Vipshop: Still A Good Deal Even After Climbing Over 100%

Summary

- Opening up China will affect Vipshop's revenue, however, in the short-term only in my opinion.

- There is a lot of growth in the long run.

- The financials are very good and profitability metrics are better than the closest competitors.

- A conservative estimation still suggests the company is attractive at these levels.

Robert Way

Investment Thesis

With the Vipshop's (NYSE:VIPS) strong UFCF generation and with China starting to open up, which may be a negative in the short run, I believe the company is undervalued even with conservative assumptions and even after rallying over 120% in the last year. The company is very attractive at these levels for long-term investors who would like to add some exposure to China.

China Opening Up - Bad in the Short Run

There's a negative for the company that China is starting to open up. People want to go out more again and experience outside life and not shop online anymore. This will affect the company's results in the short term in a negative way sure, but to be honest, I don't think this will last. China is the largest e-commerce in the world. I can see that people will go out a bit more in the beginning of the opening up as we see right now, however, in my opinion, bargains online will prevail in the long run and people will switch back to mainly online shopping to save money.

TikTok is one of the biggest social media platforms in China. Video shopping through the platform will drive online sales further. The platform has well over 1B monthly active users and people advertise their businesses and other things for sale constantly, which will drive further growth.

Online retail sales have more than doubled since 2014 and this trend is expected to continue in the years ahead. Although people may want to experience normal shopping for a while as China opens up, which may bring down that statistic slightly, the overall trend will continue. Vipshop is 3rd largest e-commerce retailer in China, after Tmall (BABA) and JD.com (JD). The company is going to capture a significant amount of the e-commerce business in the long run.

Financials

At the end of FY22, the company had over $3B in cash and short-term investments, while having no long-term debt and only around $400m in short-term debt. This is a great position to be in. A lot of investors aren't big fans of leverage, but as long as the debt is manageable, I don't see a problem with it. Here we don't have to worry about it.

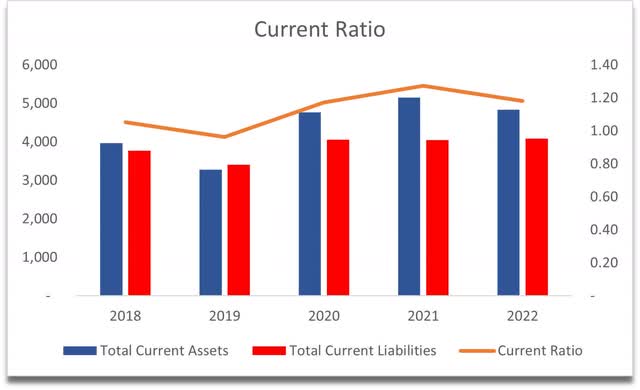

The company's current ratio is healthy enough, hovering a little over 1.0, which means that Vipshop is able to cover its short-term obligations.

Current Ratio (Own Calculation)

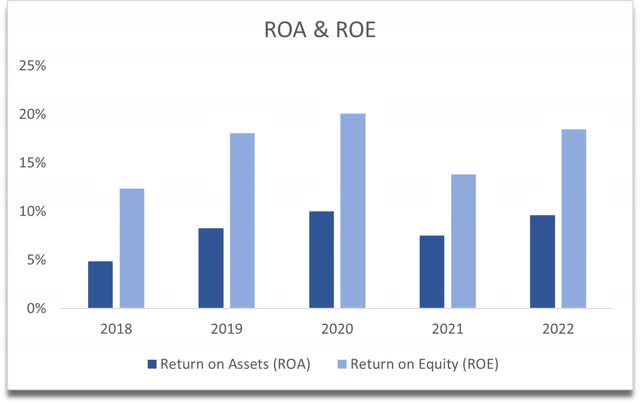

In terms of profitability and efficiency, the company's ROA and ROE have been very steady over time and above my thresholds, which means that the management is able to achieve more with fewer assets and less shareholder capital and create value for everyone involved.

ROA and ROE (Own Calculations)

Return on capital compared to a few competitors is also higher, which means the company is enjoying a decent moat and a competitive advantage.

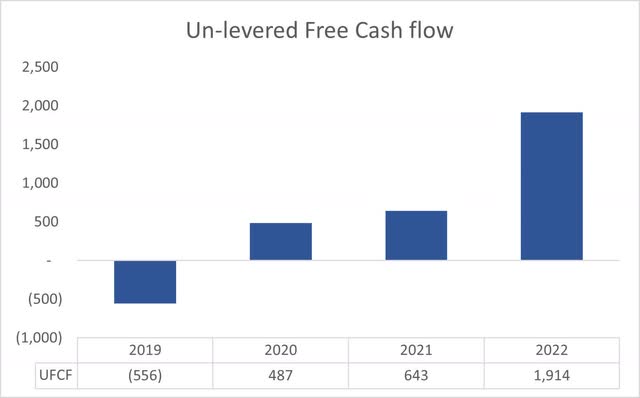

The company's unlevered free cash flow has been very healthy in the last 3 years as the company's inventories eased, and less capex spending translated into more cash available.

Overall, a decent balance sheet is going to weather any macroeconomic downturn even with a slowdown in demand for online shopping, which I believe won't last and will continue to take more market share in the future.

Valuation

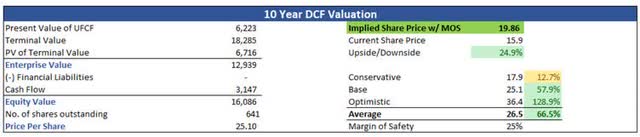

I decided to go with conservative revenue figures because I like to be safe than sorry and invest in a company at the wrong price which may present a very poor risk/reward ratio.

The company in the past managed to record double-digit revenue growth, however, I went with an average of 7.2% for the next decade for the base case. I went with 9.3% for the optimistic case, while for the conservative case, I went with 5.3%. I believe that these assumptions are on the lower end as there is a lot of opportunity for expansion in the e-commerce sector in China.

In terms of the margins, I decided to keep conservative here too and assume that the company isn't able to achieve better efficiency in the next 10 years, which I think is unlikely, but I would like to pay as little as possible for a good company, especially if the company is still undervalued even with these type of assumptions in place.

To go one step further, I will add a 25% margin of safety to the intrinsic value calculation. The company has a good balance sheet so 25% is more than enough. I usually add more if the company has a bad balance sheet.

With that said, the company's intrinsic value is $19.86, implying around 25% upside from current valuations.

Intrinsic Value (Own Calculations)

Closing Comments

Even after the share price appreciated over 100% in the last year, the company still has a lot of room to grow and is a very good investment in the long run. It doesn't mean that the company will continue to perform this well, especially after such a run-up. The company is due to report Q1 '23 earnings in mid-May, I would expect a lot of volatility and maybe even profit-taking from those who have been holding this for a while. The company has a strong moat, is generating good UFCF, and is relatively cheap still.

I'll be waiting for the earnings to go by first as I don't like the volatility, but I wouldn't be against opening a position at these prices, and if the company drops on earnings, then that's even better as I could grab the company for a bigger discount, especially if I intend to hold it in my portfolio for a long time.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.