The 10 Best High-Yield Monthly Paying ETFs You've Never Heard Of

Summary

- Recession is almost certainly coming, likely within 1 to 2 months.

- Stocks are likely to fall 15% to 30%, and possibly as much as 45% if the United States defaults on its debt in 3 to 4 weeks.

- High-yield monthly dividend stocks are a great way to stay calm, sane, and safe in the likely coming market mayhem.

- Here are the 10 best high-yield monthly paying ETFs you've never heard of.

- They offer 3.5% to 5% very safe yields, zero risk of permanently losing your money, and in the coming recession are 92% likely to stay flat or soar as much as 70%.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

Deagreez

The video version of this article was published on Dividend Kings on Wed, May 3rd.

---------------------------------------------------------------------------------------

Recession is coming, and no less than Warren Buffett thinks so.

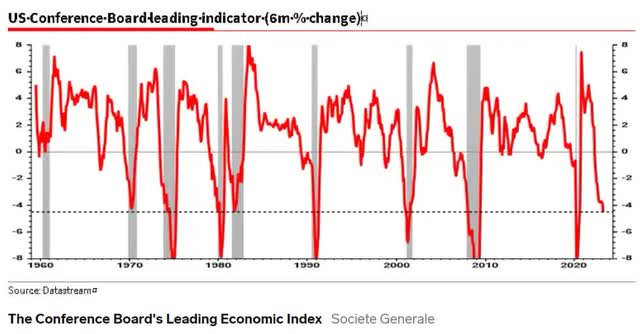

The Conference Board's leading economic index has never fallen at this rate over six months without a recession starting soon after.

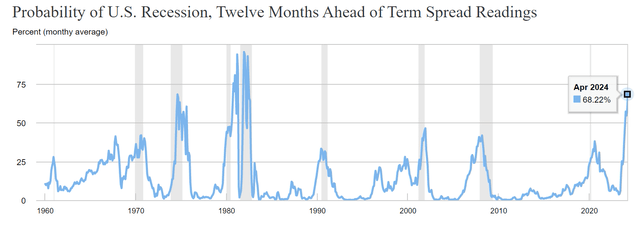

The 3m-10yr yield curve, the most accurate recession forecasting tool in history, has never been so inverted.

- Last week it hit -1.92%

- -1.79% Monday, May 8th.

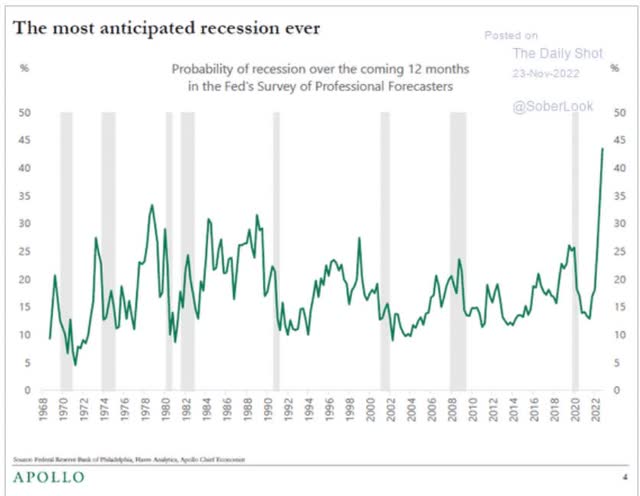

It's the most anticipated recession in history.

- 80% of Americans expect recession

- 96% of CEOs

- the Fed

- Warren Buffett

- the bond market (100% chance by October 2024).

The NY Fed estimates it's the highest recession risk in 42 years. Never in history has risk been this high without a recession starting soon afterward.

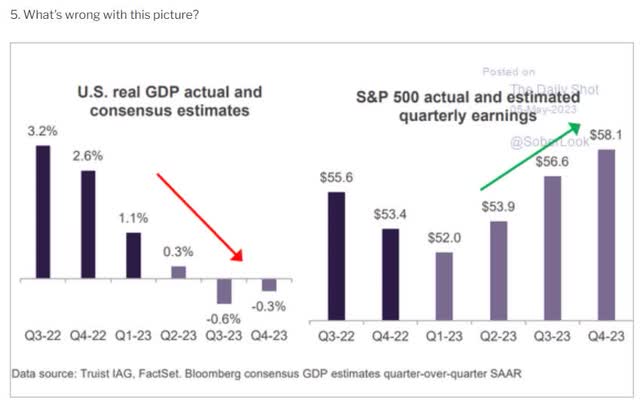

Behold The Mildest Expected Recession In History

Wells Fargo agrees with the Bloomberg consensus that the recession begins in July, lasts six months, and peaks at a 0.9% GDP contraction.

Full-year 2023 growth is expected to be +1.0%.

If economists are right (they always underestimate recession severity), it would be the mildest recession in history.

- the previous record -1% peak decline and -0.4% full-year growth in 2001

- the September 11th recession.

Here's how mild the recession might be.

The Fed thinks unemployment will rise from 3.4% to 4.6%.

Wells Fargo thinks 5.1% peak unemployment.

Since WWII, the average unemployment is 5.75%.

But there is good news for those terrified of another Great Recession or Pandemic level crash.

There is very little chance of another major financial crisis, much less a 2008 style economic meltdown.

But if you're worried about a recession, there are ten new high-yield exchange-traded funds, or ETFs, that are 92% likely to help you sleep well at night in the coming market mayhem.

S&P Bear Market Bottom Scenarios

Best Case

| Earnings Decline | S&P Trough Earnings | Historical Trough PE Of 15 (upper end of the range) | Decline From Current Level | Peak Decline From Record Highs |

| 0% | 229 | 3439 | 16.9% | -28.6% |

| 5% | 218 | 3267 | 21.0% | -32.2% |

| 10% | 206 | 3095 | 25.2% | -35.8% |

| 13% | 199 | 2992 | 27.7% | -37.9% |

| 15% | 195 | 2923 | 29.3% | -39.3% |

| 20% | 183 | 2751 | 33.5% | -42.9% |

Base-Case

| Earnings Decline | S&P Trough Earnings | Historical Trough PE Of 14 (historical mid-range) | Decline From Current Level | Peak Decline From Record Highs |

| 0% | 229 | 3210 | 22.4% | -33.4% |

| 5% | 218 | 3049 | 26.3% | -36.7% |

| 10% | 206 | 2889 | 30.2% | -40.1% |

| 13% (average since WWII) | 199 | 2793 | 32.5% | -42.1% |

| 15% | 195 | 2728 | 34.0% | -43.4% |

| 20% | 183 | 2568 | 37.9% | -46.7% |

Worst Case

| Earnings Decline | S&P Trough Earnings | Historical Trough PE Of 15 | Decline From Current Level | Peak Decline From Record Highs |

| 0% | 229 | 2981 | 27.9% | -38.1% |

| 5% | 218 | 2832 | 31.5% | -41.2% |

| 10% | 206 | 2683 | 35.1% | -44.3% |

| 13% | 199 | 2593 | 37.3% | -46.2% |

| 15% | 195 | 2533 | 38.7% | -47.4% |

| 20% | 183 | 2384 | 42.4% | -50.5% |

| 25% (Joint Economic Committee, 3 Month Debt Default Scenario) 5% probability | 172 | 2235 | 46.0% | -53.6% |

Even in a mild recession where inflation keeps corporate profits from declining at all, stocks are likely to fall about 17%.

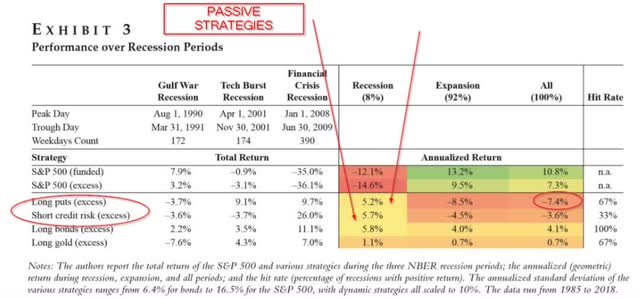

These 10 ETFs are 92% likely to stay flat or go up. Possibly as much as 70%.

High-yield, paid monthly, and did I mention these ETFs are risk-free?

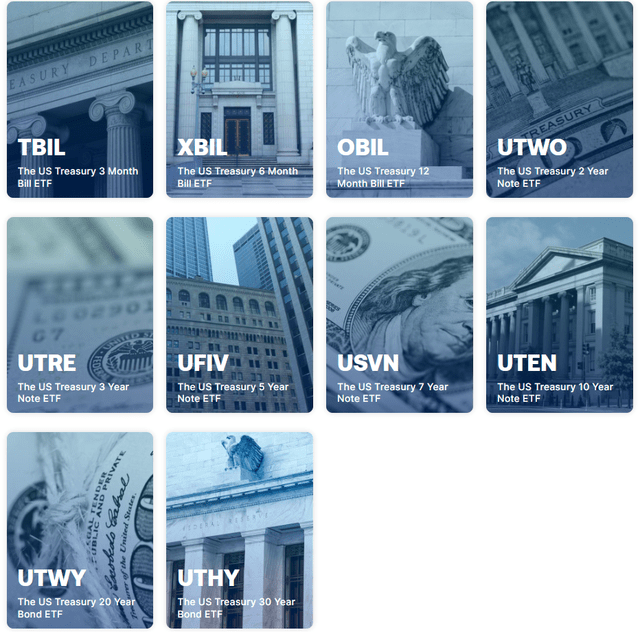

Simply put, these are the ten high-yield monthly paying ETFs you've never heard of.

Single Bond ETFs: The Purest Form Of Risk-Free Income

These 10 ETFs own just one asset each, their respective "on the run" US Treasury bills and bonds.

- (TBIL) 3-month US treasury (pure cash) - rowboat

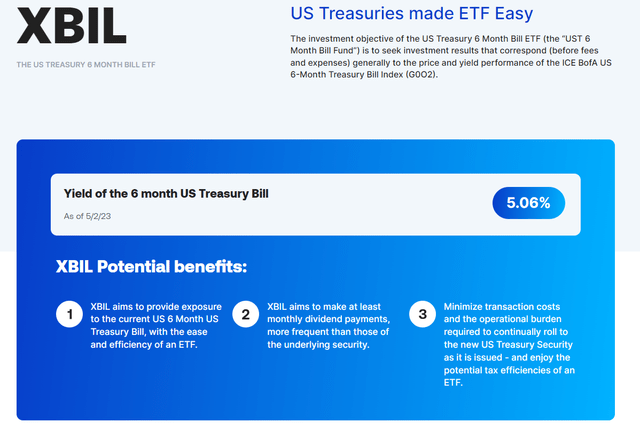

- (XBIL) 6-month US treasury - jetski

- (OBIL) 12-month US treasury - dingy

- (UTWO) 2-year US treasury - tugboat

- (UTRE) 3-year US treasury - motorboat

- (UFIV) 5-year US Treasury - submarine

- (USVN) 7-year US treasury - cruise ship

- (UTEN) 10-year US treasury - battleship

- (UTWY) 20-year US treasury - supercarrier

- (UTHY) 30-year US treasury (pure hedging power) - Starship Enterprise.

The Benefits Of Single Bond ETFs

Why are these ETFs the perfect solution for bond investors looking to buy US treasuries?

There are three main benefits.

- perfect duration control (you own one bond and one bond only)

- monthly income

- long bond income that's more stable than ZROZ or EDV (zero coupons vs. regular bonds).

"On the Run" means literally the newest version of that particular bond.

Buying a 2-year bond from the Treasury or through your broker will age over time.

The duration will change over time.

ETFs naturally roll over maturing bonds into new ones, but every Treasury ETF other than these owns ranges of bonds.

- 1 to 3-month T-bills

- 1-3 year bonds

- 7-10 year bonds

- 20-30 year bonds (zero coupons).

These ETFs always own the newest and thus fixed-duration bonds, which you can pinpoint with laser-like effectiveness.

In other words, say you want to own a 10-year Treasury bond.

IEF is a 7-10 year Treasury ETF and you can't own just the 10-year bond.

If you buy a bond from Treasury Direct or your broker, that bond will age over time and won't be a 10-year bond.

- in one year, it's a 9-year bond

- in two years, an 8-year bond.

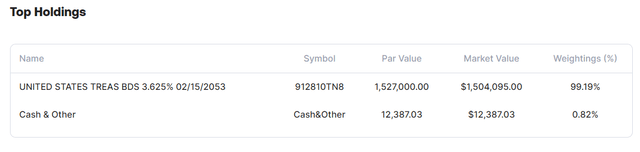

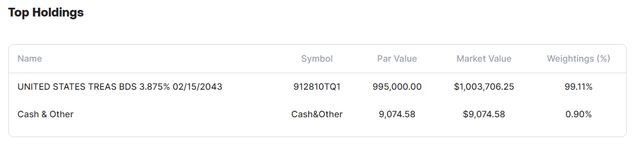

UTHY is always the newest 30-year bond with a duration of 29.85

- up or down 30% in value with every 1% chance in the 30-year yield.

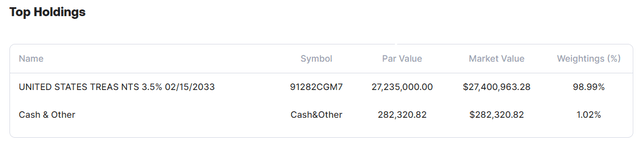

UTHY Owns The February 15th 30-Year US Treasury

Every three months, the US treasury sells new 30-year bonds.

- outside of a debt ceiling crisis.

UTWY Owns The February 15th 20-Year US Treasury

UTEN Owns The February 15th 20-Year US Treasury

TBIL is a 3-month bond with effectively no duration risk; it's pure cash.

XBIL is a 6-month bond and is immune from debt default risk.

If we still default in 6 months, we're in a depression and have bigger problems to worry about, according to S&P, Fitch, and Moody's.

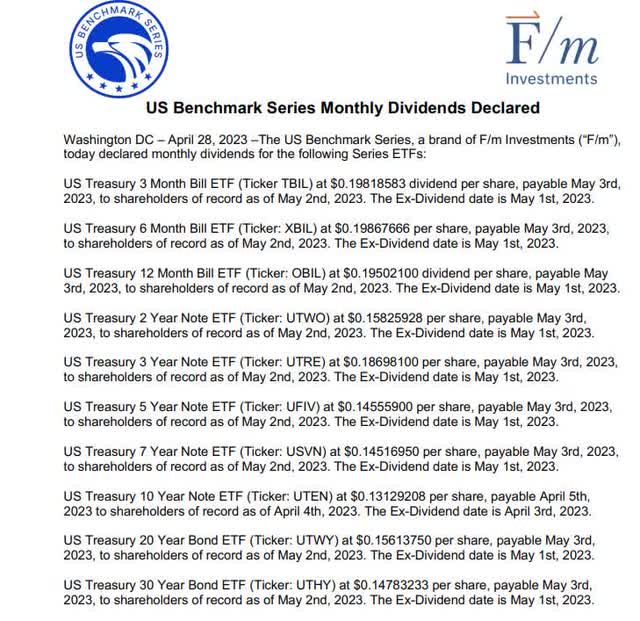

Another benefit of these ETFs is monthly dividends.

Short-term bond ETFs like BIL (1-3 months) and SHY (1 to 3 years) pay monthly dividends.

But longer duration bonds? Like EDV or ZROZ (20 to 30-year zero coupons) pay quarterly.

U.S. bonds pay interest every six months; ETFs smooth out that income.

In fact, the longest-duration bonds, EDV and ZROZ, are zero coupons.

A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed." - Investopedia.

EDV and ZROZ income isn't from the interest payments from the U.S. treasury; it's from maturing bonds.

- more variable than traditional bond ETFs

- less stable income.

UTWY and UTHY are likely to deliver more steady income over time and on a monthly basis.

For my family's hedge fund, we want to own the longest-duration U.S. Treasuries possible for hedging purposes.

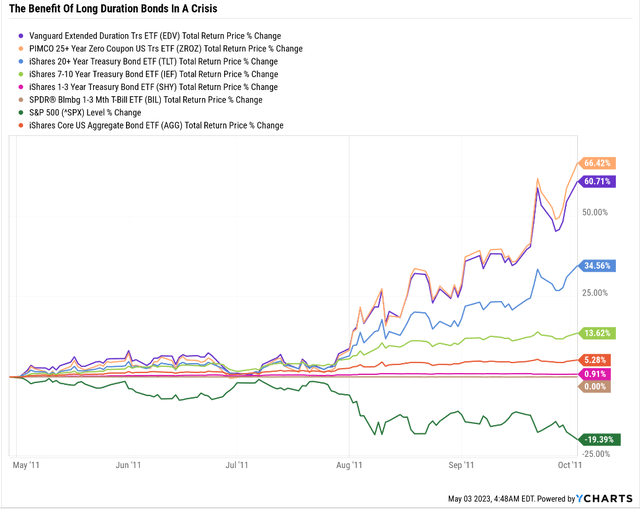

The longer the duration, the stronger the hedging power.

In the 2011 debt ceiling crisis, the S&P hit -22% intraday on October 3rd.

- 1-3 month Tbills flat (they are cash)

- 1-3 year bonds + 1%

- US investment grade bonds +5%

- 7-10 year bonds +14%

- 20+ year bonds +35%

- EDV (24 duration) + 61%

- ZROZ (27 duration) +65%

- 30-year US Treasury (UTHY) +75%.

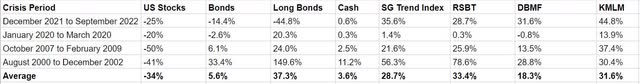

According to Duke University, long-duration U.S. treasuries are the best recession hedge in history.

Since 2000, they have averaged 37% gains in major bear markets, more than any other hedging strategy.

It's a better solution to ZROZ and EDV...at least eventually.

The Downsides Of Single Bond ETFs

The Expense ratio on single bond ETFs is 0.15% which is higher than some (though not most) bond ETFs.

- VGLT (20+ years) is 0.04%

- EDV (25 years) is 0.06%, the lowest cost super long bond

- ZROZ (25 years) is 0.15%, exactly the same as UTHY and UTWY

- BIL (1-3 months) is 0.14%

- IEF (7 to 10 years) is 0.15%.

Personally, I don't care about a few basis points of expense, but here is the biggest downside to these ETFs.

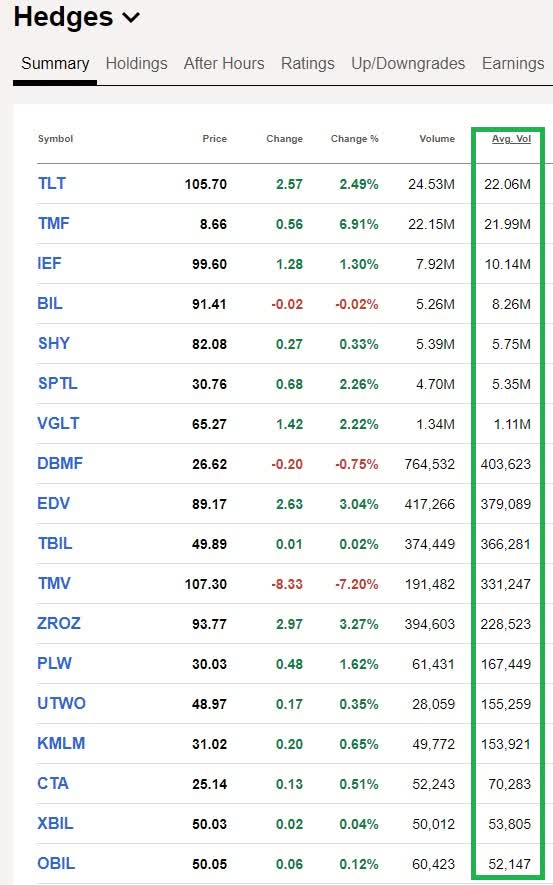

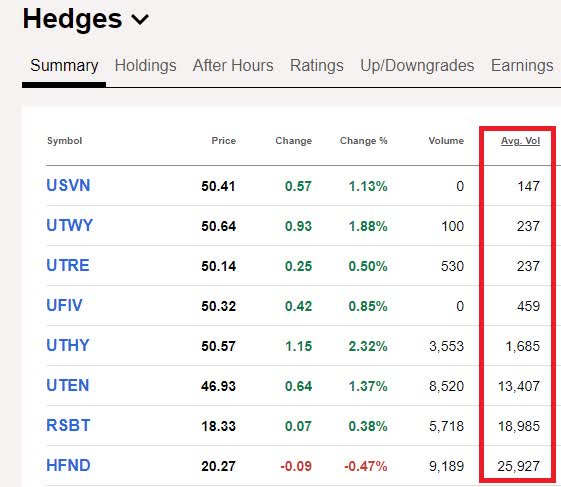

Limited Liquidity

TBIL, UTWO, and UTEN are just under one year old.

Seeking Alpha Seeking Alpha

Liquidity means the ability to sell with market orders without moving the price.

ETF liquidity is a function of two things.

- the underlying asset (net asset value)

- trading volumes.

Market makers will create or destroy shares of an ETF as orders to buy or sell are placed.

This is why UTHY is more liquid than it seems.

- I personally placed a 2500 share buy order at the market price

- the most my broker allowed for a low-volume ETF

- the price spread for the execution was 10 cents (0.2%)

- most buys (up to 1000 shares for me) are just 1-3 cents (0.02% to 0.06%)

- I've heard from a DK member who sold 1500 shares in one order

- also, 10 cent spread.

But trading volume liquidity does have one important thing to consider before buying these ETFs today.

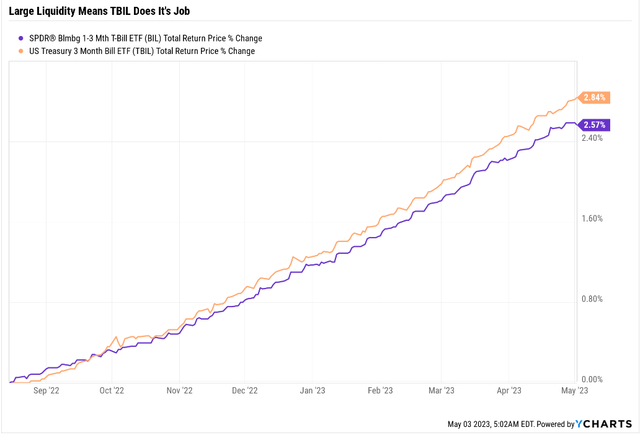

BIL is the most traded T-bill ETF in the world, with nearly $1 billion per day.

Its duration is two months, and TBIL is a 3-month duration ETF. You would expect slightly better returns over time.

And that's exactly what it's delivered. Why? Because TBIL's average daily trading volume is almost $200 million.

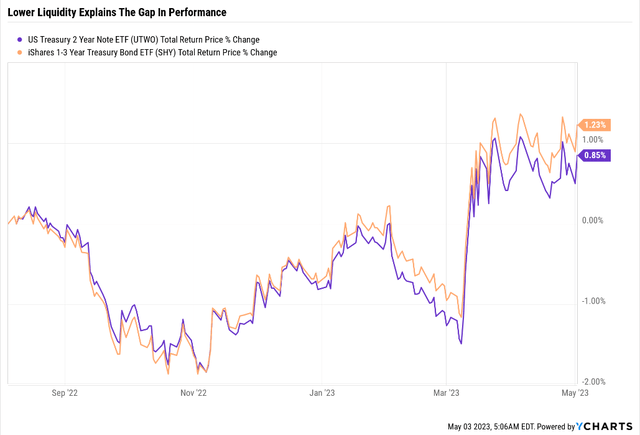

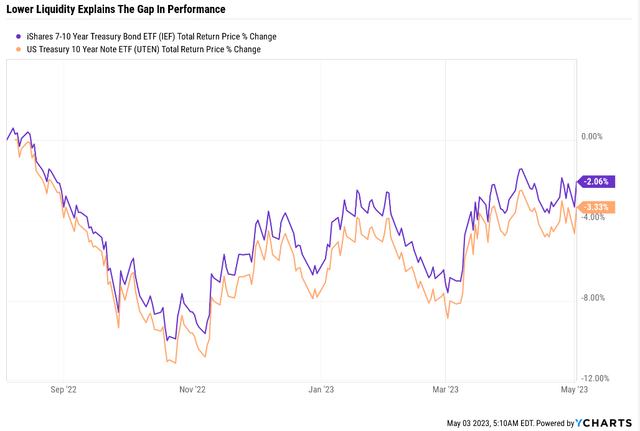

UTWO and IEF have the same duration and so should have essentially identical returns over time.

Most of the time, that's true, but recently it hasn't been. Why? Two reasons.

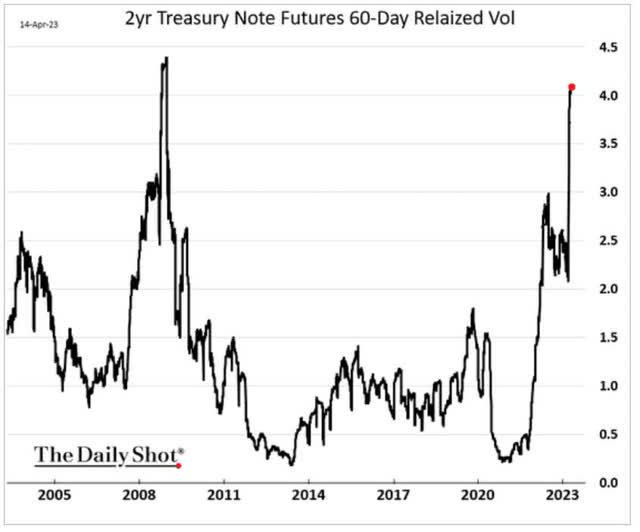

We're now experiencing the most volatile bond market since the Great Recession.

Combined with trading volumes for SHY being much higher.

- $472 million average daily volume on SHY

- $7.6 million for UTWO.

Average trading volume on IEF: $1 billion.

Average trading volume UTEN: $2 million.

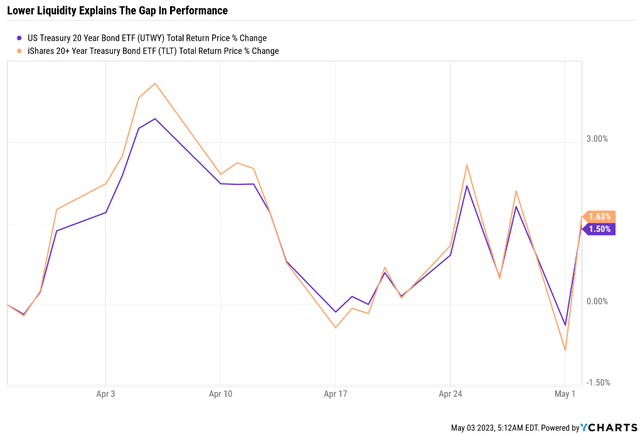

Average trading volume on TLT: $2.3 billion.

Average trading volume UTWY: $12,100.

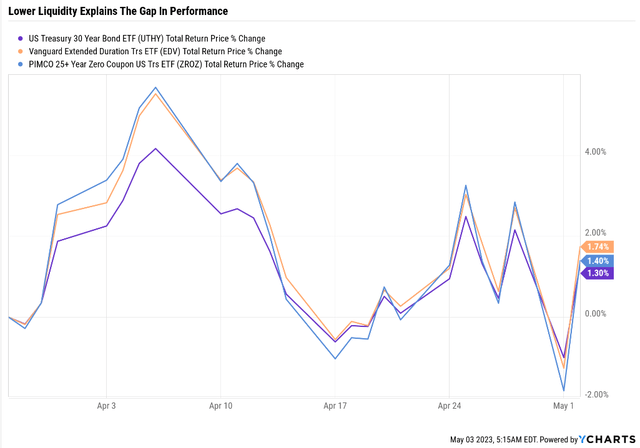

Average trading volume on EDV: $33.7 million.

Average trading volume on ZROZ: $21.3 million.

Average trading volume UTHY: $84,250.

Is there a big difference in the returns of UTHY and ZROZ, and EDV? No, but remember, UTHY has a 30 duration, significantly more than EDV's 24 and ZROZ's 27.

You would expect UTHY to outperform when bond yields are falling, and it's lagged a bit.

That's likely due to its much lower trading volumes.

As UTHY grows in popularity (its $1.5 million AUM and started with $1 million on March 28th), its volumes will increase, and it will likely start outperforming EDV and ZROZ when it matters most, during "risk off periods" like the debt ceiling crisis, recession, and any black swan events.

- Pandemic

- 9/11

- Black Monday 1987 (stocks fell 20% in a single day)

- On Black Monday, bond yields fell 1.17% in 3 days

- 30-Year Treasuries Soared 35% in 3 days.

Or one of the many Fed-induced financial crises we've seen over the decades.

How I Personally Use Single Bond ETFs

My family has a 10% chance of a $500K medical bill this year and a 1% chance of having to pay that much in the next few months.

Bonds are a rowboat, longboards are an aircraft carrier.

Not everyone needs long bonds. They are a weapon of recessionary bear market warfare. But isn't it best to bring the most powerful weapon in your arsenal if you're at war?

So to protect our $1.25 million blue-chip portfolio, I've put all non-emergency fund savings into long-duration bonds.

- 5,000 shares of UTHY to test liquidity for DK members

- I also own 1,625 shares of UTHY in my Schwab IRA

- to test stop loss liquidity when it's time to rebalance out of bonds and into stocks.

If we get another 2011-style debt ceiling market correction, the $750K worth of bonds would generate $500K in profits that we could use in the low probability (approximately 10%) of that unexpected medical bill.

Allowing us to ignore the crashing market and not sell any stocks at the worst possible time.

I DO NOT recommend a 10% allocation to UTHY just yet.

- Notice the 0.7% difference between EDV and UTHY yesterday

- Mostly due to lower trading volume.

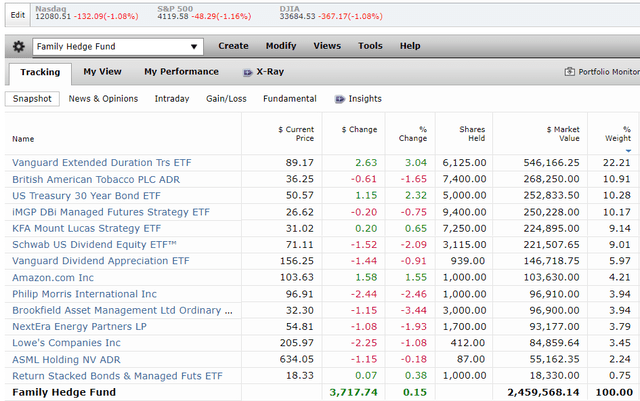

What My Family Hedge Fund Is Working Towards (What You Should Buy If You Want To Own My Family Hedge Fund)

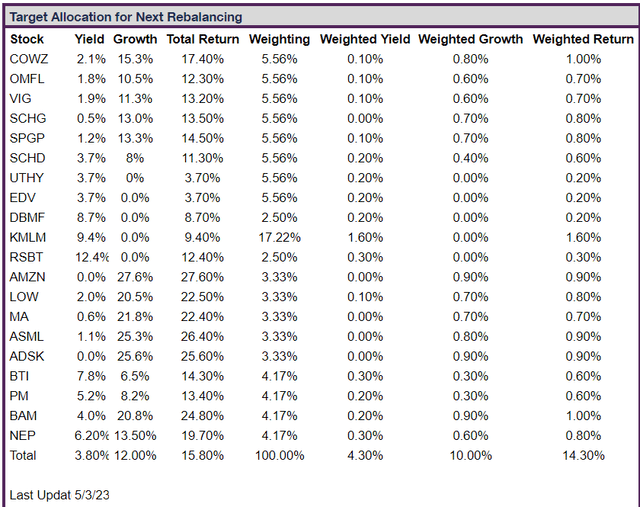

Dividend Kings ZEUS Portfolio Tracker

Note that UTHY is half the long-bond allocation in the ZEUS Income Growth portfolio.

- 33% ETFs

- 11.1% long bonds

- 22.22% managed futures

- 33% individual stocks (16.6% value, 16.6% growth).

When UTHY has sufficient liquidity/trading volume to beat EDV, I will make it 11.1% of the portfolio.

Combined, this portfolio represents 1,024 of the world's greatest companies.

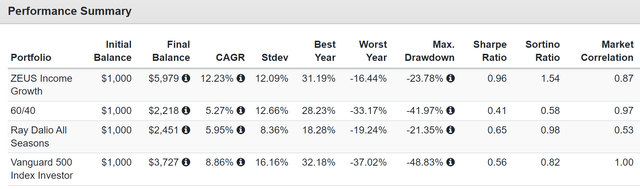

With 4.3% safe yield, 14.3% historical and consensus future return potential, and bear market Ultra SWANiness like this.

| Bear Market | ZEUS Income Growth Peak Decline | 60/40 Peak Decline | S&P Peak Decline | Nasdaq Peak Decline |

| 2022 Stagflation | -11% | -21% | -28% | -35% |

| Pandemic Crash | -10% | -13% | -34% | -13% |

| 2018 Recession Scare | -13% | -9% | -21% | -17% |

| 2011 Debt Ceiling Crisis | -1% | -16% | -22% | -11% |

| Great Recession | -24% | -44% | -58% | -59% |

| Average | -12% | -21% | -33% | -27% |

| Median | -11% | -16% | -28% | -17% |

64% smaller average peak decline in bear markets than the S&P.

43% smaller than the 60/40.

When the market falls out of bed, ZEUS barely feels it.

In the 2011 debt ceiling bear market, ZEUS fell just 1%.

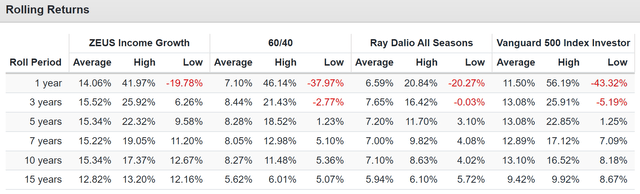

Total Returns Since December 2007 (Start of The Great Recession)

Beating the market and 2X the returns of a 60/40 and Ray Dalio, the billionaire founder of Bridgewater, the largest hedge fund manager on earth.

Negative-volatility-adjusted (Sortino ratio) returns 2X that of the market and 50% better than Ray Dalio.

- hedge funds charge an average of 5% per year in fees

- ZEUS costs 0.38% in expense ratios from its ETFs.

14.3% long-term consensus return potential from a portfolio that historically delivered average 12-month rolling returns of 14.1%, twice that of a 60/40 and Ray Dalio.

It even beats the market, just as it's expected to in the future.

Higher yield, better returns, and volatility so low it's like rolling over the market's biggest potholes in a Rolls Royce.

Bottom Line: If You Want To Own U.S. Treasuries, This Is The Easiest Way

Not everyone needs to own bonds, but single-bond ETFs are the best solution if you do, as my family does.

- short-term ETFs have excellent liquidity

- monthly dividends

- perfect duration control.

If you're a long bond investor, then it's best not to use UTHY and UTWY as your only holding right now because the trading volumes are not yet high enough to fully unlock the awesome hedging power of 20 and 30-year US treasuries. Eventually, UTHY will become the ultimate long-term hedging tool

- +90% in the Great Recession (November peak in bonds)

- +75% 2011 debt ceiling crisis

- +20% Pandemic crash.

I've spent ten years as an analyst studying how to harness the world's best blue-chip assets, whether they be stocks, bonds, managed futures, or ETFs, to create the ultimate sleep-well-at-night high-yield income growth portfolios.

ZEUS Income Growth is what my family is using, but there are plenty of other ZEUS portfolios you can build to perfectly match your risk profile, time horizon, and investing goals.

Infinite diversity in infinite combinations" - Star Trek.

My greatest passion in life is teaching you how to be a better investor. Not just picking stocks but building entire bunker retirement portfolios that can help you sleep well at night and get you to your financial goals no matter what the stock market, economy, interest rates, Fed, geopolitics, or the clowns in D.C. are doing.

That's how we can help you retire in safety and splendor, the easy way, with the world's best companies and blue-chip assets.

Assets like the 10 best high-yield monthly paying ETFs you've never heard of.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2.5 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UTHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.