LVHI: Hedged And Double-Edged

Summary

- Franklin International Low Volatility High Dividend Index ETF is a currency-hedged global dividend ETF.

- The LVHI ETF is well-diversified across countries, sectors and holdings.

- It has significantly underperformed its competitors.

- The hedge is double-edged: It is supposed to neutralize currency risks, but it may hurt if the dollar goes down.

- Quantitative Risk & Value members get exclusive access to our real-world portfolio. See all our investments here »

bagi1998/E+ via Getty Images

This article series aims at evaluating ETFs (exchange-traded funds) regarding the relative past performance of their strategies and metrics of their current portfolios. Reviews with updated data are posted when necessary.

LVHI strategy

Franklin International Low Volatility High Dividend Index ETF (BATS:LVHI) has been tracking the QS International Low Volatility High Dividend Hedged Index since 07/27/2016. It has a portfolio of 106 stocks, plus cash and short positions in various currencies, a 30-day SEC yield of 4.80%, and a total expense ratio of 0.40%. Distributions are paid quarterly.

As described by Franklin Templeton, eligible stocks must be:

- listed in one of 18 developed countries,

- in the MSCI World ex-US IMI Local Index,

- profitable over the last 4 fiscal quarters,

- dividend payers.

A "stable yield" score is calculated by adjusting the yield of stocks with price volatility, earnings volatility, local interest rates, and withholding taxes on dividends. Weights are calculated to maximize the aggregate stable yield score. Limits are set for constituents (2.5%), sectors (25% in general, 15% for REITs), countries (15%), and regions (50%). The underlying index is reconstituted annually and rebalanced quarterly. The fund seeks to mitigate risks of currency fluctuations for dollar-based shareholders using foreign currency forward contracts, futures, and swaps. Hedging positions are usually reset on a monthly basis.

Do you really want this hedge?

The currency hedge adds some complexity to the fund's price behavior, so I will try to make things as simple as possible. If you think the U.S. dollar will stay strong or become stronger, then you want this hedge. Remember what I wrote in the first paragraph: the fund has short positions in local currencies of the companies in the portfolio. It means it is long USD against these currencies. The idea of the hedge is that if Swiss holdings gain +10% in CHF, this portion of the fund gains +10% in USD, whatever the Swiss Franc does.

However, currency risk has two edges (without an "h"). If you have a doubt about the strength of the dollar, or if you seek diversification with plain exposure to foreign economies, then you'd better choose a non-hedged fund.

There is another level of complexity and risks related to currencies, not covered by the fund's currency hedge. A stronger dollar may be beneficial to a foreign company sales because their products and services become cheaper in USD, and it may also be detrimental when providers or creditors must be paid in USD.

LVHI portfolio

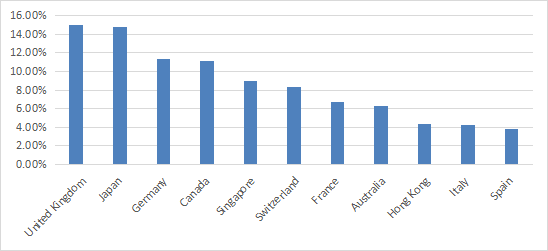

The fund invests mostly in large-cap companies (about 76% of asset value). Japan and the U.K. are the heaviest countries in the fund, and almost tie in weight, with about 15% of assets for each. Hong Kong weighs 4.3%, which represents a low exposure to geopolitical and regulatory risks related to China. The next chart plots the top 11 countries, representing 95% of asset value.

Country allocation (chart: author; data: Franklin Templeton)

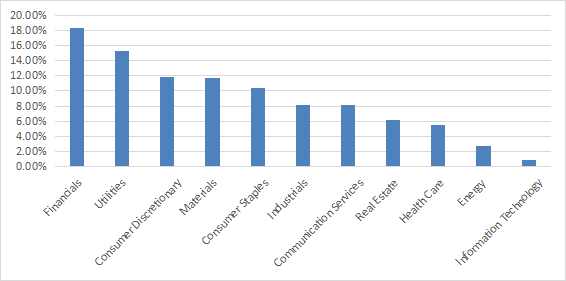

The two heaviest sectors are financials (18.3% of asset value) and utilities (15.3%). Consumer discretionary, consumer staples, and communication services are in the 10%-12% range. Other sectors weigh no more than 8%. The fund almost ignores technology (0.9%).

Sector breakdown (chart: author; data: Franklin Templeton)

The next table lists the top 10 holdings, representing about 27% of assets. The heaviest one weighs about 3%, so the fund is well-diversified and risks related to individual companies are low.

Name | Weight (%) | Ticker | ISIN | Currency |

E.ON SE | 2.95 | EOAN | DE000ENAG999 | EUR |

NOVARTIS AG-REG | 2.77 | NOVN | CH0012005267 | CHF |

MITSUBISHI CORP | 2.73 | 8058 | JP3898400001 | JPY |

NATIONAL GRID PLC | 2.72 | NG/ | GB00BDR05C01 | GBP |

BAYERISCHE MOTOREN WERKE | 2.72 | BMW | DE0005190003 | EUR |

IBERDROLA SA | 2.68 | IBE | ES0144580Y14 | EUR |

ORANGE | 2.62 | ORA | FR0000133308 | EUR |

JAPAN TOBACCO INC | 2.6 | 2914 | JP3726800000 | JPY |

SANOFI | 2.6 | SAN | FR0000120578 | EUR |

HOLCIM LTD | 2.57 | HOLN | CH0012214059 | CHF |

Past performance compared to competitors

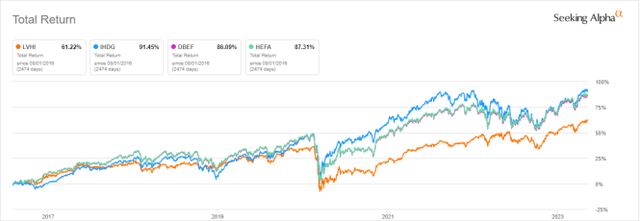

The next chart compares the total returns since 8/1/2016 of LVHI and three hedged international ETFs:

- WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), reviewed here,

- Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF),

- iShares Currency Hedged MSCI EAFE ETF (HEFA).

LVHI vs competitors since 8/1/2016 (Seeking Alpha)

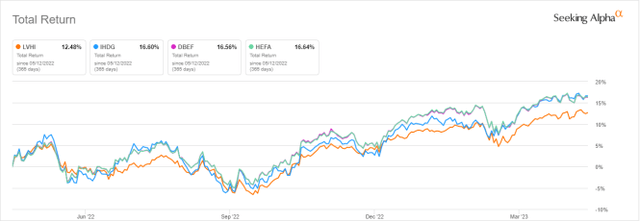

LVHI is the worst performer of this group since its inception. DBEF and HEFA have the same underlying index, which explains why their paths are so close. LVHI has also underperformed in the last 12 months (next chart).

LVHI vs competitors, trailing 12 months (Seeking Alpha)

Since inception, the share price has gone sideways with ups and down, gaining only 11.5%.

Share price, without dividend (Seeking Alpha)

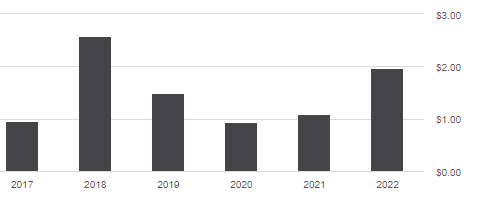

Distributions are impacted by currency rates, and also by the gains and losses on currency contracts. It makes them quite unpredictable, which income-oriented investors usually don't like. The years when the dollar surged have been especially good for distributions (2018 and 2022).

Distribution history (Seeking Alpha)

Takeaway

Franklin International Low Volatility High Dividend Index ETF is a currency-hedged global dividend ETF holding about 100 stocks from developed countries. It is well-diversified across countries, sectors, and holdings. Japan and the UK are the heaviest countries, financials, and utilities are the heaviest sectors. LVHI has significantly underperformed its competitors, both since inception and in the last 12 months. Annualized distributions show large variations due to currency rates.

The currency hedge aims at projecting the performance measured in local currencies into a performance in dollars. It is supposed to offset the currency risk for USD-based investors. However, currency risk may be beneficial. Equity funds with a currency hedge always involve two bullish bets: one in a stock strategy and one in a currency, here the USD.

Quantitative Risk & Value (QRV) features data-driven strategies in stocks and closed-end funds outperforming their benchmarks since inception. Get started with a two-week free trial now.

This article was written by

Step up your investing experience: try Quantitative Risk & Value for free now (limited offer).

I am an individual investor and an IT professional, not a finance professional. My writings are data analysis and opinions, not investment advice. They may contain inaccurate information, despite all the effort I put in them. Readers are responsible for all consequences of using information included in my work, and are encouraged to do their own research from various sources.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.