Buy Alert: Grab Attractively-Priced Brookfield And Blackstone

Summary

- BX and BAM are number one and two in alternative assets under management.

- Both are attractively priced right now.

- We look at their latest earnings results and discuss why we think both are worth buying hand-over-fist right now.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

z1b

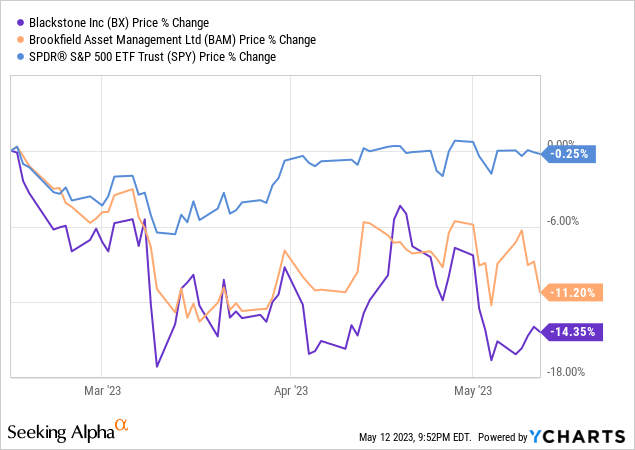

Blackstone (NYSE:BX) and Brookfield Asset Management (NYSE:BAM) are number one and two in alternative assets under management. They are rapidly closing in on $1 Trillion each, with BX at $991.3 billion and BAM at $834 billion. Moreover, both are attractively priced right now given that their stock prices have struggled over the past three months in spite of their continued strong growth:

In this article we look at their latest earnings results and discuss why we think both are worth buying hand-over-fist right now.

BX Stock Q1 Results

BX reported solid Q1 results. Highlights included:

- Assets Under Management were $991.3 billion as of March 31, 2023, meaningfully higher than the $974.7 billion reported at the end of 2022.

- The firm's fee-earning AUM also increased from $718.4 billion to $732.0 billion over the same period.

- The balance sheet remained in excellent shape and BX has almost $200 billion in dry powder, positioning them well for investment opportunities that may come along in the midst of the turbulent macroeconomic environment.

- Q1 distributable earnings per share was $0.97, exceeding analysts' consensus estimate of $0.95, while total net management and advisory fees came in at $1.65 billion in Q1.

- Fee Related Earnings came in at $0.86 per share, while net accrued performance revenues were $5.27 per share, reflecting substantial embedded value in the shares.

BAM Stock Q1 Results

BAM also reported solid Q1 results and reaffirmed guidance for FY 2023. Highlights from the period included:

- Assets Under Management increased once again to $834 billion on the strength of $19 billion in capital raised year-to-date and $98 billion in fundraising over the past twelve months. Fee-Bearing Capital increased 3% sequentially and 14% year-over-year.

- Distributable Earnings climbed 15% year-over-year and Fee-Related Earnings were up 11% year-over-year.

- The balance sheet remains in phenomenal, with $0 debt and $3.2 billion in cash on hand. Management mentioned that it may very well decide to use that cash pile to make an acquisition in the coming months or years whenever it determines it is opportunistic to do so and that such an acquisition would be additive to their previous assets under management guidance.

- The fee stream remains very stable, with 83% of BAM's Fee-Bearing Capital being either long-term or Permanent.

- Management emphasized that its direct lending business appears to have a particularly attractive growth runway with strong investor demand for its products. Moreover, it mentioned that its fundraising has been particularly strong in the Middle East and Asia regions.

3 Reasons To Buy BX Stock & BAM Stock Hand-Over-Fist

With the numbers from their solid quarters in view, here are three reasons why it is worth considering adding BX stock and BAM stock aggressively right now:

#1. Robust Macro Tailwinds

While their growth momentum may be slowing some, we believe that BX and BAM still have strong growth ahead of them. The reason is that alternative assets are still an increasingly popular choice for investors, especially large institutional investors that tend to invest in BX and BAM funds.

This is because alternative investments can offer advantages such as:

- lack of market correlation, providing downside protection

- they generally serve as good hedges against inflation

- they generally throw off substantial and reliable passive income. This makes them especially useful for high net worth individuals who are looking to live off of their investments as well as pension funds and insurance businesses that need a steady stream of income to meet their obligations.

Moreover, sectors like real estate, infrastructure, renewable power, and direct lending all remain quite fragmented and also filled with large scale deals, providing opportunities for deep pocketed and skilled investors such as BX and BAM to invest in areas with limited competition, unlock substantial synergies through mergers and acquisitions, and even implement their operational expertise to generate additional alpha for investors.

Last, but not least, sectors like infrastructure and renewable power are in need of enormous investment in the coming years and decades, providing a strong tailwind to existing high-quality assets (which BAM and BX own in spades) as well as enormous development opportunities which can result in outsized returns.

Moreover, both have very diversified business models, giving them numerous avenues for generating growth.

#2. Strong Competitive Positioning

As the number one and two alternative asset managers with large global presences, including having boots on the ground in many of the countries in which they operate, both BX and BAM have an extremely strong brand and relationship network from which to continue generating robust fundraising, especially when taken in tandem with their aforementioned well-diversified business models.

As BAM's CEO Bruce Flatt pointed out in his latest letter to shareholders:

In virtually all sectors... there are up to 10 industry leading players in the world. These firms are able to drive profitable growth over extended periods and across market cycles. And while the membership of this group does change from time to time, those that execute well are much more likely to maintain their position.

The attributes of leading asset managers are strong investment performance over a long period of time; access to scale capital; fund and geographic diversification; and a large-scale organization to service clients and capture future growth trends. Similar to the other major industries, there are only a handful of alternative asset managers who have these attributes today.

Our $825 billion of total assets under management, our ability to raise $75 to $100 billion annually for investing, and our ability to offer compelling co-underwrite and co-invest opportunities at scale, makes us one of these major players. We feel exceptionally privileged to be in this category and work hard every day for our clients and partners to ensure we stay there.

The same can also be said of BX.

#3. Attractive Valuations

The value propositions for both stocks are quite straightforward.

BX's estimated forward dividend yield is 4.9% and it is expected to grow Distributable Earnings per share at a 7.4% CAGR over the next five years. Assuming a constant valuation multiple, that provides a clear path to ~12% annualized total returns backed by a very strong balance sheet and competitively positioned business.

BAM's forward dividend yield is 4.2% and it is expected to grow by at least 15% per share per year over the next half decade, giving it an even more compelling total return profile relative to BX. It also has a stellar balance sheet and a competitively positioned business.

Investor Takeaway

While the space is not currently enjoying nearly the pace of fundraising growth nor asset appreciation that it has over the past decade, there are still plenty of macro tailwinds to fuel strong growth for the best-positioned alternative asset managers for many years to come.

We think that both BX and BAM are arguably the two best-positioned alternative asset managers to continue generating robust growth and therefore are worth buying right now. We rate BAM a Strong Buy and BX a Buy. As such, while we think BX is a worthwhile holding, we favor BAM along with two other alternative asset managers that offer high yields and even stronger growth potential.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point and a Masters in Engineering from Texas A&M with a focus on Computational Engineering and Mathematics. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.