Long Cast Advisers - Matrix Service: Should Unfold Quite Nicely For Investors

Summary

- I've recently purchased for us Matrix Service, an Engineering & Construction.

- The market is valuing the company on its present P&L, which is unattractive.

- If MTRX is booking work near its historical margins as management says it is, this should unfold quite nicely for investors.

pichitstocker

The following segment was excerpted from this fund letter.

Matrix Service Company (NASDAQ:MTRX)

I've recently purchased for us two new investments and I'll briefly discuss one, Matrix Service, an Engineering & Construction (E&C) company that's adjacent to the hydrocarbon space. It bends metal, builds liquid and gas storage, conducts "turnaround" work at refineries, offers mining services, and has an additional services business in Electrical Transmission and Distribution.

The company is currently trading at around $5 / share. With 27M shares out, $15M in total debt, and $32M in cash, this yields an enterprise value of $120M. Pre-COVID this was a $400M EV company.

Industrial construction seems poised for a strong pipeline of work given the needed infrastructure for "new" energy (hydrogen, biofuels, ammonia, etc.), deferred CAPEX in traditional energy, and incremental N. American mining. This would support a rebound in MTRX's backlog while margin reversion to pre-COVID levels offers a pathway to profitability.

The market is valuing the company on its present P&L, which is unattractive. E&C is one of the longest-lagging industries and the company is still completing work booked during COVID, when pricing was aggressive. One larger project is losing money and construction accounting requires that when a contractor realizes it is in a loss position on a project, it must immediately recognize the entirety of that loss including expected future losses through completion. These charges were recognized in the most recent quarter ended 12/31/22 (FY2Q23).

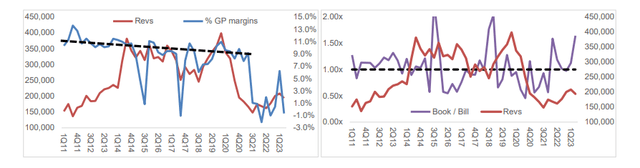

One can observe in the left chart above a blue line showing fairly consistent high single-digit gross margins in the period pre-COVID and then the immediate impact of the pandemic. The long lagging impact reflects work booked during COVID when there was a dearth of projects. Prior dips in '15 and '17 are due to earlier project losses, which occur from time to time in the construction business, regardless of the cycle, illustrating why it's such a crazy industry. The right chart shows the book-to-bill ratio (purple line). Anything over 1x means the company is adding more work and the backlog is growing.

For the last six quarters, book-to-bill has been at or above 1x. Management at MTRX and at other E&Cs exposed to similar end markets talk about a robust pipeline of pending work supporting new and traditional energy. If MTRX is booking work near its historical margins as management says it is, this should unfold quite nicely for investors.

The same management has been in place for over a decade; they've guided the company through prior cycles. The balance sheet is healthy and can support loss projects through completion. Random intangibles like weather can have a material impact on the business, so this can be a frustrating industry to invest in. But the time to buy E&C companies is when the income statement is at its worst and backlog growth lies ahead. That defines the present opportunity.

MTRX is our first hydrocarbon adjacent investment, a part of the market I've long said I'd avoid. The underlying support for avoiding hydrocarbons was a more than twenty-year-old argument with a college friend, now a chemist and environmental scientist at Princeton, to whom I could not then defend part ownership of businesses that were despoiling our environment.

Much has changed over the years. Where "the majors" once treated environmental regulations with antipathy, now they are making - and in some cases leading in - investments in hydrogen, in carbon capture, in biofuels, and in other parts of the energy transition. Furthermore, the reality is that hydrocarbons will be part of our energy diet for years - it's got to come from somewhere - and N. American production is among the most responsibly produced.

| disclosure |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.