The Ultimate Kryptonite For REIT Shorts

Summary

- Over the last few months, we’ve seen a growing number of short sellers enter REIT-dom as it’s somewhat of a perfect storm.

- Inflation, rising rates, a banking crisis, and a CRE (commercial real estate) meltdown (as the media describes) have given short sellers a perfect canvas for painting their fear-based short pitch.

- I want to provide you with what I believe is the Kryptonite that will stop them in their tracks.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Devrimb

This article was published on iREIT on Alpha on Wednesday, May 10, 2023.

According to Wikipedia, Kryptonite is "a fictional material that appears primarily in Superman stories" and in its "best-known form, it is a green, crystalline material originating from Superman's home world of Krypton."

Superman's greatest weakness is often considered to be Kryptonite, because it de-powers the superhero, so any villain who uses it against him will steal his powers and make him useless.

Over the last few months we've seen a growing number of short sellers enter REIT-dom as it's somewhat of a perfect storm.

Inflation, rising rates, a banking crisis, and CRE (commercial real estate) meltdown (as the media describes) has given short sellers a perfect canvas for painting their fear-based short pitch.

I don't dismiss these short sellers either, especially if they have a verifiable track record, because sometimes I can learn from them.

However, I want to provide you with what I believe is the Kryptonite that will stop them in their tracks.

The Kryptonite for REIT Shorts

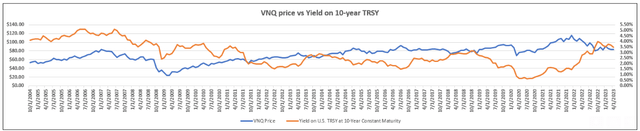

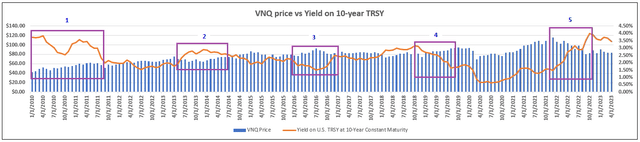

Generally speaking there's an inverse relationship between interest rates and market prices, in particular high yielding or long duration stocks. This is not a perfect relationship since sometimes both interest rates and market prices drop or rise together.

An example of this is during the Great Financial Crisis.

Toward the end of 2008, REIT prices plummeted, and interest rates fell sharply. REIT prices fell, along with most other stocks, due to the uncertainty in the banking sector and at the same time rates were cut to help stimulate the economy.

However, on average there's an inverse relationship. I used Vanguard Real Estate ETF (VNQ) as a proxy for REITs and the yield on 10-year Treasury securities as a proxy for interest rates.

FRED / Yahoo Finance (compiled by iREIT)

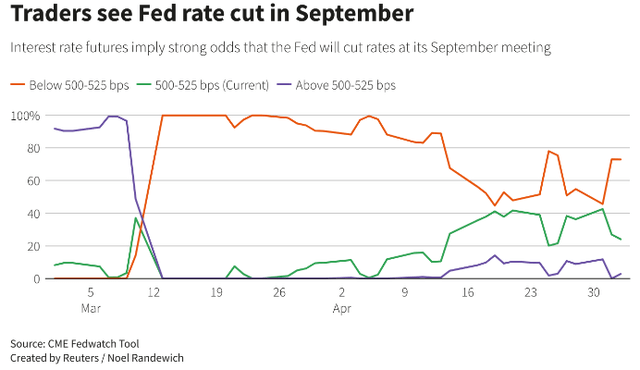

Now the last thing I want to do is try and predict macro-economic events, but the general consensus is that we're nearing the end of the Fed rate hike cycle. Once the Fed pauses, or even begins to cut rates, it should provide a strong catalyst for REITs to return to their normal valuations, all else being equal.

Now there's no guarantee on how or if the Fed will adjust its monetary policy, and there's no guarantee when rates come down that REITs will return to their normal valuations, but we can look at historical trends and I would say that it's more likely than not that REITs will benefit from multiple expansion and return to their normal valuations when the Fed pauses or cut rates.

So what implications might this have on traders that hold a short position?

Anytime someone shorts a stock they have to buy it back at some point. Their goal is to buy it back for less than they sold it for, but sometimes the price action doesn't go their way so they will cover their short by buying the stock to flatten their position.

One of the downsides to holding a short position is that your losses can be unlimited. If you're long a position and it goes to zero, then all you can lose is the money you invested.

However, if you're short on a position, there's no limit on how much the stock can appreciate and how much you will have to pay to cover the short. So if the Fed pauses or cuts interest rates and REITs start to appreciate rapidly, it could cause panic for short sellers, motivating them to cover their position, or what some might call a "short squeeze."

In my view, right now is one of the best times in recent memory to buy REITs given the deep discounts that they are trading at along with the strong probability that we are at the tail end of the rate hike cycle.

But there may be even more potential for REITs that have a high level of short interest if prices are rising and short sellers are buying to cover. If the Fed does cut interest rates, it could indeed be the ultimate kryptonite for short sellers.

Let's take a look at a few of the REITs that fall into this category:

Medical Properties (MPW) - Short Interest: 19.48%

MPW is an equity REIT that primarily owns hospital properties that are leased to operators on a net-lease basis. They own or have an ownership interest in 444 properties that contain approximately 45,000 licensed beds and have properties located in 31 U.S. States and 10 countries.

There have been multiple short campaigns waged against the company for over a year now from firms like Hedgeye and Viceroy Research with accusations of alleged excessive spending, suspicious accounting practices, and making the company appear to be worth more than it really is by allegedly overpaying for properties to inflate their net asset value ('NAV').

MPW decided to take action and filed a lawsuit against Viceroy Research claiming the short-seller had made multiple (and allegedly) defamatory and misleading claims that had apparently hurt the company and its shareholders. In its press release, MPW addressed some of the accusations made by Viceroy.

One such accusation is that MPW engages in "revenue round-tripping" which basically implies that MPW overpays for a property, and then the operator has the extra proceeds to pay the rent when they could not otherwise.

MPW was quick to point out that the money they pay for real estate goes to the former owner or developer of the property, not the hospital operator. One example they used was a $27.5 million dollar investment they made to build a hospital in Texas.

MPW asserted that virtually all the funds were paid to the developer (Medistar Gemini) and their sub-contractors rather than the operator (NeuroPsychiatric Hospitals). Another example they used was when they acquired five hospitals in Florida from Tenet Healthcare, the proceeds were sent to Tenet, not the operator Steward.

Since the short campaign began, MPW has continued to do business and has continued to generate rental income, and has continued to pay dividends to its shareholders. There has been no SEC investigation into accounting practices and the founder and current CEO Ed Aldag, Jr still owns a significant stake in the company (3,116,010 shares).

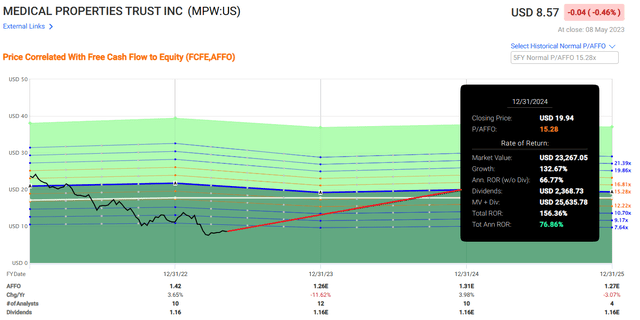

So if interest rates are cut and short-sellers allegations fall flat, what would a return to their normal valuation look like?

MPW's five-year normal P/AFFO multiple is 15.28x, whereas they're currently trading at an AFFO multiple of 6.29x. Over a two-year holding period, if MPW gets back to their normal multiple it would deliver a 76.86% total annual rate of return. We rate MPW a Spec BUY.

Arbor Realty (ABR) - Short Interest: 13.89%

ABR is an internally managed mortgage REIT that originates and services loans for multifamily, single-family rental, and commercial real estate. They operate their business through two main segments: Structure Business and Agency Business.

Within the Structured Business they primarily issue bridge loans but also invest in mezzanine loans and preferred equity. Through their Agency Business they originate, sell and service loans issued for multifamily properties through government-sponsored enterprises ("GSEs") including Fannie Mae and Freddie Mac. Additionally, through their Agency Business they pool and securitize loans and sell the securities to investors while retaining the servicing rights.

Recently NINGI Research began a short campaign against ABR when they filed a report (author still unknown) making multiple accusations against ABR. One of the accusations claimed that Arbor has allegedly been "hiding" a portfolio of toxic assets through a web of fake holding companies for more than a decade.

Another accusation claims that ABR was "secretly" selling properties and that the sale profits are "missing." Arbor swiftly responded in a press release asserting that NINGI's report contains multiple (and allegedly) misstatements and inaccuracies and is a transparent attempt to allegedly mislead the public so that NINGI can profit from their short position. Basically a short and distort tactic.

Arbor did not categorically go through all the accusations made by NINGI but made a general statement that the report was misleading and lacks merit. I detailed this in a previous article, but I'm very skeptical of this short report and NINGI Research as a whole.

One of my biggest issues with it is that they don't list who wrote the report. If we don't know who wrote it, how are we supposed to know what qualifications they have to make the claims contained in the report?

How are we supposed to trust that this "author or research team" was able to find alleged hidden "toxic" assets that no one else has discovered over the past 10 years?

Is the auditor corrupt too?

Why hasn't the SEC got involved after 10 years of supposed fraudulent accounting practices?

While NINGI makes claims that ABR is hiding assets, they have no problem hiding the author of the report.

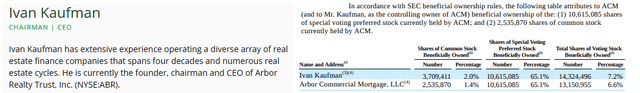

Oh and did I forget to mention that the founder, chairman and CEO Ivan Kaufman personally owns 3.7 million shares of common stock and owns 2.5 million shares of common stock through his company Arbor Commercial Mortgage, LLC? I'm guessing he's not too concerned about all the "hidden toxic assets."

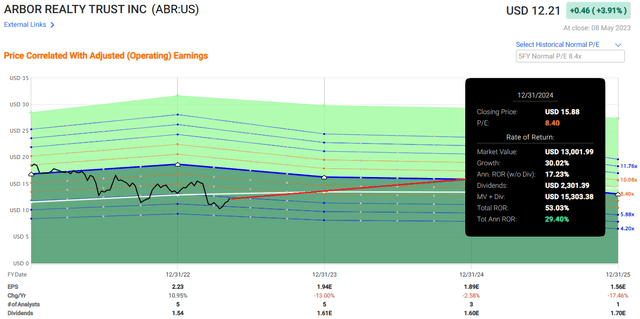

So what would it look like if ABR returns to its normal valuation when interest rates are cut and the report written by (fill in the blank) lacks any meaningful information?

ABR's five-year normal P/E is 8.40x but it is currently trading at a P/E multiple of 5.74x. Over a two-year holding period you would receive a total annual rate of return of 29.40% if ABR reverts back to its normal valuation. At iREIT we rate ABR a Spec BUY and assign it a tier 2 rating in our mortgage REIT coverage.

Digital Realty Trust (DLR) - Short Interest: 5.34%

DLR is a data center REIT that has a portfolio of more than 300 data centers that serves approximately 5,000 customers with properties located in the U.S., Europe, Latin America, Africa, Asia, Australia, and Canada.

Data centers are very specialized buildings that must have infrastructure in place to pull in enormous amounts of electricity, cooling systems to maintain servers, backup sources of power to prevent any interruption of service, and highly sophisticated security systems to prevent any breach.

In 2022 Jim Chanos announced that his company had a large short position against data center REITs. His main argument is that at some point hyperscalers will build more of their own data centers and won't need to lease as much space from data center REITs. He went on to say that the space they continue to lease will be at reduced rates and that the data centers' largest customers will become their biggest competitors.

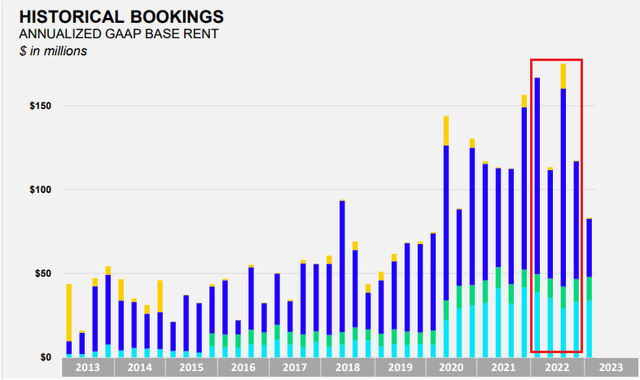

Bill Stein, who was the CEO of Digital Realty at the time, said that Jim Chanos might not be aware that DLR's demand has never been stronger and that they currently had record bookings. Bill further refuted the short thesis by saying that they're increasing their rental rates on both new and renewal leases and that their escalators are now being indexed to the consumer price index ("CPI") which will hedge against inflation.

Now out of all the short campaigns we've looked at in this article, this one has the most merit, in my opinion, even though I disagree with Jim Chanos' argument. It is true that hyperscalers like Microsoft and Google are building out their own data centers and someday they may decide to build all of their own data centers, but at this point that's not the case.

Hyperscalers use data center REITs to supplement their own data centers and I don't see that changing anytime soon, if ever. Microsoft and Google have plenty of resources to build data centers, but is that what they specialize in? Should they spend their time and resources to build all their own data centers or should they focus on their core competencies?

Another problem with the short thesis is that DLR had record bookings in 2022. I highlighted DLR's 2022 bookings and it doesn't seem like they are having any issues leasing out space.

Another point I would like to make is that even if the worst-case scenario plays out and hyperscalers no longer have any need for data center REITs, the cloud is not slowing down and there are plenty of other businesses that will continue to need data centers. As previously mentioned, DLR has around 5,000 customers, not just three.

Don't get me wrong, it would definitely have a significant impact if hyperscalers no longer relied on data center REITs, but e-commerce will only continue to grow, and the other 4,997 customers (and future customers) will continue to need data centers in order to run their businesses. Again, this is the worst-case scenario, but I don't see anything in DLR's numbers to suggest that this is happening.

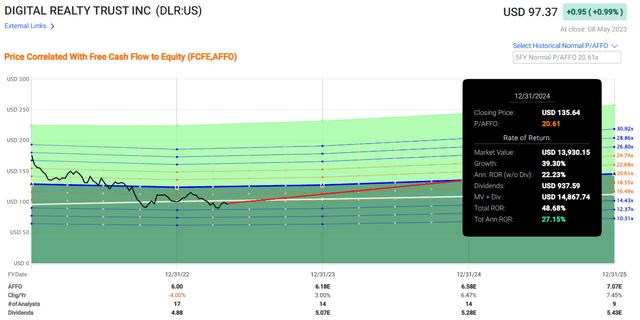

If interest rates are cut and DLR's continues to report record bookings, what would it look like if DLR returned to its normal valuation?

DLR's five-year normal P/AFFO is 20.61x but currently they are trading at an AFFO multiple of 16.06x. If DLR returns to its normal valuation it would result in a total annual rate of return of 27.15% over a two-year holding period. At iREIT we rate Digital Realty a Strong Buy.

In Closing

As I said earlier, I always try to learn from shorts, if there's anything worth learning from. Clearly all three REITs that I just referenced are cheap and I cannot argue with the fact that the underlying fundamentals (for all three) are weakening.

However, shares are extremely attractive (in our eyes), and at some point - when rates stop increasing - the entire REIT sector should begin to trade in line with historical norms. And at that point, we expect a massive short squeeze…

"It's kryptonite, Superman. Little souvenir from the old hometown. I spared no expense to make you feel right at home." Lex Luthor

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABR, DLR, MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.