IYF: U.S. Financials Stocks Offer Pro-Cyclical Upside

Summary

- IYF invests in U.S. financial companies.

- The portfolio is broadly diversified, although some household names dominate the top spaces of the portfolio.

- While I think consensus earnings growth forecasts are optimistic, the fund is likely undervalued even in a conservative base case.

- IYF should perform well over a multi-year period, and its pro-cyclical characteristics make it especially appealing.

Charday Penn

Introduction

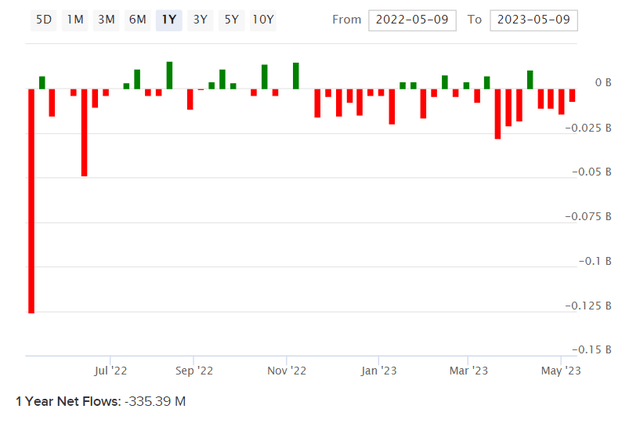

iShares U.S. Financials ETF (NYSEARCA:IYF) is an exchange-traded fund that invests in U.S. financial companies, which includes banks, insurers, and credit card companies. The expense ratio is 0.39%, with a median 30-day bid/ask spread of 0.03% (as reported by iShares themselves). Net assets under management were $1.75 billion as of May 9, 2023, and that follows a twelve-month period of negative net fund flows of circa -$335 million (see below).

ETFDB.com

Recent Context

With a country's financial industry being both fundamental and integral to the performance of the overall economy, IYF is a bet on the macroeconomic performance and health of the U.S. economy. While the economy has mostly been ticking along, and the United States may well avoid an outright recession (by the textbook definition of two consecutive quarters of negative GDP growth), the U.S. banking industry specifically has been rocky recently. A series of U.S. banking failures in 2023 has led to some consolidation, with higher rates (following a Fed rate-hiking cycle) driving down bond prices, making (mostly regional) bank balance sheets more vulnerable, and creating downward spirals with unprecedentedly rapid bank runs.

These bank runs are selective, though. Usually they have resulted from poorly compensated depositors (as compared to higher short-term rates) versus long-term maturity asset portfolios (i.e., significant duration mismatches). Also, the least capitalized and smallest (by gross size) have been more vulnerable, perhaps understandably, to shocks, especially where most of their depositors have been "uninsured" (under the FDIC limit of $250,000).

However, given the particular, "non-systemic" (unlike 2008, which was globally systemic) nature of this series of smaller-bank crises, this period is likely to result in a wave of consolidation. That is partly speculation, but it makes practical sense for larger banks to absorb smaller banks to reduce collective risks. For example, on May 1, JPMorgan Chase (JPM) bought First Republic followed its failure. Silicon Valley Bank, a widely cited failure this year, was absorbed by First Citizens Bank (SVB's commercial banking business) and HSBC (SVB's U.K. business).

IYF has therefore fallen this year, but I think this could potentially spell opportunity for long-term holders. As ever, though, I follow my typical process of gauging the value of this sector-specific, U.S.-only fund.

Return Profile

IYF's benchmark is the Russell 1000 Financials 40 Act 15/22.5 Daily Capped Index. The index measures the performance of U.S. large-caps operating in the Financials industry. At quarterly index reviews, pursuant to which IYF rebalances its portfolio, companies with a weight greater than 4.5% in aggregate (i.e., the sum weight of all companies with 4.5% or more individual weightings) are prevented from exceeding more than 22.5% of the overall index. Further, no individual company is allowed to represent more than 15% of the index. This keeps IYF relatively diversified.

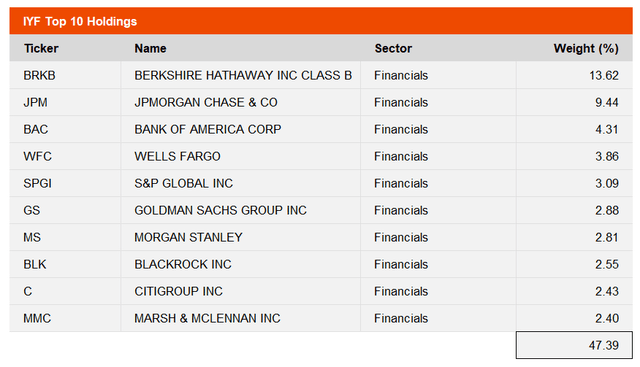

Having said that, you do see some concentration, as depicted below. Berkshire Hathaway Inc. (BRK.B, BRK.A), Warren Buffett's conglomerate, represented 13.62% of the fund, just below the weighting. JPMorgan Chase came in second, at 9.44%. These figures are as of May 9, 2023. There were 137 holdings in total.

Data from iShares.com

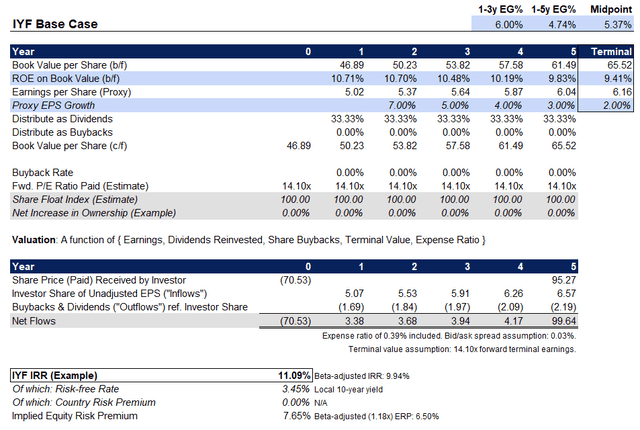

Given the limited data available from the fund's factsheet, I refer to Morningstar data which indicates a forward price/earnings ratio of 12.23x and a price/book ratio of 1.51x as of May 8, 2023, for IYF's portfolio. Also, Morningstar provide a three- to five-year average earnings growth consensus of 14.10%, which is strong, and an indicative dividend yield of 2.61%. The data implies a forward return on equity of 10.71% and a dividend distribution rate (from earnings) in the region of a third.

Holding most factors constant, and taking a conservative approach whereas earnings growth is circa 5% per annum between year one and year five in my projection (essentially I'm keeping the forward return on equity roughly constant, but taking earnings growth down to a maturity rate of 2% by year six), my implied IRR for IYF on a five-year basis is 11.09%.

Author's Calculations

That is a strong return, especially given that my projection is considerably more conservative than the consensus. However, we live in uncertain times, and I think it is wise to hold the return on equity steady rather than assuming a multi-year expansion. Further, given a 10-year yield in the U.S. (my proxy for the risk-free rate) is sub-3.5% at present, the implied ERP in my conservative base case is 7.65%. On a beta-adjusted basis (I calculate beta as 1.18x on a three-year basis), the ERP drops to 6.5%; this is still healthy. A fair ERP for a mature U.S. sector like Financials would be 5.5% at most, in my opinion, with an acceptable range being perhaps 4.2-5.5%.

Parting Comments

As we head into the next business cycle, I think IYF will perform well, and could even see further out-performance. I also think there is potential for earnings multiple expansion; the current forward multiple of 14.10x seems cheap for any sector in the U.S. equity market. On other hand, many consider the current rate-hiking regime as being over now; if this is true, the medium-term holds rate cuts in store for us. Rate-cutting regimes are usually bad for banks conventionally speaking, since they tend to lower yields on assets and reduce net interest margins charged by banks. On the other hand, lower yields also mean stronger bond prices, which could help to shore up balance sheets and attract depositors back (out of alternatives like money market funds).

All considered, I like IYF, and I would take a bullish stance at present. You have an IRR potential of 10% or more per annum, with the opportunity for a surprise upside beyond this should consensus analyst estimates ring even close to true in reality. IYF also, per my calculations, carried an elevated 'upside beta' of 1.26x, more than the average beta of 1.18x cited earlier, making IYF an interesting pro-cyclical investment opportunity as the United States begins to approach a new business cycle.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.