BOIL: Hopes For A Rebound In Natural Gas Are Looking Grim

Summary

- Wild swings in natural gas prices caused by the Russia-Ukraine war continue to attract speculative bets on the commodity.

- We suspect that we are witnessing the classic symptoms indicating that retail traders are suffering from the illusion of value.

- Fundamentals, however, suggest that the meteoric surge in natural gas prices in 2022 is unlikely to repeat without some severe disruption to supply.

- The perverse dynamic of shale oil production means high oil prices are indirectly placing downward pressure on natural gas prices.

- We initiate a "Hold" rating on BOIL for now, with a view to short natural gas on speculative rebounds.

imaginima/iStock via Getty Images

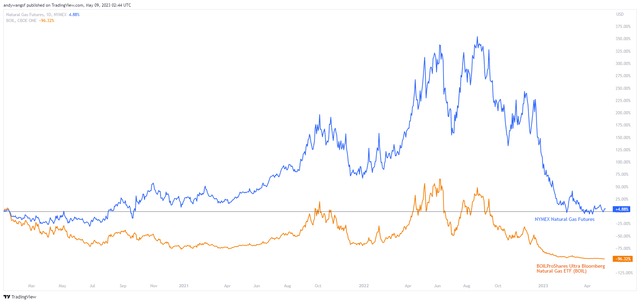

It has been more than a year since the Russia-Ukraine war stoked fears that Europe would spiral into a deep energy crisis. But the meteoric surge in natural gas prices which peaked at $9.85/MMBtu on 22 August 2022 has since witnessed an equally dramatic collapse back to 2020 levels of around $2.24/MMBtu at the time of writing.

TradingView.com, Stratos Capital Partners

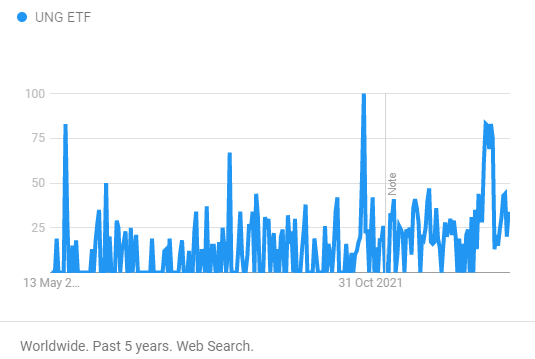

Unsurprisingly, the extreme volatility in natural gas prices has attracted the attention of speculators. And hopes for a rebound might explain the sharp increase in web searches for "BOIL ETF" and "UNG ETF", which refers to the tickers for the ProShares Ultra Bloomberg Natural Gas ETF (NYSEARCA:BOIL) and the United States Natural Gas ETF, LP (UNG), respectively. As the accompanying charts show, worldwide web searches for BOIL and UNG have increased in recent months according to data from Google Trends.

Google Trends

Google Trends

Interestingly, there is also consensus among Seeking Alpha (SA) analysts that the outlook for these ETFs is generally bullish. At the time of writing, SA analysts have an overall "Buy" rating on both ETFs. SA's proprietary quant rating model, however, is much more pessimistic and assigns a "Strong Sell" rating for both ETFs.

As for our view at Stratos Capital Partners, we are leaning towards a more pessimistic view of natural gas, and we initiate our "Hold" rating on BOIL.

Misplaced Hopes And The Illusion Of Value

A casual review of recent articles published in the financial media, as well as anecdotal evidence from discussions in trading forums, suggests to us that speculative hopes of a rebound in natural gas have been building up in recent months. We are not surprised by the growing interest among retail traders looking to take bullish positions on natural gas, mainly through exchange-traded derivatives or a natural gas ETF such as BOIL or UNG. But what surprised us was the sheer lack of fundamental reasons and logic supporting the bullish thesis.

The vast majority of bullish arguments offered were based on a potential escalation in geopolitical tensions with Russia, extreme winter conditions, and the typical "because natural gas prices have fallen too far". Indeed, we suspect that we are witnessing the classic symptoms indicating that one is suffering from the illusion of value. Retail traders mistaking low prices for value seems to have been disillusioned by the magnitude of the recent swings in natural gas prices. They seem to believe that all they need to do is to wait for prices to swing up again, just like they always did before. Surely, catching prices at current lows means that there is a "margin of safety" to shield them from outsized losses, right?

Price And Value Are Different Things

Undoing the confusion that arises from trying to understand the difference between price and value is fundamental to successful investing in our view. But investors would often prefer to jump straight into trading strategy or analyst ratings without having to read philosophical writings on value. So this section is specially dedicated to readers who are keen to learn more about our philosophy on the topic.

The concept of value may be better understood by comparing commodities trading with investing in equities. We argue that value investing is naturally more compatible with investing in equities, while short-term trading of price action tends to be more compatible with commodities. We are not necessarily condemning all commodity traders to be short-sighted day traders, but merely making the general point that it is more natural to invest in equities and to trade commodities. One reason why investing differs from trading is that time tends to favour the former but rarely the latter.

For equity investors, the buy-and-hold strategy itself is a winning strategy with a positive expectancy, due in part to the natural tendency for equities to drift higher over time. This tendency to drift higher is due to several factors including corporations being a productive asset, productivity growth in general over time, the rising share of corporate profits versus labour income, and inflation. Thus, when one is investing in the equity of a business, one should be investing with the expectation that the business will continue to add value for its shareholders over time.

Most commodities, on the other hand, are usually regarded as an economic resource. Thus, the spot price of a commodity is usually determined solely by short-term demand and supply, and there is limited scope in adding to the value of a commodity itself. More often than not, technological innovation and improvements in productivity over time actually result in less of a commodity being used in the production of a final good. The rewards of innovation also go towards increasing the profitability of corporations that invested in research & development, rather than directly increasing the perceived value of a commodity by the broader market. This is because innovation typically occurs at the corporate level, and not at the point at which a commodity is extracted.

Finally, the production and supply of a commodity itself can be adjusted to match market demand. Commodity producers constantly try to tweak production levels by investing to increase production when demand is strong and prices are high, and by curtailing production when there is excess supply and prices are low. Holding on to a commodity over time simply doesn't add value to it, unless there is some constraint to supply over an extended period of time that would result in a persistent demand-supply gap. Only under such special circumstances can one argue that prices are not reflecting the realities of that demand-supply gap and that a commodity may be undervalued.

To be clear, price and value are different things. And the price of a commodity can certainly fluctuate as a result of speculative demand. When the market deems (or bets) that the future price of a commodity will rise, then futures prices will adjust to reflect that expectation. The problem with price, however, is that it is often fickle and challenging to predict with accuracy.

Value, on the other hand, forces prices to reflect the underlying demand and supply of a market over time. Although prices may occasionally stray from value as a result of speculation, prices eventually adjust in response to underlying economic forces.

Waiting For A Rebound Could Be Very Costly

Patience is often a prerequisite for successful value investing, simply because great business plans and value creation could take several years to materialise in the form of actual earnings. However, for speculators holding onto a bullish position on natural gas, the cost could really add up over time.

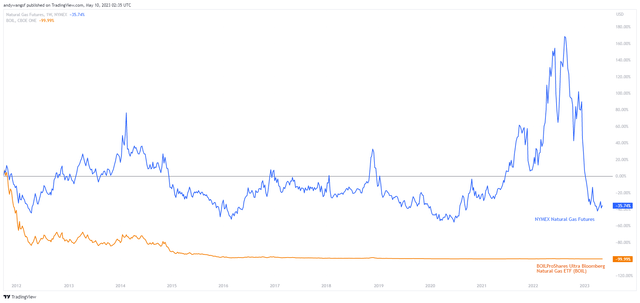

TradingView.com, Stratos Capital Partners

As the accompanying chart demonstrates, the price of BOIL tends to decline over time. This is partly due to the cumulative effects of contango. In the futures market, contango refers to when the price of futures contracts that expire further in time is higher than the price of contracts with a closer expiry.

Due to BOIL having to constantly switch out nearer futures contracts for contracts that are further away from expiry in order to maintain a leveraged long position on natural gas, the cost of switching contracts adds up over time when the market is in contango. Furthermore, because tracking near-term natural gas prices means holding futures contracts with a short window to expiration, transaction costs also add up quickly just to roll the position over time. Expectedly, the expense ratio for BOIL is also much higher compared to regular unleveraged ETFs, at 0.95%.

This characteristic of the futures market presents a difficult challenge for traders. That the BOIL is an effective tool to trade natural gas only in the short term but is destined to become a losing trade the longer one extends the holding period.

Fundamentals Are Consistent With Lower Prices

Although we do not completely dismiss the possibility that natural gas prices could rebound from current levels simply because the commodity may be oversold from a technical standpoint, the lack of fundamentals supporting a bullish view means we see little reason to take on risks. Besides, the fundamentals for natural gas are actually looking quite grim in our view.

A recent article published by Reuters provides a good explanation of why natural gas production in the U.S. has not been cut despite the recent plunge in prices. In short, the excess supply and build-up of natural gas in storage is predominantly due to natural gas being produced as a by-product of shale oil production. Because oil prices have remained elevated and are at profitable levels for shale oil producers, production has expanded in the Permian Basin. This has resulted in more shale gas being produced and stored despite lower prices.

This perverse dynamic of shale oil production means high oil prices are indirectly placing downward pressure on natural gas prices. So long as oil prices remain at levels that are profitable for shale oil producers, the excess production of shale gas is unlikely to cease.

For natural gas prices to rebound, it seems the market would need to bet on colder winters and a booming economy, both of which are currently not within the scope of even the more bullish analysts around.

In Conclusion

Overall, our assessment of the outlook for natural gas leans towards a more bearish view. We initiate a "Hold" rating on BOIL for now, with a view to short natural gas on speculative rebounds.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NG1:COM, BOIL, UNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.