VIXY: Buy Insurance Before The House Catches Fire

Summary

- Enough leading indicators strongly suggest that a recession is either here already or will arrive in the next few months.

- However, the stock market remains in "Hakuna Matata" mode, as the VIX sits very close to post-pandemic lows.

- I believe that now could be a good time to buy insurance by holding the ProShares VIX Short-Term Futures ETF alongside the S&P 500.

- Looking for a helping hand in the market? Members of EPB Macro Research get exclusive ideas and guidance to navigate any climate. Learn More »

skynesher/E+ via Getty Images

Introduction: I smell a recession

Something smells funny in this market.

The indicators of economic slowdown continue to mount. Anecdotally, one could point to the ongoing regional bank crisis - which is really the manifestation of, among other underlying macroeconomic issues, a very restrictive interest rate environment. Most recently, we saw the growth in consumer prices drop more than expected, following the plateauing of producer prices and the sharp pullback in industrial commodities from the mid-2022 peak levels.

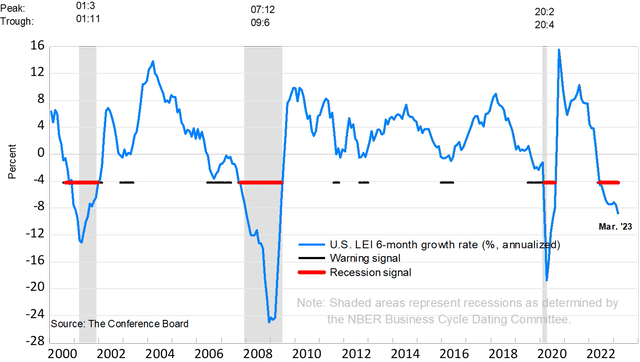

More broadly, the Conference Board's Leading Economic Indicators ("LEI") have been flashing a bright yellow light for a few months. Notice in the chart below how the YOY change in the index, currently at -9%, suggests either a recession in the near future or one that is already ongoing but has yet to be identified.

Virtually all factors that go into the calculation of the index, from manufacturing new orders to consumer expectations for business conditions, deteriorated in the most recent reading - sharply, in some cases.

The market is still partying

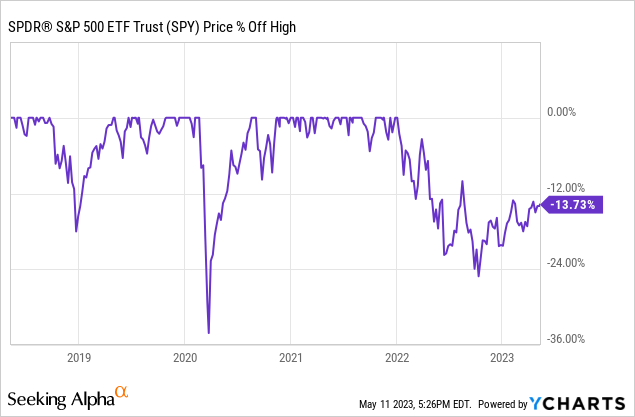

Yet, the S&P 500 (SP500), which has been up nearly 5% annualized since right before the start of the COVID-19 bear market, remains resiliently not too far from all-time highs, more precisely in a 14% drawdown (see chart below). For context, the drop from the peak reached around 25% a mere six to eight months ago, with the recent rebound suggesting improved sentiment and, dare I say, a sense of complacency.

I believe that the same "Hakuna Matata" attitude can be seen in the VIX at less than 17 today. The fear index has not remained at those depressed levels for more than two or three weeks since the start of the pandemic. When the index dropped that low, it did not take too long for the VIX to spike. This, in fact, is the nature of the volatility gauge: it tends to revert to the long-term historical average of around 19 to 20 like clockwork.

The VIX reverts to the mean

The following chart may help to illustrate the point. The x-axis represents the maximum pullback in the VIX level from the historical peak. The y-axis represents the one-year forward change in the VIX level. Each blue dotted line is a daily data point that goes back to the 1990s.

Not a surprise, given the mean-reverting nature of the VIX, there is an inverse relationship between these two variables. In other words: the deeper the VIX goes, the higher it is likely to be in 12 months.

Today, we sit about 80% below peak VIX levels. While by no means a guarantee of what could happen in the future, the current setup suggests that the index could be well above 17 this time next year.

DM Martins Research, data from Yahoo Finance

Why VIXY might make sense?

One interpretation of the above is that the S&P 500 is currently overvalued given the macroeconomic fundamentals and should be sold or shorted. However, I do not like the trading approach of betting against a beta-positive asset, which is akin to trying to swim upstream: one could succeed for a moment, but ultimately be dragged out to sea.

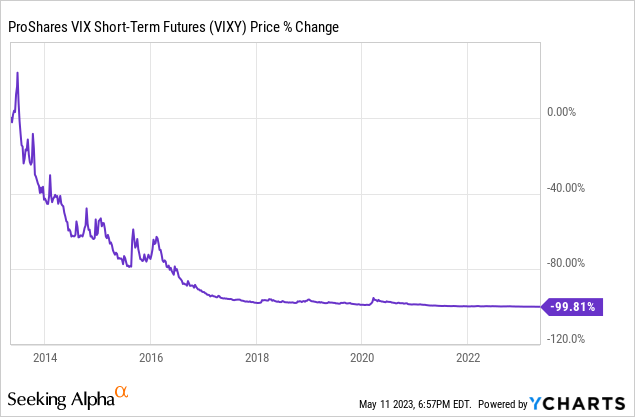

Another interpretation is that one could benefit from betting on a VIX fund like the ProShares VIX Short-Term Futures ETF (BATS:VIXY) in hopes of seeing the index and the fund price skyrocket. This is a potentially better action plan for a short-term trader, in my view, but a less compelling strategy for long-term investors like me.

As a refresher from my previous articles on VIXY, this ETF is doomed to lose over long periods (clearly depicted in the chart below) due to what is known as negative roll yield. In other words, the price declines progressively as the fund goes long the more expensive VIX futures contracts that expire later and sell them more cheaply as the expiry date moves closer.

This, in fact, is the reason why I never consider VIXY a buy, choosing instead to flip my rating between sell and hold depending on how compelling it may be to own the fund at any given moment. I downgraded the ETF to sell in May 2022, and I am upgrading it to hold today.

My favored approach is to still own the S&P 500, as I currently do, but "buy insurance" on it. With the VIX at low levels and ahead of what I expect to be a period of economic deceleration, I believe that VIXY is an inexpensive hedge today relative to the potential turbulence that looms on the horizon.

Worth noting, VIXY is a very jittery fund. According to Portfolio Visualizer, the annualized volatility of 68% is more than five times higher than the S&P 500's. In practice, it means that relatively little should be allocated to VIXY given its risk profile. Personally, I feel comfortable owning one part VIXY for every ten parts S&P 500 in moments like this.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.

This article was written by

Daniel Martins is a Napa, California-based analyst and founder of independent research firm DM Martins Research. The firm's work is centered around building more efficient, easily replicable portfolios that are properly risk-balanced for growth with less downside risk.

- - -

Daniel is the founder and portfolio manager at DM Martins Capital Management LLC. He is a former equity research professional at FBR Capital Markets and Telsey Advisory in New York City and finance analyst at macro hedge fund Bridgewater Associates, where he developed most of his investment management skills earlier in his career. Daniel is also an equity research instructor for Wall Street Prep.

He holds an MBA in Financial Instruments and Markets from New York University's Stern School of Business.

- - -

On Seeking Alpha, DM Martins Research partners with EPB Macro Research, and has collaborated with Risk Research, Inc.

DM Martins Research also manages a small team of writers and editors who publish content on several TheStreet.com channels, including Apple Maven (thestreet.com/apple) and Wall Street Memes (thestreet.com/memestocks).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VIXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.