Contracting Credit Leads Economy And Equities Lower

Summary

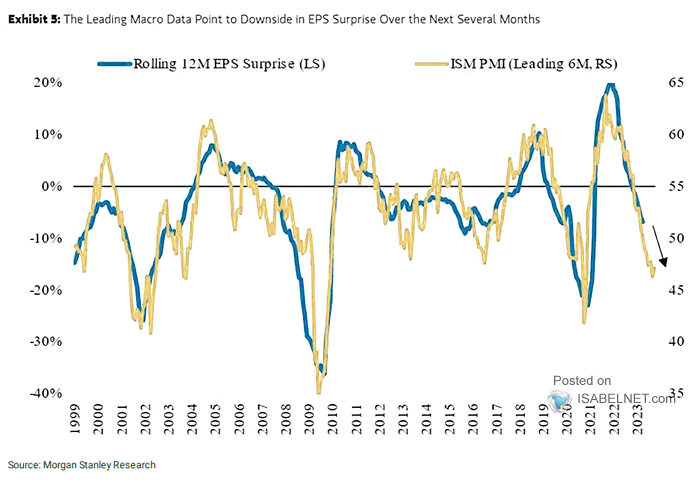

- The ISM purchasing managers' index is leading corporate earnings lower over at least the next 6 months.

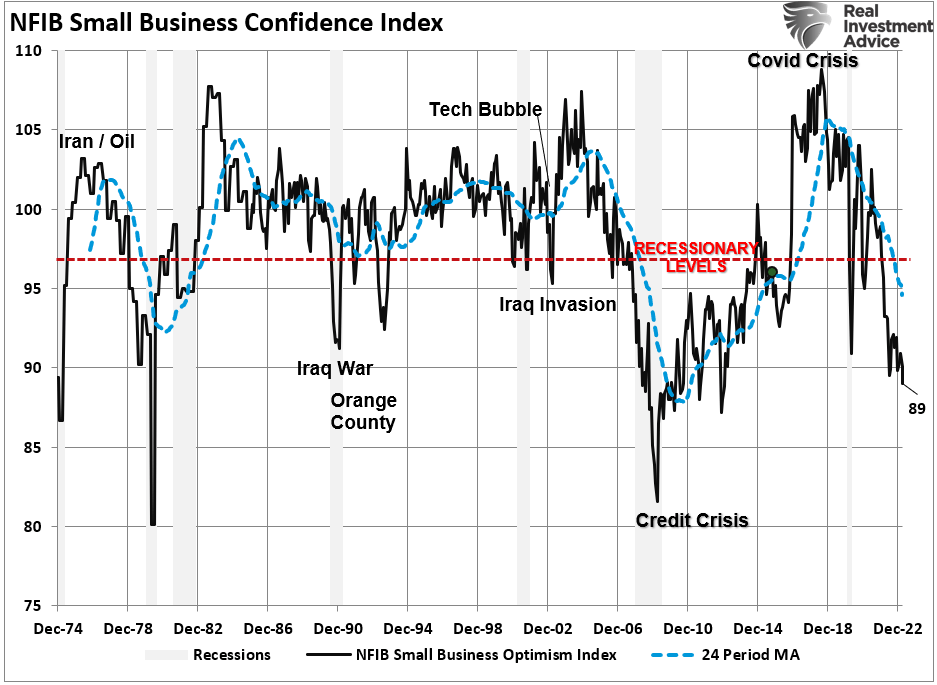

- The NFIB Small Business Confidence Index now lower than during the pandemic shutdown, is at levels seen during past recessions.

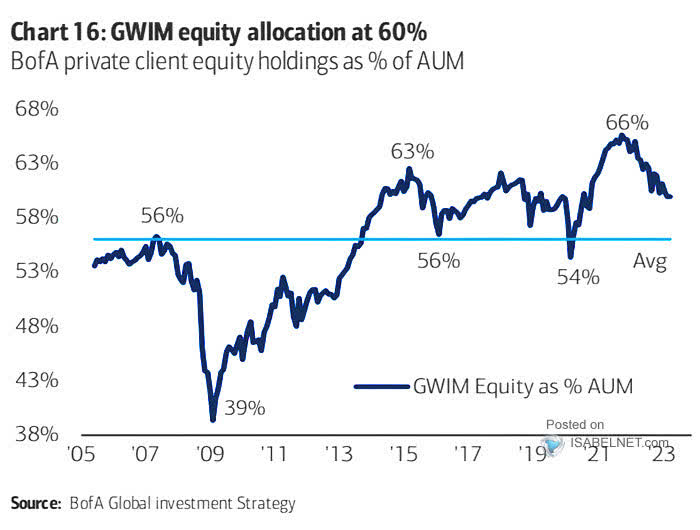

- The allocation to equities in retail portfolios (below since 2005) is down from the peak in 2022, but at 60%, still well above the 40% range typical of bear market bottoms.

primeimages/E+ via Getty Images

Eyes on the recessionary bear prize. Valuable investment opportunities are in the making.

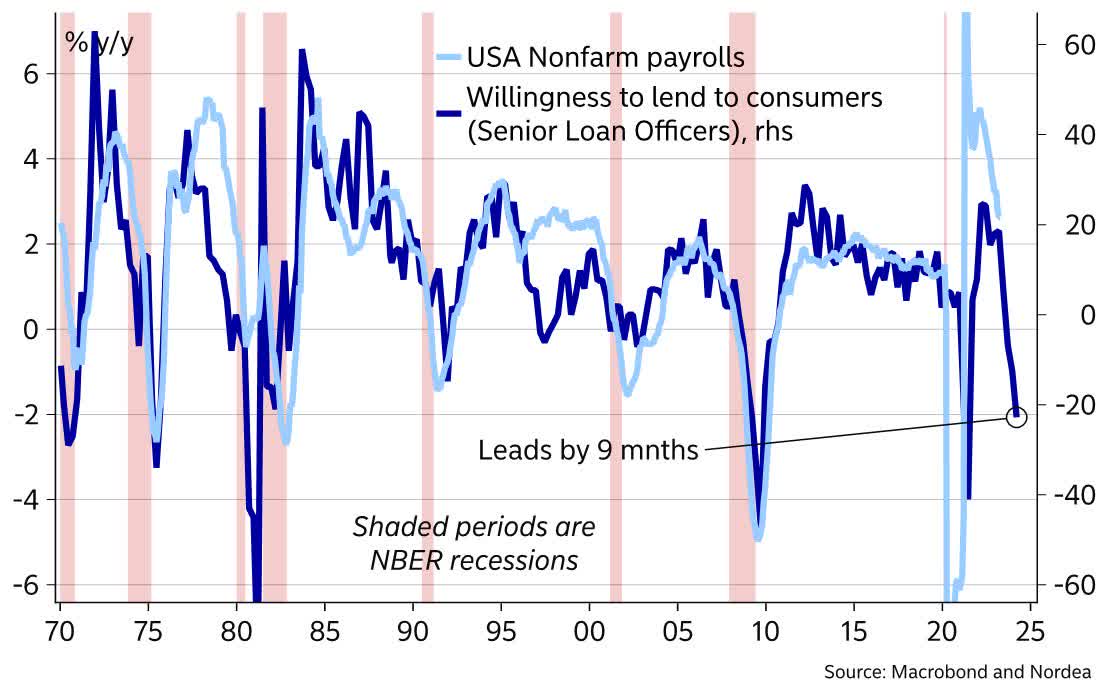

The chart below shows the Senior Loan Officer Survey (willingness to lend to consumers - in dark blue) versus US nonfarm payrolls (light blue) and recessions (in pink) since 1970.

Next, we see that the ISM purchasing managers' index (in yellow below since 1999, courtesy of ISABELNET.com) is leading corporate earnings (blue below) lower over at least the next 6 months.

The NFIB Small Business Confidence Index, now lower than during the pandemic shutdown, is at levels seen during past recessions (below since 1974, via Lance Roberts).

Lastly, we have the allocation to equities in retail portfolios (below since 2005). Down from the peak in 2022, but at 60% still well above the 40% range typical of bear market bottoms. Most are still heavily risk-exposed heading into a recessionary bear market. This is going to leave a mark for years to come.

Disclosure: No positions.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by