SCHD Vs. MOAT: Which One Is Better?

Summary

- One of the primary reasons for including ETFs in my book is because of the enhanced demand within the REIT sector.

- In today’s article, we’re going to compare the Schwab U.S. Dividend Equity ETF™ to the VanEck Morningstar Wide Moat ETF.

- Warren Buffett said that non-professionals should simply invest in a cross-section of businesses and that “a low-cost S&P 500 index fund will achieve this goal."

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

gopixa

This article was published on iREIT on Alpha on Tuesday, May 9, 2023.

I just finished the manuscript for my new REITs For Dummies book and I decided to dedicate an entire chapter to real estate investment trust ("REIT") exchange-traded funds ("ETFs").

One of the primary reasons for including ETFs in my book is because of the enhanced demand within the REIT sector. As more capital flows into the space, investors are seeking more efficient ways to invest, and ETFs have been a terrific way to become a virtual landlord.

Another reason for including ETFs in my new book is because I wanted to help investors navigate the REIT ETF universe and compare the various alternatives. As you may know, I recently launched my own REIT ETF Index known as the iREIT-MarketVector™ Quality REIT Index.

Our team focuses on income investing, and hopefully this REIT Index will be the first of many focused strategies in which our team utilizes our research to serve a differentiated ETF marketplace.

In today’s article, we’re going to compare the Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD) to the VanEck Morningstar Wide Moat ETF (BATS:MOAT). Although our research company is known as Wide Moat Research, we are not related to the MOAT ETF.

Fund Overview

As we go through the article, we will compare the two funds side by side.

Let’s begin by looking at the fund overview and strategy for each, beginning with SCHD.

SCHD is a low-cost fund that is passively managed by Charles Schwab with the objective to track as closely as possible the total return of the Dow Jones US Dividend 100 Index. The fund has an expense fee of just 0.06%, meaning that for every $10,000 invested in SCHD, your fees would amount to only $6.

SCHD incorporates a style in which they seek high-quality companies that pay dividends across a diversified set of sectors. As we will see in the dividend and holdings sections, SCHD is very well rounded in terms of holdings and types of dividend stocks.

SCHD was formed in October 2011.

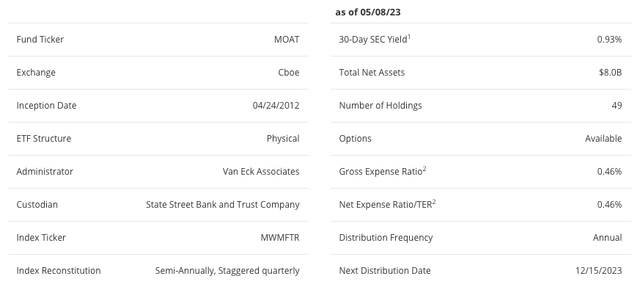

The VanEck Morningstar Wide Moat ETF is managed by VanEck Associates Corporation and seeks to track the performance of the Morningstar Wide Moat Focus Index.

This fund goes through a reconstitution twice per year and is staggered quarterly, but it is still rather passive in terms of management. However, MOAT does have a much higher expense ratio of 0.45%, meaning every $10,000 invested costs $45 per year.

The types of stocks that MOAT invests in are not only attractively priced companies, but also companies with a competitive advantage within their respective sector. Unlike SCHD, MOAT is not all that focused on dividend paying stocks. You will find more growth stocks and higher multiple stocks within this ETF than you would in SCHD.

MOAT was formed in 2012.

Differing Portfolio Strategies

As I mentioned, these two ETFs have a differing approach when it comes to building out their portfolio. MOAT takes an approach in which it is diversified, but diversified to a lesser degree in terms of holdings. SCHD has a total of 104 positions, whereas MOAT has a total of 49 positions.

Both funds are passively managed, to a degree, and both recently went through their first reconstitution of the year, which we will look at now.

Let’s begin with MOAT.

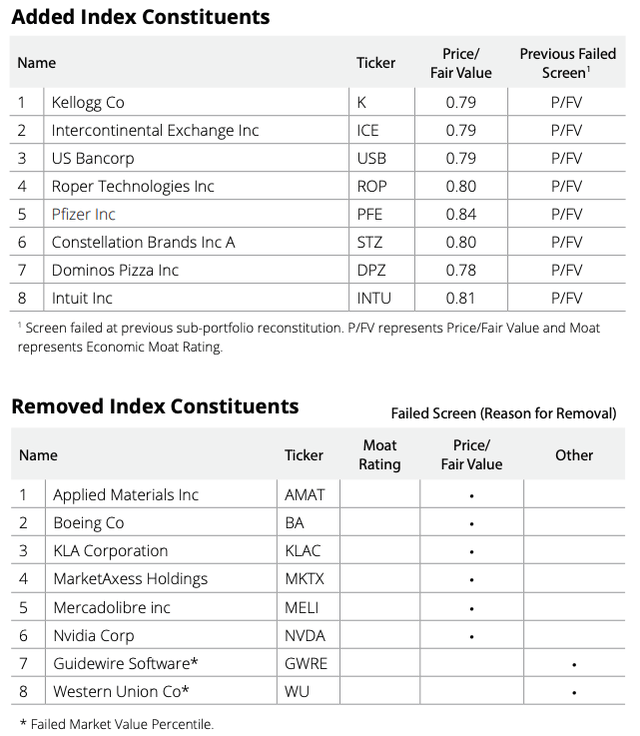

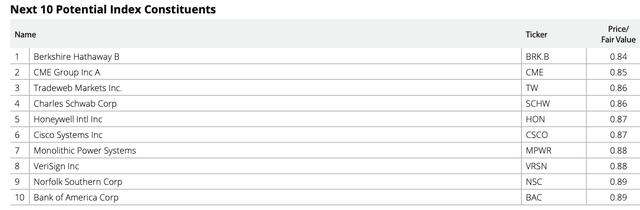

MOAT has a staggered rebalance in which it is divided into two sub-portfolios, with one sub-portfolio reconstituted in December and June; the other in March and September.

As for the March reconstitution, here is a look at eight stocks that were added to the fund and the positions that were removed from the fund.

As you can see, the reason for the change was primarily due to valuation. None of the removed positions saw a downgrade in terms of their moat status, which is notable.

One name that pops out that was added was U.S. Bancorp (USB), which is a regional bank that has been under some heavy pressure since the mini financial crisis ensued in March.

In the document published by VanEck, they also show the next 10 potential adds, which included the likes of Berkshire Hathaway (BRK.B), Charles Schwab (SCHW), Cisco Systems (CSCO), and Bank of America (BAC).

Given all that, here is a fresh look at the top 10 holdings for MOAT:

Meta Platforms, Inc. (META) and Microsoft Corporation (MSFT) are two of the top holdings that have been on a tear in 2023, which has helped the strong performance that MOAT has seen on the year.

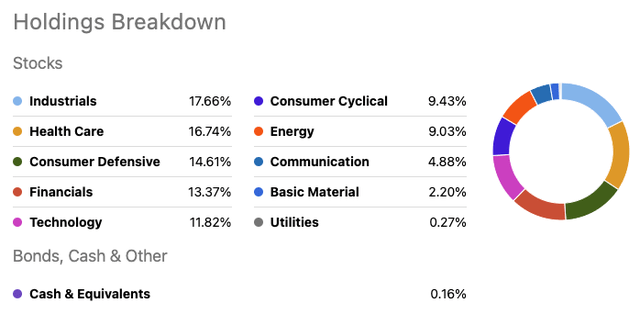

I mentioned diversification at the start, and although MOAT has half the positions as SCHD, they still diversify across many different sectors, as you can see from the sector breakdown below:

Now, let’s see how SCHD compares. Again, SCHD is more focused on dividend paying companies. Let’s begin by looking at the sector diversification:

Looking above at MOAT, we saw the top three sectors were Technology, Industrials, and Health Care. SCHD has two out of three, but Technology accounts for less than 12%, whereas for MOAT, that sector accounted for more than 28% of the entire fund. The sector diversification is much more spread out within SCHD, which can lower risk as well.

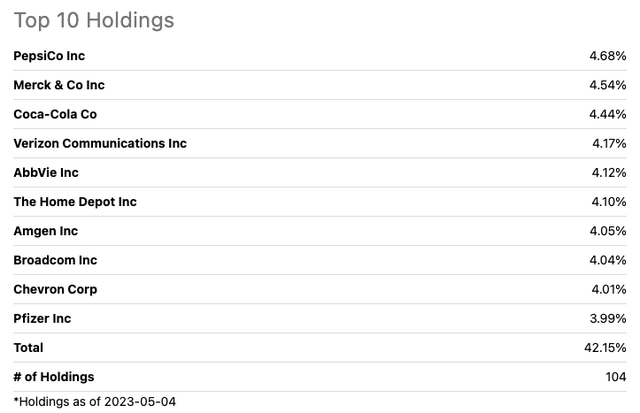

Let’s next take a look at the fund's top 10 holdings and their weightings within the ETF.

Looking at SCHD’s top 10 holdings, you can see they take a much different tone. Broadcom (AVGO) would be the only real technology company within the top 10, whereas with MOAT you saw the technology exposure throughout the top positions.

The top 10 positions for MOAT accounted for 28% of the entire fund, whereas the top positions here for SCHD have a much bigger weight, even though the fund has double the amount of positions, as they account for 42% of the entire fund.

During SCHDs reconstitution, the management company added 25 new names, with the top 5 names being material. The additions included: AbbVie (ABBV), Chevron Corporation (CVX), United Parcel Service (UPS), Blackstone Inc. (BX), and Ford Motor Company (F).

The management company removed 24 securities, which included the likes of International Business Machines (IBM), Cummins (CMI), and Prudential Financial (PRU). The management company viewed these companies as less likely to have the cash flow available to continue increasing their dividend at their historic rates.

Dividends A Focus For SCHD, Not MOAT

As I stated earlier, dividends are not a primary focus for MOAT as they are looking for businesses with a competitive advantage trading at a discount, whereas SCHD is looking at the dividend aspect of things as well.

As such, below you are going to see drastically different dividend payouts and yields.

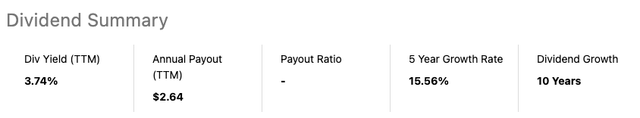

First, let’s look at SCHD:

SCHD paid $2.64 per share over the past 12 months, which equates to a dividend yield of 3.7%. In addition, over the past five years, we have seen 15.6% dividend growth, so not only do you get a nice yield, but strong dividend growth as well.

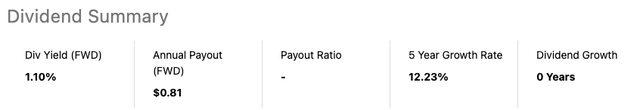

MOAT on the other hand has a yield that sits around 1%. SCHD pays out their distribution quarterly, whereas MOAT pays out there dividend once per year in December.

Performance Showdown

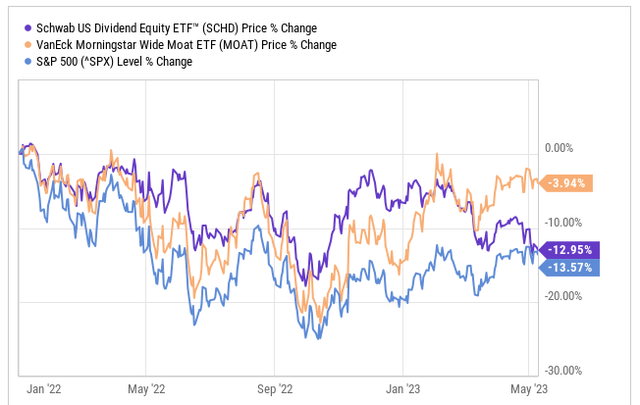

2022 was a rough year for the stock market as a whole, but 2023 has been a nice rebound thus far. Is it sustainable, not at this pace, although that would be nice if it does, but I am not getting my hopes up.

Going back to the start of 2022, through today, the S&P 500 (SP500) is still down roughly 14%, even with the 7% increase we have seen in 2023.

SCHD has not fared all that much better, as the ETF’s share price has fallen 13% over the same period. MOAT, on the other hand, is down only 4%, which helps dramatically with META being their top position and doubling so far in 2023.

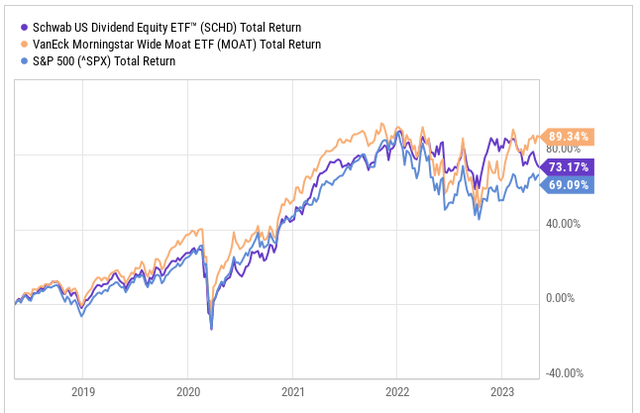

Now, when we widen things out and look at the past five years and look at total return, the pecking order still remains the same. MOAT has a 5-year total return rate of 89%, SCHD returning 73%, and the S&P 500 returning 69%.

MOAT is certainly going to have a lot more volatility given how they invest in more growth stocks. Meanwhile, SCHD is going to provide a little more stability. It all comes down to your risk appetite and your investing strategy.

In Closing…

In Warren Buffett’s 2013 letter to Berkshire Hathaway’s shareholders, he wrote:

“In aggregate, American business has done wonderfully over time and will continue to do so (though, most assuredly, in unpredictable fits and starts).”

He stated that non-professionals should simply invest in a cross-section of businesses and that “a low-cost S&P 500 index fund will achieve this goal.”

How serious was Buffett about this recommendation?

He even put similar instructions in his will for how his cash should be invested for the benefit of his family. He said that his will instructs that 90% of the money should be invested in a low-cost S&P 500 index fund with 10% in short-term government bonds.

For Mother’s Day, I plan to build an ETF portfolio for my mother, and I plan to include SCHD. In addition, I just set up a fund for my grandson, Asher, who just turned one yesterday. I will seed the fund with around 70 shares in MOAT.

Interestingly, neither SCHD or MOAT own REITs, and I’m hopefully that my mother and grandson will soon become a virtual landlord via my newly created REIT ETF blueprint.

As I always like to end my articles, all the best and Happy SWAN Investing!

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOAT, SCHD, SCHW, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.