Marvell Technology: A Value Perspective, Risk-Reward Not Lucrative

Summary

- Wanted to take a look at the company’s financials primarily. This is not a deep dive into the company’s potential.

- Financials are not the greatest, and I have seen much better metrics in other semiconductor companies that I covered.

- Even with an optimistic outlook on revenue growth and margin expansion, the company is overvalued.

Sundry Photography

Investment Thesis

With earnings just around the corner, I wanted to take a look at Marvell Technology (NASDAQ:MRVL) through a value perspective by diving into the company's financials, and overall sector outlook in the short run, and give my opinion on the company's stock price. The company has benefited from the massive bull rally since the bottom of the pandemic in 2020, and even though it has dropped around 55% since the peak of December of '21, the company is still quite overpriced in terms of value.

With further headwinds ahead in terms of the economy and the sector, I believe the company has a lot more room to go down and not everything is priced in just yet.

Briefly on Results

The company had a decent year in terms of revenue at the end of January '23, which is the company's fiscal year-end. The company saw around 33% revenue increases y-o-y, which is a slight slowdown in growth from the prior year. The previous year the revenue growth was around 50%.

Data center revenues for the fourth quarter were up 35%, enterprise networking up 26%, carrier infrastructure 19%, and consumer and automotive 13% and 7% respectively.

The company is pushing to report non-GAAP figures, which I’m not a big fan of, however, I’ll go along with it.

Non-GAAP gross margins were 64.5%, around 50% GAAP, non-GAAP operating margin expanded to 35.5% while GAAP stood at around 4%. Non-GAAP earnings were $2.12, while GAAP saw a loss of $0.19 a share.

The company is not particularly young any longer, and as I mentioned I'm not a big fan of companies who push non-GAAP measures, other than that, the company saw very strong growth in revenue in most segments, however, this may not be the case in the short run because of the economic uncertainty.

Short-term Outlook- Opportunity

In the recent past, I've covered a few semiconductor companies, and most of them reported a slowdown in revenue growth in the first half of this year and some recovery towards the end of the year when inventories start to come down at a quicker pace and the love for the semiconductor sector starts to return.

It is predicted that the global semiconductor revenue will drop by over 11% in ‘23, with a nice bounce of around 18% in '24. The exuberant demand for new electronics during the pandemic panic is dissipating, partly due to the rise in costs attributed to high inflation and interest rates. People are not upgrading their devices that fast anymore because of these reasons. The sector is very cyclical, and it seems like it has not bottomed out yet completely. This, in my opinion, will present a good buying opportunity sometime in the next 6-12 months when volatility normalizes. Right now, I believe there will be a lot of volatility which will bring down many stock prices of many different companies, including MRVL.

We already saw AMD (AMD) dropping around 10% in earnings, only to recover all of that and much more on a rumor that the company is partnering up with Microsoft (MSFT), which the company denied the claim. The markets are irrational in the short run, but ultimately the company's worth comes out in the long run.

Financials

While creating a financial model of MRVL, I noticed a few red flags that do not correlate with the company's share price performance. The company’s stock performance has been riding the bull wave and even with the stock price dropping over 55%, the stock price is still too pricy for the risk/reward ratio that I am comfortable with.

The company as of FY23 had $911m in cash, which is the highest amount of cash it had in the last 6 years, while the long-term debt is around $3.9B. This usually isn't much of a problem to me if a company can pay off the annual interest expense comfortably, but seeing that MRVL is reporting non-GAAP figures, my first thought was that it may have an issue in the future.

GAAP EBIT as of FY23 was $360m, while interest expense was $165m, so the company was able to cover the interest, however, that is a very low ratio. In previous years, the company's interest coverage ratio was in the negatives and the only way I could see the company paying the interest is through cash from operations.

While looking at this with a value mindset, there is nothing good about this situation. I prefer seeing companies being able to cover the interest expense at least 6 times over with the EBIT it generated. It is a much safer position to be in.

Debt was necessary for acquisitions, which was a smart move, however, solely depending on debt may have consequences.

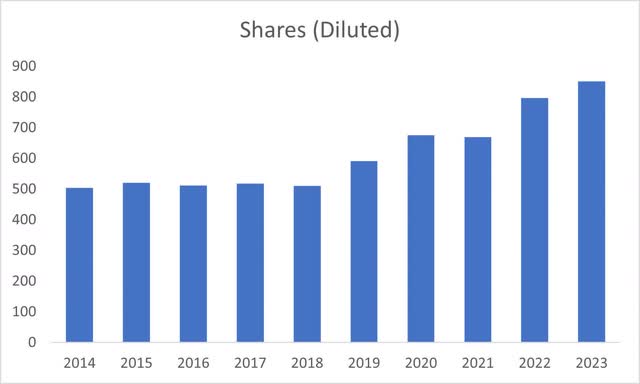

Another thing that I didn’t like about the company’s management was the dilution of shareholder value over the last 10 years. The company has increased its share count by around 69% in the last decade. I'm assuming a lot of this was due to the company wanting to acquire firms for growth, pay down debt, and other similar activities, however, I prefer companies that have been buying back shares rather than diluting.

Shares outstanding (Company's financials)

In the most recent transcript, the management said it "returned $319m to shareholders through dividends and buybacks." That's not that much in my opinion but hopefully, the company will stop diluting going forward.

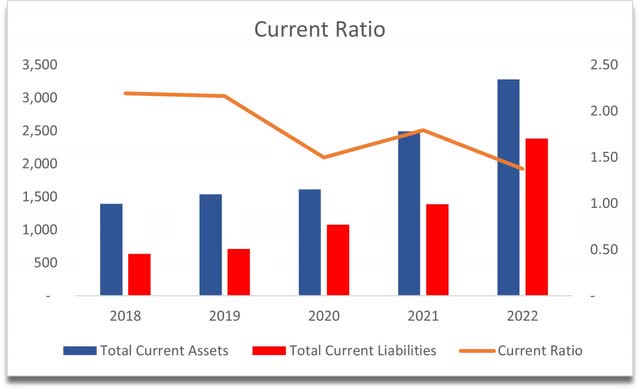

The current ratio of MRVL is decent but has been on a downtrend for the last 5 years, which is a little worrisome. As long as it is above 1.0 it's good, however, it would be better if it was closer to 1.5- 2.0. The company has been around those levels before so I think it can do it again.

Current Ratio (Own Calculations)

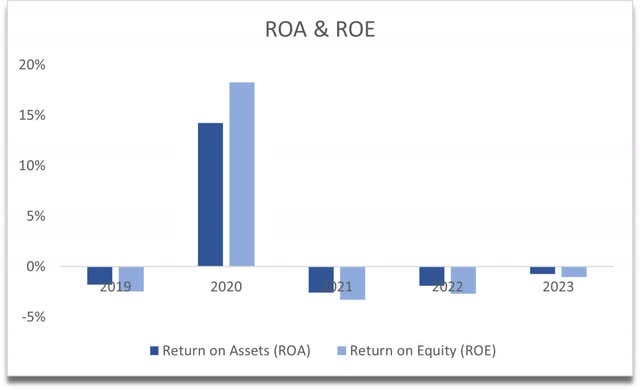

In terms of efficiency and profitability, the company’s ROA and ROE are not great. I figured these would be bad once I saw the company reporting non-GAAP figures. There is no value in these metrics yet. I'd like to see ROA be around 5% and ROE around 10% at the minimum.

ROA and ROE (Own Calculations)

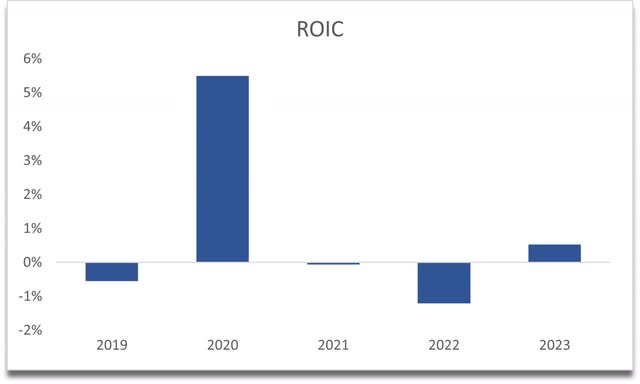

The same story can be said about ROIC. It’s very poor. This suggests that the management is not able to invest in positive NPV projects and has no competitive advantage and no moat.

Overall, the balance sheet is not the nicest I've seen in the semiconductor sector. To be honest it is probably the worst of the semiconductor companies I've covered previously. So, maybe the prospects of high revenue growth over the long term can justify the high share price. Let's have a look at the revenue growth and what I would be willing to pay for it.

Valuation

Analysts see -6.57% revenue growth in the next year and 18% the year after. The other years are not very reliable because the number of analysts drops from 29 to 8 and 1. So, 18%. It’s not a very good growth rate in my opinion for a company that is trading so high.

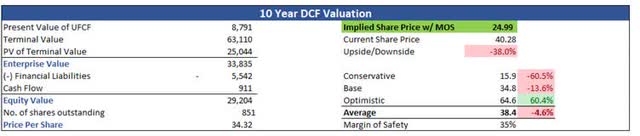

I decided to take a more optimistic approach for the valuation and the base case scenario, I went with a 20% average growth per year, for the optimistic case, I went with 22%, while for the conservative case, I went with 18%. This valuation ignores the fact that the semiconductor industry will decline by 11%. So, it is on the very optimistic side.

In terms of margins, gross margins were 50% in FY23, Net margins were -3% and EBIT margins were 6% (all GAAP). I went with improvements on these also with around 200bps on gross, 10% improvement on net margins, which is massive, and EBIT improved by around 400bps by ’32. I figured the company is bound to become more efficient in the future as many companies do.

On top of these optimistic estimates, I will add a 35% margin of safety to my intrinsic value calculation, because the balance sheet and the metrics are not very good. I usually add 25% if the company's books are top-notch.

With that said, MRVL's intrinsic value is $25 a share, implying a 39% downside from the current valuation.

Intrinsic Value, with optimistic assumptions (Own Calculations)

Closing Comments

In terms of value, the company offers very little in my opinion. The company seems to be inefficient and unprofitable. In the long run, if the company doesn't fix the issues above, it will come right down to where it hasn't been in a long while. There are much better options to invest in if you want to have some sort of semiconductor sector exposure. MRVL is not one of them. I think the price may rebound because it fell over 55%, but to me, nothing is interesting here, and I do not like to bet on companies just because they might perform well in the future. I would like to see good companies operating efficiently, profitably, and not diluting shareholder value.

I'm not going to recommend selling, as it might pop once the love for the sector returns, however, I wouldn't recommend investing now either, because the risk/reward ratio is not very appealing to me. I’ll keep this on the watchlist and will follow the sector closely but for now, the company is going to be way at the back of my mind.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.