GDXJ: Extremely Poor Risk-Reward Outlook

Summary

- While the VanEck Vectors Junior Gold Miners ETF would likely outperform if gold prices manage to push higher, the risk-reward outlook is extremely poor here.

- Despite the recent rise in gold prices, junior gold miners have been unable to grow their sales and earnings, while free cash flows remain negative.

- Gold itself is also overvalued relative to its fundamentals, and a close back below $2,000 could easily see gold move back down to its range lows around $1,600.

- If history is a guide, a 20% decline in gold could easily see the ETF lose half of its value.

Adrian Los

The VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) is highly leveraged to the price of gold, which is facing a potential downside reversal. Despite elevated gold prices and falling energy costs, the underlying MVIS Global Junior Gold Miners Index still generates negative free cash flows. Even a slight drop in gold could see the GDXJ post huge losses in my view.

The GDXJ ETF

The GDXJ tracks the performance of the MVIS Global Junior Gold Miners Index, a market-cap-weighted index of global gold- and silver-mining firms, focusing on small and mid-caps. The index covers global precious-metals-mining firms that generate at least 50% of their revenues from gold and silver. To ensure diversification, single stocks are capped at 8%. A sector-weighting cap factor is employed to ensure that 80% are determined as gold stocks, and silver stocks are limited to not go above 20%. The GDXJ charges an expense fee of 0.53%. I last wrote about the GDXJ on January 9, where I gave the ETF a 'hold' rating (see 'GDXJ: Junior Gold Miners On Shaky Ground'). Since then, despite gold prices rising 7%, the GDXJ has risen just 1%. This underperformance has been a long-term feature of the GDXJ and there is no reason to expect it to reverse.

Highly Leveraged To Gold Prices, Particularly On The Downside

Gold bulls often like the GDXJ as it tends to outperform during gold bull markets due to the fact that a 1% increase in gold prices and sales leads to a much larger increase in corporate profits and free cash flows. If gold bulls are right and the metal manages to move higher, the GDXJ is highly likely to outperform.

However, while the GDXJ has a track record of outperforming during gold prices rallies, its underperformance during periods of gold weakness has been even more extreme. During the gold bear market of 2008, a 28% gold price decline resulted in a 79% GDXJ decline. During the 2011-2015 bear market, a 44% decline in gold resulted in an 88% decline in the GDXJ. During the 2000-2022 gold bear market, a 21% decline in gold resulted in a 58% decline in the GDXJ.

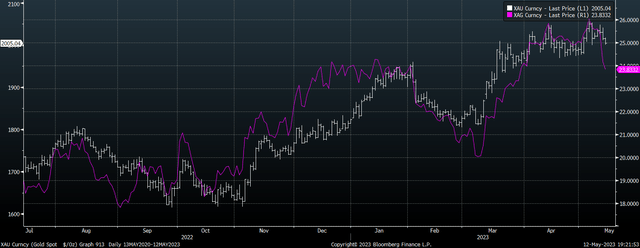

GDXJ Vs Gold Price (Bloomberg)

Long-Term Underperformance Versus Gold Reflects Deteriorating Fundamentals

The brutal underperformance during gold bear markets explains why the GDXJ has lost 85% of its value relative to the price of gold since 2007, a whopping 11% annual decline. I urge GDXJ investors to avoid looking at the ratio of the ETF relative to gold prices and concluding that junior gold miners are therefore undervalued, which is not the case. The underperformance reflects the failure of rising gold prices to translate into sales, earnings, and free cash flows.

Over the past decade, while gold prices are up 16%, the MVIS Junior Gold Mining Index has seen per share sales fall by 20%, operating cash flows fall by 24%, earnings fall by 35%, and book valued fall by 38%. The only fundamental variable that has improved over this period has been dividend payouts, which have risen by 54%, but with free cash flows in negative territory and net current assets shrinking, there is little hope of this trend continuing.

Gold Price Vs MVIS Junior Gold Miners Book Value Per Share (Bloomberg)

Gold Losing Its Grip On $2,000

As I have argued in a number of articles of late, gold prices are highly susceptible to a downside reversal as they are extremely elevated relative to their historical drivers - namely inflation-linked bond yields and commodity prices. See 'Gold Hits New All Time Highs, Don't Expect Them To Last' and '4 Key Questions Gold Bulls Should Be Asking Right Now' for more details. To add to the risks highlighted there, the US dollar is also showing signs of ending, while silver prices have seen a significant downside move. A close back below $2,000 could easily see gold move back down to its range lows around $1,600 and based on the performance of GDXJ in gold bear markets in the past, this could result in a 50% decline in the ETF.

Gold And Silver Prices (Bloomberg)

Summary

While the GDXJ would likely outperform if gold prices manage to push higher, the risk-reward outlook is extremely poor here. The GDXJ's long-term underperformance relative to gold reflects its outsized declines seen during gold bear markets. Even at current gold prices, the GDXJ is overvalued as high gold prices have failed to translate into earnings and free cash flows. I believe a 20% decline in gold could easily see the ETF lose half of its value.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of GDXJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.