SPMB: It Is Probably Time To Start Buying Agencies

Summary

- The SPDR Portfolio Mortgage Backed Bond ETF is a fixed-income exchange-traded fund.

- The vehicle focuses on Agency mortgage-backed securities, and is entirely driven by rates given the AAA rating of the asset class.

- If an investor thinks the Fed has ended its interest rate hike cycle, then said investor should turn bullish Treasuries and inherently MBS bonds.

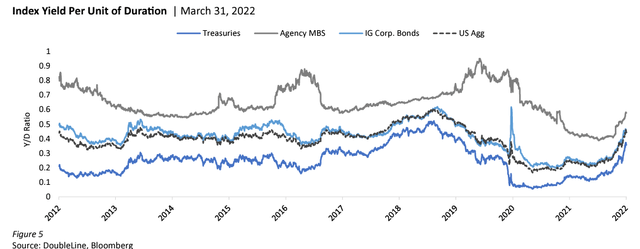

- MBS securities have a more advantageous yield per unit of duration as per DoubleLine and should be able to capture a nice capital gain in 2024 as rates come down.

Andrii Dodonov

Thesis

The SPDR Portfolio Mortgage Backed Bond ETF (NYSEARCA:SPMB) is a fixed income exchange traded fund. The vehicle focuses on Agency mortgage backed securities, and aims to mirror the performance of the Bloomberg U.S. MBS Index:

The Bloomberg U.S. MBS Index (the "MBS Index") measures the performance of the U.S. agency mortgage pass-through segment of the U.S. investment grade bond market. The term "U.S. agency mortgage pass-through security" refers to a category of passthrough securities backed by pools of mortgages and issued by one of the following U.S. government-sponsored enterprises: Government National Mortgage Association ("GNMA"); Federal National Mortgage Association ("FNMA") and Federal Home Loan Mortgage Corporation ("FHLMC").

Agency MBS bonds are AAA securities, hence the SPMB performance is entirely driven by rates. The fund has a 6 year duration, and the bulk of its holdings have maturity dates from 5 to 10 years out. An investor can think of MBSs as another form of a risk free assets, but with generally a wider spread and a more advantageous yield per unit of duration:

Yield per unit of Duration (DoubleLine)

Ultimately, if an investor thinks the Fed has ended its interest rate hike cycle, then said investor should turn bullish Treasuries and inherently MBS bonds. We are of said opinion. With the CPI coming in a tad softer than expected yesterday and the ongoing banking turmoil, we think the Fed will be in a 'wait and see' mode. The banking crisis has resulted in tighter lending conditions, which in turn percolates down the economy in tighter financial conditions, a form of monetary tightening. Just like any economic factors, it takes time for these implications to come down the chain, and the Fed is keenly aware of that. We are in the camp of no more Fed hikes, but higher for longer (at least for the entire 2023).

That said, we have penned a couple of articles where we assigned Buy ratings to Treasury instruments (either unleveraged via ETFs or packaged in the CEF format with other asset classes and leverage). We are now of the same opinion here for MBS bonds. SPMB is not very exciting for a retail investor, offering currently just a 2.95% yield, but will be able to generate a capital gain next year as the Fed will eventually lower rates.

SPMB is indeed more of an institutional holding given its deep liquidity and large AUM, but offers interested retail investors with exposure to the MBS asset class, at the intermediate point of the duration curve.

Analytics

- AUM: $4.3 billion

- Sharpe Ratio: -0.74 (3Y).

- Std. Deviation: 6.31 (3Y).

- Yield: 2.95%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income - MBS bonds

- Duration: 6 yrs

- Expense Ratio: 0.04%

Holdings

The fund is composed entirely of mortgage backed securities:

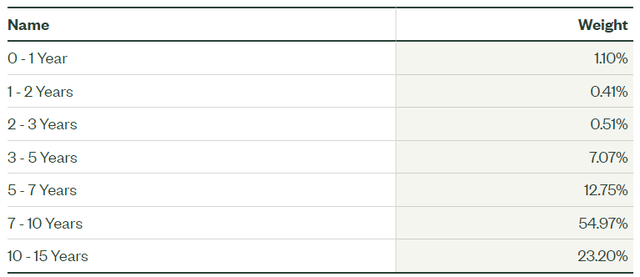

As a reminder, this asset class is rated AAA, thus an investor is not taking any credit risk here. Most of the bonds in the portfolio fall in the 5 to 10 years maturity ladder:

Maturity Ladder (Fund Fact Sheet)

Performance

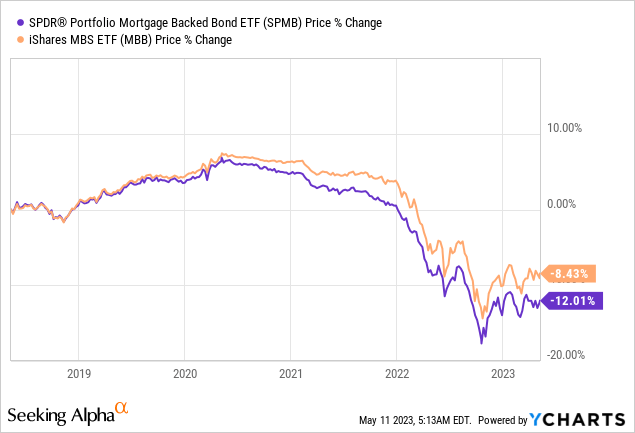

As rates rose, SPMB's NAV collapsed:

Just like treasuries, MBS bond prices are driven by interest rates solely given their AAA rating. As the Fed raised rates, prices moved down.

If we are to believe the current SOFR forward curve, then 2024 should see a 10% plus capital gain for this asset class, given the duration profile for the fund.

Conclusion

SPMB is a fixed income exchange traded fund. The vehicle focuses on Agency MBS bonds and exhibits a high liquidity. Agency MBS bonds are rated AAA, thus the asset class is driven by rates solely. The fund had a tough 2022 given the violent rise in rates. We are of the opinion that we have witnessed the last Fed hike this cycle, with the Fed in a 'wait and see' mode now. This should translate into a bright future for SPMB, especially in 2024. Unleveraged Agency MBS bonds are more of an institutional asset play given the current low yield of 2.95%, but a retail investor can look forward to an anticipated capital gain of 10% plus in 2024 given where the forward SOFR curve is pricing rates. We are assigning a Buy rating to SPMB here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.