CIK: Resilient HY CEF, Back To Normal

Summary

- Credit Suisse Asset Management Income Fund is a fixed income CEF focused on the U.S. high yield market.

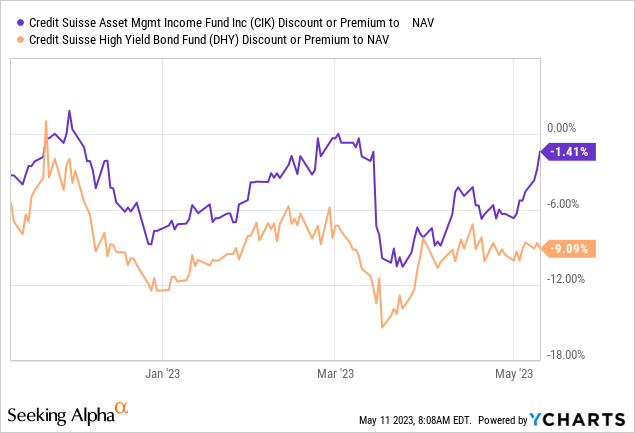

- The CEF experienced a significant 10% widening of the discount to NAV when questions were swirling regarding Credit Suisse's viability.

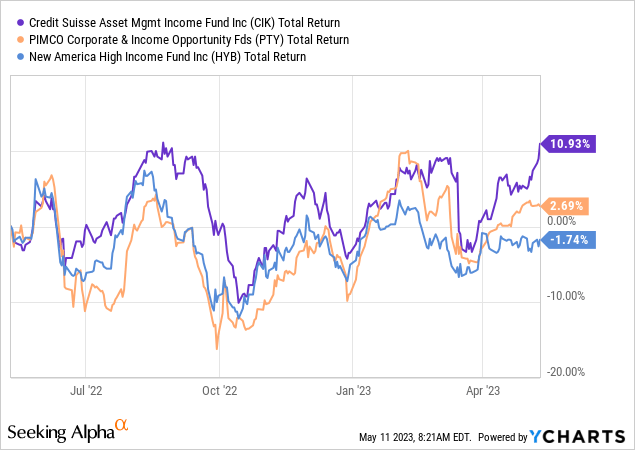

- The fund has now almost closed back that gap as anticipated and is significantly outperforming in the HY CEF space on a 1-year look-back.

- The carry in the U.S. HY CEF space is attractive, with the ICE BofA US High Yield Index Effective Yield at 8.43%.

HAKINMHAN

Thesis

We have covered the Credit Suisse Asset Management Income Fund (NYSE:CIK) in a number of previous articles, with the last one flagging the shocking market action that occurred in this fund when questions were swirling around Credit Suisse's (CS) viability. The article pointed out that CIK was a separate legal entity, and the only impact from a potential CS default at the time would be through a change in the portfolio management team. We were anticipating a recovery in the discount to NAV once a solution was found.

Sure enough, you cannot keep a good CEF down. CIK has now almost fully re-couped the 10% widening of the discount to net asset value, and is significantly outperforming on a 1-year look-back when compared to some of its brand name peers in the U.S. high yield space.

2023 is the year of defaults and near bankruptcies, and it is worth highlighting to retail investors the robustness of the CEF structure. Unlike banks for example, which rely on depositors for their funding, a CEF is set up for stressed scenarios, by funding either through term preferred equity or asset-based lending (repo or TRS structures). A CEF is also set-up as a bankruptcy remote vehicle as we have seen in our CS analysis. None of the CIK assets sit with Credit Suisse, since CIK is a separate legal entity altogether.

We correctly highlighted in our prior article that once there is more certainty regarding the portfolio management team for CIK going forward, we were going to see a substantial recovery in the discount to NAV. In hindsight, this was a great buying opportunity, and while we did purchase some shares, it was not enough given the substantial move-up we have seen here.

State of the High Yield Market

While spreads in the high yield market are still fairly contained, from an all-in yield perspective we are close to the top end of the range:

We like to look at all-in yields because the bond market is firstly a cash market - when a borrower pays interest on a loan, real dollars come out of the account. Real cash is driven by an all-in yield, or the actual rate for the bond or loan. Spreads are more of a capital markets instrument, because they indicate relative valuation of debentures versus a treasury or swap benchmark.

Currently, the ICE BofA US High Yield Index Effective Yield is at 8.43%, which is above the long-term historic range of 5% to 8%. We feel there is another risk-off event to be had here, but in our view, all-in yields are not going to go above 10% this cycle. That makes the current carry for the CEF space fairly attractive.

Premium/Discount to NAV

After experiencing an almost -10% widening in its discount to NAV, the CEF is now back close to flat:

We can observe how the market favors CIK and its portfolio over the other Credit Suisse CEF (DHY). CIK has had an outstanding historic track record, and with some stability now established given the UBS take-over, the CEF is 'back to normal' from an operating business perspective.

Performance

The CEF is now significantly positive from a total return perspective on a 1-year lookback:

CIK manages to outperform the PIMCO Corporate & Income Opportunity Fund (PTY) and the New America High Income Fund (HYB) on the respective time frame.

Conclusion

CIK is a fixed income CEF. The fund focuses on U.S. high yield and now displays an outstanding total return performance on a 1-year lookback. The vehicle was roiled earlier in the year by the turmoil surrounding Credit Suisse, with its discount to NAV widening violently to -10% in a matter of two business days. We highlighted in a prior article how the CEF is a separate legal entity altogether, with its assets having nothing to do with CS, and we were anticipating a 'back to normal' performance for the spread when the situation was clarified with CS. Our viewpoint has now been validated, with the CEF recouping most of the discount widening. CIK is a great historic performer and will continue to deliver.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CIK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.