RVT Vs. SQLV: Competing Royce Small-Cap Value Funds

Summary

- The Royce Value Trust CEF invests in value-oriented stocks of small-cap and micro-cap companies. The fund benchmarks the performance of its portfolio against the Russell 2000 Index.

- The Royce Quant Small-Cap Quality Value ETF is under the Legg Mason ETF Investment Trust. The fund also benchmarks the performance of its portfolio against the Russell 2000 Index.

- Both funds are evaluated and then compared against each other. Other SCV fund possibilities are listed with some article links.

- Despite Royce Investment Partners' involvement in both funds, there are differences that give investors the ability to decide which fits into their own portfolio strategy best.

- The funds show a mixed picture when it comes to return and risk data, so while I rate both a Buy, with a preference for RVT for its large discount.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

syahrir maulana

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Small-Cap Value funds have been an interest of mine recently as I started reviewing each of the funds I own and if they are doing well enough to keep or tax-loss harvesting is their best attribute as far as my portfolio is concerned. I included links to recent articles at the conclusion of this review of the Royce Value Trust CEF (NYSE:RVT) and the Royce Quant Small-Cap Quality Value ETF (NASDAQ:SQLV).

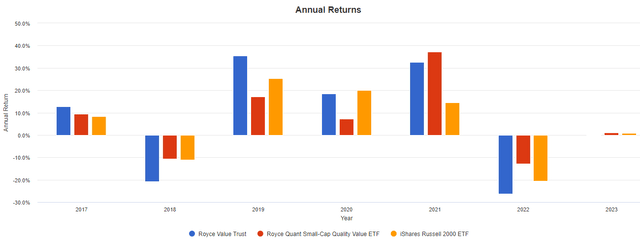

The funds show a mixed picture when they come to return and risk data, so while I rate both a Buy, I am not picking one over the other.

Why Small-Cap Value stocks?

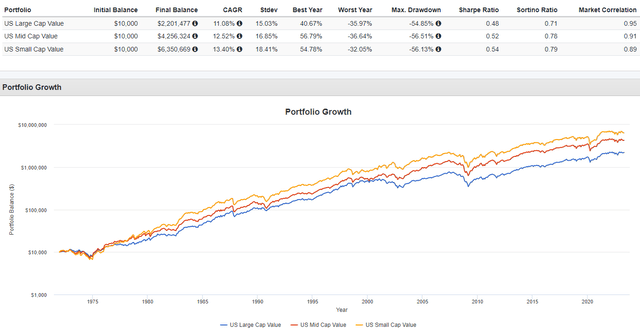

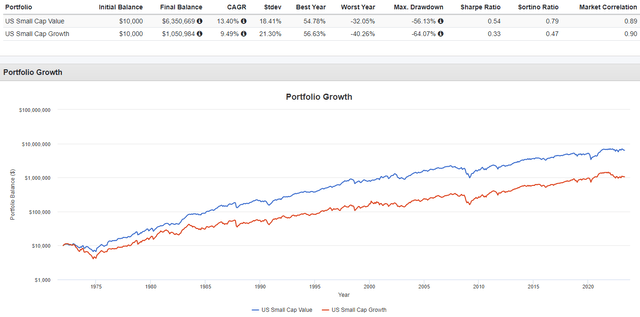

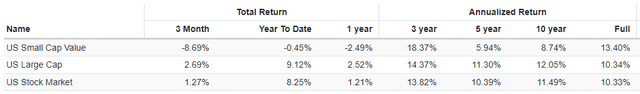

As the next graph shows, this set of Value stocks has outperformed their larger cousins since 1972.

Within the Small-Cap segment, the Value stocks have a wide performance gap over the Growth stocks.

Royce Value Trust CEF review

Seeking Alpha describes this CEF as:

The Funds primary investment objective is long-term capital appreciation, that it will seek to achieve by normally investing more than 65% of its assets in common stocks, convertible preferred stock and convertible debentures. Current income is a secondary investment objective. Royce Value Trust, Inc.'s portfolio includes common stocks, preferred stocks, corporate bonds and repurchase agreements. RVT dates back to 1986.

Source: seekingalpha.com RVT

RVT has $1.6b in AUM and has a TTM Yield of 9.6%. Annualized fees were 105bps for the 12-months ended 3/31/23, of which 74bps was for the managers. Unique amongst CEFs, that fee runs from 50-100bps based on RVT's performance, with no monthly fee taken for extended negative returns.

RVT holdings review

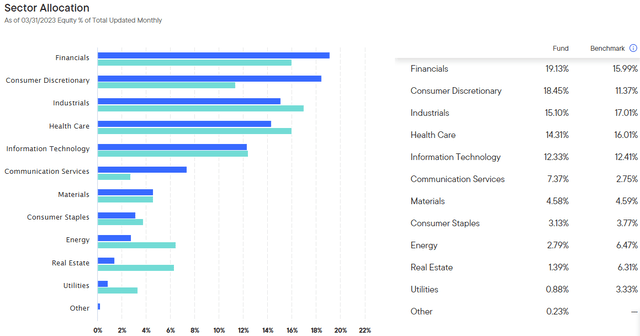

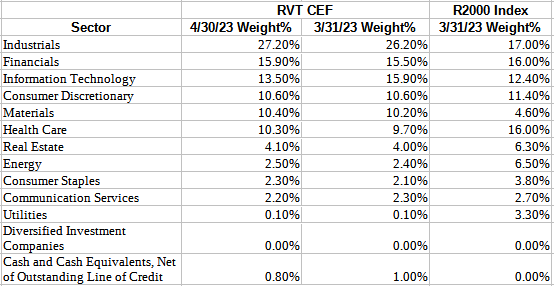

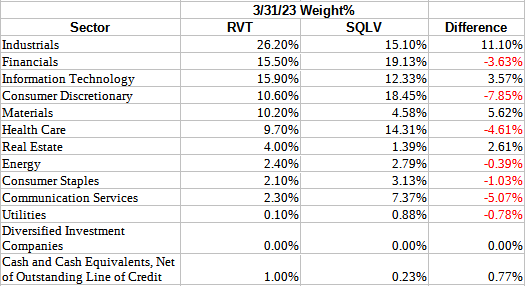

I chose to show two sets of sector data as the index comparison was only for 3/31/23 and that holdings data had more detail. The movements between months were minor.

royceinvest.com; compiled by Author

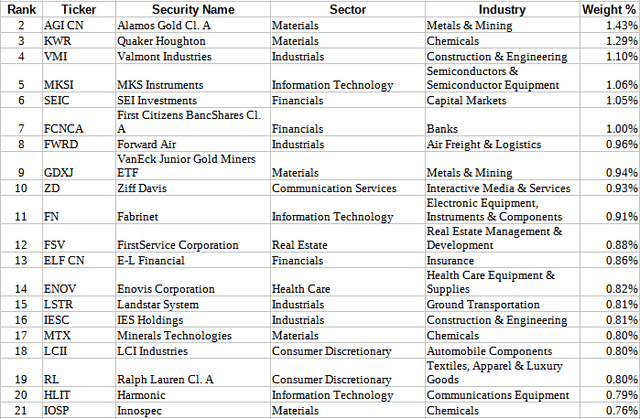

The actual top holding was a Repurchase Agreement at 2.47%; I chose to ignore that one.

royceinvest.com; compiled by Author

RVT holds 479 assets, with those shown above accounting for 19% of the portfolio. The Top 200 holdings represented 85% of the Fund's equity investments as of 03/31/23.

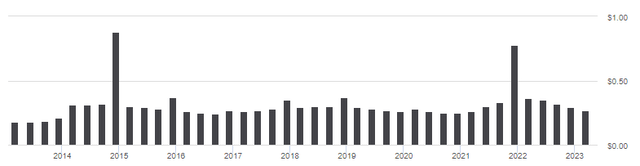

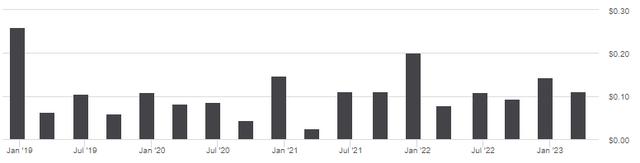

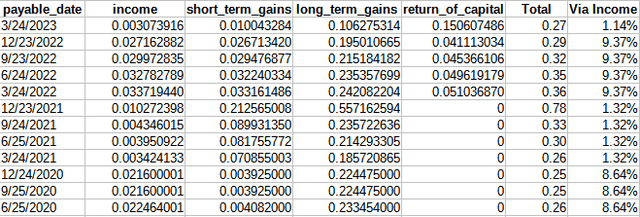

RVT distribution review

Unlike ETFs, CEFs are not graded on their payout results. It was listed that the payout growth has been under 1% over the past five years. While the 9.6% yield is impressive, very little comes from income.

royceinvest.com; compiled by Author

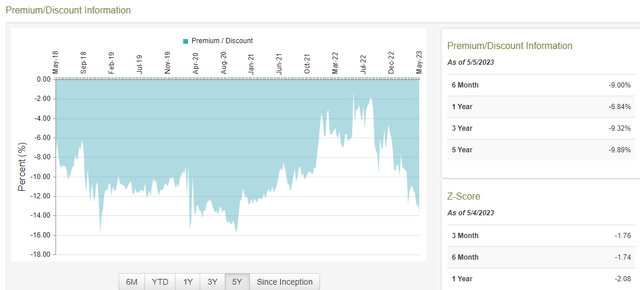

RVT premium/discount review

As indicated by the -2.08 Z-score, RVT's discount is at a very attractive level currently at 13.5%. RVT has not sold at a premium though since 2007 but the discount does shrink as the chart shows.

Royce Quant Small-Cap Quality Value ETF review

Seeking Alpha describes this ETF as:

The investment seeks to achieve long-term growth of capital. The fund primarily invests in equity securities of small-capitalization companies that are traded in the United States and meet certain criteria using a proprietary methodology created by the fund's sub-adviser. Under normal market conditions, it invests at least 80% of its net assets, plus borrowings for investment purposes, if any, in equity securities of small-capitalization companies or other instruments with similar characteristics. SQLV started in 2017.

Source: seekingalpha.com SQLV

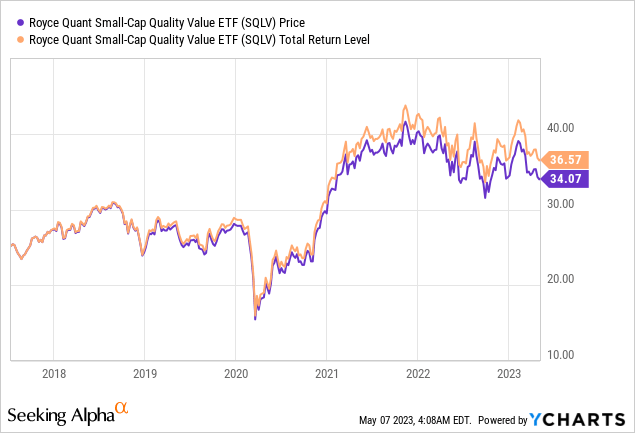

SQLV has only $24m in AUM and comes with 61bps in fees. The TTM Yield is only 1.34%.

SQLV holdings review

Sector data was last updated as of 3/31/23.

SQLV measures themselves against the benchmark, but doesn't invest based on it, thus the sector weight differences.

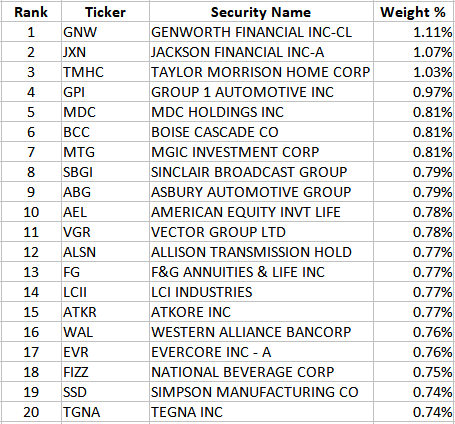

Top holdings

franklintempleton.com; compiled by Author

SQLV holds about 250 stocks, with the Top 20 representing about 17% of the portfolio. The Top 125 stocks account for 68% of the portfolio, meaning the bottom half still have impact on performance.

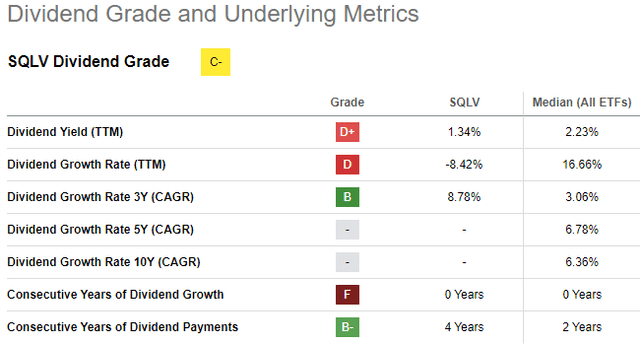

SQLV distribution review

With its low yield, payouts are less important here versus RVT's. That payout level is reflected in their "C-" grade from Seeking Alpha. Unlike RVT, 100% of the distributions come from income.

seekingalpha.com SQLV scorecard

Comparing Funds

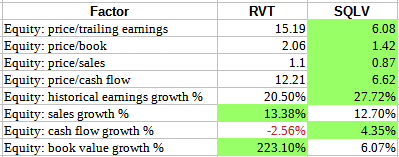

I start with some basic equity data for each fund, with the better value marked in Green.

Fidelity.com; compiled by Author

All the Value ratios favor SQLV over RVT; with the Growth ones split. I'm sure some of that reflects the sector allocation differences, as shown next.

multiple pages; compiled by Author

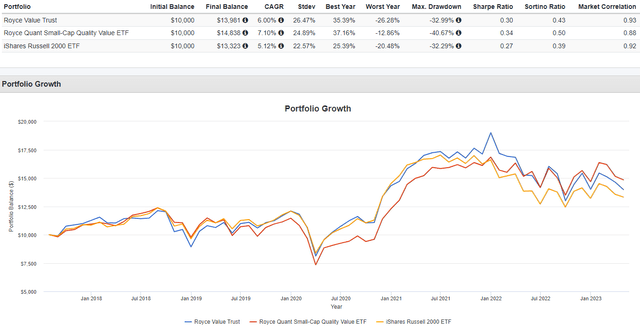

For the next comparison, I included the iShares Russell 2000 ETF (IWM) as a proxy for the benchmark both measure themselves against.

While both have done better than IWM since SQLV started in 2017, neither RVT nor SQLV has been the consistent best performer.

Picking which fund

Of course, any due diligence would expand the search before deciding and for that Seeking Alpha has a good search tool, which I noted below. You will also find links to several recent SCV article I wrote. That said, here is a brief summary of the differences between these funds.

- Investors can pick up RVT at a large discount (13+%), one of its biggest advantage over SQLV.

- Assuming the investor is okay with RVT using non-income for most of their payouts, RVT is the better fund for income seekers.

- Preference for which sectors are more weighted between the two funds: something that will vary amongst investors.

- RVT's leverage is only 2%, so that should not concern those who avoid CEFs because of that.

- With similar returns, SQLV would be my choice for it having much lower fees, which reduce the return investors see.

Portfolio strategy

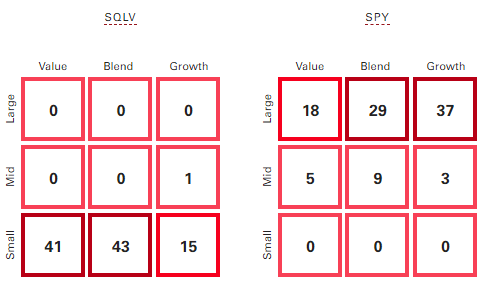

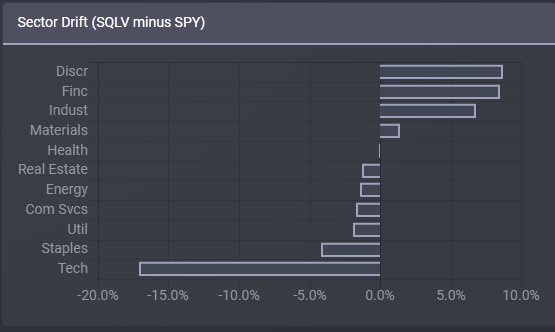

For investors focused on the stocks that comprise ETFs like the SPDR S&P 500 ETF (SPY), RVT or SQLV investors gain diversification in two ways as illustrated in the next two sets of data. Being a CEF, neither tool I used includes those funds. First, we compare market-cap and growth/value allocation differences.

advisors.vanguard.com

For investors highly into Large-Cap ETFs, SQLV (and RVT) helps to balance out their market-cap allocations. SQLV, I assume RVT based on its name, both increase the allocation of Value stocks compared to SPY. Looking at sectors, investors wanting/needing less Technology exposure get that by adding either SQLV or RVT.

ETFRC.com

Where it matters the most, what an investor earns, Small-Cap Value stocks have beaten all Large-Cap stocks and the overall US stock market since 1972, though which was best has varied.

Related small-cap articles

- AVUV Vs. XSVM: Active Small-Cap Value ETFs Use Different Strategies

- RZV Vs. AVUV: No Consistent Winner In The Small-Cap Value Space

- I Replaced IJS ETF With XSVM ETF: Good Timing?

- DFSV Vs. VBR: New Small-Cap Value Beating Vanguard's

Those tickers are a fraction of the SCV ETFs. Seeking Alpha's ETF screen finds 32 (screen link).

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XSVM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.