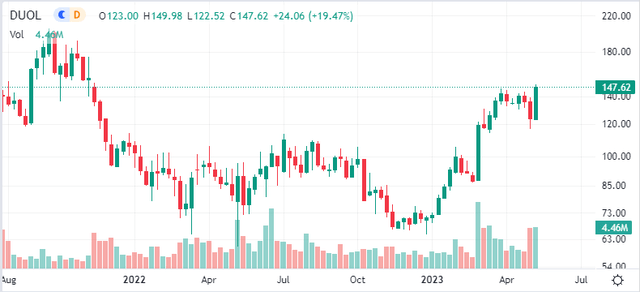

Duolingo: Strong Revenue Momentum To Continue

Summary

- Duolingo, Inc. beat Q1 2023 revenue and EPS estimates and raised its full-year bookings, revenue, and EBITDA guidance.

- The company is seeing no macro headwinds and the business is firing on all cylinders.

- Generative AI should be a growth driver going forward and is already part of the new higher-tier subscription Duolingo Max.

- Looking for more investing ideas like this one? Get them exclusively at Growth Stock Forum. Learn More »

Tomwang112

Duolingo, Inc. (NASDAQ:DUOL) beat Q1 2023 revenue and EPS estimates thanks to the strong momentum of the subscription business that is expected to continue in the coming quarters. The company is seeing no macro headwinds and the business is firing on all cylinders.

A quick look at the most important metrics and year-over-year changes:

- DAU (daily active users) and MAU (monthly active users) grew 62% and 47% to 20.3 million and 72.6 million, respectively.

- Paid subscribers grew 63% to 4.8 million.

- Total bookings rose 37% to $140.1 million and subscription bookings increased 40% to $110.1 million.

- Total revenues grew 42% to $115.7 million, beating the consensus by $3 million.

- Subscription revenue grew 49% to $86.2 million.

Based on the strong performance in the first quarter, Duolingo raised the full-year bookings guidance range from $530-542 million to $552-561 million, total revenue guidance range from $486-498 million to $500-509 million, and EBITDA guidance from $48.6-$59.8 million to $55-61 million.

I have nothing to complain about when I look at the first quarter numbers and the increased full-year guidance, and it appears the company has properly set the stage to beat and raise throughout 2023, the same way it did throughout 2022.

The results also show how unfounded the recent selloff was, as it was driven by the troubles and the threat that generative AI poses to Chegg, Inc. (CHGG), a company that is not really a competitor to Duolingo but is also in the education business. Chegg is seeing generative AI as a threat to its business going forward, but AI is likely to be a potential competitive advantage for Duolingo.

Last quarter, Duolingo announced a new higher-tier subscription offering powered by GPT-4 called Duolingo Max. The company says this is not an “off the shelf” use of GPT-4, but that it is combining it with its proprietary machine learning systems and gamified approach to learning to make its products more engaging. Duolingo Max has two specific new features:

- Explain my answer. It does what it says – it explains the mistake the user made.

- Roleplay. This feature provides conversational practice.

The approach with this rollout is the same as with prior changes to the learning app, gradual and after relentless A/B testing with a small base of users before a broad rollout. The company did not have material bookings of Duolingo Max yet, and given the slow and steady nature of the rollout, we will probably not see a major contribution this year.

CEO Luis Von Ahn seems very enthusiastic about this new offering, as this brings the company closer to its initial goal of the app being as similar as possible to a human language tutor and at a fraction of the cost to the user.

The average revenue per paying subscriber has been decreasing in the last few quarters as the company has been adjusting its pricing from flat to regional, and that meant a lower price in many regions. But this has been a major net positive and drove significant growth in paying subscribers over the last few quarters. And with the gradual rollout of Duolingo Max, which has a higher price than the basic subscription, average revenue per paying subscriber should start to trend higher at some point in the following quarters and should provide a nice tailwind for revenue growth.

And lastly, other revenues have grown nicely over the last few quarters. This is still a relatively small category, but delivering high growth rates as the company’s in-app monetization strategy is starting to pay off. These are the new gamification features that motivate users to purchase gems, the in-app currency.

Conclusion

Duolingo, Inc. remains well-positioned to deliver strong growth in 2023 and the following years. Based on the strong performance in the first quarter, I believe the company is likely to continue to beat and raise as the year progresses. The implementation of regional pricing has served as an accelerant for paid subscribers and with these downward adjustments largely complete and with the planned rollout of higher-tier Duolingo Max, average revenue per paying subscriber should start to rise at some point in the next few quarters and become a tailwind for revenue growth.

Our model portfolio has accumulated a position in Duolingo in Q3 and Q4 of 2022, and I believe DUOL stock has more room to run. Absent a market meltdown in the following quarters, the stock could test the 2021 all-time highs in the next 12-18 months.

I publish my best ideas and top coverage on the Growth Stock Forum. If you're interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.

This article was written by

My articles represent my personal opinion and analysis and should not be regarded as investment advice in any way. Readers and subscribers should do their own due diligence and/or consult their financial advisor before making decisions to buy or sell securities. Trading and investing include risks, including loss of principal.

Exclusive research: http://seekingalpha.com/author/oneil-trader/research

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DUOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.