indie Semiconductor Q1 Earnings: Questions Surface

Summary

- indie Semiconductor put out a very strong Q1 2023 earnings report, with impressive topline growth.

- However, looking forward down the road into H2 2023, investors are starting to question whether indie's growth rates may start to decelerate.

- In essence, there's a mismatch between investors' expectations and the near-term growth of indie Semiconductor.

- Investors will have to brace themselves for the share price to remain volatile.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

PonyWang

Investment Thesis

indie Semiconductor (NASDAQ:INDI) put out a report that was very much in line with expectations and didn't incentivize bulls to retain control.

I believe the most uninspiring part of the earnings report is the allusion that, beyond Q2 2023, the growth rates may not quite live up to investors' expectations.

Furthermore, given the lackluster progress in underlying profitability, investors are now starting to question the likelihood that, in fact, INDI is able to reach positive profitability in Q3 2023.

I don't believe this quarter will significantly move the needle on investors' expectations one way or another; therefore, I'm neutral on this stock.

Why indie Semiconductor? Why Now?

indie Semiconductor provides automotive semiconductors for Advanced Driver Assistance Systems ("ADAS"). The idea here is that INDI can continue to take market share and rapidly outgrow the sector, as it provides tier 1 automakers with a seamless way to interact with mobile platforms.

The focus for indie Semiconductor is on the sensors and in-cabin experience of predominantly electric vehicles and, in time, autonomous vehicles too.

The key really is that indie Semiconductor isn't pinning itself down to one technology but rather is technology agnostic. And with the growth of next-generation vehicles, INDI believes that its core advantage stems from its highly diverse customer base.

Next, let's discuss its financials.

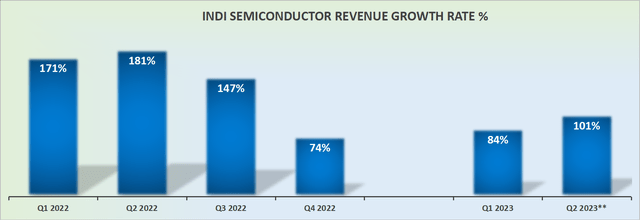

Revenue Growth Rates Remain Very Strong

indie Semiconductor's revenue growth rates are expected to accelerate into Q2.

That being said, consider this, on a twelve-month trailing basis, indie Semiconductor's revenues reported approximately $196 million. Consequently, the fact that indie Semiconductor guides for about $210 on a forward annualized basis is quite uninspiring.

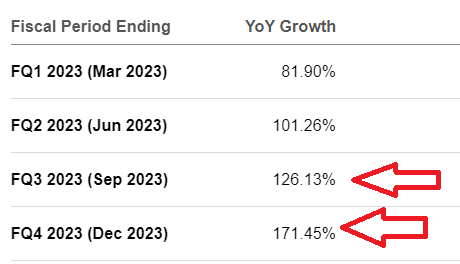

Let me put it this way, presently, for 2023 as a whole, the consensus figure was pointing to approximately $250 million in revenues.

More specifically, looking at the forward twelve months starting Q2 2023, the fact that INDI's revenues are only expected to reach $210 million puts forward the discussion that, perhaps after Q2 2023, its revenue growth rates may slow down.

During the earnings call, indie Semiconductor's CEO Donald McClymont said:

We are now on pace to more than double our top line again this year, our third year in a row of doing so.

Again, this reinforces the possibility that INDI's revenue growth rates may decelerate relative to expectations.

SA Premium

After all, as you can see here, analysts following the stock had some heroic expectations, particularly with regard to H2 2023. Allow me to put it another way; what got investors unenthused about INDI wasn't so much the outlook for Q2, but rather the prospects that H2 2023 may not live up to investors' expectations.

Long-Term Profitability Profile? Maybe Too Far Out?

Previously, indie Semiconductor had guided for long-term targets of 60% gross profit margin with 30% operating margins. Now, we are looking at indie Semiconductor's gross profit margin stabilizing around 52% for the second consecutive quarter.

In fact, if one were to be pedantic, we'd observe that INDI's gross margin in Q1 2023 was 52.2% while the guidance for Q2 points to around 52%.

Even if we consider that there's some room for conservatism in this guidance, the fact remains that there's a wide gap between around 53% and INDI's long-term aspirations of seeing 60% gross profit margins.

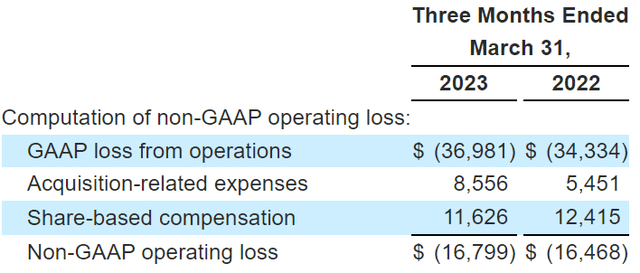

Furthermore, for now, INDI's non-GAAP operating margins are not positively leveraging off higher revenues.

What you can see above is that despite strong y/y topline growth, there's just no expense leverage.

And none of this would be bad in and of itself, were it not for INDI's valuation.

INDI Stock Valuation -- 6x forward sales

Previously, as we headed into Q1 earnings, investors believed that they were paying around 5x forward sales, given INDI's pace of growth.

Now, with its new guidance pointing to Q2 being on annualized run-rate of $210 million, the stock's multiple has expanded to 6x.

Then, on top of that, INDI is seeing very little positive progress in its operating losses.

That being said, INDI maintains that starting H2 2023 INDI will be profitable. However, even on a non-GAAP basis, a very strong ramp-up in profitability will be required for INDI to reach this target.

The Bottom Line

These results in and of themselves were not bad. Not at all. The problem here is the mismatch between investors' expectations heading into the first quarter and the look-ahead guidance beyond Q2 not living up to investors' expectations.

Overall, I'm neutral today. But keen to reappraise this business again in the near future.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.