Park Hotels & Resorts: International Travel Recovery To Be Catalyst

Summary

- PK delivered impressive financial results in 1Q23, surpassing market expectations.

- The demand outlook for PK looks promising, with indications of healthy growth rates and a potential recovery in international tourism.

- I expect the reopening of the San Francisco and Hawaii markets to be a near-term catalyst for earnings and multiples revision.

PixelsEffect/E+ via Getty Images

Overview

Park Hotels & Resorts (NYSE:PK) is a hotel and resort chain that primarily operates in the United States. The business posted an EBITDA of $146 million in 1Q23. Revenue per available room [RevPAR] was down 10% from 2019 levels, but up 1.4% sequentially if we exclude San Francisco assets. The quarterly results were better than expected, and the commentary that accompanied them shed light on the company's long-term prospects, suggesting that the recovery is continuing. As a result of the 1Q EBITDA performance, management increased their guidance for the full fiscal year 2023, especially the midpoint. In conclusion, I recommend buying PK stock as I anticipate the company to maintain its high level of performance and achieve its guidance. Additionally, I foresee potential positive developments in the near term through international travel to San Francisco and Hawaii.

1Q23 earnings

PK's first-quarter 2023 results showcased impressive performance, with revenues reaching $648 million, surpassing the consensus estimate of $617 million. Similarly, the adjusted EBITDA of $146 million exceeded market expectations, which were set at $133.6 million. The company also demonstrated strong EBITDA margins, reported at 22.5%. Furthermore, PK experienced significant growth in RevPAR, with a remarkable increase of 36.4% to reach $158.84. Another notable highlight was AFFO per share, which stood at $0.42.

Demand outlook

I have confidence in the demand outlook, and I don't see any reason why PK can't ride this wave of recovery. Based on April's preliminary results, management claims that RevPAR has continued to show healthy growth rates, indicating a sequential monthly increase. International tourism should also continue to surge back to pre-covid levels, which I believe we are nearing. I anticipate that Park Hotels & Resorts will benefit from the current wave of travel recovery in fiscal year 2023 and potentially in fiscal year 2024 as well. There are already observable enhancements in New York as a result of the increasing number of European travelers visiting the city. However, the reopening of the Asia Pacific region is still taking form, making San Francisco and Hawaii the focal points of attention (near-term catalyst). In addition to leisure travelers, the management anticipates a recovery in business transient travel, which has shown consistent improvement and is expected to fully rebound by the middle of 2023..

San Francisco

I view the San Francisco travel situation as an upcoming catalyst for possible earnings/guidance revision. While China is still a laggard in participating in the recovery, travel and tourism industry has been recovering at a healthy pace with 2022 seeing a 211% increase in international visitation. Of course, PK benefited as well with all four of its San Francisco hotels generated positive EBITDA in the in 1Q23 for the first time since the pandemic. When considering the numbers directly, the operational measurements are still significantly lower compared to the levels seen in FY19. During 1Q23, the comparable RevPAR in the market was still 50% lower than that of the first quarter in 2019. Additionally, the ADR and occupancy were still down by 8% and 39.5%, respectively. But this tells me that there are still plenty of room to recover, and this phase of recovery could provide an acceleration to earnings in the short-term. Now, what could steer this catalyst farther away from FY23 is the geopolitical tension between the US and China. In my opinion, unless we go to a full out war, I believe small steps would be taken by both sides to ensure their economy yield positive results. For one, US has already lifted any covid restrictions on travelers from China, which is a good first step to travel recovery. Suppose we see a strong international recovery from China and other parts of Asia to San Francisco and Hawaii, I expect the market to react very positively on such news or comments from the management

Valuation

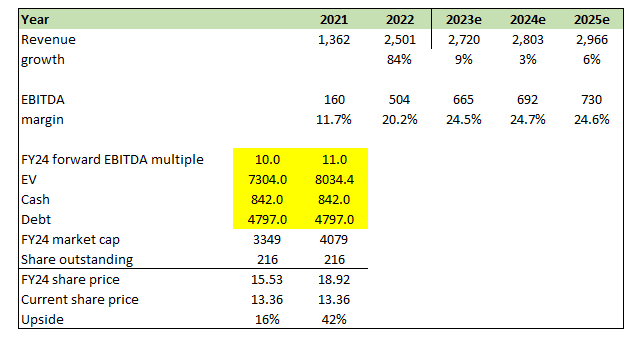

Based on my model, I see an upside range of 16% to 42%, with the main difference being the multiple at which the stock would trade. As I previously stated, I believe news of international recovery in San Francisco and Hawaii would be the catalyst for a multiple reversion (which is currently trading below average). The positive narrative of a faster pace of recovery would strongly appeal to investors, driving inflows into the stock. Pre-covid, the stock traded at around 10 to 11x EBITDA, and I believe that is where it will eventually trade once everything normalizes.

Own model

Conclusion

PK demonstrated impressive performance in 1Q23, surpassing market expectations and showcasing strong financial results. EBITDA, revenue, and RevPAR all exhibited positive growth. The demand outlook also appears promising, with indications of healthy growth rates and the potential for a recovery in international tourism. I expect the reopening of the San Francisco and Hawaii markets to serve as a near-term catalyst for PK's earnings and multiples revision. Considering the near-term catalyst and the upside potential in valuation, I recommend buying PK stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.