Barclays: Potential Triple-Digit Upside Opportunity For The Brave

Summary

- Barclays closed an impressive Q1 2023, reporting £2.6 billion of quarterly operating profits.

- Management voiced confidence for the rest of 2023, expecting further revenue growth on the backdrop of NIM expansion.

- In light of all the positivity, I argue that a valuation of ~3x P/E and ~0.3 P/TBV is clearly underpricing the UK bank.

- I upgrade my EPS expectations for BCS through 2025, and I now calculate a fair implied share price equal to $27.42.

hatman12

Barclays' (NYSE:BCS) delivered exceptional Q1 2023 results, reporting about £2.6 billion of quarterly operating profits, and clearly beating analyst consensus estimates with regards to almost every metric. Accordingly, my previous estimate of £7-8 billion of annual profits by 2025 doesn't look like a phantasy anymore, but now almost like a low bar to clear.

Considering BCS's outstanding profitability, which continues to expand on the backdrop of a favorable interest rate environment, I argue that a valuation of ~3x P/E and ~0.3 P/TBV is clearly underpricing the UK bank; and I believe a stock price rerating is imminent.

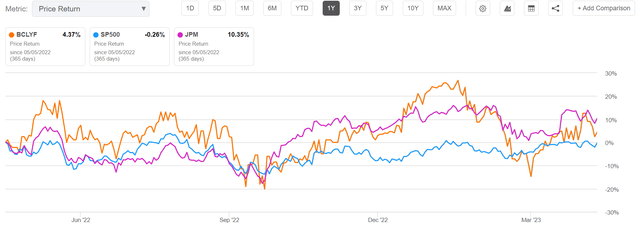

For reference, Barclays stock has underperformed recently versus JPMorgan (JPM): For the trailing twelve months, BCS shares are up about 4%, as compared to a gain of 10% for U.S.' competitor JPM.

BCS' Outstanding Q1 2023

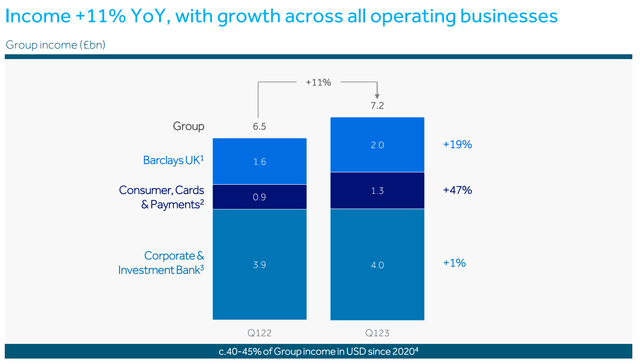

Barclays reported an exceptional Q1 2023, comfortably beating analyst estimates with regards to both topline and earnings. During the first quarter of 2023, Barclays generated approximately £7.2 billion in revenues, up 11% YoY versus the £6.5 billion in the same period of 2022. Notably, Barclays' top line exceeded analyst expectations by nearly £450 million.

In terms of profitability, Barclays' accumulated a quarterly profit before taxes and impairments of £3.1 billion, up close to 29% YoY versus the £2.4 for the same period one year earlier; group net income for the quarter was £1.78, also up 29% YoY.

Barclays' Q1 2023 profitability reflects a post-tax return on tangible shareholders' equity (ROTE) of 15%, versus guidance >10%. Additionally, the bank achieved a cost-to-income ratio of 57%, a favorable decline of 600 basis points compared to the previous year. Barclays' CET1 expanded to 13.6%.

Notably, all of Barclays' operating segments contributed to the strong Q1 results:

- Barclays UK business expanded income to £2 billion, up 19% YoY, mostly anchored on favorable NII expansion, which contributed close to 90% of the segment's growth

- CCP grew revenues by 47%, to £1.3 billion, driven by NII expansion and 30% YoY balance growth

- The Corporate and Investment Bank grew its income to £4 billion (up 1% YoY), despite a super challenging macro backdrop for dealmaking

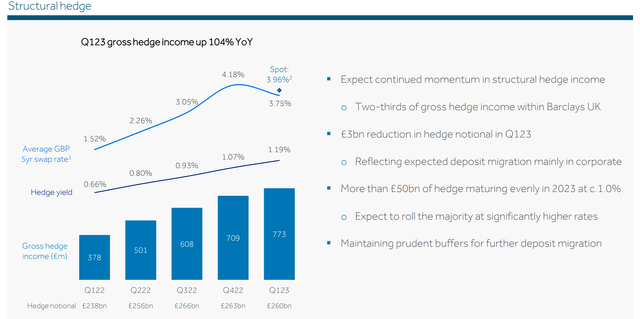

While Barclays had already enjoyed a successful year in 2022, benefiting from a favorable expansion in net interest margin compared to the 2010-2020 decade, I believe that the complete impact of the advantageous interest rate environment will likely become more evident towards the latter part of 2023 or early 2024. So there is still a bit of benefit outstanding.

Now, in the call with analysts post Q1 reporting, management pointed out that the bank expects to see continued tailwinds from interest rate hedge momentum. Notably, Barclays also disclosed that there will be more than £50 billion of hedge maturing in 2023, capital that has been invested at a 1% annual rate. This capital can now be rolled into opportunities that yield ~3.75%, if not more. With that frame of reference, Barclays' management reiterating the previous guidance of greater than 320 basis points NIM for Barclays UK business by end of 2023, suggesting a high likelihood of more than £7 billion of group earnings.

Target Price: Raise To $27.42

Reflecting on a supporting interest rate environment, paired with a solid business model/ strategy execution, I upgrade my EPS expectations for BCS through 2025: I now estimate that BCS's EPS in 2023 will likely expand to somewhere between $2 and $2.2. Moreover, I also raise my EPS expectations for 2024 and 2025, to $2.3 and $2.4, respectively.

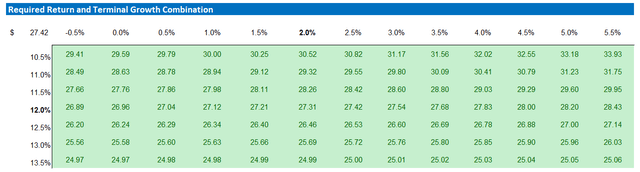

I continue to anchor on a 2.5% terminal growth rate (approximately in line with estimated nominal UK GDP growth to reflect conservatism), but I increase my cost of equity estimate by 100 basis points, to 12%, reflecting the most recent stress in the U.S. banking sector.

Given the EPS update as highlighted below, I now calculate a fair implied share price for BCS equal to $27.42.

Please note that my EPS expectations are only slightly above, or in line, with equity analysts at leading investment houses. Morgan Stanley for example sees 2025 EPS at approximately $2.5/share, while Credit Suisse and JPM estimate the earnings power at $2.3/share and $2.25/share respectively.

Author's EPS Estimates and Calculation

Below is also the updated sensitivity table.

Author's EPS Estimates and Calculation

Risks Associated With BCS

When considering the risks associated with investing in Barclays stock, and banks stock in general, I want to emphasize my belief that the actual risks are lower than what the market perceives. However, it is crucial to acknowledge the potential for heightened exposure to tail-risk events. Should such a risk materialize, it could result in a substantial drop in Barclays' valuation. It is noteworthy that the company's stock price has not yet fully recovered to pre-financial crisis levels. In any case, it is reassuring to note that Barclays maintains a robust Common Equity Tier 1 (CET1) ratio of 13.6%. This ratio serves as a significant buffer for the company, safeguarding it against various market stress scenarios, including severe ones.

Conclusion

Barclays closed an impressive Q1 2023, reporting £2.6 billion of quarterly operating profits. Management voiced confidence for the rest of 2023, expecting further revenue growth on the backdrop of NIM expansion. In light of all the positivity, I argue that a valuation of ~3x P/E and ~0.3 P/TBV is clearly underpricing the UK bank. I upgrade my EPS expectations for BCS through 2025, and I now calculate a fair implied share price equal to 27.42.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BCS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice: this article is market commentary and/ or a reflection of the author's opinion only,

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.