Airbnb: Procyclical Nature Justifies Cautious Outlook

Summary

- Airbnb Rooms has the potential to drive significant demand growth in the long term, which could offset the current lower ADR outlook.

- It's prudent for the company to issue a conservative guidance due to the cyclicality of the online travel industry.

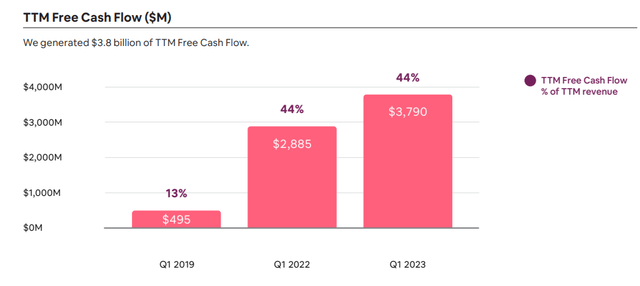

- The company's strong free cash flow profile (44% TTM FCF margin) could help it navigate through the macro headwinds.

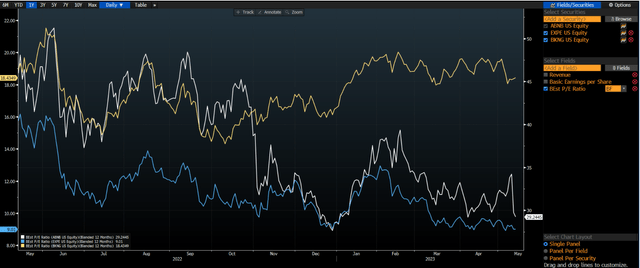

- I'm bullish on the stock, given that its forward P/E has declined by almost 50% from its recent peak.

imaginima

Investment Thesis

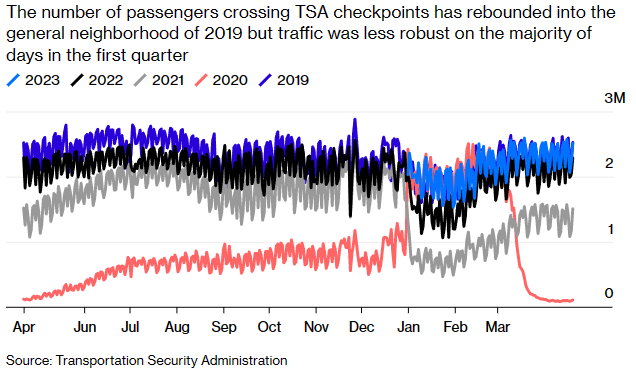

Airbnb (NASDAQ:ABNB) maintains a global leadership position for Alternative Accommodations (AA), creating a 1.8 billion community based on connection and belonging. Despite a significant slowdown in travel during the Covid-19 pandemic, the company achieved a 20.5% CAGR in net revenue from FY 2019 to FY 2022. As travel accommodation is a pro-cyclical business, which is very sensitive to the business cycle, it's not surprising that the company would come across a demand slowdown in coming quarters. While the US consumption data, in general, is still resilient, the company's lower-than-expected guidance merely reflected a conservatism of macro headwinds in the near term. In addition, I believe the debut of Airbnb Rooms and Host Passport will drive significant demand growth despite lower Average Daily Rates (ADR). As a result, I think investors shouldn't overreact to the short-term guidance, since the company's strong products and services will likely continue to support higher growth in the long term.

Bloomberg

Strong Rebound in Post-Pandemic

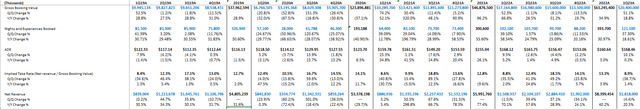

Let's look at some numbers. Airbnb has demonstrated its ability to rebound faster from the disruptions caused by Covid-19, with 394 million Nights and Experience Booked, exceeding the pre-pandemic 2019 level of 327 million. Despite a challenging year-on-year comparison, the company recorded an impressive 19% growth in Gross Booking Value during 1Q FY2023, indicating robust demand at the beginning of this year. Additionally, from FY 2020 to FY 2022, ABNB incredibly managed to turn around its negative adjusted EBITDA margin from -7.4% to 34.6%, boosted its adjusted EPS from $-6.8 to $4.4, and improved its FCF per share from $-2.4 to $5.5. Therefore, given the company's strong track record of recovering from the pandemic, I believe it has the ability to navigate through macro headwinds and a potential recession.

1Q FY2023 Takeaway

Despite a better-than-expected 1Q FY 2023 earnings result, Airbnb's disappointing 2Q FY2023 guidance resulted in a 10% pullback after hours. Both revenue and GAAP EPS were above consensus estimates, and adjusted net income margin expanded by 930 bps YoY. It's worth noting that revenue grew by 20.5% YoY, which is in line with the CAGR of the past four years.

According to the 2Q outlook, the management anticipates an increase in implied take rate YoY, ((defined as net revenue divided by gross booking value)), which reflects the company's competitive advantage in the business. However, the company's 2Q revenue guidance of $2.35 billion to $2.45 billion (12%-16% YoY) is slightly below the consensus estimate of $2.42 billion. Nonetheless, the company expects Nights and Experiences Booked in 2Q to be lower than the revenue growth, citing an unfavorable YoY comparison following the Omicron variant in 2Q FY2022. The company anticipates YoY decline in adjusted EBITDA margin due to changes in the expected timing of marketing spend relative to the last year. Furthermore, the company slashed ADR guidance. During the earnings call, The CFO explained:

"In terms of full year expectations, the year-over-year growth in ADR should be, I think, still probably down in that kind of mid-single-digit range. There's really no change in our expectations on ADR growth."

The company expects not only slightly lower ADR YoY in 2Q FY 2023 but also incremental compression throughout the rest of this year, leading to lower gross booking value in FY 2023. Therefore, despite strong 1Q results, the conservative 2Q guidance reflects a potential cyclical slowdown in travel and macro headwinds. However, a new strategic priority, as I'll discuss below, could be a future growth catalyst for ABNB.

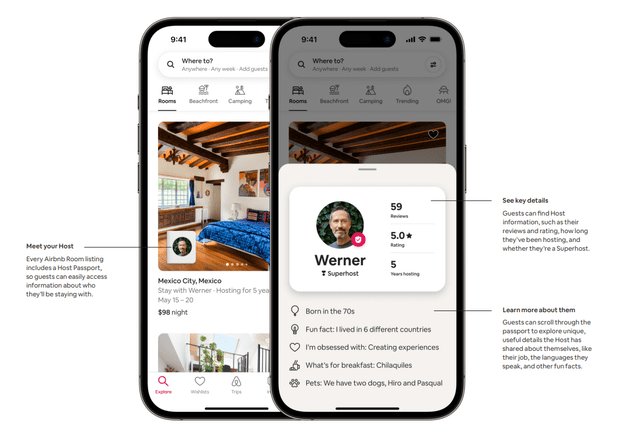

Airbnb Rooms and Host Passport

One of the most exciting announcements was the debut of Airbnb Rooms and Host Passport in its Summer 2023 Release, with 50 new features and upgrades. Given the lower ADR outlook in FY 2023, the company prioritized affordability after receiving millions of people's feedback on how to improve Airbnb. In the earnings call, the management addressed:

"Airbnb Rooms gets us back to the idea that started it all, back to our founding ethos of sharing. And they're also one of the most affordable ways of travel, with an average price of only $67 a night. In fact, over 80% of Airbnb Rooms are under $100 a night. And in the current macroeconomic environment, people want to travel affordably."

This immediately generated 19 million impressions on Twitter, indicating strong interest in the product. By lowering the average price to $67, I believe this can be a growth catalyst to significantly boost Nights and Experience Booked and offsetting the negative impact of lower ADRs. With travel currently more expensive than pre-pandemic levels, the move could boost its market share in the long run.

Moreover, every Airbnb Room now comes with a host passport, which allows guests to get to know their hosts before booking, potentially appealing to those who have safety concerns about staying with strangers. This additional feature may also make Airbnb a more attractive option for those seeking cheaper booking prices compared to hotels.

Valuation

Although ABNB is currently trading at P/E GAAP TTM of 37.61x, the blended forward (BF) 12-month P/E ratio stands at 29.2x (right axis) when we replace the numerator with Bloomberg's estimated adjusted EPS (excluding stock-based compensation and income tax effect). Despite ABNB's premium multiple compared to peers such as Booking Holdings (BKNG) at 18.4x (left axis) and Expedia Group, Inc (EXPE) at 9x ((left axis)), the high valuation can be justified through its robust FCF growth of 57.3% for FY 2022 and adjusted net income margin of 32.4% (compared to EXPE's 9.2% and BKNG's 23%). It's important to remember that ABNB was unprofitable with negative FCF during the pandemic. Therefore, considering the multiple has already come down from its recent high of 50x, I believe it's getting attractive based on its long-term risk and reward profile.

Conclusion

In sum, Airbnb had a decent 1Q FY2023 results. However, the company's 2Q guidance is conservative due to a potential cyclical slowdown in travel demand. The company's new strategic priority on Airbnb Rooms, which offers more affordable accommodations and comes with a host passport for additional safety, would lower ADRs but could be a significant growth catalyst for Nights and Experiences Booked. If successful, this move could help Airbnb capture more market share in the long run. Overall, I believe the recent pullback could be a buying opportunity as current lower guidance has reduced the market consensus, which could create upside surprises for the company to beat expectations in the coming quarters.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.