Delta Air Lines: Significant Upside Potential (Rating Upgrade)

Summary

- Delta Air Lines continues to forecast a strong 2023.

- Travel industry peers are reporting a similar outlook further supporting this view.

- Considering the current environment and Delta's valuation, I believe DAL has a significant upside potential going into the summer months.

Sundry Photography

Introduction

Delta Air Lines (NYSE:DAL) and many other companies in the travel sector reported earnings over the past month. As has been forecasted by many, the results and the outlook for 2023 was generally phenomenal. The dominant narrative was that travel demand continues to be strong despite regional bank uncertainty and potential future macroeconomic uncertainties. Consumers have been and continue to value travel experiences more importantly than in pre-pandemic times. Yet, Delta Air Lines, going into the high-demand summer months, has been seeing range-bound trading in its stock price. This is likely a result of investors taking a potential macroeconomic uncertainty and slowdown into consideration, but I think this is highly unjustified. The travel industry, not only Delta, has shown consumers' resilience and willingness to put travel on top of their budgets as they value experiences more highly today than in pre-pandemic times. This will likely continue the travel demand strength generating a massive tailwind for Delta Air Lines. Therefore, I am upgrading my rating on Delta Air Lines from a buy to a strong buy as the company's valuation is likely undervalued considering the magnitude of the impending potential.

Delta Air Lines' Earnings

During Delta's 2023Q1 earnings report, the company provided an optimistic 2023 demand forecast with strong results. The company reported a net loss of $363 million. The result, despite the headline loss, was not bad. The first quarter is a seasonally weakest, and the loss was also driven by a $563 million annual profit sharing Delta did with its employees. Thus, looking at an adjusted number, the company's operating income was $546 million with a net income of $163 million. Further, during the quarter, the company generated an operating cash flow of $2.2 billion. I believe this result was phenomenal. Not only did the March quarter see record operating cash flow, but the outlook of an adjusted operating margin of 14 to 16% in the coming June quarter confirmed the bullish view of strong travel demand.

Going deeper into future expectations, the company gave an upbeat forecast during the earnings call. The management team said that given the "solid first quarter performance and visibility into the strength of summer travel demand, we are confident in our full-year guidance for...earnings of $5 to $6 per share." This reiteration in the aggressive forecast came on the backs of "consumer demand [being] well ahead of pre-pandemic levels." Further, when asked about why the company was confident, the response was the result of "the strength that [the company] is seeing both internationally and domestically."

This healthy demand environment "enabled [Delta Air Lines] to accelerate [the] reduction" in debt as the company paid down $1.2 billion on debt and finance lease obligations during the quarter improving the balance sheet. It is true that the company is still heavily burdened by a total debt and finance lease obligations of $22 billion but given the pace of balance sheet recovery and the magnitude of the travel demand, a quarterly interest expense of about $227 million, in my opinion, is manageable while the company works toward normalizing this levels throughout 2023 and 2024.

Overall, I believe the March quarter and the company's outlook for the upcoming quarters continued to be strong on the backs of a strong travel demand that does not seem to be ending any time soon. Experiences are being valued more by consumers. Thus, considering the current strong tailwind, Delta Air Lines could enjoy better stock price movement in the coming months.

Travel Industry Views

Delta was not the only company giving an optimistic 2023 travel demand view, Marriott (MAR) and United Airlines (UAL) also gave a similar view reflecting a strong demand.

Marriott is one of the biggest hotel chain operators. As such, a bullish view by the company likely means a positive travel environment, which could further support my thesis regarding the strong tailwind for Delta Air Lines. And, Marriott, during the company's earnings call, said that "while macroeconomic uncertainty persists, it has not weighted on travel demand to date. In fact, demand continued to rise across all customer segments in the quarter" with a solid forward booking making the "global leisure demand...incredibly robust." Therefore, Marriott's views support the argument that consumers are valuing experiences more important than before leading to a continued strong travel demand that has not shown signs of weakening.

Further, United Airlines, Delta Air Lines' peer in the airline industry, also gave a bullish view. During the company's earnings call, the management team said that the "macroeconomic weakness is being offset with a counter-trend of consumer spending continuing to rebalance back to services," and because the airline industry "still remain[s] below [the] historical GDP relationship," arguably, there could be "more room to run in the revenue recovery." I believe this view solidifies my bullish opinion, Delta's views, and Marriott's views of consumers valuing experiences, or travel, heavily likely creating a continued strong tailwind for Delta Air Lines.

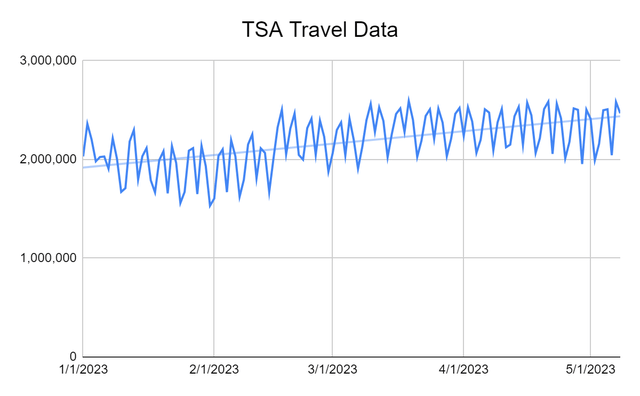

Finally, as the chart below shows, the air travel demand, shown by the TSA data, has shown an increasing trendline data throughout 2023 with no visible signs of a slowdown. Therefore, looking at Delta, Marriott, United Airlines, and TSA data, I believe it is reasonable to argue that Delta will continue experiencing a strong tailwind from travel demand throughout 2023.

Undervalued

Delta Air Lines currently has a market capitalization of about $22 billion with a forward price-to-earnings ratio of about 6.18. Further, when taking into account expected 2024 earnings, the company is trading at about 5 times the 2024 eps estimate, and the current level of valuation multiple, in my opinion, is low. Historically, before the pandemic, the company traded at around 10 times the earnings multiples from 2015 - 2019. These time periods did not have major recession concerns like today, but the time period also did not have a historic rebound in travel demand. When considering that Delta Air Lines is expecting strong revenue growth and continued balance sheet recovery on top of what seems to be an unending travel demand even in an uncertain and volatile macroeconomic environment for the past year, I believe it is unfair to value the company lower than its historic times when no signs of impending trouble are visible. Therefore, considering the past valuation and the current tailwind, I believe Delta Air Lines is undervalued and warrants a significant upside.

Risk to Thesis

Despite the current travel demand being strong even during high inflationary and uncertain economic conditions if the macroeconomic conditions significantly worsen, my bullish thesis could be challenged. Traveling is discretionary spending; thus, a potential rise in unemployment rates, persistent inflationary pressure, worsening credit environment, or any major factors that burden the consumers could have a profound effect on travel demand.

Summary

Recession Fears on an uncertain macroeconomic environment are a likely force keeping Delta Air Lines' stock at bay. However, over the past year, despite uncertain economic conditions, travel demand has been and is continuing to be strong as consumers value experiences more importantly. And, with airlines and a leading hotel chain guiding for continued strength in the travel industry, I believe Delta Air Lines could continue to see a significant tailwind throughout 2023. However, despite the magnitude of the future potential, Delta Air Lines' stock, in my opinion, is an undervalued possibility due to the fears of economic uncertainty. But, considering the current trends and a cheap valuation multiple, I believe Delta Air Lines is a strong buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.