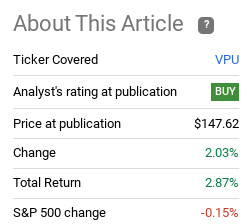

VPU: Market Headwinds Lead Me To Utilities Yet Again

Summary

- I have used passive Utility ETFs for a long time for diversity and stability.

- While I have held VPU for years, I am tactical when I add to that position. This is one such time period where I think adding makes sense.

- A number of factors support buying here. Key among them is past performance during the last debt crisis.

- My bullish view stems from my opinion that markets are too complacent right now. If I am correct, that means pain ahead, and VPU offers some protection in that case.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

jamesteohart

Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Utilities ETF (NYSEARCA:VPU) as an investment option at its current market price. The fund's stated objective is "to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector" and is managed by Vanguard.

I have advocated for including VPU as a portfolio diversifier to my followers since I began writing on Seeking Alpha. But this comes with a caveat - knowing when to buy is critical for this sector just like all others. Back in Q1 I believed adding to my position made sense and I have been proven right since that review was published:

Fund Performance (Seeking Alpha)

As we push in to the second half of the year, I figured it was time to update my thoughts on the Utilities sector. Not surprisingly, I believe a buy case can still be made, despite the recent out-performance. I have some serious doubts about stability in the equities market going forward and I believe VPU will help me round out my U.S. exposure. I will take the primary points as to why in turn below.

Markets Appear Too Calm For My Liking

One of the first attributes to consider at the moment is how complacent the market is. I see a number of headwinds that make miss distrust this complacency and that is fundamental to why I favor getting more defensive right now. Of course, there are always reasons to be bearish and/or focus on negative headlines. That is a fact of investment life that we have to get used to.

But it is important to be cautious when the markets are not pricing in fear or uncertainty. When the VIX - a measure of market volatility - spikes, that often represents a great buying opportunity to buy on excessive fear. But the opposite can be true. When the VIX drops or remains at a below-average level for too long, that can signal a selling opportunity or at least a time to reset.

And that is precisely the environment we are in here. The VIX is just over 17, which is a historically low level:

This doesn't mean the VIX cannot stay at these levels or even move lower still. Similarly, it doesn't automatically translate in to gains for the Utilities sector or VPU. But it does mean markets are very tame in the short-term. This always gives me pause and this time around it tells me the time is ripe to get more defensive. Cyclical areas like Tech have already have a great calendar year, so why not take some chips off the table or put them in to Utilities in case things go awry? Seems logical to me, and that is definitely a strategy I will pursue.

Debt Crisis In The Making?

The second macro-development that has Utilities on my mind is the debt ceiling debacle. As is par for the course in Washington DC, we have another preventable crisis brewing that likely won't be solved any time soon. This is an expansion on the prior paragraph. With another crisis looming - why aren't markets pricing in it? That seems like a mismatch to me and something I want to prepare for while the rest of the market ignores it.

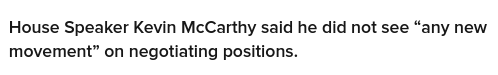

To understand why, let us look at recent statements from major political figures with respect to this upcoming debt ceiling deadline. A few days ago House Speaker McCarthy made headlines:

Debt Ceiling Headline (CNBC)

In similar fashion, President Biden appeared unlikely to back spending cuts as a prerequisite for raising the debt ceiling:

Debt Ceiling Headline (New York Times)

At this juncture, it looks like the debt ceiling is going to be a topic of discussion for a while. Progress will be made, eventually, but it is going to take time. In the interim, I expect plenty of ups and downs in equities and am generally surprised that already has not started happening.

So - why does this matter? And why do I see this as a headline risk for stocks in general?

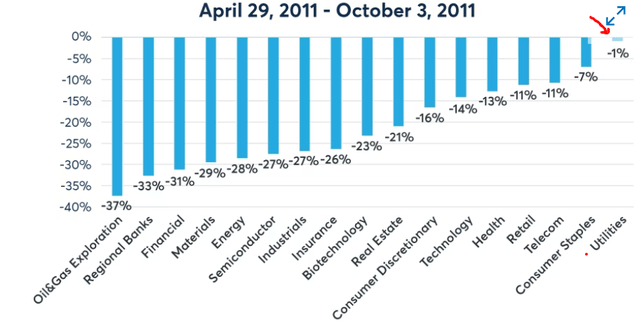

The reason is because prior cycles of this kind have ended poorly for most sectors. If we think back to the 2011 government shutdown when Republicans made similar spending cut demands of then-President Obama, stock markets took a big tumble. Yet, losses were not equally spread out. Energy, Financials, other cyclical areas suffered the most. But contrast, defensive names (while still losers) held up better. And leading the way in this regard was none other than Utilities:

Sector Performance (2011 Debt Ceiling Crisis) (CME Group)

This is a classic example of why I hold VPU. It often comes in handy at just the right time - when markets get rattled. While I do not necessarily "want" to see a similar crisis play out this time, I am going to prepare for it. Holding VPU is one such way to prepare and that is why I am adding to it here.

If Inflation Justifies A Fed Pause, Income Plays Benefit

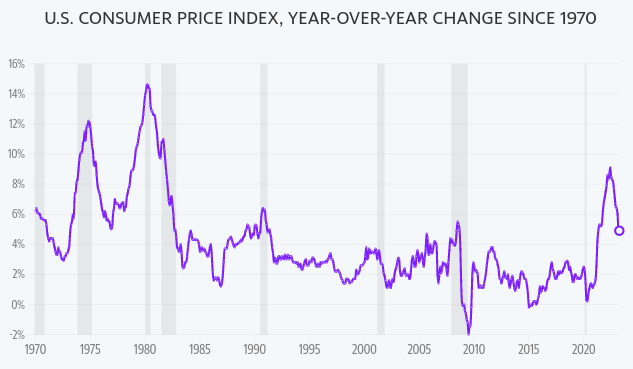

A third reason I like VPU here is with respect to inflation. While still elevated, it is dropping on a year-over-year basis in comparison with prior months this year. This is giving the Fed breathing room and making a "pause" on rate hikes a very real possibility in the second half of 2023:

CPI Readings (Yahoo Finance)

Looking ahead, there is a chance we are near a turning point / end of the rate hike cycle. The impact this will have on equities as a whole is likely to be mixed, but I view is positively in particular for income-oriented plays. This includes Utilities, and VPU by extension.

For now we don't know if and when the Fed will pause. But after this past week's reading, Fed Chairman Powell was quoted in relation to whether or not this will justify a pause as follows:

We feel like we're getting closer or maybe even there"

Source: Wall Street Journal

The conclusion I draw here is the Fed is very likely to pause. They are starting to set the stage for it and the inflation data is getting to the point where it can support that policy shift.

Some might argue that VPU is not really an "income" play. With a current yield just over 3% I can see that argument. But we have to remember this is relatively higher than other sectors and Utilities is a traditional income play. So even if the current yield is not very high, funds such as VPU are probably going to draw in more conservative, income-oriented investor cash.

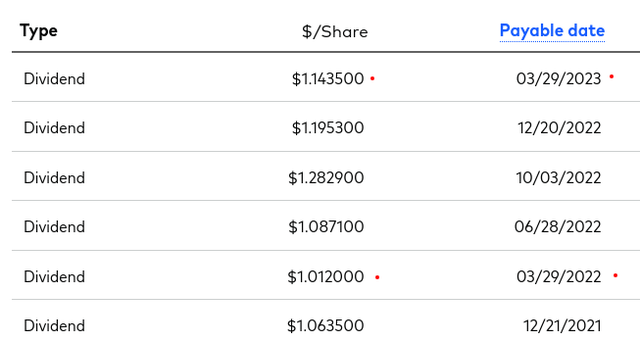

Further, I view dividend growth attractively here. This supports buying the fund and can keep the yield from dropping even if the share price rises (since the higher distribution can make up for the impact a higher share price would have on the yield). The Q2 distribution is still unknown at this juncture, but Q1 gives me a lot of comfort. VPU in particular pumped out 13% dividend growth on a year-over-year basis:

Quarterly Distributions (Vanguard)

My takeaway is VPU is as relevant for income as ever. This makes it a long-term hold candidate, and the other factors mentioned in this review make it a short-term one as well.

Bottom-line

Utilities are not talked about as much as they should. But they do come in handy when other sectors come under fire - as they did during the debt ceiling crisis in 2011. With the potential for a similar scenario this summer, why not allocate some cash in anticipation of that event? If I'm wrong, VPU will probably hold up reasonably well anyway. If I'm right, history tells us the out-performance may be substantial.

What this signals is the risk-reward is attractive. I believe a combination of shifting to cash, fixed-income, non-US stocks, and Utilities are all good moves with the macro-headlines we are dealing with right now. This makes me a continuous bull on VPU, and I suggest readers give this idea some consideration going forward.

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, VCV, PML, PDO

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VPU, BUI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.