QYLD: A Risk Factor No One Talks About

Summary

- QYLD is a popular covered call fund attracting interest of income oriented investors.

- It is typically expected to outperform when the market is flat or trending down.

- There are some scenarios where QYLD could have disastrous results.

- While rare, investors should be prepared for those situations.

AUDINDesign

Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) is a very popular fund which also happens to be highly controversial. The fund is controversial not because it engages in questionable tactics or anything like that but because people tend to have strong opinions about the fund one way or another. While some people say that this fund is designed to underperform the markets in the long run, others say that it's a great vehicle for generating income and a decent hedge against a bear market or a sideways market.

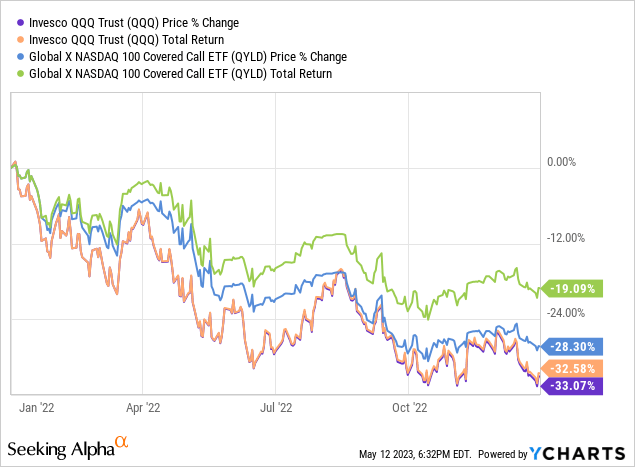

Many people assume that this fund will outperform during a bear market or a choppy sideways market because it generates a premium by selling covered calls. The logic seems simple enough. If QQQ drops 10% in a year and this fund generates 10% worth of premiums from selling covered calls, it should be flat (in total returns) and outperform QQQ. That's what common sense says and that's what happened last year. Even though both QQQ and QYLD saw their value drop by about 33%, QYLD's total return was -19% against QQQ's total return of almost -30%.

However, this doesn't guarantee that QYLD ETF will outperform in every bear market or in choppy sideways markets. There are actually scenarios where QYLD could significantly underperform during a bear market or even a choppy sideways market even though it was designed to take advantage of those situations.

I am specifically talking about prolonged W-shaped markets where the market takes a dive, quickly climbs back up, then takes another dive, recovers again and takes another dive and so on. W-shaped markets are rare but they are possible and if they happen, they tend to cause a lot of destruction in covered call funds.

How? Let me explain. Each month, QYLD sells monthly covered calls exactly at the money which means it gives up all upside. For example, if QQQ's current price in the beginning of a month is $300, QYLD will sell monthly covered calls with a strike price of $300. It will collect about $10 in premiums and that's the maximum amount the fund can gain during the month no matter what happens.

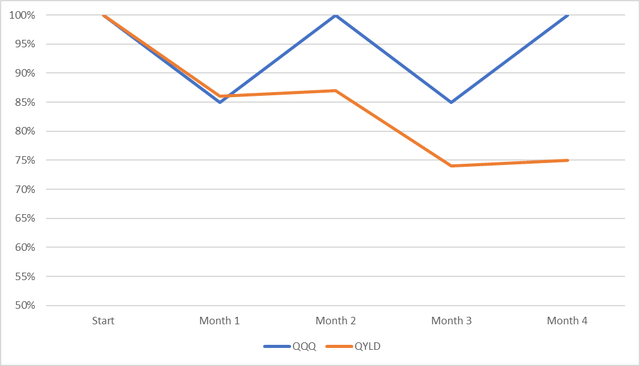

Let's say we are in a wild W-shaped market. In the first month, QQQ takes a 15% dive and drops from $300 to $255. The next month it recovers back to $300. In the third month it drops 15% again to $255 and in the fourth mount it climbs back to $300. So in a four month period, QQQ dropped 15% twice and climbed back to where it was and did 2 round trips. At the end of the 4 month period, QQQ is flat.

Now let's see where QYLD went during this period. First, it sold covered calls at $300 and collected a premium of $10. Next month it sold covered calls again at $255 and collected another $10 in premiums but missed out on the recovery that was enjoyed by QQQ. At the end of the second month while QQQ is back to $300, QYLD is still down about 13% despite the premiums it collected. In the third month while QQQ dropped 15%, QYLD also drops 15% (minus premiums collected) so now QYLD is down 27% while QQQ is down -15%. On the fourth month QYLD sells covered calls at the money again and collects another $10 but doesn't participate in the recovery.

| QQQ | QYLD | |

| Start | $300.00 | $25.00 |

| Month 1 | $255.00 | $21.50 |

| Month 2 | $300.00 | $21.75 |

| Month 3 | $255.00 | $18.75 |

| Month 4 | $300.00 | $19.25 |

If this continued for a couple more cycles you could see QYLD eroding down more than 50% in a matter of few months while QQQ mostly traded back and forth to end flat.

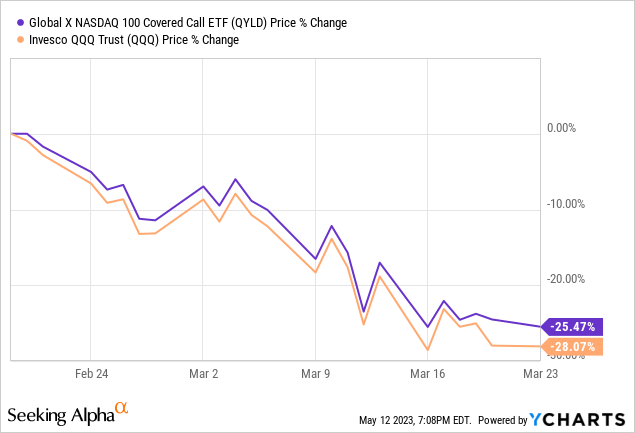

It's been a long time since we had a truly W-shaped market but we can look at how each fund performed during the COVID crash of March 2020 and quick recovery afterwards. First let's look at the initial crash. We see that when QQQ dropped 28%, QYLD dropped 25%. The 3% difference was due to the call premium collected by QYLD which offered very limited amount of downside protection.

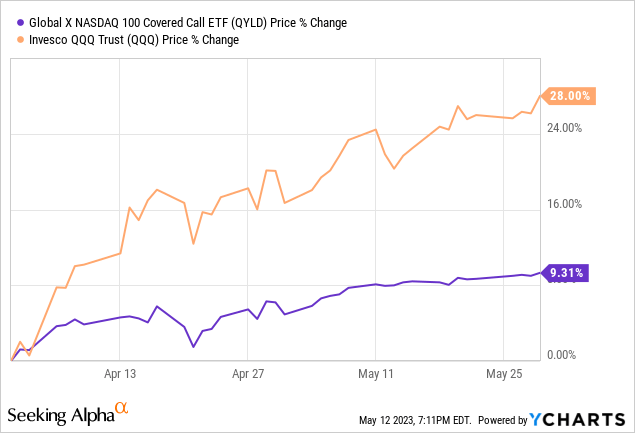

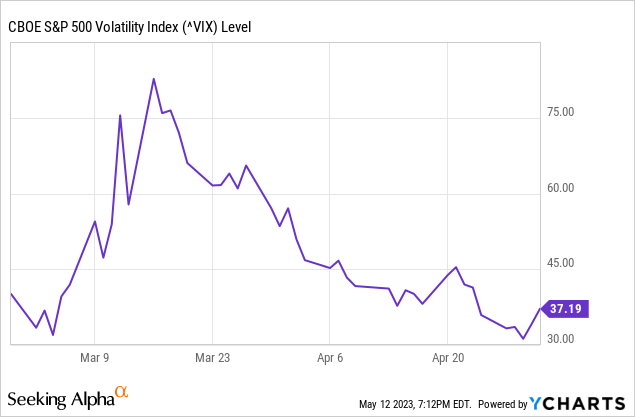

Now let's look at the V-shaped recovery that followed. Notice that in months of April and May, QQQ was up 28% but QYLD was only up 9%. We should also note that during that period VIX was extremely high (second graph below) so QYLD was able to collect higher than average premiums.

If there was a second leg down to March 2020 crash and QQQ had another 25% drop during this time, QYLD would have dropped another 20-23% even though it had barely participated in the recovery. A few more cycles like this could have wiped out most of the fund.

This risk is not specific to QYLD either. It could affect every fund with similar strategy such as QYLD and RYLD. When a fund sells at the money calls against 100% of its positions, it gives up on all upside for a premium. In most market conditions it could work fine but in W-shaped markets or conditions where a market quickly drops and has a V-shaped recovery on the next month, the results will be dramatically worse.

Basically if you are selling covered calls on monthly basis and the share price of the stock rises dramatically your shares will get called and now you have to repurchase those shares at a much higher price. If you bought QQQ at $300 and sold covered calls against it and the ETF rose to $330, now you have to buy new shares at $330 to be able to keep selling calls. Of course most of the calls sold by QYLD are cash-settled but math works out the same.

There are some possible solutions to this problem. For example a fund could sell covered calls against less than 100% of its portfolio. There are funds that do this such as QQQX (QQQX), QYLG (QYLG) and DIVO (DIVO). These funds sell covered calls against only a portion of their portfolio so they participate in upside too. Another approach would be to set call strikes higher when the market is volatile. Other funds such as JEPI (JEPI) and JEPQ (JEPQ) follow this approach. When VIX is higher, they sell their calls above the current price so that their fund can benefit from upside potential. Some of these funds are actively managed which means they can be flexible about how they manage their strategy while QYLD uses a non-flexible automated approach where it sells calls against 100% of its portfolio exactly at the money at all times regardless of market conditions or how VIX is doing.

Now I am not predicting a W-shaped market ahead of us, neither am I telling people to sell QYLD. This fund has a place in a well-diversified portfolio but you should understand what you are buying and how it could act in different market conditions including those rare conditions that come once in a blue moon but can have serious effects on your funds.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QYLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a very small position in QYLD that's less than 1% of my total portfolio value.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.