PacWest Bancorp's Painful Plunge

Summary

- Shares of PacWest Bancorp took a beating after the company filed its 10-Q that showed some interesting subsequent events.

- Although some of the news was good and other news was neutral, the picture has shown signs of worsening in recent days.

- This truly is a binary prospect and investors would be wise to weigh the risks of it carefully before going long or short the stock.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

da-kuk

The volatility just keeps coming when it comes to small regional bank PacWest Bancorp (NASDAQ:PACW). After the company released its 10-Q on May 11th, shares of the business plunged, closing down 22.7%. This move lower was driven by some interesting and mostly negative disclosures the company provided in the aforementioned release. In short, the bank continues to be under pressure and there is an elevated risk that it will not survive for the long run. This does not mean that the company is destined to collapse. But it does create an incredibly binary scenario that investors will want to weigh before they decide to purchase stock in the company, to short it, or to stay away from it entirely.

Mixed, but mostly negative, developments

In late April of this year, the management team at PacWest Bancorp announced financial results covering the first quarter of the company's 2023 fiscal year. In the days that followed, I performed an analysis of my own on the company to determine just how good or bad the picture was. In that analysis, I recognized that there were renewed concerns about the ability of the company to stay afloat in the long run. This was offset only marginally by the significant upside potential that the company offered in the event that it did not collapse. Because of this incredibly binary scenario, I ended up down grading the PACW stock from a ‘buy’ to a ‘hold’.

It's not terribly common for significant details to come out in a company’s 10-Q that were not already provided in the earnings release in question. But given how rapidly the banking sector is changing and the fact that a lot of the consternation that's bubbling up involves PacWest Bancorp specifically, it shouldn't be a surprise to see additional disclosures. Before we get to the 10-Q disclosures, however, the company did provide investors one update earlier this month.

As of early May, there was some optimism that the worst was over for PacWest Bancorp. According to management, core customer deposits as of May 2nd totaled roughly $28 billion. That's a modest improvement over what the company ended the first quarter of the 2023 fiscal year at. In addition to being a vote of confidence in the business by its depositors, the company was also happy to state that 75% of those deposits were insured. That was up from 71% at the end of the most recent quarter and compared to 73% on April 24th of this year. This means that, even if deposits experience another outflow, the risk of a bank run is smaller than a scenario in which insured deposits make up a smaller portion of overall deposits.

There were some other interesting tidbits in that announcement as well. For starters, the company said that it had recently paid down $1 billion of borrowings using the excess liquidity that it had. This is always great to see since this means a reduction in interest expense and would only normally be a vote of confidence. In addition to this, management reiterated that they were exploring strategic asset sales. They clarified in this press release that this included moving the $2.7 billion Lender Finance loan portfolio from being classified as held to maturity to being held for sale. Any sort of proceeds from this kind of transaction could be used to pay down short term borrowings that the company has from regulators that were initially brought on to serve as a plug on customer deposits.

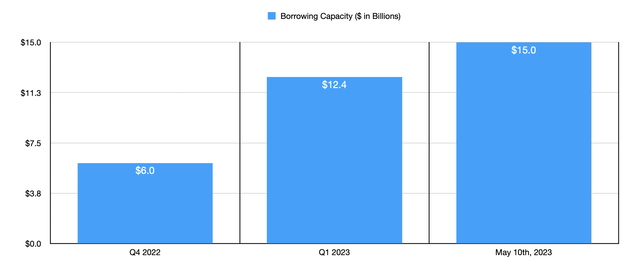

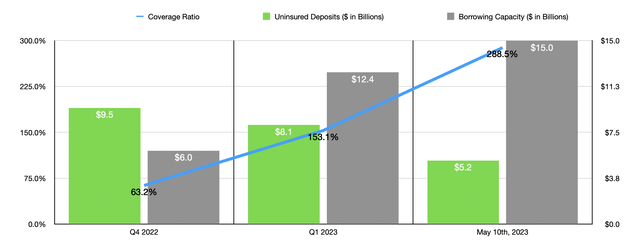

Based solely on the developments announced up to this point, one could make the case that the picture for PacWest Bancorp and its investors was improving. However, this perceived improvement took a step back when the company released its 10-Q a few days later. In that filing, management said that they had, on May 5th, declared distributions for both common and preferred shareholders. Again, that's another vote of confidence. But where matters turned south was where the company stated that, on May 10th, it pledged an additional $5.1 billion of loans to the Federal Reserve Board in order to get access to another $3.9 billion of additional borrowing capacity under its existing discount window borrowing facility.

This brought the company's total liquidity, which consists of on balance sheet liquidity and unused borrowing capacity, up to $15 billion. Almost certainly, some of this increase in liquidity was driven by the company's decision on May 5th to transfer $384 million of loans that were classified as how to maturity to being held for sale and completing $431 million of loan sales in the days leading up to and including May 5th. Notably, while the company did experience a charge off of $12.2 million with the $384 million loan transfer, it did book a modest $0.1 million gain on the loan sales. This shows that, at least with small amounts, the company has not had to take any significant haircuts that would be indicative of fire sales.

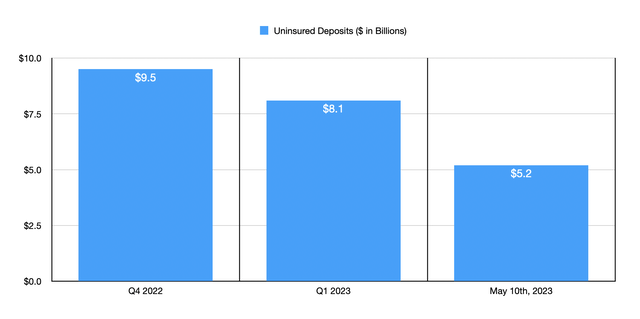

These changes on their own were not necessarily a problem in and of themselves. Rather, it's why the company made them that is the issue. During the week ending May 5th, according to management, total deposits fell by 9.5%. Most of that occurred in the last two days of that period. This was in response to news reports on May 3rd that the company was exploring ‘options’ and having talks with various parties. These discussions centered in part around a potential sale of the business. And as we have seen with recent transactions, this often results in a material loss of value for shareholders. So although there might not have been a fundamental problem with the company, the perception that it might still be in trouble was enough to cause depositors to panic. If there is a good side to this, it's that this panic resulted in a further decrease in the uninsured deposits that the company has. Overall uninsured deposits totaled $5.2 billion on May 10th. That's down from the $8.1 billion that the company had at the end of the first quarter. Keeping all else the same, the lower that uninsured deposits are, the lower risk the company has of a terminal bank run.

Takeaway

Based on the data at my disposal, I remain quite torn when it comes to PacWest Bancorp and its ability to survive. It truly is a binary scenario where investors who do put their money in today will either make a tremendous amount or will likely lose it all or most of it. Because of this risk to reward pay off, and the fact that what happens with the company is based less on fundamentals and more on perception, I do believe that a neutral stance is appropriate at this time. So because of that, I have decided to rate it a ‘hold’ with the caveat that any investor who's not comfortable with a very dangerous risk-to-reward ratio should consider allocating capital elsewhere.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.