PDO: Best To Wait For A Better Price Due To Inherent Risks

Summary

- Investors are in desperate need of income today to maintain their lifestyles in the face of the rapidly-rising cost of living.

- PIMCO Dynamic Income Opportunities Fund invests in a portfolio of bonds to provide investors with a high level of current income.

- The worst of the interest-rate carnage is likely behind us, but this fund still has some risks from CMBS securities.

- The PDO closed-end fund has very high leverage and is failing to cover its distributions through income and gains.

- The fund is trading at a discount, but it is probably best to wait for a better price due to the inherent risks here.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

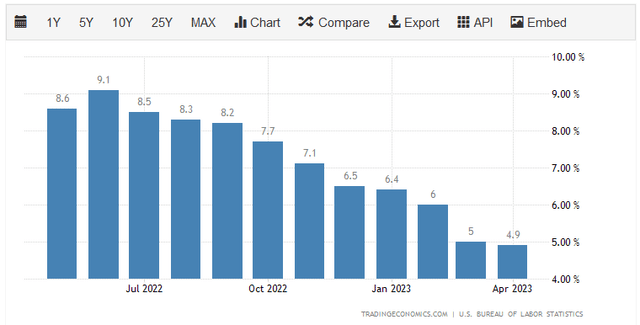

Riska

Without a doubt, the biggest problem facing the average American household today is the rapidly rising cost of living. This is evident in the consumer price index, which is an index of the variation in the prices of goods frequently purchased by average people. The index has been pointing to a decline in the overall rate of price increases recently, but the most recent report showed a 4.9% increase in the consumer price index year-over-year, which is still much higher than we are accustomed to:

For the most part, wages have not kept up with this rising cost of living, so most people have had to make some sacrifices. In particular, we have seen households draw down their savings accounts and take on debt in an attempt to maintain their standard of living. I discussed this in a recent blog post. This is an obviously unsustainable situation, and it will undoubtedly not end well. We saw some of the consumer strain play out this week as The Walt Disney Company (DIS) saw subscriptions to its streaming service decline by four million quarter-over-quarter. Disney is basically the go-to name for families with children, so when these people are forced to cancel to save a few dollars a month, it is pretty obvious that people are severely stretched financially.

We are certainly not immune to this as investors. After all, we all have bills to pay and need to purchase food and fuel to function in our own daily lives. We do have better solutions that can be employed to pay for these necessities, however. For example, we have the ability to put our money to work to earn an income. Perhaps the best way to accomplish this is to purchase shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are unfortunately not very well followed in the investment media, nor are many financial planners familiar with them so it can be difficult to obtain the information that we really need to make an informed decision about these entities. This is a shame because these funds have a number of advantages over open-ended mutual funds or exchange-traded funds. In particular, a closed-end fund is able to employ certain strategies that allow it to earn a much higher yield than any of the underlying assets, as well as pretty much anything else in the market.

In this article, we will discuss the PIMCO Dynamic Income Opportunities Fund (NYSE:PDO), a CEF which yields a very impressive 11.80% as of the time of writing. This is clearly more than just about any common stock or exchange-traded fund ("ETF"), including traditionally high-yielding entities such as master limited partnerships. Thus, it is clearly a fund that could be used by investors to earn a high level of income today. As long-time readers likely know, PIMCO funds have a tendency to be tremendously expensive, but this one appears to be an exception to that rule. This is quite nice and could be a good sign, so let us investigate and see if this fund could be a good investment for your portfolio.

About The Fund

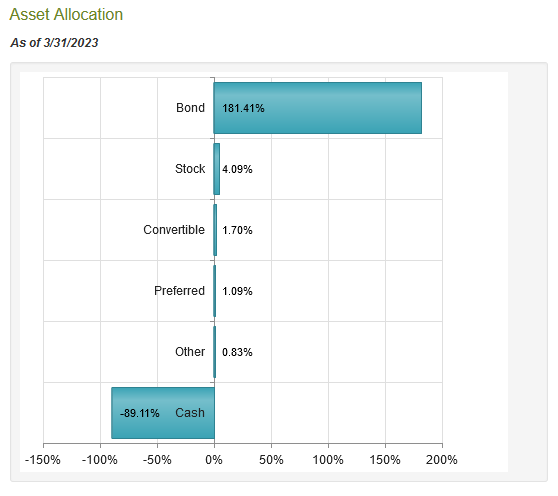

According to the fund's webpage, the PIMCO Dynamic Income Opportunities Fund has the stated objective of providing its investors with a high level of current income while still ensuring the preservation of capital. This is not particularly surprising for a PIMCO fund since most of them invest primarily in fixed-income securities. This one is no exception to this, as the fund's portfolio includes only a small allocation to anything apart from bonds:

CEF Connect

The reason why this objective is not particularly surprising is that bonds are by their nature an income vehicle. After all, a bond is purchased at face value, makes a regular interest payment to its owner, and then pays the face value at maturity. Thus, anyone that purchases a bond at issuance and then holds it to maturity will have no capital gains. The sole return is the interest payments that are made to the investor. Thus, these securities are usually bought by people that are trying to protect the money that they already have and earn a steady stream of income from it.

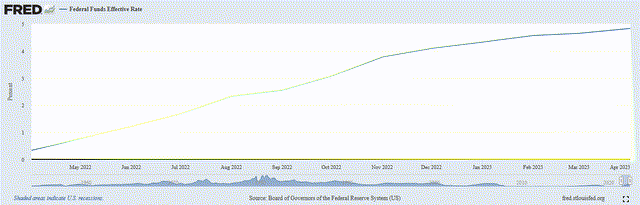

Although bonds will not deliver capital gains over their entire lifetime, it is possible for traders to earn some by taking advantage of changes in bond prices. This comes about because bond prices fluctuate with interest rates. It is an inverse correlation, so bond prices decline when interest rates increase and vice versa. That is something that is important today, due to the fact that the Federal Reserve has been aggressively raising interest rates in an effort to combat the incredibly high inflation that is dominating the economy. As we can see here, the federal funds rate has risen from 0.33% a year ago to 4.83% today:

Federal Reserve Bank of St. Louis

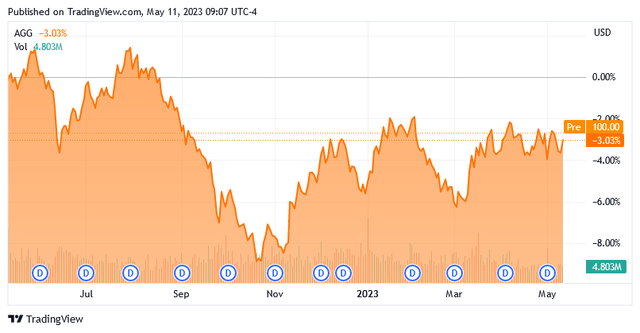

We have seen similar moves in other nations around the world, as high inflation is not solely an American phenomenon. In fact, Japan and China are the only nations in the G20 that have not raised their benchmark interest rates over the past two years as of the time of writing. The rising interest rate has had a devastating effect on bond prices. We can see this in the various bond indices. Over the past year, the Bloomberg US Aggregate Bond Index (AGG) has fallen 3.03% but it was down much more at the end of 2022:

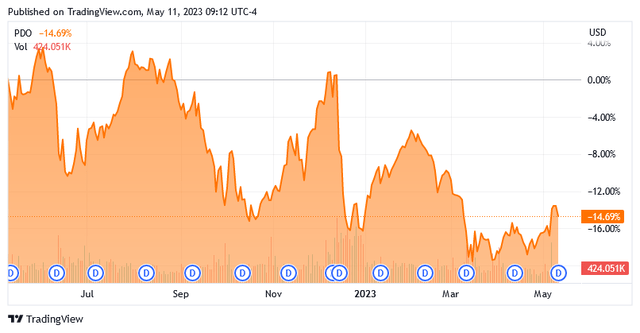

This is, of course, not a problem for anyone that holds their bonds to maturity. After all, the bond will still pay its face value when it matures no matter what the price in the market. However, the fund itself will trade based on the current market value of the bonds. The PIMCO Dynamic Income Opportunities Fund has not been immune from the carnage in the bond markets, as it is down 14.69% over the same period:

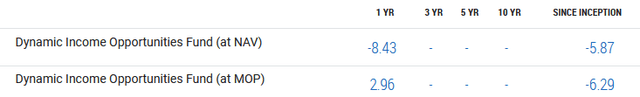

At first glance, this is likely to be very disappointing as the PIMCO closed-end fund appears to have underperformed the index by a substantial amount. However, there are a few things to consider here. The first is that the PIMCO fund pays a much higher yield, so investors in the fund were receiving that over the period. This reduces the performance difference between the two funds, especially for those investors that are reinvesting some or all of the distributions into shares of the fund. The second important point is that closed-end funds can have their market price performance vary substantially from the performance of the actual portfolio. This is something that can occasionally create opportunities for us to acquire the fund's assets for less than they are actually worth. We will discuss this later. As of yesterday's market close, the PIMCO Dynamic Income Opportunities Fund actually delivered a positive 2.96% return for someone that held the fund for the past year and reinvested all distributions:

We can see though that the portfolio actually had an -8.43% total return over the same period. Thus, the fund's performance in the market has been substantially better than the portfolio's performance over the past year. This is not unusual for a PIMCO closed-end fund, but it is not something that we would really like to see as it could indicate that the fund's market price is higher than it should be.

Fortunately, it does appear that the worst is over for the bond market. The April CPI Report put headline inflation at 4.9% year-over-year, which missed expectations. It also created the impression that inflation is not getting worse, so the Federal Reserve can pause on rate hikes while it waits to see what effect the current rate has on the economy. This should add some stability to bond prices. In addition, it appears very likely that the United States will soon enter a recession, as numerous economic indicators are showing slowdowns in various sectors. A recession usually reduces inflation because consumers cut back on spending. That further suggests that interest rates probably will not rise much more from today's levels. As bond prices are inversely correlated to interest rates, this should indicate that bond prices will not decline too much more than we have already seen due to interest rate hikes.

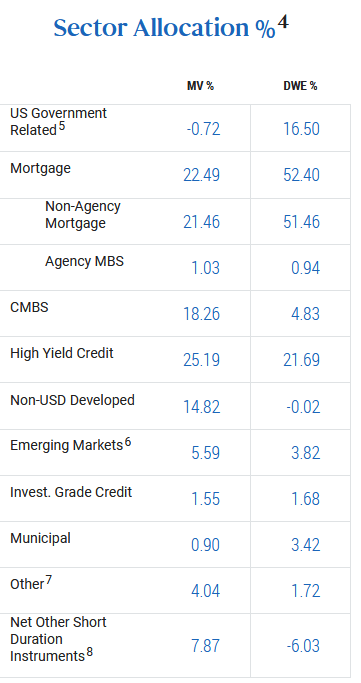

I have mentioned the current problems with commercial real estate a few times in articles over the past few months. In short, many employers switched to home-based work or implemented work-at-home programs in response to the 2020 lockdowns. While we have seen a few companies get their employees back to the office, many others have decided to make home-based work a permanent fixture of their work environment. These companies no longer have a need to rent as much office space as they once did, so it logically makes sense to simply not renew their rental leases at expiration. This allows those companies to save a significant amount of money, but it has also created a problem in the commercial real estate market. At this point, readers might be wondering what this has to do with the PIMCO Dynamic Income Opportunities Fund. Well, approximately 18.26% of the fund is invested in commercial mortgage-backed securities:

PIMCO

This represents a risk that investors should consider. This is because the property owners that took on the mortgages backing these securities need the rental income from their properties to pay the mortgage. As that rental income is declining, this is straining their ability to pay the mortgages. If the mortgages do not get paid, there is no money available to pay the holders of these securities. That includes this fund. While mortgages usually do give the lender the right to seize and auction off the property to recoup the money, there is no guarantee that the sale price will be sufficient to completely pay off the mortgage. That is especially true considering the rising vacancies that we are seeing in the commercial real estate space. Thus, the fund's exposure to these securities could expose investors to some potential losses. Granted, the fund's 18.26% allocation is probably not enough for any losses here to completely devastate it, but we should still not ignore this risk.

Leverage

In the introduction to this article, I stated that closed-end funds such as the PIMCO Dynamic Income Opportunities Fund have the ability to employ certain strategies that can boost their yields well beyond that of any of the assets in the underlying portfolio. One of these strategies is leverage. Basically, this fund is borrowing money and using those borrowed funds to purchase bonds and other credit securities. As long as the interest rate on the borrowed money is lower than the yield that the fund receives from the purchased securities, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this is usually going to be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to too much risk. I generally do not like to see a fund's leverage exceed a third as a percentage of its assets for this reason. Unfortunately, the PIMCO Dynamic Income Opportunities Fund dramatically exceeds that limit as its levered assets currently comprise 48.94% of the portfolio. That is, to put it mildly, one of the highest leverage ratios possessed by any closed-end fund. It is also high enough to expose investors to fairly large losses if things go wrong. With that said, the worst is probably behind us as far as interest rates go, so the risks here are not nearly as great as they were a year ago. I would still feel more comfortable with lower leverage, though.

Distribution Analysis

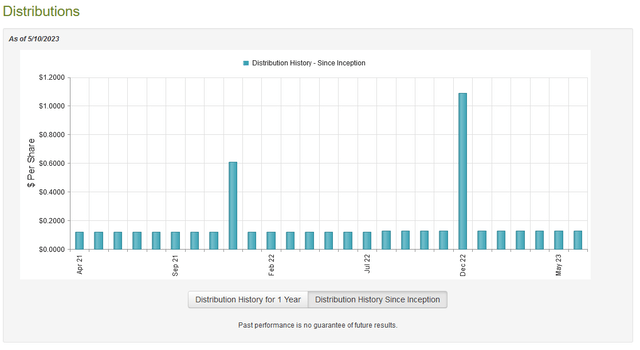

As mentioned earlier in this article, the primary objective of the PIMCO Dynamic Income Opportunities Fund is to provide its investors with a high level of current income. In order to achieve this goal, the fund invests in a portfolio of bonds and other credit securities that primarily provide their returns in the form of income to the owner. The fund then applies a significant amount of leverage in order to boost the effective yield of the portfolio. As such, one might assume that this fund would have a very high yield. This is certainly the case as it currently pays out a monthly distribution of $0.1279 per share ($1.5348 per share annually), which gives it an 11.80% yield at the current price. The fund only has a relatively short history, but it has been remarkably consistent about its distribution over the years:

We can see that this is one of the few fixed-income funds that actually increased its distribution over the past year. This is something that might be expected to be common since higher interest rates result in bond yields being higher, but usually, the losses from falling bond prices were too great for most funds to overcome. This history is something that will certainly be appealing to any investor that is seeking a safe and secure source of income to use to pay their bills or other expenses. However, since this is one of the only bond funds that raised its distribution in the past year, we want to investigate its finances to ensure that it can actually afford the distribution that it currently pays out.

Fortunately, we have a relatively recent document that we can consult for the purposes of our analysis. The fund's most recent financial report corresponds to the six-month period that ended on December 31, 2022. This report will therefore not include any information about the fund's performance over the past four months, but it will give us a good idea of how well it performed over the course of the most aggressive of the 2022 interest rate hikes. This is nice because that was the event that imposed the greatest challenges on bond funds last year. Over the six-month period, the PIMCO Dynamic Income Opportunities Fund received a total of $377.150 million in interest and $3.533 million in dividends from the assets in its portfolio. This gives the fund a total investment income of $380.683 million over the period. It paid its expenses out of this amount, which left it with $278.258 million available for investors. This was, unfortunately, nowhere close to enough to cover the $465.848 million that the fund paid out in distributions during the period. At first glance, this is something that is very concerning because we typically like to see bond funds covering their distributions completely out of net investment income.

There are other methods that the fund can employ to obtain the money that it pays out to its investors, however. For example, it might have capital gains that can be paid out. As might be expected from the overall weakness in the bond market though, the fund failed miserably at this task. It did report net realized gains of $66.641 million during the period, but this was more than offset by net unrealized losses of $372.604 million. Overall, the fund's assets declined by $160.346 million after accounting for all inflows and outflows. The fund's assets would have declined by much more, but it issued $333.207 million in new shares during the period. Thus, the fund relied heavily on new money to pay its distribution and even then, it failed to completely achieve that. This is not something that is sustainable over an extended period, so we will want to keep a very close eye on the PIMCO Dynamic Income Opportunities Fund finances going forward.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the PIMCO Dynamic Income Opportunities Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund's assets for less than they are actually worth. This is the case with this fund today, which is unusual for PIMCO funds. As of May 10, 2023 (the most recent date for which data is available as of the time of writing), the PIMCO Dynamic Income Opportunities Fund has a net asset value of $13.02 per share but the shares only trade for $12.95 per share. This gives the fund's shares a 0.54% discount to net asset value at the current price. That is not as attractive as the 1.85% discount that the shares have averaged over the past month, and to my mind, it is not a large enough discount to offset the concerns about the fund's distribution that we just discussed. My suggestion here is to wait for a more attractive price before buying the fund.

Conclusion

In conclusion, bond funds like the PIMCO Dynamic Income Opportunities Fund are a bit more attractive than they were a few months ago because it appears that the interest-rate risks are largely behind us at this point. However, there are still some concerns about PIMCO Dynamic Income Opportunities Fund because of the relatively high percentage of commercial mortgage-backed securities in the portfolio as well as its very high leverage. The fund's distribution also could be a concern, as it is currently paying out far more than it is earning. While this is one of the few PIMCO funds that trade at a discount, the discount is very small and does not appear to be pricing in the potential risks. It is probably best to wait for a better entry price for PIMCO Dynamic Income Opportunities Fund.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.