Intel's Turnaround: The Market Vs. Peter Lynch

Summary

- The market has given a horrible scorecard to Intel’s CEO Pat Gelsinger’s turnaround plan – so far.

- Intel's price lost about $100B in market cap since Gelsinger took the CEO position in 2021, while it cumulatively retained a total of $110B of earnings.

- Put another way, even if Gelsinger has done nothing, the retained earnings should have pushed its market cap by ~$100B, according to Buffett’s $1 test.

- However, evaluating turnaround stocks requires a contrarian mindset, like those exercised by Peter Lynch.

- And this article will show Lynch's approach paints a different picture of Intel’s turnaround prospects than the Market sees.

- Looking for more investing ideas like this one? Get them exclusively at Envision Early Retirement. Learn More »

welcomeinside

Thesis

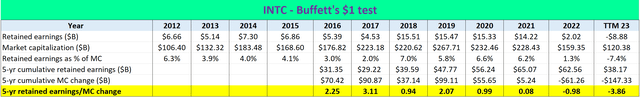

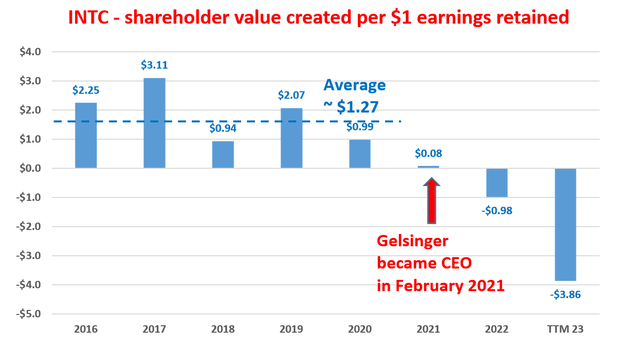

According to Warren Buffett's "$1 test," a CEO should be able to increase a company's market capitalization (“MC”) by at least $1 for every dollar of earnings retained. The scorecard of this test is jointly determined by the market (which controls the stock price and the MC) and the CEO’s ability to allocate capital.

And regrettably for Intel (NASDAQ:INTC) shareholders (this author being one of them), its CEO Pat Gelsinger has failed the test miserably since he took office in early 2021 as shown in the two charts below. The first chart below illustrates that from 2012 to 2020 (i.e., before Gelsinger took office), INTC managed to generate an average of $1.27 in MC for every $1 of retained earnings, passing the $1 test with a wild margin. However, since Gelsinger's arrival in 2021, the scorecard took a severe downturn. To wit, INTC has lost about $100B in MC (based on annual average stock prices) since he took office. While at the same time, the company retained a cumulative total of $110 billion in earnings. Consequently, Gelsinger's score on the $1 test has been in the negatives as seen.

Source: Author based on Seeking Alpha data

Source: Author based on Seeking Alpha data

Clearly, the market is not buying Gelsinger’s turnaround plan. However, investing in turnaround stocks by fault requires a contrarian mindset – like those exercised by Peter Lynch. He popularized the concept of "turnaround stocks" in his book, "One Up on Wall Street." And he emphasized that investing in turnaround stocks requires a contrarian mindset – you need to be patient and willing to invest in companies that were unpopular or out of favor in the market. Besides patience and willingness, Lynch also emphasized several factors that investors should consider when evaluating such opportunities. And therefore, it is the goal of this article to examine INTC stock against these key principles and characteristics based on Lynch's approach:

- The turnaround potential. Lynch believed that successful investors could identify companies that were facing temporary setbacks rather than irreversible decline. The key is to look for signs of change or catalysts that could lead to a turnaround, such as management changes, new products, cost-cutting measures, or industry tailwinds.

- Solid balance sheet. Turnaround stocks may have gone through a rough patch, but it is crucial to ensure that the company has a solid financial foundation to weather the storm and support its recovery. Examining the company's balance sheet, debt levels, and liquidity is essential to assess its financial health.

- Earnings potential. Lynch stressed the significance of analyzing a company's earnings potential. Look for signs that the company's earnings could rebound as it overcomes its challenges. This could involve studying industry trends, the company's market share, product pipelines, or any initiatives that could lead to increased profitability.

1 - The turnaround potential and CHIPS Act

This is really the key to a turnaround stock: the issues must be temporary and must not be a secular decline. And I see a strong industry tailwind for INTC together with many of the catalysts that Lynch mentioned, including new products, cost-cutting measures, and also policy support. Gelsinger has begun to right-size the company by enacting cost-cutting measures, which ought to result in savings of $3 billion and upwards of $10 billion by 2025. These actions include personnel reductions at both the operations and sales departments, as well as refocusing its efforts on building state-side foundries – which leads me to the discussion of the CHIPS Act.

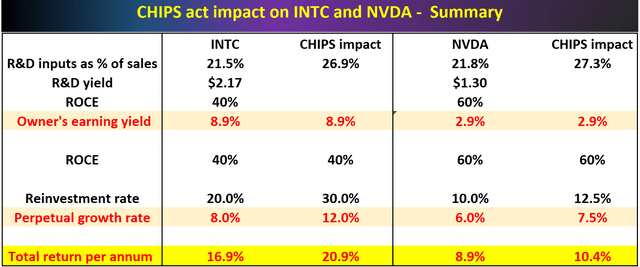

I view the CHIPS Act as a clear indicator of the industry tailwind and a most important catalyst for INTC. My analysis is that INTC is well positioned to benefit the most from the CHIPS Act thanks to its fab initiative (say more than its peers like NVDA as detailed in my table below). To wit, with INTC's return on capital employed (ROCE), the support from the CHIPS Act is projected to boost its growth rate by approximately 4% to 12% annually via tax credit, subsidies to its CAPEX projects, and R&D support from national labs and university labs.

Source: Author based on Seeking Alpha data

2 - Balance sheet

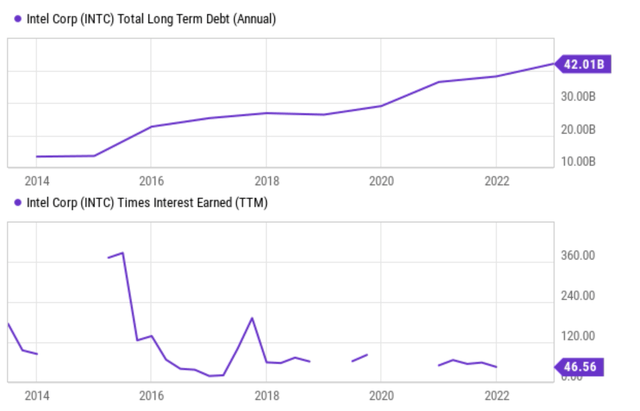

There is no denying that Intel has a substantial amount of debt. As seen from the chart below, its total long-term debt has risen from around $10 billion to $40 billion over the past decade. The major causes are its capital expenditures in R&D facilities, manufacturing facilities, and also acquisitions.

However, thanks to a combination of low borrowing rates and positive cash flow, the company’s balance is in a very strong position in my view. As seen from the bottom panel below, its interest coverage is currently around 46x (which means it takes about only 2% of its EBIT earnings to service its debt). It is extremely conservative and to put a better context: the overall economy’s debt coverage is around 6~7x and the average coverage ratio is even lower for most families with a mortgage obligation.

In the meantime, the company is taking action to preserve cash. As aforementioned, it’s undergoing a cast reduction plan. The board of directors also decided recently to cut the quarterly dividend by about 2/3. These measures should further protect its balance to ensure it has ample liquidity to navigate through the turnarounds.

3 - Earnings potential

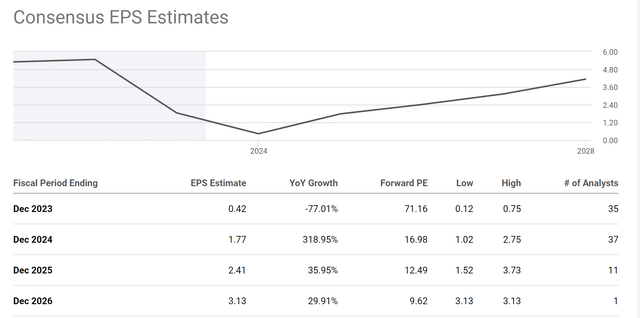

With the secular tailwind and its finances, I view the recovery of earnings as a logical result. And consensus estimates seem to expect the same as seen in the next chart below. They provided EPS forecasts for Intel over the next few years. There is no doubt that 2023 will be a tough patch, and consensus estimates expect a significant decline in earnings compared to the previous year (-77% YoY growth). And the growth is expected to continue (at ~30% YOY rates on average) for the next two years and EPS is expected to reach $3.13 in 2026.

Risks and final thoughts

Just to be clear – there are plenty of near-term challenges associated with the stock (as with turnaround stocks in general). These risks include macroeconomic issues (like supply-chain congestion and inflationary pressures), geopolitical risks (like the U.S. trade tension with China, a major market for Intel), policy risks (e.g., potential restriction on chip product exports), and also risks specific to Intel’s operations. INTC products face a very uncertain future in the smartphone market (or mobile computing in general), a crucial segment for future growth. And at the same, the releases of several of its PC-based chips have suffered delays recently.

However, my results above following Lynch’s framework lead me to believe that its turnaround plan is viable. My view is that the above challenges as only temporary and its business fundamentals and financials are fundamentally sound. In the meantime, there is a strong industry and secular tailwind. Finally, the market’s overly negative sentiment has compressed its P/E so much (the FY1 and FY2 P/E ratios are in the 12x to 16x range only) that now there is a wide margin of safety.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

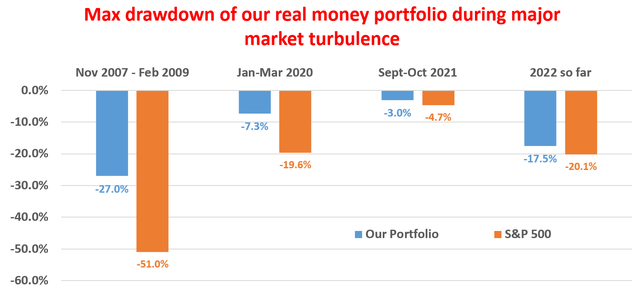

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.