Altria: The New Normal

Summary

- Altria remains a compelling investment opportunity for conservative income investors.

- It has control over its own destiny with a portfolio of reduced risk products.

- Investors could greatly benefit from a "new normal" of high yield and low valuation through compounding returns.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

krblokhin

There are plenty of high yielding stocks on the market today, and I don't see that changing anytime soon, with Fed being stubborn around interest rates. Perhaps we are in a new normal of high yield, and there's nothing wrong with that.

Accumulating quality high yield stocks such as those in the REIT (VNQ), MLP, and Consumer Staples sectors can be greatly beneficial, especially if one has fixed costs like fixed rate mortgages that are locked in for the next decade or beyond.

Moreover, Bank of America (BAC) recently outlined risks around the potential for a full-blown recession this year, and as such, it may be a good idea to start building multiple cash flow streams outside of one's primary income source.

This brings me to Altria (NYSE:MO), which I last covered here in October. The share price has only risen by 2% since my last bullish take on the stock, but it's given a 6% total return thanks to dividends.

In this article, I highlight recent developments and why Altria is currently a great high yield value stock while the market appears to be sleepy around it.

Why MO?

Altria recently made waves with the announcement of its Njoy acquisition. While it does come with a steep price of $2.75 billion, it should be able to easily finance this deal from the $2.7 billion that it's getting from Philip Morris International (PM) as a "severance" payment for ending the IQOS distribution agreement.

Moreover, MO is putting the Juul fiasco behind it, with the recent $235 million settlement to resolve Juul-related cases. While MO no longer holds an equity interest in Juul, it's received in exchange nonexclusive rights to Juul's heated tobacco intellectual property.

It's too early to tell what MO will do with this IP, it leaves the door open for MO to develop its own heated tobacco product down the road. While it may seem that Philip Morris International has an insurmountable lead in the heated tobacco space, it's important to keep in mind that this is still a nascent technology that was in its infancy just 5 years ago. Plus, the vast majority of smokers, especially in the U.S., haven't yet made the switch, meaning that plenty of market share remain up for grabs.

Near-term risks to Altria include volume declining by 11.4% YoY during the first quarter. This is after very mild changes in volume during the 2020-2021 pandemic period. Moreover, the volume decline isn't the same industry-wide, as consumers are clearly downtrading to cheaper brands from the likes of Imperial Brands (OTCQX:IMBBY), which is seeing a far lower volume decline in the low single digit over the same timeframe.

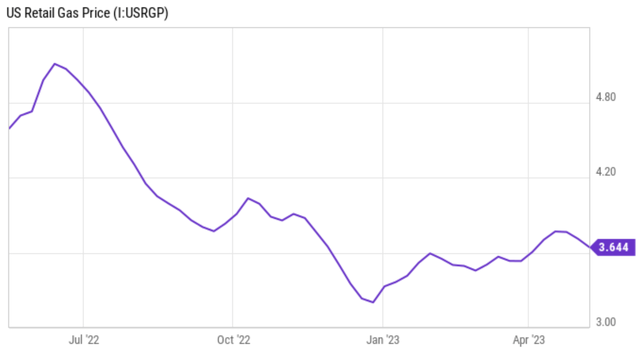

Plus, tobacco consumers are generally sensitive to gas prices, and as shown below, the average price per gallon of gas in the U.S. has greatly moderated since reaching highs last year.

Importantly, MO remains a highly profitable enterprise due to price inelasticity (pricing power) of its products, which contributed to respectable 5.4% YoY growth in adjusted EPS during the first quarter. Looking ahead, MO's on! Nicotine pouch brand could be a meaningful growth driver down the road as it continues to see strong growth, with 38% YoY growth in shipment volume during the first quarter.

Plus, while Njoy is a distant third in the vaping category, it is the only vape to be authorized for sale by the FDA at present. It also has limited availability, and MO could greatly change that by positioning the product across its distribution network.

It's also worth mentioning that its deal with Japan Tobacco (OTCPK:JAPAY) to distribute heated tobacco sticks with the Ploom X device has promise, but that is at least a couple of years away.

MO's management expects a compound EPS growth rate in the mid-single digits through 2028 and grow its smoke-free volumes by at least 35% over the next 5 years from a base of 800 million annual units. This is expected to result in a near doubling of smoke-free net revenue to $5 billion by 2028.

At the same time, management expects to maintain capital discipline, which includes retiring $1.3 billion worth of debt in February and a target debt to EBITDA ratio of 2.0x by 2028.

Meanwhile, investors get to 'njoy' a high 8.2% dividend yield that's covered by a 76% payout ratio. MO is also a dividend king with 53 consecutive years of raises under its belt and has a 5-year dividend CAGR of 7.2%.

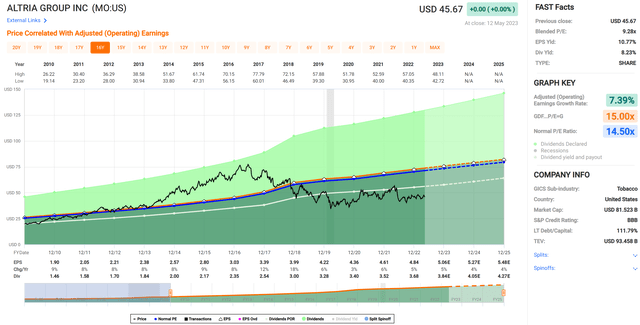

At the same time, MO's stock price has been rangebound over the past 6 months, and currently sits at the lower end of that range at $45.67 with a forward PE of just 9.05, sitting well under its normal PE of 14.5. Analysts have a conservative price target of $49.77, representing a potential 17% total return over the next 12 months.

Investor Takeaway

Altria Group remains a compelling investment opportunity for conservative income investors. Its stock currently trades at a wide discount to its historical average valuation and offers an attractive 8.2% dividend yield that's well-covered by growing earnings.

Plus, MO has the ability to chart its own course with reduced risk products with full ownership of a vaping device that's FDA authorized, a fast-growing nicotine pouch brand, and heated tobacco distribution with Ploom X down the road.

Lastly, MO investors could greatly benefit if the low valuation and high yield is the "new normal" for Altria stock, considering the high income and potential for accretive share buybacks. As such, MO could give investors potentially strong total returns from here.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.