first and ask questions later as they do not want to be left holding the bag.

Is Now A Great Time To Buy?

There is an old saying that investors should buy when there is blood on the streets, even when that blood is your own. Is now the time to buy these preferred share funds, since there is copious amounts of blood everywhere?

My personal belief is no, because we have not yet resolved the main driver behind the deposit runs. Recall, the regional banks are under stress because the Federal Reserve chose to raise interest rates by 500 bps in an incredibly short period of time.

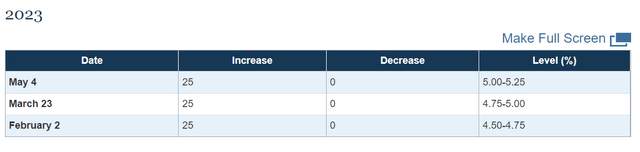

In fact, the Federal Reserve recently raised interest rates by another 25 bps at the May FOMC meeting and suggested interest rate cuts were unlikely in 2023 (Figure 9).

Figure 9 - Fed raised interest rates by 25 bps at May FOMC (Federal Reserve)

In the absence of lower interest rates, the double pressure of unrealized securities losses and deposit flight on regional banks will continue.

Until the situation changes, I believe regional banks will continue to face pressures and potential bank runs, and regional bank preferred shares will continue to be sold.

When Will The Fed Cut Interest Rates?

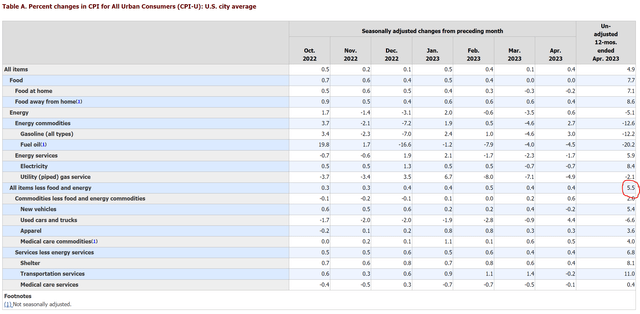

While this is pure speculation on my part, I believe economic conditions will have to deteriorate meaningfully before the Fed will consider cutting interest rates. Simply put, with 3.4% Unemployment Rate and core CPI increasing at an 5.5% YoY rate, the Fed has no room to cut interest rates (Figure 10).

Figure 10 - Inflation is still running hot with core CPI at 5.5% YoY (BLS)

Conclusion

Previously, I recommended investors avoid the HPF fund, as it appeared to pay out more than it earns. However, the ongoing U.S. regional banking crisis is putting further strain on the fund, as it has outsized exposure to the Financials sector.

Until the Federal Reserve and the government addresses the core problems behind deposit flight out of regional banks, preferred shares issued by regional banks will continue to come under pressure which will negatively impact the HFP fund.

I continue to recommend investors avoid the HPF fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.