Perella Weinberg: Margin Risk And No Upside

Summary

- Perella Weinberg Partners is an investment bank that provides strategic and financial advisory services globally.

- Revenue has grown at a 9% rate in the last 5 years but faced noticeable volatility.

- Margins are poor, with OPM negativity in 5 of the last 6 years.

- We do not see a clear route to industry average profitability.

- Markets are pricing PWP at a steep discount to other IBs.

MarioGuti/iStock via Getty Images

Investment thesis

Our current investment thesis is:

- PWP is rightfully a highly regarded advisory, with quality employees. It should have no issues winning work long term.

- The problems are around its financial performance, which is concerning. Margins are not good and growth is volatile. We see no route to parity with peers.

- PWP is very cheap relative to other IBs, pricing in the problems.

Company description

Perella Weinberg Partners (NASDAQ:PWP) is an investment bank that provides strategic and financial advisory services globally.

Their services include advice on strategic and financial decisions, mergers and acquisitions, shareholder and defense advisory, capital markets advisory, private capital placement, and financing and capital advisory solutions.

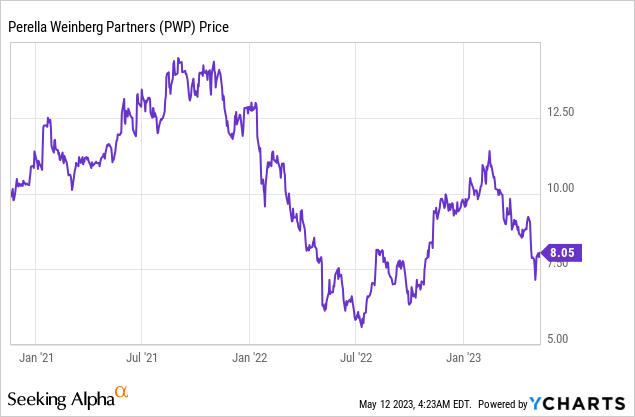

Share price

PWP's share price initially made gains following its listing but quickly saw a reversal of fortunes, experiencing a sustained period of decline. This was driven by a strong FY21, similar to the other banks, followed by a rapid decline in performance as the market softened.

Financial analysis

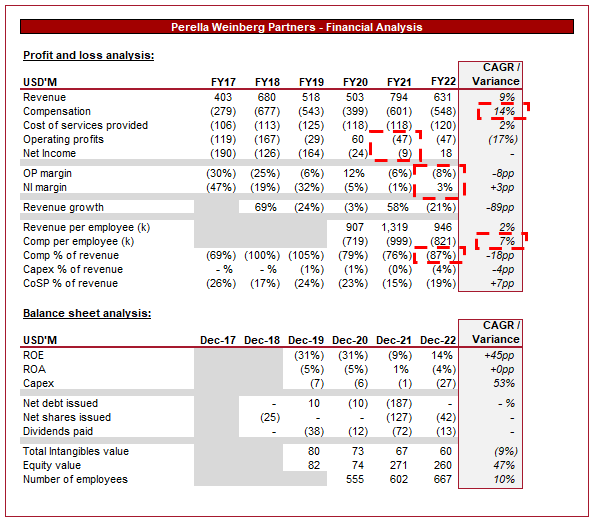

PWP financial performance (Tikr Terminal)

Presented above is PWP's financial performance for the last 6 years. The business has struggled to develop to the degree required to achieve sustainable profits.

Revenue

PWP has achieved a revenue growth rate of 9% across the last 5 years, although there has been significant volatility during this period. All but one period has seen growth or decline in excess of (-)20%.

Due to the size of the business, PWP is somewhat exposed to fluctuation in the size of projects. If a large deal is won, it can inflate a period's performance compared to the prior, and equally, if the business does not achieve the same in the following year, a decline may occur. For this reason, it is difficult to assess Y/Y movements, and it's better to consider the overall directional movement, which in the case of PWP is positive.

Further, the business has benefited from M&A-hospitable trading conditions, with record low interest rates and relaxed monetary policy. This reached its extreme in FY21, when pent-up transaction demand post-lockdown exploded, resulting in a record year for advisory work. PWP was able successfully win client work and increase its mandates, resulting in a growing client base. This comes with the basic art of providing a good service. In the advisory world, the key is to be flexible, dependable, and to provide a valuable output/result. With PWP being founded in 2006, it is clear that the business has done well to develop its market expertise, developing trust, and a strong reputation.

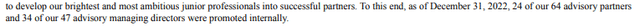

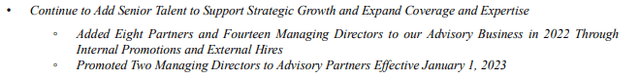

Moreover, MD growth is also a contributor to revenue. MDs & Partners are responsible for pitching for work, winning clients, and generally driving forward the market awareness of the firm. For this reason, many investment banks will aggressively grow through the recruitment of external MDs, expecting them to bring their expertise but also their clients.

As the following annual account extract shows, the majority of PWP's MD recruitment has been external hires, illustrating the focus on driving business. Through a brief review of PWP's website, the majority of these external MDs are former bulge bracket employees, suggesting the recruitment is adding value.

Promo/recruitment (FY22 accounts)

In the most recent period, 8 new partners and 14 new MDs were recruited/promoted, as well as 2 more individuals from 2023 onward. This should act as a driver of revenue in the coming years, especially once any non-competes etc. end for the external recruits.

New recruits (FY22 accounts)

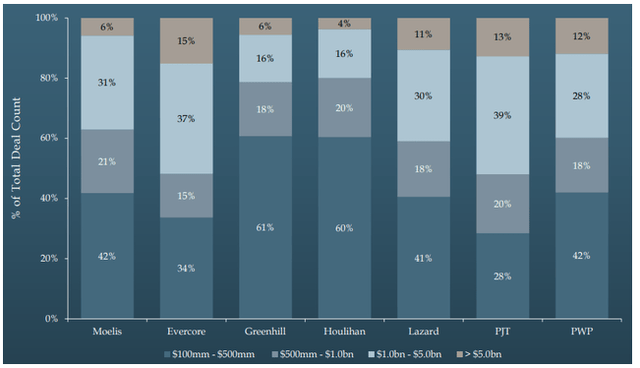

The majority of PWP's transactions are >$500M, suggesting the business is truly an "elite boutique", pitching for many of the projects that the bulge bracket is looking to win. This is a reflection of how highly rewarded PWP is in the market.

Deal count by size (Moelis)

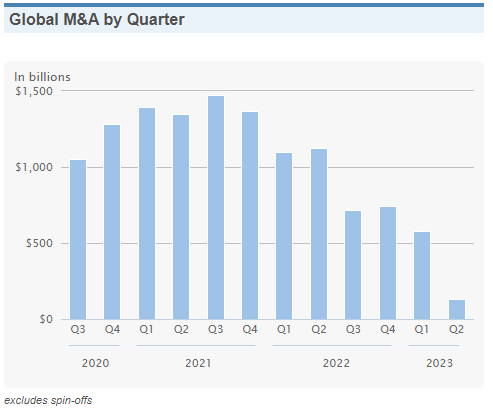

Following the increased activity in FY21, FY22 was far milder. This was driven by a change in market and economic conditions. Fears of a recession have created uncertainty in the market, with many investors more stringently assessing opportunities, especially when analyzing valuations. This makes it more difficult for buyers and sellers to agree on a price / sellers to find buyers, widening the valuation gap.

Further, heightened rates have led to the cost of capital increasing. As a result of this, businesses are finding it far more difficult to raise capital, as well as buyers facing higher costs to finance transactions. Again, this leads to difficulties with company valuations, reducing activity.

The impact is illustrated in the graph below, with quarterly M&A value declining consistently since 2021.

M&A value by quarter globally (Dealogic)

Our view is that this will likely continue into FY24, as inflation remains the primary target of central banks. This could mean an extended period of underperformance where upside potential is limited.

The opportunity for PWP will come with restructuring, which is generally a practice that is counter-cyclical in nature. When markets weaken, a greater number of businesses require restructuring support. The question is whether this can offset the decline in M&A activity, which seems unlikely.

Margin

PWP's margins are not good. The company has been losing making at an operating level for 5 of the last 6 years. The losses have been declining but the business has yet to show an ability to achieve sustainable profits.

The primary reason for this is compensation, which has continually grown despite movements in revenue. The cost now represents 87% of revenue, far above the industry average. Our view is that a 60-65% level is good, which PWP has not been close to achieving. This suggests incentives are not aligned between employees and shareholders, as employees are seemingly benefiting at the cost of shareholders regardless of growth or decline.

It is difficult to see PWP's route to profitability as employee costs are fixed to an extent and recruits will not accept a lower comp package than their peers, meaning it must be revenue that needs to increase.

Balance sheet

PWP is asset-light with a fairly uneventful balance sheet.

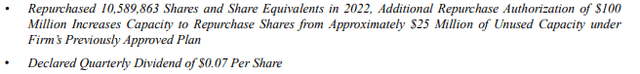

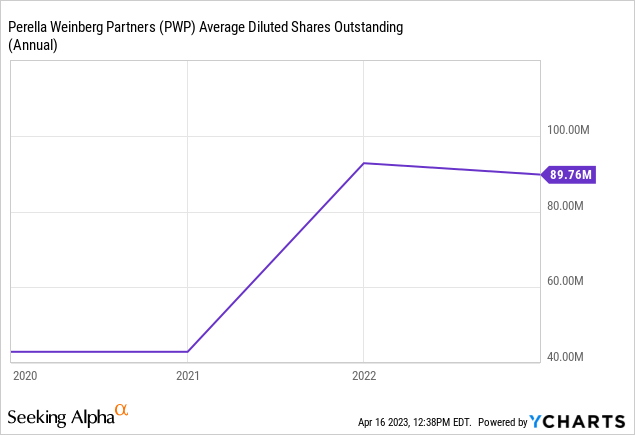

The company has looked to distribute to shareholders where possible, including dividends and buybacks. Further, Management likely believes the stock is undervalued, as they have announced an additional repurchase program of $100M.

Distributions (PWP)

Despite the buybacks, diluted shares have increased in the last few years.

Outlook

Outlook (Tikr Terminal)

Presented above is Wall St. consensus view on the coming year. It is impossible to forecast where the market will go in the future but this is a valuable directional view of the business.

Interestingly, PWP is expected to achieve flat growth in FY23, with margins improving. Flat growth is possible if restructuring or M&A activity picks up, otherwise, this looks difficult to achieve.

As mentioned previously, we are not convinced with margins unless revenue increases noticeably. This does not look to be the case yet OPM is expected to improve. With compensation being the material cost driver, this looks unlikely.

Peer comparison

Investment banks (Tikr Terminal)

Presented above is a comparison of PWP to a cohort of investment banks on a financial basis.

PWP performs poorly, with a lower NIM and poor growth. Even if we compare the forecasted margins, PWP still underperforms the average.

This is a reflection of where PWP is in its development. The company still has further improvement required until it can be a comparable stock, even if it is a comparable business in trading terms.

Valuation

Valuation (Tikr Terminal)

Due to the lack of operating profitability, we have compared the company's valuation on a sales basis. This is a less reliable indicator and we are not a fan of the metric, but nevertheless, it is all we have.

Based on this, PWP is substantially undervalued compared to a subset of its peers. Markets are seemingly pricing in an extended period of poor profitability and growth.

Final thoughts

PWP is clearly a highly regarded advisor on Wall Street. The company boasts an impressive roster of employees and its revenue per employee is extremely good. We are expecting a mild year as interest rates remain elevated and investors are hesitant to transact, however, this does not seem an issue in the medium term.

The issues with the business are not commercial in nature but the financial profile. Margins are terrible and revenue is still volatile. The company is trading at a substantial discount to its peers, which alleviates the risk that it is overvalued but upside looks unlikely.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.