IEFA: Logic In The Ex-U.S. Approach

Summary

- We are heavily underweight the U.S. right now. We have 0% U.S. stocks in our portfolio.

- IEFA captures this view with an ex-U.S. approach to the developed market large-cap space.

- While tech is benefiting from some AI tailwinds and technical effects from peak-rate speculation on horizon values, the market is not acknowledging credit-related dangers.

- Moreover, the market is not acknowledging the pronounced risk of lower baseline growth in the developed world related to deglobalisation.

- Finally, it is much more likely than not that we will see another rate hike. Overall, while other developed markets also have risks, their markets have rightfully languished.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

FrankRamspott

We are not ETF investors, but we do think some trends applying today can be captured by an ETF like the iShares Core MSCI EAFE ETF (BATS:IEFA), which captures exposure to large-cap stocks outside of the US but still in developed markets. The benefits of developed markets over emerging markets are well known and come down to general conservatism, but the key element is the lack of US exposure. US markets are seeing a relatively broad recovery, maybe driven more by tech and the interaction with horizon values and rates in market imputed valuations. This is because peak rate speculation continues, and while what goes up must come down, it is still a little early given inflation data and Fed rhetoric. In other respects, there remain major credit dangers in the US that have not shown themselves yet, and developed market long-term growth rates should be revised downwards on geopolitical concerns. Overall, defaulting to US stocks is not a correct approach anymore, and a secularly complex environment requires more selectivity that IEFA broadly provides.

IEFA Breakdown

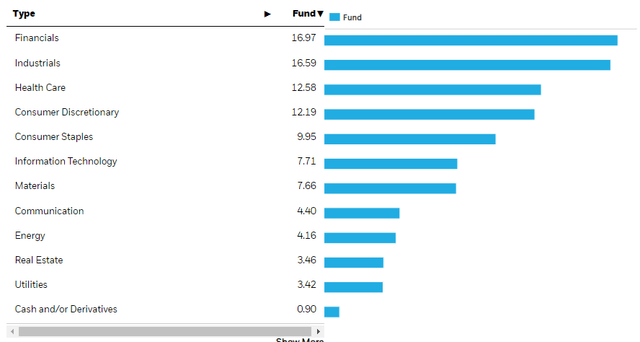

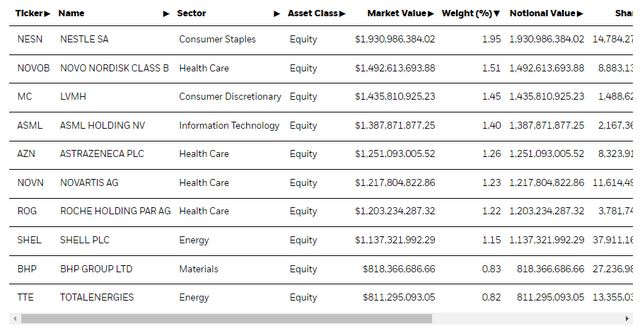

The breakdown of IEFA is as follows, demonstrating exposure to quite a few large-cap European names in the healthcare and consumer space:

IEFA Top Holdings (iShares.com)

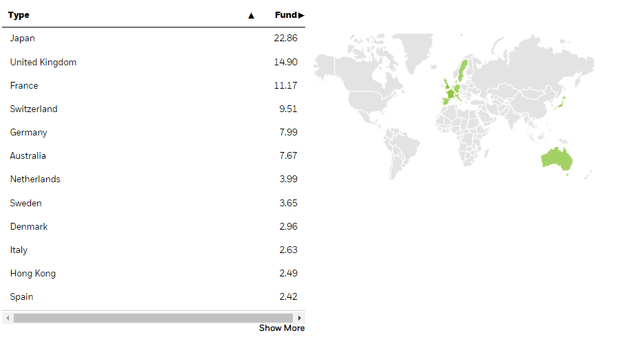

The ETF is highly diversified with over 3,000 holdings. Japanese exposures, a market with market cap distributions that are more uniform and less scale-free, are not visible in the top 10, but they make up the plurality of exposures in terms of geography.

Geographies IEFA (iShares.com)

The sectoral exposures are as follows:

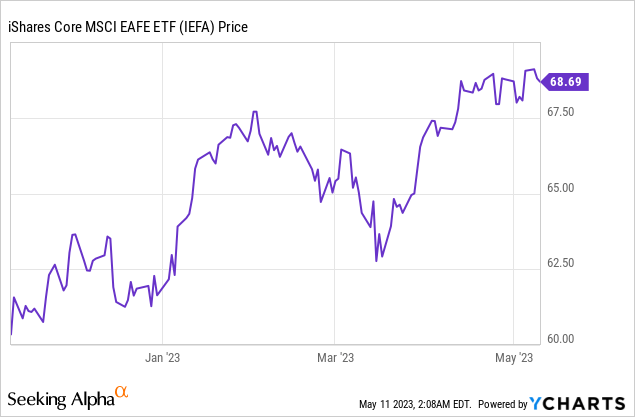

The substantial exposure to financials in the reason for a little bit of a V-shaped rebound in recent performance, but with depositor and asset concerns limited to regional banking in the US, which existed in a bit of an enshrined position that isn't meaningfully replicated in European nations which require a second tier of banking for regional markets (for the most part), concerns subsided and the recovery ensued, possibly as peak-rates also started becoming a more pronounced possibility according to the market.

Otherwise, exposures in IEFA are typically European and Japanese, so quite a lot of consumer discretionary and industrial exposures, with a fair but of healthcare exposures too, where Japan and Europe are #2 and #3 in terms of size of healthcare markets.

Going EX-U.S.

Major indices are mulling US inflation data, except for US indices, which have rocketed upwards again in hopes of peak rates. Markets still believe that the Fed will respond to the banking challenges, but without the risk of contagion and with the relevant institutions already in place, it's not in their purview to deal with that, and they will likely continue to raise rates since inflation remains pretty high at 4.9%, nowhere near the 2% yet, and actually nowhere near the 3.2% consumer inflation expectations as of the Michigan survey in December 2022. With inflation above forecast expectations, wage-price spiraling continues to be a possibility, especially as employment remains relatively strong.

US markets are very responsive to the matter of peak rates because they are weighted towards tech, whose valuations are in turn weighted towards horizon values due to secular expectations for their businesses being more positive. Therefore, costs of capital matter a lot for their valuations, which remain high multiple and more subject to rate gravity. To tech's credit, recent advances in NLP have been a boost to tech generally, with their sights on upending tedium in white collar jobs (and probably one day those white collar jobs themselves). However, peak rate speculation may be premature still.

With rates possibly still rising, there are a lot more latent hits that markets should be concerned about. Employers are getting aggressive about returns to offices, and this is because the value of these properties are now highly questionable. With the fact that regional banking often serves these commercial real estate markets, there is even a financing-side risk to the value of major fractions of the real estate market. With credit crunches generally likely, both organically from higher rates but also due to punctuated events on the asset-side of banks, US real estate could take some major hits and further reduce household wealth and security. This would be bad for the economy and affect consumers broadly.

Conditions are not really getting better. Rates are being hiked and there is a sublinear response - things could get painful. Moreover, there are persistent geopolitical risks of undefinable scope and locus, which could stem from anywhere like de-Dollarisation risks from the Middle East, food security issues, energy security issues in the next winter where the last one was exceptionally mild in Europe, China and Taiwan, as well as general progress in economic nationalism that promotes beggar-thy-neighbour behaviour and general lack of cooperation. These are paradigm-shifters as far as the tenor of economic growth goes and need to be properly weighted.

Bottom Line

While market in Japan are a lot cheaper on a US basis due to the JPY's declines, and other markets have similarly languished more intensively or made explicit declines like in Europe, the US markets remain for some reason optimistic. We are not optimistic, and won't put money in markets that we think are going to get much more disappointed than others. IEFA, for the diversified and high-level ETF investor, at least acknowledges this potential risk. The stubborn US consumer has been remarkable, and a saviour for the moment for the US growth data, but at some point they will start saving, unless they are so convinced of persistent inflation that they've decided to keep frontloading spending.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.