RYLD: A Fund That Should Outperform In A Recession

Summary

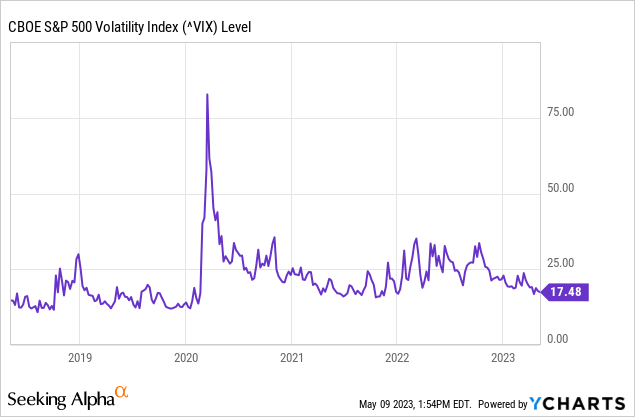

- Funds that use options strategies similar to the Global X Russell 2000 Covered Call ETF usually outperform during market selloffs because of the increased volatility levels.

- There are multiple signs of a prolonged economic slowdown, and the Fed remains committed to raising rates. Fear and uncertainty levels in the market should stay elevated.

- This fund offers a good balance between income and capital preservation. This covered call offers significant and consistent monthly payouts without taking excessive risks.

Torsten Asmus

Investing strategies should evolve as markets change. Today the economic environment has become much more complicated. Inflation remains high, rates continue to rise, and now there have been increasing signs of a prolonged economic slowdown. Some of the indicators pointing to a prolonged recession include rising inventories, falling real wages, business and consumer confidence levels falling, and unemployment filings at multi-year highs. With the economic outlook uncertain, most of the broader indexes have been predictably more volatile over the last year.

Some of the hardest hit investors during this inflationary period have been those focused on income. With inflation rates consistently rising at levels higher than most companies are growing their dividends, investors are struggling to get inflation-adjusted income.

One of the more well-known income investing strategies that several funds now use is a covered call selling approach. This tactic involves selling the right to buy assets that a fund already owns by giving someone else the right to buy certain holdings at a specific price. An Exchange-Traded Fund that has successfully used this strategy for nearly three years now is the Global X Russell 2000 Covered Call ETF (NYSEARCA:RYLD).

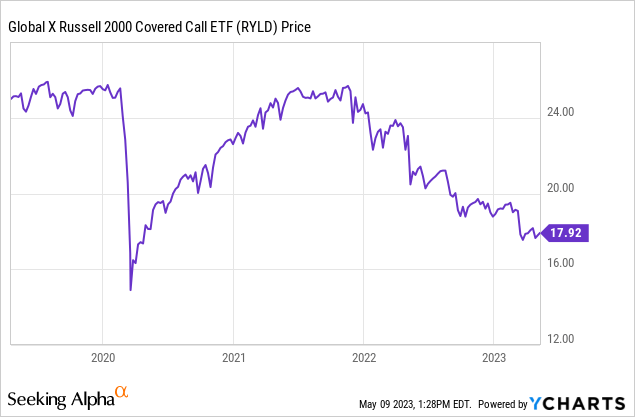

The primary appeal of covered call funds such as this ETF is income. Even though this exchange traded fund is down 2.53% over the last three years, this fund's total returns over that time period are 40.29%. Investors in RYLD have consistently gotten significant monthly payouts and double-digit annual income without only minimal principal loss. This fund has delivered on core purpose of being able to pay out impressive inflation-adjust income without taking excessive risks.

With signs of a slowdown increasing and the economic outlook deteriorating I want to discuss how this fund will should perform if there is a prolonged recession. Today my view is that this fund is a strong buy. The Global X Russell 2000 Covered Call ETF has the right balance between having holdings that are volatile enough to generate consistent and significant income, but also making sure the underlying investments in strong core companies and sectors. This fund should significantly outperform if the economy enters a recession, since the markets are likely to remain more volatile than usual in that scenario.

The specific covered call strategy that this fund uses is to sell at the money calls using exchange traded notes that require cash to be paid at expiration, not the delivery of the underlying equity holdings. This particular fund is an income-based ETF that owns the Russell 2000 by purchasing VTWO, which makes up 30% of the investment's holdings. The managers then sell calls against the index. The holdings of this fund are 16.4% health care, 15.99% financial services, 14.83% industrials, 4.24% basic materials, 10.53% consumer cyclical, 7.65% real estate, 4.17% consumer defensives, 3.46% utilities, 6.53% energy, 2.42% communication services, and 13.79% technology. This fund has an expense ratio of .6% and 1.4 billion in assets under management.

The key to this fund is the implied volatility premiums in the at-the-money call options that this fund sells to make the monthly distributions. The more the implied volatility premiums in the options, the higher the monthly distributions made from the income derived from selling these calls is. It does not matter that delivery does not or cannot occur, a covered call is a term used to describe selling an option against one or multiple holdings. The coverage is the holding at the point of sale.

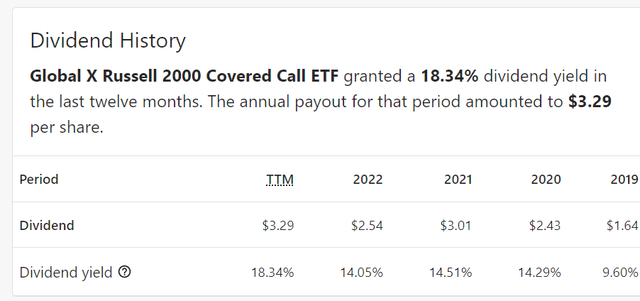

A chart of RYLD's dividend payouts (www.portfolioslab.com/symbol/RYLD)

RYLD's dividend payouts have been predictably higher since 2019 in years where the market has been more volatile.

This fund has been slightly more volatile than most investments indexed to the S&P 500 and other indexes, which is the main reason RYLD has outperformed most other covered call funds. The 3-year standard deviation of RYLD is 13.68, which is noticeably higher than the standard deviation of Global X S&P 500 Covered Call ETF (XYLD), a fund indexed to the S&P 500. This ETF has outperformed other covered call funds over the last three years such as the Global X S&P 500 Covered Call ETF and the Global X Nasdaq 100 Covered Call ETF (QYLD). RYLD has outperformed XYLD by 8% over the last 3 years, and the fund has outperformed QYLD by 17% during this time period.

Overall volatility levels have been much higher in the market since the pandemic hit in late 2019, and inflationary pressures combined with a now slowing economy have made the economic outlook more uncertain. Between 2020 and 2022 this fund has paid out nearly 14.3% of in per year during that period, and the recent volatility levels in the market over the last 3 years are obviously a better benchmark for determining likely distributions moving forward than the levels seen in 2019 before the Pandemic hit.

One of the mistakes in my view that some individuals make when assessing a covered call fund such as RYLD, is these people simply compare this type of investment's overall returns and long-term income to similar returns offered by different kinds of investments. While obviously someone could simply buy a stock that is performing well such as Apple and then sell shares to generate income, covered call funds have two significant benefits that most investments do not. First, these funds offer monthly payouts. Second, these funds enable investors to get income without having to sell the underlying asset. Most dividend investors are not seeking simply to maximize the income they can receive, they want predictable and steady returns that can help pay for the cost of living.

Of course, some loss of principal is inevitable since these types of investments, since covered call funds are selling off upside gains without downside protection. Still, the additional income that covered call funds such as RYLD can normally payout when market selloffs occur and volatility levels are higher should more than make up for that risk, as this fund has consistently showed since its inception in early 2019. With the economic outlook uncertain and volatility levels likely to remain elevated, this fund should be able to offer steady and significant income without significant risks to the principal.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.