SJB: This ETF Has Won Big At HYG's Expense, And Will Again

Summary

- I'm concerned about the health of the high yield or "junk bond" market, which makes me a fan of SJB. It can profit from an unraveling of that market segment.

- This ETF is essentially the opposite of HYG, the giant high yield bond ETF that was once a holding in the Fed's portfolio.

- I think it's only a matter of time before junk again earns its name. That's why I rate SJB a Buy.

designer491

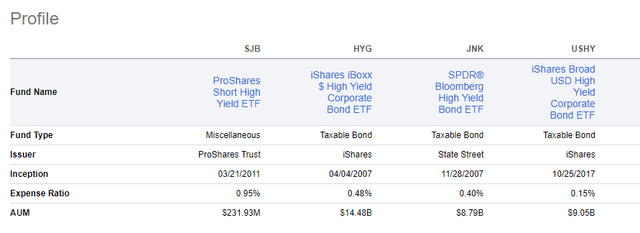

ProShares Short High Yield (NYSEARCA:SJB) is an ETF for high-yield (a.k.a. "junk") bond detractors. I include myself in that group, at least until some form of sanity returns to the credit bond markets. Simply put, junk bonds are junkier than they typically are. They have been levitated by years of easy monetary conditions, and had to be rescued by the Fed in 2020. In fact, among the $8.7 billion of bond funds the Fed bought outright during that year to prop up the wilting market for less than high quality debt was iShares iBoxx $ High Yield Corp Bd ETF (NYSEARCA:HYG), one of the more visible and sizeable ETFs that track the junk bond market. HYG's portfolio is split between BB and B-rated bonds, which can be high total return sources in friendly markets. But in the sludge that characterizes the state of the market for less-than-Treasury bonds amid inflation, reinvestment risk and a budding corporate profits recession, investors are taking way more risk than usual if they are counting on receiving the income and price returns like they had during the good times.

ProShares Short High Yield (SJB) is the only ETF designed to directly profit from declines in high yield bonds. While that sector continues to hang on, I think deep price declines in high yield bonds, and thus ETFs like HYG are inevitable. What's bad for HYG is good for SJB, and that's why I rate SJB a Buy.

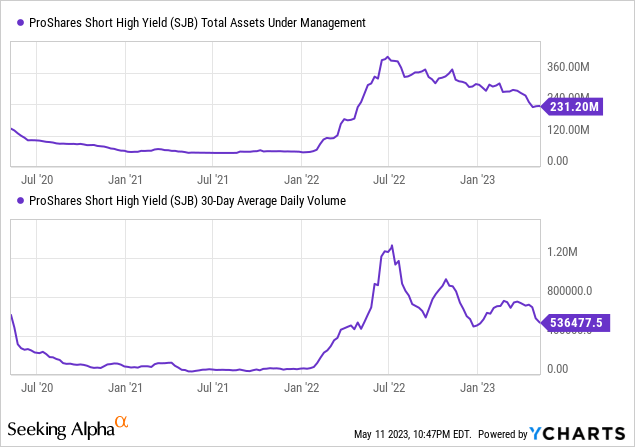

SJB is a $230 million ETF that has been around since 2011, but it was not until early 2022 that its AUM and trading volume made it sufficiently liquid for more than very small investments. Here's a chart showing that evolution.

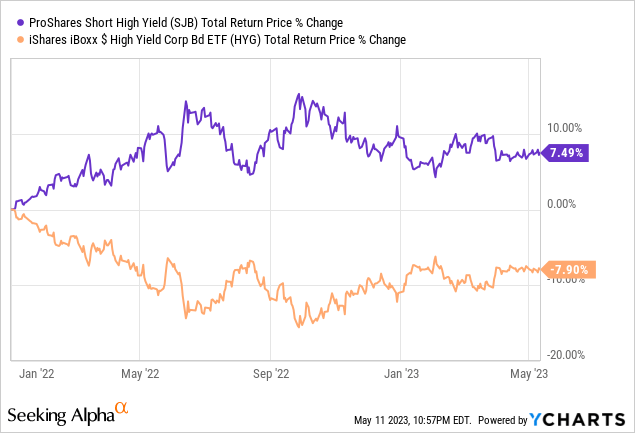

SJB is constructed using swap contracts from Citibank (C), UBS (UBS) and Goldman Sachs (GS) (other firms are also considered, though not currently part of the portfolio), and backs this up through ownership of US Treasury Bills. The goal of the ETF is to deliver on a daily basis a return that is the precise opposite of the index that HYG tracks. So, SJB is essentially the opposite of HYG. However, investors should be aware that with inverse ETFs, the math can make it so that over weeks, months or longer time periods, SJB should not be expected to maintain that -1 for 1 performance relationship.

I research, follow and analyze a large number of single inverse ETFs like SJB, and I've owned it several times over the years. And while a common criticism is what I just described above (as more of a disclaimer, really), the history of SJB and many other inverses I have analyzed over the years is that they tend to be better holdings over, say 6-12 months than many investors give them credit for. For SJB, this chart shows that after going through all of the chaos of 2022 and the start of 2023, it actually produced a return that is nearly the opposite of HYG, including dividends. If these 2 lines look like mirror images of each other, that's because they do, and because they are supposed to!

The other common criticism of single inverse ETFs like SJB is that its expense ratio is high, at 0.95%. My response: high compared to what? One of the unique things about SJB is that, well, its unique. There are no other ETFs, at least any of sufficient size, that do what this one does. I expect others to emerge in time, but for now, this is the main game in town, if you believe as I do that the junk bond market is on borrowed time.

That said, I do think that there will be a shining opportunity to re-engage with high yield fixed income. But that is likely to be a much lower prices than today. And when that eventually happens, the fallen angel ETF will likely be at the top of my watchlist for consideration.

But who knows when that will be? 2024 or 2025, maybe? For now the opportunity is lining up to make money on a big crack in the high yield bond market. The timing is impossible to know, but the evidence is lining up.

Rising stars, fallen angels and dangerous times for high yield bonds

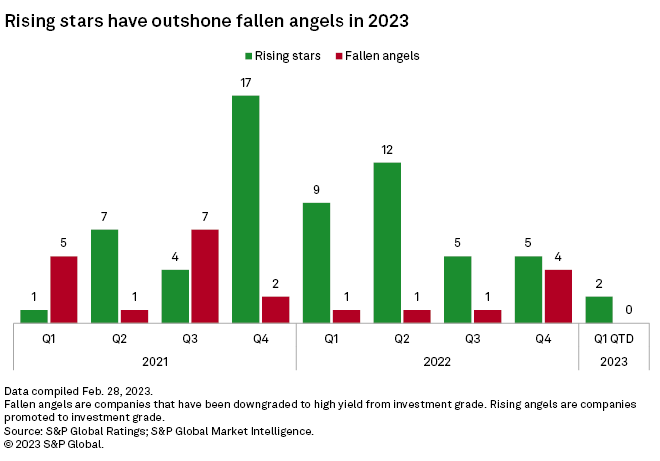

One indicator of the fading fortunes of the corporate bond market comes from the trend in so-called "rising stars" and "fallen angels." A recent report by S&P Global noted that The BBB space has expanded in recent decades amid a general reduction in the credit quality of U.S. corporations as low interest rates facilitated a buildup in leverage.

So far in 2023, the number of fallen angels - companies that have been downgraded to high-yield from investment-grade - has been outpaced by rising stars going the other way.

S&P Global

"At some point, there will be an investment-grade downgrade story, but that's more a story for the second half of 2023," said Viktor Hjort, global head of credit strategy for French bank BNP Paribas. "A year ago corporate fundamentals were good and you had COVID-19 buffers," Hjort said. "Fast forward a year and those buffers have not been entirely depleted, but they are nowhere near as strong."

If only that were the worst news for high yield

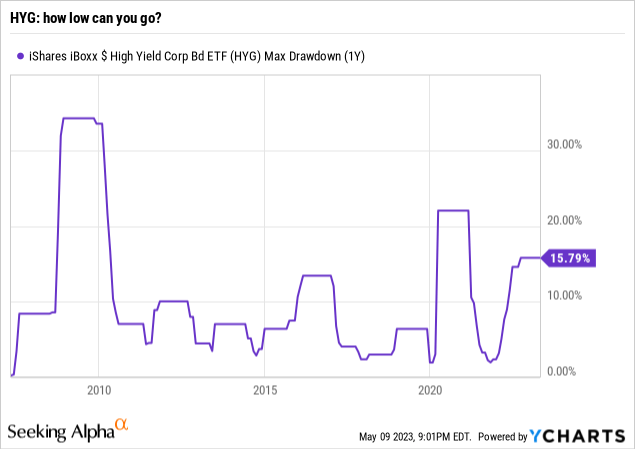

HYG is no stranger to total return meltdowns. This chart shows that it fell by more than 30% during the global financial crisis, more than 20% during the onset of the pandemic, and 15% during 2022, when the Fed hiked interest rates.

So, if you are keeping score at home as they say, high yield bonds wilt under pressure from financial crises, crises of investor confidence, inflation and rising rates. That's a lot of risk factors, in addition to the big one on the table, which is the massive refinancing situation that many junk-rated issuers face next year, when bonds issued at historically low interest rates come due, and must be replaced by borrowing at much higher rates.

The table above shows that despite the asset and trading volume lift in SJB, investor interest in shorting high yield bonds is still not significant, at least not in this form. HYG has a fairly liquid options market, so put buyers can take that route. I've done that in the past too, but I prefer not having the time pressure involved with options, and the simplicity of the non-levered, -1 to 1 relationship that SJB provides.

The stage is set... but the opera lady hasn't sung yet

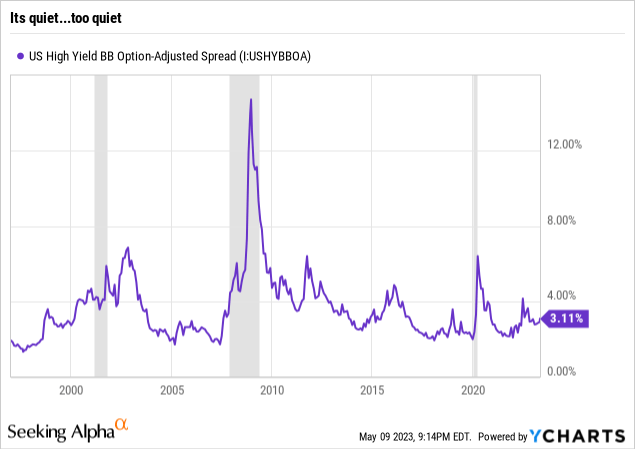

One of the go-to indicators of stress in the junk bond market is the spread between BB bonds, the highest level of junk, and US Treasuries. Perhaps the most bullish thing I can say right now about the high yield sector is that this indicator has not fired yet. Spreads are still low.

But as they say, this is the type of thing, where spreads "blow out" as traders like to say, that happens slowly, then all at once. That's what occurred during those grey zones in the chart above. What are those grey zones? US recessions. What are we on the verge of, at least in my view? A recession. So, I view SJB as being in the range where I can put a Buy rating on it, and thus HYG gets a Sell from me. I think the reckoning for high yield is due later this year or latest early 2024, and that's enough for me to at least step into a modest starter position here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.