Exxon Mobil: After The First Quarter Earnings

Summary

- The Exxon Mobil Corporation forward price-earnings ratio is pretty low in this rather expensive market.

- The forward price-earnings ratio is likely to be even cheaper when one factors in the cost reduction efforts underway.

- The low price-earnings ratio conveys low expectations about the future that Exxon Mobil Corporation management is likely to beat.

- The industry challenges, particularly the challenges from 2015-2020, are very unlikely to repeat.

- Exxon Mobil total returns are likely to rise to an annual rate of low to mid teens as management cost reduction and growth plans become effective.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

JHVEPhoto

Exxon Mobil Corporation (NYSE:XOM) recently reported first quarter earnings. Earnings are widely expected to be below what they were in fiscal year 2022. But much of the industry sits below historical average valuations.

Earnings Reports

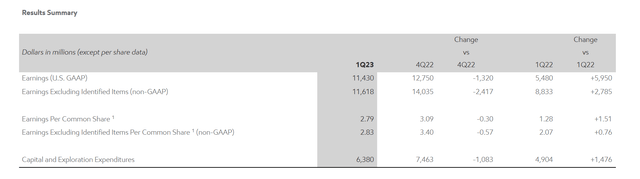

The company surprised the market with a positive first quarter comparison compared to the fiscal year before.

Exxon Mobil Earnings Summary (Exxon Mobil Earnings Press Release First Quarter 2023)

The earnings comparison was due to a little bit of growth combined with some cost cutting, as well as the continuing search for more value-added products. Clearly, the company strategy is "denting" the effects of lower commodity prices compared to the previous fiscal year.

Now the company is unlikely to beat fiscal year 2022 results unless commodity prices improve considerably. But it is clear from the first quarter that management efforts are adding to the company profitability.

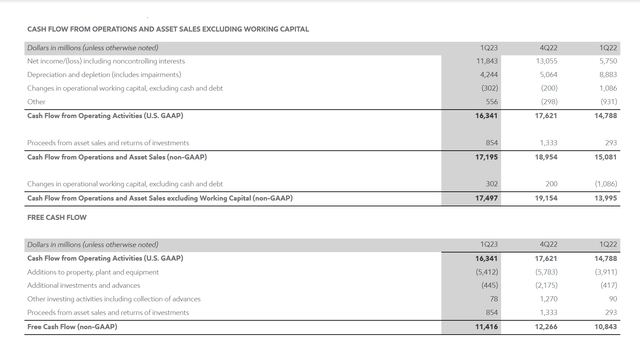

Exxon Mobil Cash Flow Summary And Free Cash Flow Calculation (Exxon Mobil Earnings Press Release First Quarter 2023)

Even the cash flow improved over the previous fiscal year. The company appears to be generating plenty of excess cash for the stock repurchase program. There also appears to be plenty of money for future dividend increases.

Stock Price Action

The Exxon Mobil Corporation stock price appears to have reacted favorably to the earnings release. Even now with the market under pressure, the stock price is not far from its all-time high for the latest 52 weeks. This stock price outperformance is likely to continue.

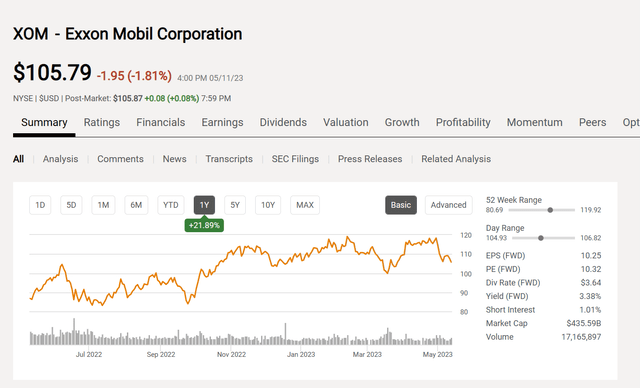

Exxon Mobil Common Stock Price History And Key Valuation Measures (Seeking Alpha Website May 11, 2023)

The forward price earnings ratio is shown above. By most measures, compared to many industries in the current market, that is one very low price-earnings ratio. Not only that, but the company is known for conservative accounting. Both of those considerations point to a low-price-earnings-ratio strategy that should lead to strong investment performance. That is a known strategy backed up by decades of research that points to a long-term outperformance of the common stock.

Recent Compared To Historical Returns

Clearly, the market does not expect much of this company despite a very long history of treating investors rather well. The last decade or so, the returns were abnormally low.

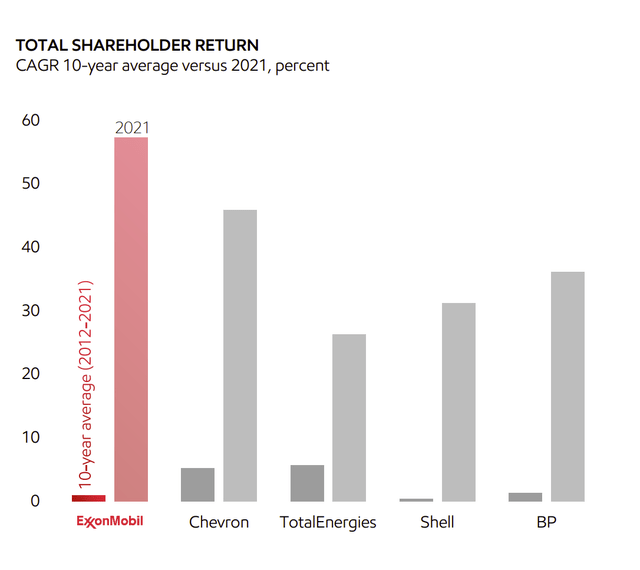

Exxon Mobil Latest Shareholder Return Comparison (Exxon Mobil December 2022, Investor Update)

What the chart shows is that the last decade was fairly challenging. The big oil price decline that signaled the end of rapid unconventional growth probably began the most trying five or six years (that ended with the covid challenges) in quite some time for the industry. Frankly, I don't expect that challenge to repeat itself for quite some time (if ever).

There were also clearly some majors that did better than Exxon Mobil during that time period. But that improvement was not all that great when one considers what the chart for a highflier like Tesla, Inc. (TSLA) would look like during the same time period.

Most commodity industries go through periods like this. Some cyclical downturns are just plain brutal. This period followed "the roaring nineties," when frankly the industry could do no wrong. But the key is that Exxon Mobil emerged from that challenge in good shape.

Cost Efficiencies

Another thought is any management that starts publishing return comparisons is likely to do something to improve the return comparison chart shown above in the future. Managements that do not want to improve the situation "sweep it under the rug." This management clearly has several ideas for future return improvements.

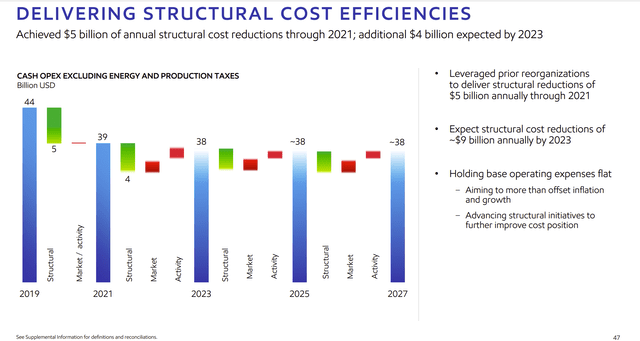

Exxon Mobil Structural Efficiency Gains And Cost Reduction Goals (Exxon Mobil December 2022, Shareholder Update)

Even though profits are expected to be down for a while, management is working on cost reductions shown above. That means when prices recover, there will be more profits at the same price levels. This suggests a pattern of higher highs and higher lows (also known as cycling higher). That makes the currently low price-earnings ratio shown above an even better bargain because the company intends to earn more money in the future under similar assumptions for the current fiscal year.

Looking For That Extra Edge

Furthermore, management is expanding the cost reduction goal. Good managements often achieve some pretty ambitious goals. But the nice part about an ambitious goal is that if management happens to miss the goal, the end result is likely still pretty satisfactory.

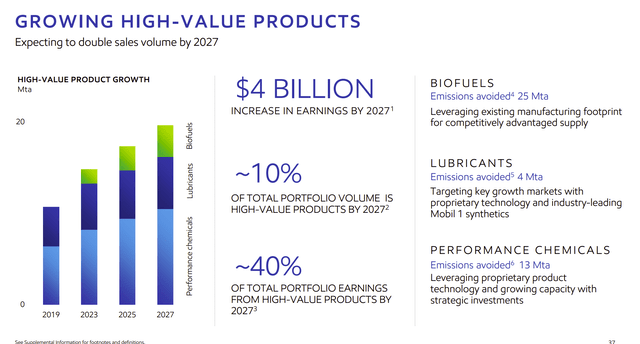

Introducing value-added products while exiting commodity products in the chemical division aids the cost-cutting strategy.

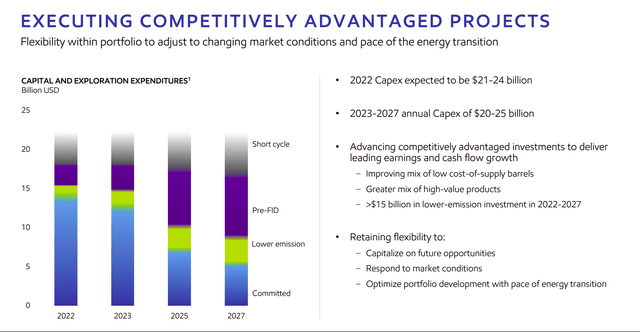

Exxon Mobil Capital Expenditure Plans And Overall Objectives (Exxon Mobil December 2022, Investor Update)

One of the things that management looks for is that slight edge that adds pennies to the income line that began at the top with the sales dollar. In many ways, this is a constant treadmill, because product lives involve formerly great products heading into the sunset of antiquity.

The ironic thing is that now a lot of those value-added products are ESG products or ESG related products that the market really has no idea that the company is involved in.

Exxon Mobil Foray Into ESG And Related Products (Exxon Mobil Investor Update December 2022)

In the future, the chemicals and products division is likely to grow in importance as the company introduces either ESG products recognized by the market or ESG-related (as in more climate friendly than before) types of products.

One of the products the industry is already familiar with is hydrogen. That market is already rapidly growing. Obviously, more than the industry already produces will be needed. But for the time being, it looks like natural gas will be the preferred source of hydrogen because the carbon-hydrogen bond is easier to break than is the oxygen-hydrogen bond in water. That translates into a cost advantage that cannot be overlooked for the time being.

But there are so many ancillary products needed to make the more visible products function as advertised. Exxon Mobil is big enough to pick and choose the products that allow it to "take its profit amount out of the middle." Smaller competitors often only get the crumbs.

Earnings Growth Is The Result

What many do not realize is that the industry is in a prime position to benefit from the green revolution for some time to come. The reason is that many of the industry products and future development products are cost advantaged. Even the green revolution has some respect for costs. As long as that is the case, then oil and gas are likely to be needed for a very long time to come.

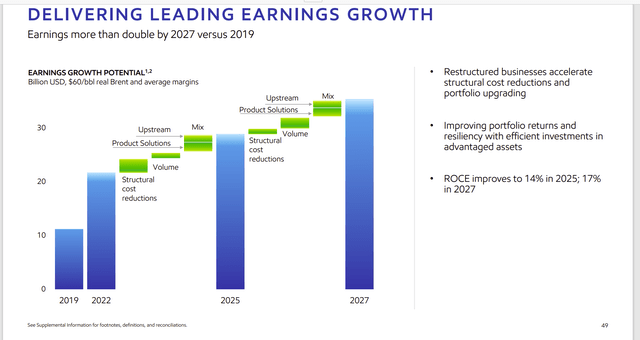

Exxon Mobil Earnings Growth Projection Using WTI $60 (Exxon Mobil Investor Update December 2022)

Now many have pointed out that oil and gas fluctuate quite a bit more than earnings improvement shown above. In the short term, it is certainly true that commodity price variations will dominate stock price movements.

But as time goes on, the accumulated cost savings, and low breakeven upstream projects will likely dominate the outlook. That implies higher cyclical lows points over time, followed by higher earnings in the next upcycle due to enhanced profitability.

Additional returns will come from the ability of the company to raise the dividend as industry conditions warrant.

Corporate Goal

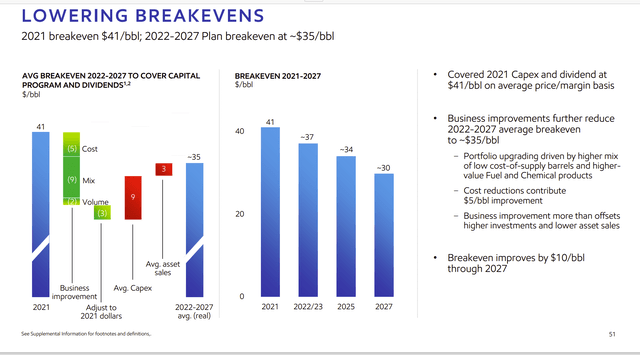

The whole strategy is designed for the company to make money at lower commodity price levels than was the case before.

Exxon Mobil Overall Long-Term Goal To Lower Corporate Breakeven (Exxon Mobil Investor Update December 2022)

The company management aims to make the overall performance match some of the lowest-cost producers in the industry. The company does have the integration ability and research to produce valued added products that are less related to the industry cycle than the upstream products that come out of the wells.

Major Ideas

My own belief is that the current plans lead to a transition of Exxon Mobil Corporation as a growth and income play for risk-averse investors. The future ability to raise the dividend will probably be a lot better than it has been in the recent past. Total returns for a company this size are likely to be in the low to mid teens.

Given the volatility of oil and gas, some years will be above that average and other years will likely be forgettable. But overall, the future appears to be very different from the past very challenging decade. We are very unlikely to repeat the industry experience of 2015-2020 ever again.

Clearly the Exxon Mobil Corporation price-earnings ratio does not forecast a lot of improvement. That should gradually change over time as management plans take hold. There is always a risk that these plans do not have the promised benefits. There is always a risk that the industry suffers a severe and sustained downturn. But overall, the future looks better than it has for some time for Exxon Mobil Corporation.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.