Atmos Energy: Buy - Even In Light Of Unrelenting Political Pressure

Summary

- Atmos Energy is the largest US natural gas-only local distribution company LDC.

- ATO's service territory is substantially more insulated than peers from concerns related to long-term reductions in natural gas usage.

- Management has earned high marks for consistency in earnings and dividend growth, operates in a positive regulatory environment, and has a high-quality balance sheet.

Fentino

Atmos Energy (NYSE:ATO) is the largest US natural gas-only local distribution company LDC. ATO services more than 3 million customers and 1,400 communities in 8 states. The states include Virginia, Kentucky, Tennessee, Mississippi, Louisiana, Texas, Nebraska, and Colorado. While there continues to be partisan rumblings concerning the continued use of natural gas in America and it seems political battlelines are being drawn, the underlying electoral and regulatory climate in these specific states appears to support ATO as a timely utility investment.

Who is Atmos Energy?

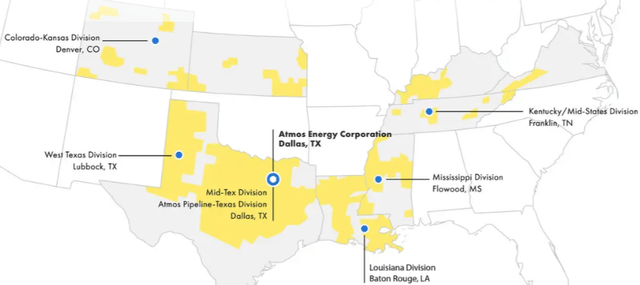

Atmos Energy is engaged primarily in the distribution and sale of natural gas. The company operates through six regulated natural gas utility operations: Louisiana Division, West Texas Division, Mid-Tex Division, Mississippi Division, Colorado-Kansas Division, and Kentucky/Mid-States Division. The map (shaded yellow) below, from ATO most recent investors presentation, outlines their service territory.

Atmos Energy Service Territory (Atmos Energy)

Atmos Energy is a "pure" natural gas LDC utility. While there are multi-utility firms with natural gas LDC services, there are only a handful of "pure" gas utilities, including Spire Inc (SR) and Southwest Gas Holdings (SWX). Atmos Energy's customer base leans heavily towards residential with gas sales breakdown for FY Sept 2022: 64% to residential customers, 34% to commercial and industrial clients, and 2% other. ATO operates in three divisions: Utility LDC, Pipeline and Storage, and Corporate. As with many gas utilities, ATO utilizes a fiscal year ending September, with the first two fiscal quarters encompassing much of the high-use heating season.

Utility LDC services provided 71% of FY2022 net income and Pipeline and Storage contributed 29%. Pipeline assets include ~5,700 miles of intrastate pipeline in Texas and 5 natural gas storage facilities.

Atmos Energy has earned an SPGMI Quality Rating of "A" rating for 10-yr consistency in earnings and dividend growth by CFRA. There are only 13 non-water utilities with an A rating and no utility has earned an A+ rating. ATO's consistency in growth is projected to continue. In FY2023, ATO is expected to earn $6.02 a share, up from $5.60 in FY2022. FY2024 is expected to clock in at $6.41 and rise to $6.90 in FY2025. Dividends are expected to follow suit, maintaining a consistent 50% payout ratio at $2.72 last year, $2.92 this year, and $3.20 and $3.45 in 2024 and 2025, respectfully. Most analysts are comfortable projecting 6% to 8% long-term growth in both EPS and distributions for the next several years.

Political "Cancel Culture" Climate

Natural gas has joined the new national pastime of "banning activities" and joins the trends of a ban on gasoline ICE cars. West coast cities are banning natural gas as a heating and cooking fuel source. There are currently at least 50 cities in California, Oregon, and Washington which passed "electrification laws" prohibiting the use of gas in residential and commercial construction. New York just passed a law outlawing natural gas appliances and heating systems in new buildings, including renovation projects, of less than 7 stores by 2026 and requires all-electric heating and cooking in new construction and renovation for taller buildings by 2030. The Federal government recently announced its desire to ban natural gas cooking stoves in another step towards total electrification of the US. It is most interesting how political stances have changed. In 2019, National Grid (NGG) and Consolidated Edison (ED) instituted a moratorium on new natural gas hook ups in downstate NY due to a concern over lack of pipeline capacity and hence long-term supply. This action led to threats by the governor to revoke the business licenses from these two unless the moratoriums were withdrawn, which they were, but now a ban of the same natural gas appliances has become politically correct.

With such a negative political outlook for natural gas, why invest in a natural gas LDC? Simple - Atmos Energy's service territory is in better shape than its peers on either coast. Plus, city- and county-wide natural gas bans are running into legal trouble in the courts. The US Court of Appeals has ruled against local regulations prohibiting the installation of natural gas appliances. As reported in a press release by the American Gas Association, an industry association:

On April 17, 2023, the U.S. Court of Appeals for the Ninth Circuit issued an opinion which held that the plain text and structure of the Energy Policy and Conservation Act (EPCA) preempts State and local regulations concerning the energy use of natural gas appliances, including the City of Berkeley's ordinance that prohibits the installation of natural gas piping within newly constructed buildings. California Restaurant Association v. City of Berkeley, No. 21-16278

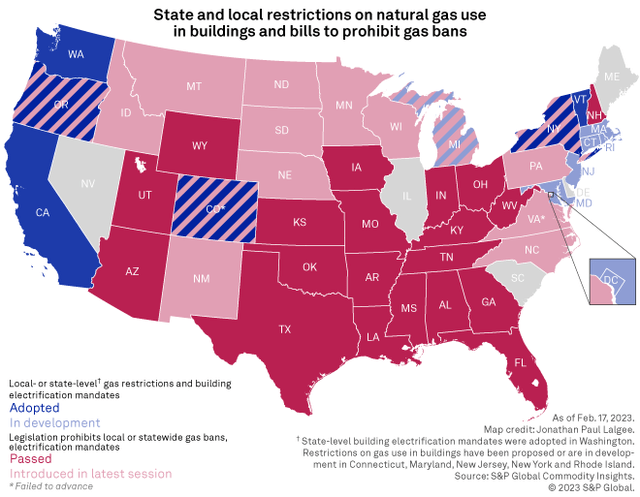

In Feb 2023, S&P published a map of various states' stance on the issue of legislatively forced electrification of buildings. Of interest to investors should be the location of states which have specifically prohibited local bans on the use of natural gas in buildings.

State and local restrictions on natural gas usage (S&P Global)

In July 2022, European Union lawmakers voted to classify natural gas and nuclear power as "green" or "sustainable" sources of energy. Generally speaking, using natural gas to generate electricity or to heat or cool multiple homes at once will be considered sustainable, while other uses, such as individual residential gas appliances, may be excluded. In Jan 2023, Ohio passed legislation classifying natural gas as a "green" fuel and could become a life jacket for companies struggling with ESG policies in the investment community.

The end result for Atmos Energy investors is positive because in ATO's service territory of mid-America, natural gas for heating, cooking, and power generation will be around for a long time.

Regulatory Environment

State regulators are the gatekeepers to utility profitability and investor total returns, and each state decides their own utility regulations. The difficulty for retail investors is how to evaluate the maze of different state's approach to utility profitability. Decades ago, S&P's Regulatory Research Associates RRA devised a rating system for individual states utility profitability oversight as part of their credit analysis. However, RRA results are not published for public consumption, and are usually a few years old by the time I locate a source. On occasion, S&P will provide state updates with changes. I maintain a running spreadsheet of RRA ratings. The current publicly available map of State Regulatory Rankings is dated Aug 2020. According to my records as of Nov 2022, the following RRA changes have been announced by S&P on their blog: Upgrades: Colorado, New Hampshire, Oklahoma, and North Carolina; Downgrades: Kentucky, Louisiana, New York, Texas, Connecticut, and Maryland. RRA state regulatory assessment ratings are segregated into 6 categories, three major and three minor, with 1-1 being Above Average and the most credit friendly, 2-2 being Average, and 3-3 being the lowest Below Average.

Based on my updates, RRA's regulatory ratings for Atmos Energy's service territory are: Above Average 1-3 Tennessee; Average 2-1 Virginia, Mississippi, Nebraska, Colorado; Average 2-2 Kentucky, Louisiana; Average 2-3 Texas. The underlying analysis implies Atmos Energy operates in states with mostly above average regulatory ratings, which is very positive for investors. There could be some concern with Texas oversight rated of Below Average in the Average category as that state is a substantial portion of ATOs service territory and represented 65% of FY2022 rate base.

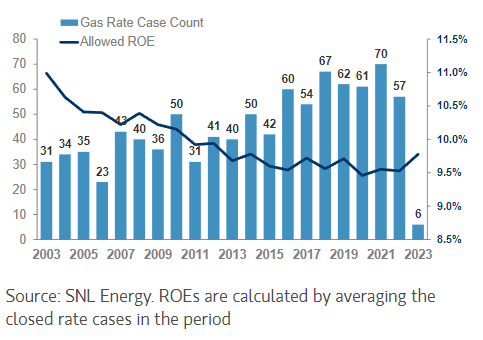

Overall, investors should feel comfortable that industry-wide regulatory return on equity ROE has been ticking up. As the graph below indicates, natural gas utility allowed ROE bottomed out in 2020 after a 20-year decline and has been slowly improving since. The trend of higher allowed ROE should continue as utility operating costs increase with higher financing costs and inflationary pressures.

Gas Utility Allowed ROE (S&P Global)

Within the world of regulation of natural gas LDC utilities, there are two parts to customer billings: the cost to provide the infrastructure to the customer and the cost of the natural gas consumed by the customer. LDCs like Atmos Energy earn an allowed ROE on its delivery investments but the cost of the natural gas consumed utilizes pass-through accounting where the LDC bills and recoups its actual cost for gas delivered to the customer. During Feb 2021 winter storm Uri in Texas, ATO spent an additional $2.2 billion to purchase natural gas on behalf of its customers, with ATO taking on debt to cover the cash flow shortfall. Texas regulators recently announced a rate increase to allow ATO to recoup this expense and to pay off the storm related debt, improving ATO's short-term credit profile. This is a positive for ATO investors.

Investment Thesis

The combination of 1) a strong balance sheet and 2) a solid potential for above-average rate base growth from highly visible and low-risk infrastructure safety and reliability capital investments will continue to reward long-term ATO investors. Commodity gas pricing has collapsed from its 2021 high, which is a benefit to Atmos Energy. Ratepayers gas bills will decline as will those for electric utilities with gas-fired power plants. Lower ratepayers utility bills will translate to lower regulatory pushback on fuel recovery requests as high natural gas prices from last year can be offset with declining prices this year. There should be lower regulatory and political pressure on the utility industry overall as utility rates are declining due to weak natural gas pricing. In addition, ATO's regulatory business- and inventor-friendly service territory is much more insulated than peers from concerns related to long-term reductions in natural gas usage.

Atmos Energy is expected to increase earnings by 6% to 8% a year until at least 2027. The distribution payout ratio has hovered around 50% for many years, which increases the chance of dividend growth in the same 6% to 8% range. While its stock is not particularly inexpensive, ATO still offers an acceptable utility investor's anticipated total return in the 8%+ range, based on a 2.5% cash yield and a current PE of 20.5x.

I have Atmos Energy on my Buy list during any price weakness. It fits nicely with my current pure-LDC holdings of Missouri-based Spire Inc., Spire's convertible preferred equity units (OTCPK:SRCU), Spire's preferred Series A (SR.PA). I have also owned Southwest Gas Holdings from before Mr. Icahn took control and destroyed its business model. I fully expect to add to the spinoff of SWX's utility construction subsidiary Centuri when it begins trading and expect the remnants of SWX to be offered as an acquisition candidate. Atmos Energy will eventually be a replacement for SWX in my utility portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SR, SR.PA,SRCU, SWX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not currently long ATO but plan to add as a long-term portfolio addition during any upcoming market weakness.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.