CLTL: Odd Duckling T-Bill Fund, 4.6% Yield

Summary

- Invesco Treasury Collateral ETF is a fixed income exchange traded fund.

- The fund broadly aims to mimic the return profile of an index that contains US Treasury Obligations with a maximum remaining term to maturity of 12 months.

- The fund has a bit of a fluid duration profile, with the portfolio manager being able to pick a faceted maturity ladder.

- CLTL falls in the 'cash parking vehicle' category, with only AAA Government collateral and a low duration profile.

miniseries/E+ via Getty Images

Thesis

The Invesco Treasury Collateral ETF (NYSEARCA:CLTL) is a fixed income exchange traded fund. As per its literature:

The Fund will invest at least 80% of its total assets in the components of the ICE U.S. Treasury Short Bond Index. The Index measures the performance of US Treasury Obligations with a maximum remaining term to maturity of 12 months. The Fund is not a money market fund and does not attempt to maintain a stable net asset value (NAV). The Fund does not purchase all of the securities in the Index; instead, the Fund utilizes a "sampling" methodology to seek to achieve its investment objective. The Fund and the Index are rebalanced and reconstituted monthly.

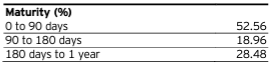

We call this fund an 'odd duckling' because it does not have a defined duration target, but it allows the portfolio managers to pick securities that fall in the index definition (at least 80% of the portfolio). This gives the vehicle a fairly fluid maturity ladder. At the moment, the vehicle is concentrated in T-Bills maturing in less than 90 days, holdings which make up over 50% of the portfolio.

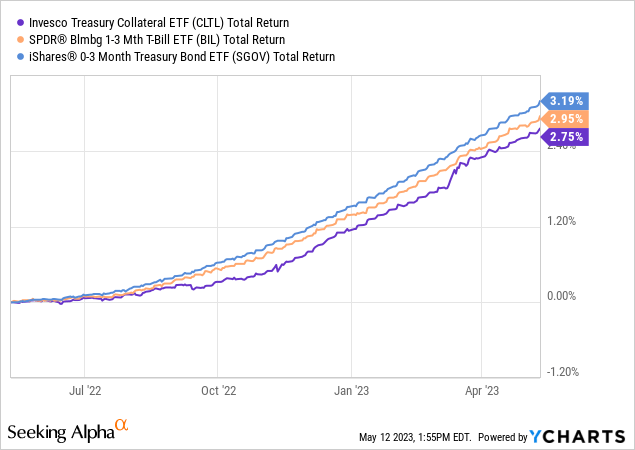

The ETF falls in the 'cash parking vehicle' category, with only AAA Government collateral, and a low duration profile. The fund has slightly underperformed its peers on a 1-year total return basis, and we are referring to the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and to the iShares® 0-3 Month Treasury Bond ETF (SGOV) funds here. You can find our coverage of both funds on the Seeking Alpha platform.

There are increased idiosyncrasies happening in the front end of the curve due to the debt ceiling discussions, but we feel they will ultimately kick the can down the road. Neither party has anything to gain by engineering a U.S. default that would put significant strain on capital markets. Regulators and the Fed are aiming for a 'soft landing', and they will not get one via a sovereign debt default. We believe, though, that rates will stay higher for longer, and the front end of the curve will be above 5% during this time. CLTL is aptly set up to capture that yield.

Analytics

- AUM: $1.4 billion

- Sharpe Ratio: -2 (3Y)

- Std. Deviation: 0.48 (3Y)

- Yield: 4.6%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income - T-Bills

- Duration: 0.38 yrs

- Expense Ratio: 0.08%

Holdings

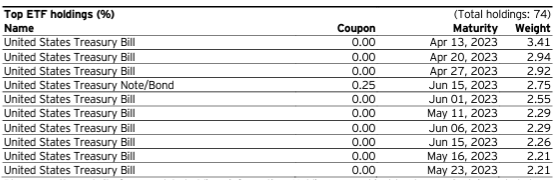

The fund contains only Treasury Notes or Treasury Bills:

Holdings (Fund Fact Sheet)

Since the instruments are obligations of the U.S. Government and highly liquid, the granularity does not matter much from a credit default perspective. The only impact from the portfolio diversification is felt in the maturity and duration ladder for the fund:

Maturity Ladder (Fund)

Most of the collateral matures within 3 months, making this fund very front ended at the moment.

Performance

The fund has a nice upward-sloping total return profile, but it underperforms other names we covered in the space:

We can notice from the above graph how CLTL has the worst performance from the analyzed cohort. Yes, on an absolute basis, the difference is quite small, yet ultimately good funds do outperform long term and there is a reason for that.

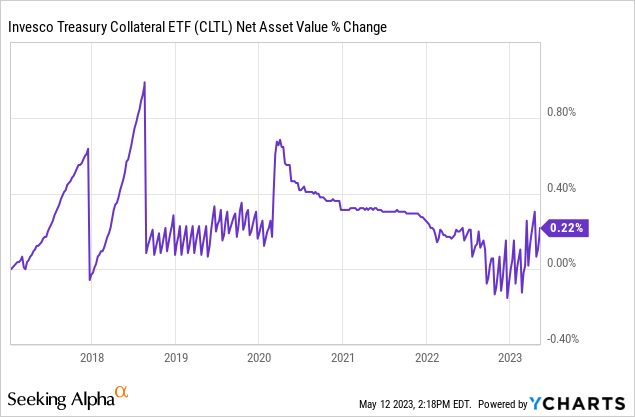

The fund does not define itself as a money market fund, but we can see its NAV has been incredibly stable in the past decade:

As observed in the above graph, the maximum deviation for the NAV has been 0.8%, but on average the fund only observes a 0.4% deviation.

Conclusion

CLTL is a fixed income exchange traded fund. The vehicle aims to replicate to a certain extent an index that is focused on T-Bills and Treasury notes with a maturity date of less than 12 months. CLTL has a bit of a fluid duration profile, with the portfolio managers able to pick and choose maturity ladders within the index context. The fund is very short-dated, nonetheless, and currently has a 0.38 years duration. With a low fee of only 8 bps, the vehicle is competitive but has lagged the likes of SGOV or BIL in the past year (albeit by a small margin). With a 30-day SEC yield of 4.6% the fund is an attractive cash parking vehicle, but we are still favoring the above two mentioned funds that we cover as well.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.