Compass: This Rebound Has Steam

Summary

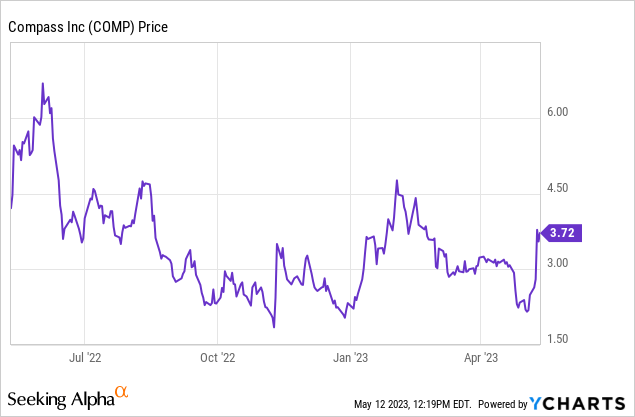

- Shares of Compass surged more than 30% after the company reported much better-than-feared Q1 results.

- Though revenue declined -31% y/y, Compass gained market share sequentially relative to Q4.

- And in spite of revenue contraction, the company made improvements to adjusted EBITDA losses.

- Compass is also indicating that it will be free cash flow positive for the year.

courtneyk

Right now, there's a lot of doom and gloom around the real estate industry. Interest rate hikes aren't having the intended impact on home prices - because of the sharp spike in interest rates, would-be sellers are hanging onto their homes for longer in order to retain a low interest rate, keeping inventory low and transactions muted.

This, of course, has hurt brokers like Compass (NYSE:COMP) - but as usual, the markets have taken more of a short-term approach in sending Compass stock down sharply from COVID-era levels. In reality, this major national brokerage is taking advantage of the turndown to rationalize its expense base, motivate its highest-performing agents, and expand the staying power of its brand.

Compass' recent Q1 earnings print caught investors by surprise after a string of bad news. Not only is the company expecting revenue declines to moderate in Q2, but the company also re-affirmed its commitment to being FCF positive for the year. The stock jumped up more than 30% in response.

In my view, there's a lot of promise in Compass shares for the balance of the year. Compass is finally proving to the markets that although it's facing tremendous macro and industry pressure, it's likely faring a lot better than many of its competing brokerages - as evidenced by its ability to cull losses while also gaining market share. I remain bullish on Compass, and I'd remind investors that the real estate industry has always been cyclical (even if we haven't seen these kind of shocks since 2008-2009) - but the work that Compass is doing now, especially on shoring up its profitability, will echo long past when the recession is over.

Here is my full long-term bull case on Compass:

- Within a few years, Compass has become a dominant brokerage - Compass' market share of U.S. real estate transactions is growing rapidly to ~5%. Already deeply embedded into major coastal markets, Compass is more recently pushing into new office opportunities in the Midwest. There's still room for further expansion. Even after the new market activity this year, Compass is still penetrated into less than half of the U.S. population.

- Tertiary revenue opportunities - Recently, Compass has been opening the door to new monetization opportunities, including starting its own title company. This positioning helps Compass derive more wallet share from real estate transactions as a whole. Compass has commented that attach rates on these tertiary services are rising. Compass estimates its U.S. TAM is $240 billion, of which only $95 billion and the rest is coming from adjacent services.

- Strong branding - Compass built a brand around being a full-service, high-quality real estate brokerage, very similar in style and profile to competitors like Berkshire Hathaway HomeServices or Sotheby's. This gives the company a very strong distinguisher against other tech-first rivals like Redfin.

- Scalable platform - Compass' primary costs lie in the R&D spending to deliver its technology platform for Compass agents, as well as the sales and marketing costs of advertising its brand to homebuyers/sellers and potential new agents. These costs are scalable: as Compass' scale grows, and as agent productivity grows (the average Compass agent generates 19% more sales in the second year), Compass will be able to improve its profitability margins, which we have already seen in the company's latest results.

To me, the post-earnings rally in Compass is just the beginning in right-sizing the stock's valuation to its proper worth. It's worth noting as well that Compass has a relatively strong balance sheet with $364 million of cash (against roughly ~$250 million of debt) to help the company navigate through this recession - which, on top of an expectation to be FCF positive, gives the company plenty of staying power. Stay long here.

Q1 ahead of expectations; and forward outlook is much better than feared

Here's the good thing about investing in beaten-down companies: usually, expectations are pretty low, and exceeding low expectations can lead to huge upward gyrations in stock price.

Take a look at Compass' Q1 results below:

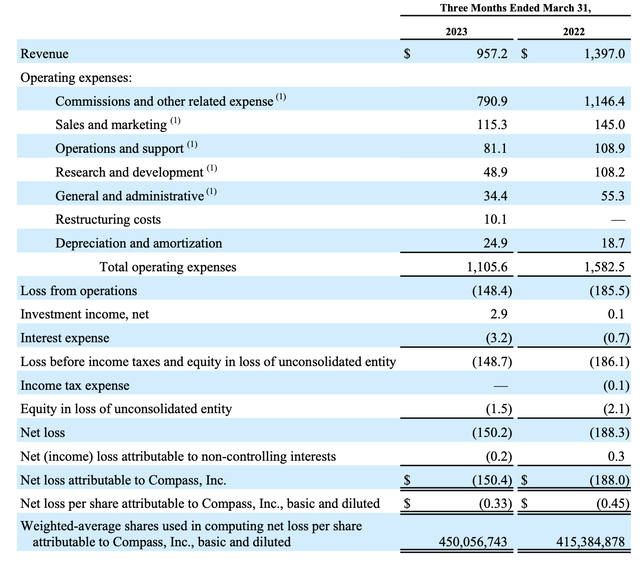

Compass Q1 results (Compass Q1 earnings deck)

Compass' revenue declined -31% y/y to $957.2 million, a function of a -24% y/y decline in total transactions and a -32% y/y decline in total transactional value. This was, however, a lot better than feared, as Compass had guided to a decline of between -32% y/y and -39% y/y in Q1.

And amid the sharp revenue decline, the industry did worse: as Compass reported that relative to Q4, it gained 17bps of market share to end Q4 at 4.5% national market share.

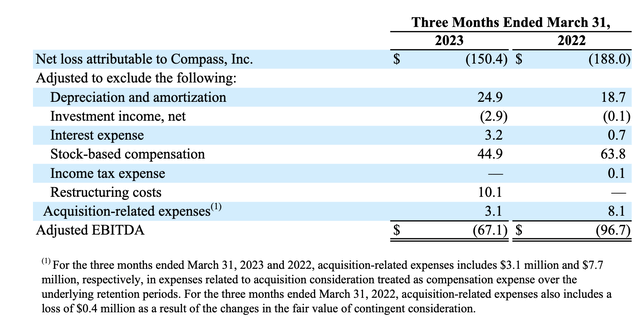

The bigger story here, however, is expense management. In spite of sharp revenue declines, Compass achieved adjusted EBITDA of -$67 million in the quarter, which is an improvement of $30 million year over year:

Compass adjusted EBITDA (Compass Q1 earnings deck)

Expense management is management's top goal, and CEO Robert Reffkin noted on the Q1 earnings call that these aren't temporary cost cuts intended to salve over a temporary recession, but permanent structural changes:

Most importantly, the market performance in Q1 and what we already are seeing for Q2 adds to our confidence that we have set the right OpEx targets to generate positive free cash flow in 2023.

I want to emphasize two important points as it relates to OpEx. First, if the market should worsen beyond 25% down, we are prepared to take additional steps to reset OpEx levels lower. Keep in mind, the most recent estimates for the year from NAR, Fannie Mae and the MBA are for a decline in the range of 12.6% down to 22.5% down.

Number two, as I previously said, we are confident that we've set the right OpEx target range of $850 million to $950 million. We have taken permanent actions not temporary ones. We expect to stay within this range over the next two to three years. We will be just at $900 million annualized by year-end.

And our management team is committed to actioning continued efficiencies with a goal of operating towards the midpoints of our OpEx range over the next couple of years, even as the market improves to more normalized levels. As a result, when the market improves in the future we will be well-positioned for generating significant long-term profits."

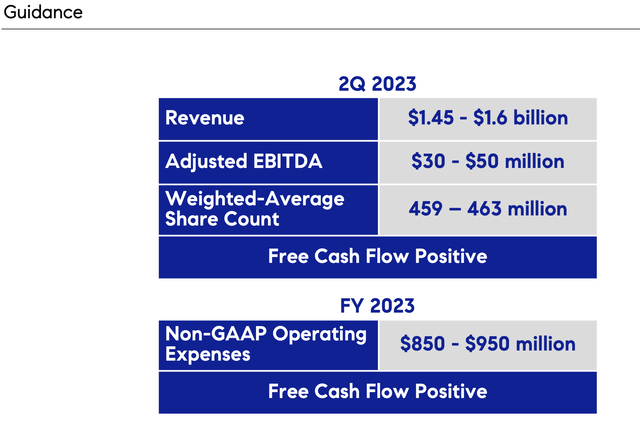

Compass' outlook also provides quite a robust picture of the remainder of the year. On a revenue basis, the company's $1.45-$1.60 billion guidance implies the y/y declines moderating to a range of -29% y/y to -21% y/y. Compass additionally expects adjusted EBITDA to turn positive in Q2:

Compass outlook (Compass Q1 earnings deck)

Furthermore, Compass is expecting every quarter for the remainder of 2023 to generate positive cash flow, which is an undeniable expression of strength amid sharp macro-driven industry headwinds.

Key takeaways

Recessions are a test for companies to reshape management priorities and turn cost structures upside down, and Compass is making the right moves to stabilize itself in the short-term while positioning for market share growth and profitability expansion in the future. Keep riding the upward momentum here.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COMP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.