GOVT: Treasuries Are Safe For 2023 - Hide There For A Good Time, Not A Long Time

Summary

- Sentiment is quite negative for Treasuries, with the US debt ceiling dominating headlines. In the past, buying US bonds amidst such fear has proven to be a good short-term trade.

- Monetary policy tightening measures are hitting the economy now, and commodities prices have eased in the last year. Both provide a bias for further near-term softer CPI prints.

- US stocks face a difficult time in the next 6 months with pressure on earnings. A Fed pivot to cutting rates may not be enough to change this.

- The iShares U.S. Treasury Bond ETF is a way to play these themes for 2023. Not for the long term though, the Fed may return to their money printing ways.

Torsten Asmus

GOVT ETF overview

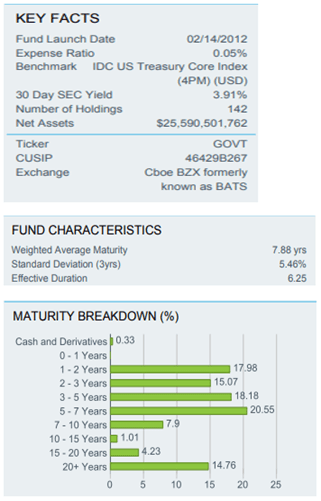

The iShares U.S. Treasury Bond ETF (BATS:GOVT) is a low cost (0.05% expense ratio) way to get exposure to the results of an index made up of U.S. Treasury bonds. The maturity profile consists of Treasuries ranging from 1 to 30-year maturities.

iShares U.S. Treasury Bond ETF Factsheet as of March 31

At quarter-end, the yield was near 4%, and duration was sitting at 6.25.

In broad terms, if we see treasury yields move around 1% across the curve this could result in this ETF fluctuating in terms of capital value of circa 6%. Note the performance history below with the fund having launched in February 2012.

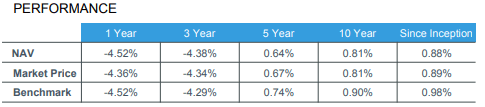

iShares U.S. Treasury Bond ETF Factsheet as of March 31

We can see above how the 12 months up to March 31 saw the NAV decline 4.5%, so that is how that sensitivity has played out in the recent past. Whilst the 5Yr+ part of the yield curve has risen less than 1% over that period, some shorter dated maturities experienced much larger moves higher.

Despite such long-term performance numbers, I believe one can achieve a good result in the GOVT ETF for the rest of 2023, where there is a significant chance of a recession. I would not rule out a shift downward of 1% across the yield curve in such a scenario.

Will the US default on its debt in 2023 and cause Treasury yields to rise?

This question has been making front page news globally in recent weeks. When a potential event is so widely discussed, I usually wonder whether it is wise to try and protect one's investments from the event. That is, in this case, should I sell Treasuries for example? After all, supposedly according to most media articles, Treasury yields are sure to rise in rise in such a scenario.

Firstly, let's not lose sight of the fact that this event may not even happen. However, as an investor, I would not want to bet too strongly on that, who wants to rely on politicians? Then again one would not be surprised to see an agreement reached near the last minute.

The second point I would make that is not being discussed so much is to question whether Treasury yields would necessarily rise under a drawn-out scenario of negotiations. One in which could involve a lengthy delay to lifting the debt ceiling, or default and / or a credit rating downgrade.

If we experience delays, the market may start factoring in a steeper slowdown in the economy and even a recession occurring sooner. In order to reach an agreement in further negotiations the market might focus on their being more aggressive government spending cuts. Even if the risk of a default or credit rating downgrade rises during this time, there may still be a strong desire to own US Treasuries.

What happened when the US credit rating was downgraded in 2011?

In 2011 many strategists and the media suggested treasury yields would rise if the US experienced a debt downgrade. In fact, the opposite occurred. For those not old enough to remember, here is an article from the day after the US debt downgrade in 2011. It refers to the yield on the US 10-year falling to 2.5% that day. It closed that year below 2%.

Falling US Treasury yields is a contrarian viewpoint to what I am reading in most of the mainstream news articles I am coming across this week.

Such a move occurring this time around still sounds a little counterintuitive. Yet I can still find some articles of some forecasting the price of US debt to hold up strongly during these negotiations. UBS suggested this month that bonds may actually rally if the US runs out of cash to pay its debts.

The big short in 2023 in Treasuries - will they be wrong again?

Commenting on what investor sentiment is in any market and what might be factored in is always a subjective exercise. Even acknowledging this though, I have seen other indications that too many investors may already be positioned for the "rising US Treasury yields on debt ceiling concerns" trade.

CFTC, Bloomberg.

Looking at the chart above, it looks like an ideal setup for fans of the George Costanza investing strategy.

The last time we had bearish bets to this extreme on the charts was in late 2019, yet the first 6 months of 2020 saw a huge plunge in yields.

Then in late 2021, the hedge funds had pinned their hopes on extreme long positions, thinking Treasury yields are about to fall. Only to see a huge rise in treasury yields in 2022!

Short-term inflation pressures to ease

Whilst the time lag of monetary policy is often debated, a popular opinion is that it takes around 12-18 months for interest rate changes to hit the economy. That suggests now is a difficult time for markets.

With the first Fed rate hike occurring back in March 2022, and such an aggressive rate hiking cycle, we should be expecting a tough time for the economy for the rest of 2023.

I note that commodity prices in general broke out higher of their pre-pandemic levels in mid-2021 and experienced large gains. It was then 12 months later that the US CPI prints started coming in above 8% yoy.

The CRB Commodity Index rolled over this time a year or so ago and has had a significant correction from the peak struck back then. We may now see continued relief in terms of lower-than-expected CPI prints.

Should you sell in May and go away?

With equities, I would contemplate lightening positions a little but would hold onto Treasuries for the time being. I don't want to place much faith in this age-old Wall Street adage, but in 2023 we do have more temptations than in the past to sell stocks.

We have had a nice 6-month rally from the October lows leading up to this month. However apart from the lagged effect of interest rate rises beginning to bite now, there are also no indications yet that valuations are attractive.

Another reason I would be patient about buying US stocks right now is that in the 2000 and 2008 market declines you didn't want to be jumping into the market before the first rate cut.

Treasuries and stocks more likely to be uncorrelated this year

Some may be questioning now why I am bringing up potential stock market weakness as a bullish argument for the GOVT ETF. After all both stocks and bonds suffered negative performance in 2022.

Whilst we can't rule out that happening again, I would note that it is a relatively rare occurrence in history. Thankfully I would add, for those investors who place their faith in the 60/40 portfolio.

This article notes that over the last 30 years especially, the tendency is to see stocks and bonds negatively correlated.

A key factor in why that was not the case last year, is that Treasury yields were far lower heading into 2022 than we see right now. With the yield on this ETF near 4% as I mentioned earlier, the asset class is now more attractive compared to the start of 2022.

Will de-dollarization see a move away from Treasuries?

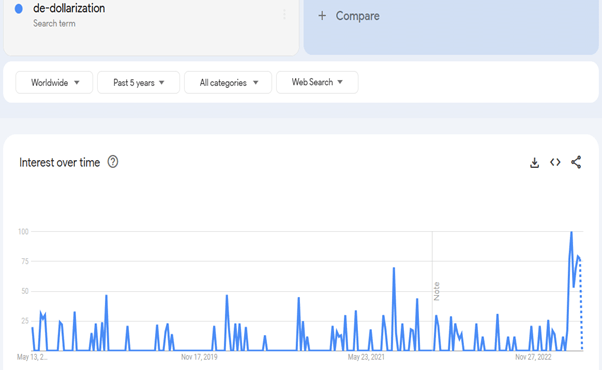

I do have plenty of sympathy for the long-term view of the de-dollarization argument. However, just like the fact that US debt ceiling concerns are making headlines everywhere right now, I also wonder whether the de-dollarization discussions might be overblown on a short-term basis.

The de-dollarization search trends are going mainstream this year.

Google trends for de-dollarization last 5 years

One wonders if this thematic is also a component of the thesis on why hedge funds are shorting Treasuries lately. If so, perhaps this could be another aspect of the crowded trade. We could be set for a short covering rally in the next few months.

At least for the time being the US Treasury market still boasts strong liquidity and a reputation as a safe haven asset. Whatever may happen in the short-term regarding US debt ceiling negotiations, the Treasury market will likely retain its many fans compared to say European or Japanese government bonds in the short term.

Are US Treasuries safe in 2024? The longer-term risks holding the GOVT ETF

I don't mind Treasuries as a short-term trade approaching mid-2023 for the next 6 months or so, but I am not inclined to hold them long-term.

The Fed has surprised me with their aggressive rate hiking cycle over the last year. Later this year though I expect a lot more pressure on them to reverse their course, maybe even just as aggressively. Over the last year the stock market has only experienced a relatively modest bear market, and the unemployment rate has not caused great concerns. Were these factors to change later this year, I could easily see the Fed rushing to be the savior in 2024.

If one was in their shoes, they could point to their previous aggressive hiking cycle as having done their bit to tame inflation. There could well be widespread calls to slash rates by then. Even if the CPI prints suggest inflation is sticky, they can just cite forward projections that inflation will moderate. I am not sure they will cop a heap of criticism if they go back to their aggressive money printing ways. That seems the easy option and short-term fix. Regarding the longer-term implications, well that might be for others to worry about!

With the potential of some supply side and structural inflation factors remaining, I worry that a further fall in inflation late this year might be short lived. In particular, I would be concerned then about the long end of the Treasury yield curve in 2024.

Conclusion

Admittedly, the credit rating of the US and the de-dollarization discussions give a somewhat uneasy feeling in the stomach buying US Treasuries exposure right now. On balance though, I expect the GOVT ETF to be a good parking spot for some of your assets for the rest of this year. The global macro backdrop is looking increasingly riskier.

It wouldn't shock me to see Treasury yields fall despite the mainstream media highlighting the risks of the opposite occurring. With plenty of bearish opinions on US Treasuries now, a counterintuitive rally might take place, not unlike what occurred in 2011.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.