It's The Stock Market Bears Betting On Big Fed Rate Cuts

Summary

- The Fed has room to pause based on an encouraging inflation outlook but is likely not in a rush to cut.

- An aggressively dovish pivot by the Fed as soon as July would likely require an unlikely deep deterioration in the macro backdrop.

- The soft landing scenario based on resilient economic conditions with the Fed projecting confidence may be the more bullish scenario for stocks.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

Chip Somodevilla

The Fed's next step in interest rate policy continues to be intensely debated. Following what has been a historic rate hiking cycle over the past year, comments by Chairman Powell in recent meetings have opened the door for a looming pause, while remaining coy about the timing.

Favorably, inflation has continued the "disinflationary process", cooling significantly from its peak, with the latest April CPI at 4.9% even surprisingly lower compared to the consensus. An argument we have made is that further tightening with higher rates is unnecessary for inflation to continue stabilizing lower.

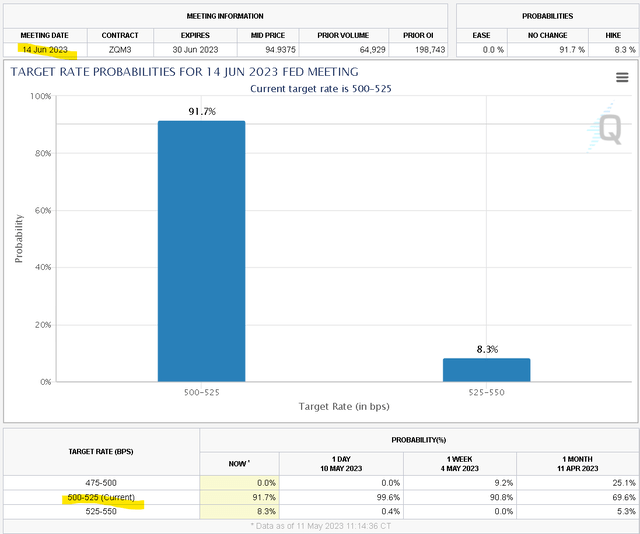

The broad consensus right now is that the Fed will hold rates through the June 14th FOMC, marking an important shift in the cycle. Indeed, according to CME FedWatch Tool, Fed Funds Rates futures imply a 92% chance that the Fed will leave the rate at 5.25%, also reflecting not only the improved inflation backdrop by also a sense of caution eyeing the turmoil in the banking industry.

Bears Have Problems

At the same time, this trajectory faces some skepticism from others pointing to a particular category of inflation or various core measures that has remained stubbornly high. The concern among that group is that inflation somehow re-accelerates, forcing the Fed to make an about-face and hike even higher with deeper consequences for the economy.

Such a remote scenario into extreme stagflation would likely be very bearish as it relates to the stock market because it goes completely against the current market baseline, forcing a repricing of risk assets.

Another possibility that would also represent a major bearish headwind for the stock market would be more of a deflationary type of deep recession, where economic indicators quickly deteriorate and unemployment surges. We haven't seen that.

Ultimately, most stock market bears looking for the S&P 500 Index (SPX) to retest the 2022 lows are going to teeter toward one of these camps; either preparing for a stagflationary nightmare or predicting a doom-and-gloom economic crisis.

Bulls Are On the Right Side of The Trade

We've been vocal with a bullish case for stocks over the last several months centered around a "soft landing" scenario in which we define an environment where inflation is cooling off while economic conditions remain resilient.

We can point to the strong labor market with the unemployment rate at a historical low and even the global PMI that has quietly climbed to a 16-month high, as reflecting an underlying strength in the economy.

A big theme during the Q1 earnings season was the ability of companies across sectors to manage margins in support of profitability ahead of expectations. A path for companies to continue outperforming expectations as interest rates stabilize and growth rebounds into 2024. We can reaffirm those views here and expect the market to move higher

What Will The Fed Do Next?

The juxtaposition between the bull and bear case for stocks helps frame the setup as to what market pricing is implying. Here is where we get into the uncertainty of how the Fed's policy will progress particularly beyond the June meeting.

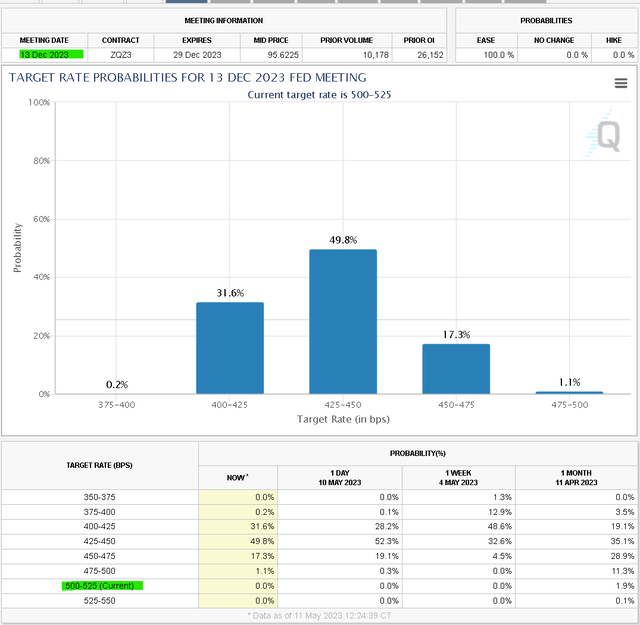

The same CME FedWatch Tool shows that the market is 100% convinced the Fed will cut rates this year. Looking ahead to the final December 13th FOMC, the market is implying an 82% probability the Fed Funds Rate ends 2023 at 4.5% or lower. Assuming a typical 25 basis point move, the market believes there is a 50% chance of at least 3 rate cuts and a 32% chance of 4 cuts over the next five Fed meetings.

The reasoning behind that pivot lower is open to interpretation, whether you are an optimist or pessimist.

As we see it, more favorable inflation indicators over the next few months would justify a cut backed by the confidence that lower rates will not spark any new inflationary pressures.

Notably, we believe this scenario is on the table and does not require significant further economic weakness. The CPI can trend lower while the labor market remains stable and the economy chugs along. This would effectively mark the Fed's success in stamping out inflation, allowing credit conditions to recover as a positive backdrop to the operating environment for companies in all sectors.

On the other hand, with a glass-is-a-half-empty view, one might argue that the Fed will be forced to cut this year because economic conditions are unraveling and easing becomes necessary to maintain financial stability.

A July Rate Cut Would Be Bearish

What we are attempting to demonstrate is that a Fed rate cut in 2023 could be connected to both bullish and bearish stock market scenarios, depending on how the data evolves.

In our view, delaying the first-rate cut into later this year is more consistent with a backdrop of an economic soft landing scenario alongside a gradual path lower in the CPI.

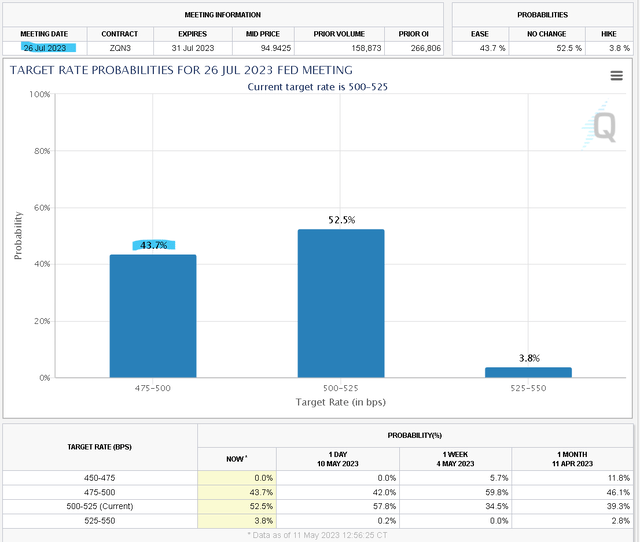

By this measure, we'll make the case that the market is simply wrong for placing such a high 44% chance of a first Fed rate cut in July. Outside of some spectacular reset lower in the May and June inflation readouts, such an aggressive dovish reversal would likely require a significant deterioration of economic conditions between now and July.

Stock market bears looking for a "Lehman 2.0" momentum where everything breaks down would welcome an immediate rate cut which would be viewed as coming from a position of weakness by the Fed. By this measure, a July rate would be a bearish development for the market because it would reflect poorly on financial market conditions.

As bulls with an expectation for stocks to run higher, the Fed pausing in June and holding steady at 5.25% through the July or September meeting would project confidence in the economy as a more bullish tailwind for stocks. This sort wait-and-see approach by the Fed in terms of not declaring victory too soon would be consistent with its recent messaging.

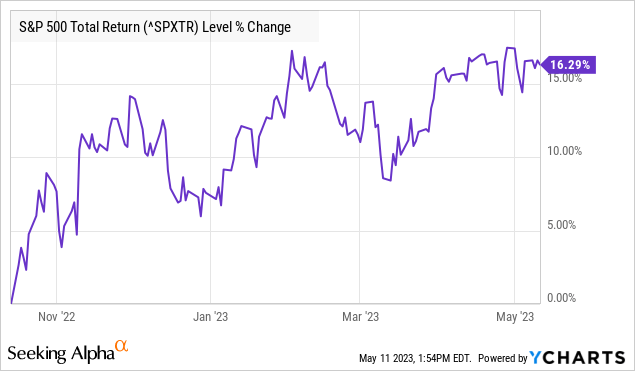

Where Will The S&P 500 Go Next?

We've presented a pretext where it's the stock market bears that are the ones looking for rate cuts. Bears sort of need a "hard landing" to materialize, sooner rather than later, as a catalyst for the market to break down.

In the meantime, bulls can sleep well at night knowing the hard market data in the indicators that matter are moving in the right direction. Continued strength in the labor market, with resiliency in another economic indicator, while inflation trends lower ends up being more bullish for stocks compared to implications of an abrupt dovish pivot.

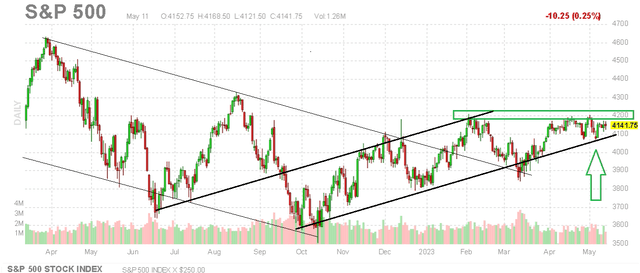

We see the S&P 500 breaking out higher from the $4200 area of technical resistance that has been in place over the last several months. Cyclical names including high-growth companies among still-beaten-down stocks are likely best positioned to lead higher in the next stage of the bull market.

To the upside, even as $4300 representing the 52-week high is the next natural target, we see room for even stronger momentum pushing toward $4500 over the next few months. As long as SPX remains above ~$3,950, the longer-term momentum remains positive.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.