NewtekOne: The Moat And The Plan

Summary

- NewtekOne's moat is its preferred lending partner status at the SBA and its NewTracker technology, providing a constant funnel of high yielding SBA loans to issue and sell.

- The 11.25% interest rate on SBA loans allows Newtek to offer highly competitive interest rates on new checking and savings accounts, up to 5% on online personal savings accounts.

- Newtek targets gathering "sticky" deposits by offering a competitive interest rate, as well as its Newtek Advantage suite of ancillary services to customers.

- Securitization business is expected to drastically slow down, if not completely stop, in favor of using deposits to leverage up the balance sheet.

- NewtekOne currently trades at a discount to the CEO's measure of fair value. Keep an eye out on the progress the bank makes in gathering deposits.

AUNG MYO HTWE

NewtekOne Banking Business - The Moat

Let's begin by stating the biggest moat that NewtekOne (NASDAQ:NEWT) possesses: recently, the NewtekOne Bank was granted the Preferred Lender Program, or PLP. In short, PLP lenders are given the authority by the SBA to extend credit to loan applicants. What moat does this provide? It comes from the terms of typical SBA loans: prime + 3.00%. In an environment where the prime rate is 8.25% as of today, this means that NewtekOne Bank's loans are earning 11.25%.

Combined with an excellent risk profile for these small business loans - as of March 31, 2023, 93.26% of the loan portfolio was in accrual status - this provides an enormous amount of financial cushion to NewtekOne's margins, and also provides a commensurate amount of freedom of action to compete for deposits in the markets. Recently, underwriting has tightened at NewtekOne due to a recession expected in the near future due to rising rates, meaning that higher FICO scores are expected and higher amounts of liquidity and collateral from loan applicants. For the time being, there is even less reason to worry about credit quality.

What does NewtekOne's loan portfolio look like right now? The average size is $152,000 for unguaranteed retained loan balances, with a total of 3,538 loans, diversified across industries and geographies.

NewtekOne Offers Nearly Unmatchable Deposit Rates

How does earning a whopping 11.25% on loans with solid loan currency rates allow NewtekOne to compete on the market for deposits? It's simple: offer higher interest rates on deposits. I'll use personal savings accounts as a very motivating illustrative example. Let's compare the rates available on a selection of online savings accounts, as of today. I will also provide a few links too:

- Newtek Bank: 5.00%

- PNC: 4.30%

- TIAA Bank: 4.25%

- SoFi: 4.20%

- Marcus by Goldman Sachs: 4.15%

- Barclays US: 4.00%

- Citibank: 3.85%

- Ally Financial: 3.75%

- Capital One: 3.75%

- Sallie Mae: 3.75%

The Fed Funds rate, the de facto risk-free rate, is currently 5.00-5.25%. NewtekOne's margins on loan interest allows it to offer depositors a rate that matches the Fed Funds rate - giving the market interest rate directly to customers - is a huge advantage in gathering deposits. Other banks simply cannot raise deposit rates at will because of the competitive nature of banking, as well as the fact that they offer loans in much more competitive markets.

If we consider that today, the prime 15 and 30 year fixed rate mortgage in the US earn 6.24% and 7.38%, prime auto loans at 4-5%, and commercial mortgage rates at 5-7%, it's easy to see why most banks have a very hard time offering 5% on deposits - the typical net interest margin at US banks is around 2.00 - 2.50%, whereas NewtekOne earns 6.25%. If we adjust for NewtekOne's accrual status rate, it's closer to 6.00%.

Gathering Deposits Faster Than Forecast

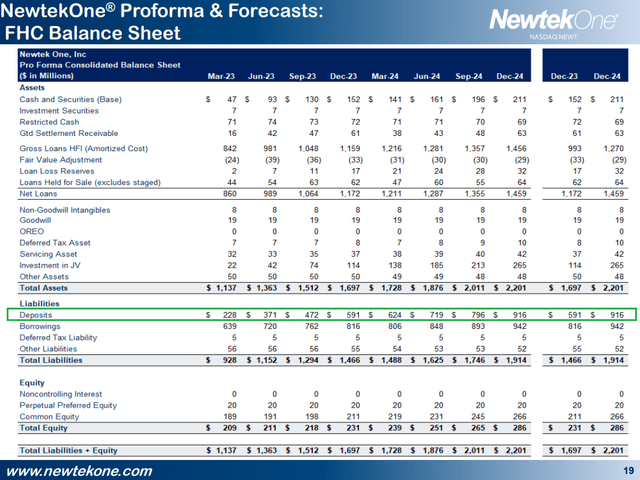

At the conference call and presentation at the end of 2022, the CEO Mr. Barry Sloane presented some pro-forma forecasts (see slide 19, or page 20 of this presentation PDF). Let's compare the figures in the projection with the figures reported at the Q1 2023 conference call (see slide 7, or page 8 of this presentation PDF).

| As of | Pro Forma & Forecast | Actual Reported |

| Dec 31, 2022 | $140 million | |

| Mar 31, 2023 | $228 million | $247.6 million |

| April 28, 2023 | $310 million | |

| June 30, 2023 | $371 million | |

| Sept 30, 2023 | $472 million | |

| Dec 31, 2023 | $591 million |

NewtekOne is beating its own projections, and continuing at last month's rate of gathering $73 million a month in deposits, is on the way to reaching the June 30 forecast by May 31. Something very notable regarding the $170 million gathered between year end 2022 and end of April 2023 is that $115 million of those new deposits were gathered by opening accounts digitally, for over 3,300 new customer accounts. Well done Mr. Sloane and NewtekOne.

NewtekOne Targets Gathering "Sticky" Deposits

I'll begin with two quotes from Mr. Sloane from the most recent conference call:

We came into this business by acquiring a bank and putting a plan together that we believe deposits have 0 duration. And all of a sudden, in the last 2 months, everyone’s waking up and going, "Wow, bank deposits at a 0 duration. And we saw commercial depositors line up, unfortunately, at some of our industry participants [SVB, Signature, First Republic] and withdraw their money.

The bank runs at Silicon Valley Bank, Signature Bank, and First Republic forced banking market participants to recognize the instability of their deposits.

I can’t tell you, in 2022, how many times I was asked about non-interest-bearing deposits and core deposits. Well, it turns out core wasn’t so core and paying zero isn’t a benefit. I would question whether these low-cost deposits that are out there on the books of the major money center banks are an asset or not. – whatever sticks is an asset or whatever moves is not. That’s a squeeze on the neck.

For over a decade now, thanks to the low interest rate environment, banks have come to regard non-interest bearing deposits as a good thing. However, with the Fed hiking rates and jump-starting competition in deposit rates, it's clear that non-interest bearing deposits are stable only if the low interest rate is stable. The deposits can move shockingly quickly. SVB was a $200 billion bank, but suffered $42 billion in withdrawals in one day. First Republic, also a $200 billion bank, suffered $100 billion in withdrawals after the SVB and Signature Bank debacle.

To add the needed nuance though, all three banks were heavily concentrated in commercial and high net worth clients, who are all well connected and who have deposits uninsured by the FDIC. However, NewtekOne does not have this concern: 94.5% of all deposits at NewtekOne are insured (slide 7, page 8 of the Q1 2023 presentation). Checking and savings accounts are commodities that compete on interest rate. By offering a highly competitive interest rate, NewtekOne Bank can avoid the instability inherent in non-interest bearing deposits.

Just for completeness, to reiterate a topic I've written about before, another factor for deposit stickiness at NewtekOne is the NewtekOne Advantage. Much like how Google encourages stickiness by offering ancillary services such as Calendar, Map, Email, Drive, etc., the NewtekOne Advantage consists of a one-stop suite of ancillary services business owners may find useful, such as online analytics, a financial dashboard, merchant processing management, payroll solutions, etc.

Mr Sloane also added that the NewtekOne Advantage could eventually provide enough stickiness that NewtekOne could safely offer deposit rates significantly below 5%:

Look, going forward, we – our business model is predicated on acquiring deposits at market cost of funds. However, it doesn’t mean that we don’t believe we’re going to be able to get commercial deposit accounts for checking at 1% and commercial high-yield savings accounts at 3.5%, which will reduce the blend. And we’ll be able to do that by combining our merchant processing, our payroll, requiring operating accounts of people we lend money to, [transcript error], which we’ll talk about. So that will wind up giving us further advantages in the future.

NewtekOne's Customer & Referral Generation Process

NewtekOne was designed to gain business very cost-effectively. NewtekOne does not have any brokers, branches, or business development officers. NewtekOne's "NewTracker" technology enables NewtekOne to gather loan leads efficiently and cost-effectively. In fact, the NewTracker is an app that is downloadable onto iPhones from Apple's App Store.

NewTracker gives NewtekOne's "Alliance Partners" full transparency into NewtekOne's back office and allows them to track the progress of their business referrals through the whole customer acquisition process. My understanding is that an "Alliance Partnership" is a company from which NewtekOne receives leads. Some of the alliances are: (Slide 22, or page 23 of the Q1 2023 presentation)

- UBS

- Morgan Stanley

- Navy Federal Credit Union

- Randolph Brooks Credit Union

- Credit Union National Association

- Meineke Stores

- TrueValue Stores

- Henry Schein

- 1-800 Accountant

Newtek is continually searching for and adding new partners to the list.

Securitization Trusts - Legacy & Future Activity

When Newtek makes a SBA loan, it comes in two parts: the individually saleable guaranteed portion, and the non-individually saleable unguaranteed portion. This is a long and detailed aspect of NewtekOne, which was the subject of my first article on the company, written just over 3 years ago. There, I explain Newtek's loan selling and securitization business in more detail with some illustrative examples.

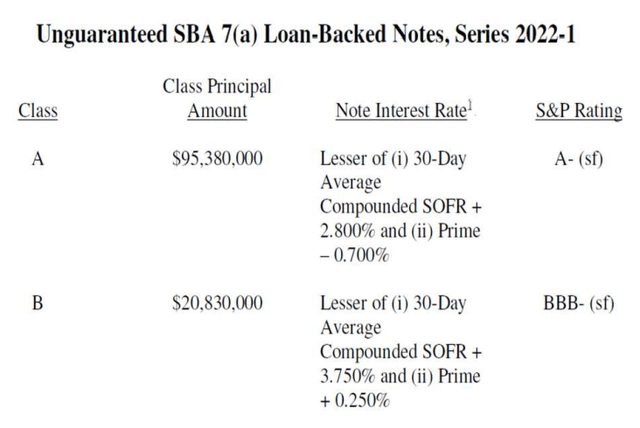

In the past, securitizations were used the effectively sell the unguaranteed portions. NewtekOne received the principal, and in exchange had to pay interest on the notes issued against the securitization trust. For example, this is one of 4 currently outstanding securitization transactions:

Example Of Securitization Transaction (Slide 17, Q1 2023 Conference Presentation)

I was present at the Q1 2023 conference call, and had a chance to ask Mr. Sloane a few questions. The transcript is available here, but below is the relevant portion:

Steven Nemo

Okay. One last quick question and this is related to the unguaranteed loan pieces. So, what are Newtek’s plans regarding securitization trusts going forward? The language in some recent news [third paragraph in this link] seems to suggest they are legacy. And so Newtek won’t issue any more securitization trusts and notes on the unguaranteed portions anymore. What are the plans going forward on that?

Barry Sloane

So, when the references to legacy, we try to refer to the legacy assets there in Newtek Small Business Finance, which are in a rundown mode. And there is a current position of uninsured loan participations in Newtek Small Business Finance in the warehouse line, that I will use the word not to get ahead of ourselves it could be securitized.

Steven Nemo

Okay. So, by legacy those – so by saying legacy, it doesn’t rule out the possibility of issuing more securitization trusts in the future?

Barry Sloane

No, I mean it’s unlikely we would do it out of the bank, because right now, the bank has about a 350 basis point interest funding advantage as well as not having to raise equity. Do you follow me?

Steven Nemo

Yes.

Barry Sloane

So, let me just finish, Steven. Going forward, the SBA loans will be done out of the bank and NSBF with its legacy securitizations, loans against securitized debt will be in a runoff mode. So, all of [indiscernible] will be done at the bank. Hopefully that answers your question.

Let's do a tiny bit of math. SOFR is currently about 5.00%, and prime is currently 8.25%. For the class A portion of the 2022 securitization, let's compute the cost of the interest:

- SOFR + 2.800% = 7.80%

- Prime - 0.7% = 7.55% (the minimum)

Given that the personal savings account NewtekOne offers yields 5.00%, business checking yields 1.00%, and business high yield savings yields 3.50%, the number that Mr. Sloane offered - 350 basis points - seems about correct. This means that in the future, using deposits as the liability to leverage the loans will be much more profitable than using the notes written against securitization trusts to accomplish the same.

Therefore as Mr. Sloane stated, we can expect that the 4 securitization trusts outstanding to be kept within Newtek Small Business Finance (NSBF) and that they will be essentially warehoused until they are run down over their lifespan. Additionally, given the 350 basis point funding advantage that deposits have over securitization, we can expect NewtekOne to no longer conduct substantial securitization offerings in the future.

NewtekOne Non-Banking Businesses & Consequences On Valuation Of Shares

During the last conference call, Mr. Sloane had a lot to say about the value of the asset-light subsidiary businesses, which in his opinion, are not valued appropriately according to accounting standards for banks.

Slide #6 is an interesting slide and we use the term adjustment to book value at 3/31 due to deconversion adjustments. I think that banks and financial holding companies basically do not have valuations for asset-light businesses like merchant services, tech solutions, insurance agency, and payroll. These businesses using a fair value calculation worth about 166 million, well they are going into our tangible book at a negative $2 million. Well, as a BDC, these were on our books at fair value and a much bigger number, it's almost $6 or $7, it's close to $7 a share. Now look, I'm not trying to rewrite accounting standard, it's not what I do. But when you look at the asset valuation of NewtekOne, it would be a disservice if you’re sort of a multiple to book value freak to not count these very valuable and vital businesses that generate cash flow with very little capital investment or CapEx and these are generating recurring cash flows and are part of our valuation. We think these businesses are quite valuable and add to the tangible book valuation of $7.77 a share.

If we take Mr. Sloane's words at face value, we can conduct a very quick "sum of the parts" valuation of NewtekOne, by simply combining his estimates of the fair value of the subsidiary businesses and the tangible book value for the whole financial holding company.

- Tangible total book value = $7.77/share

- Fair value of subsidiaries = $7.00/share

- True Value Of NewtekOne = $14.77/share

- Current Market Capitalization = ~$11.70/share

This means that at current prices, NewtekOne is trading at a ~21% discount to Mr. Sloane's valuation, and this is before we assign any P/B multiple to the valuation. Given what we know about Newtek Bank's margins, even at this early stage, approaching this very conservatively, a 1.0x multiple to Mr. Sloane's valuation is justifiable, with room to expand as the deposit gathering and leveraging up the bank's balance sheet picks up more steam. It is therefore exceedingly likely that on a "sum of the parts" basis, current market value of NewtekOne is at a steep discount to its fair value.

Now, what exactly are these businesses? I wrote about these in my previous article about NewtekOne, and you can see it in the "Breakdown of Non-Bank Entities" section. These are businesses that do not require much ongoing capital expenditure or investment to continue to operate, meaning that their asset-light nature causes them to be under-reported when valued according to the accounting standards for financial holding companies.

What To Watch For In The Near Future

The premise for converting from BDC to financial holding company was the ability to use lower cost deposits (350 bps advantage) to lever up the balance sheet, as well as the ability to use more leverage than the BDC form allows (200% debt to equity ratio) - banks typically operate at a 10-to-1 ratio. Therefore, the single most important number to track over the next 1-2 years is the quantity of deposits that NewtekOne has attracted. In order for the premise to be vindicated, an investor should hope for rapid deposit growth.

2022 Year End Forecast ((Slide 19) Q4 2022 Conference Call Presentation)

Just to reiterate how important deposit growth is - without deposit growth, NewtekOne will not be able to get lower cost leverage, as well as utilize the leverage room that the FHC form allows it to use. There are two other key metrics worth monitoring:

- % of loans that are in accrual status. A high percentage of loans in a non-accrual status mean less interest income and more loan losses.

- Growth of the non-bank entity subsidiaries. These are an integral part of NewtekOne's revenues and profits.

Overall, I rate NewtekOne a "strong buy" due to its discount to fair value as estimated by the CEO Barry Sloane, as well as its competitive position in the market: able to strongarm deposits towards itself by offering competitive interest rates. The more that deposits grow, the bigger the position that NewtekOne should merit in a portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEWT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.