Pagaya: Misunderstood And Mispriced

Summary

- Pagaya continues to execute exceptionally well, showing stability and growth in a difficult economic climate.

- The company's high operating leverage should provide significant cashflows as it turns profitable in the coming quarters.

- The company's robust balance sheet with low credit exposure provides a high margin of safety.

- The stock has unique quantitative metrics that appear to cause mispricings in the market.

anyaberkut/iStock via Getty Images

Introduction

Pagaya (NASDAQ:PGY) is an Israeli fintech startup that specializes in providing AI-based credit scoring. The company claims its proprietary systems are able to analyze a potential borrower's credit attributes with a higher degree of accuracy than traditional methods and can make more accurate predictions of their ability to repay a loan.

Pagaya is different from a traditional lender for three primary reasons:

- They have low/no credit exposure to the loans that they make, because they're all securitized and sold to investors. (With a small residual risk retention held on their balance sheet).

- Even compared to traditional "no/low-risk lenders that resell their loan book", Pagaya has less risk because they use an up-front funding model where they receive funds from investors first, and then use those funds to make the loans.

- They have a "B2B2C" model where they work behind traditional lenders helping them extend loans to their customers.

Based on those 3 reasons, I see Pagaya as an AI-based technology service provider first, essentially helping underwriters and investors "sharpen" their underwriting and investing, and a banking/credit play a distant second. This distinction is important because I believe it's the crucial reason why Pagaya is currently being grossly mispriced by the market. With the current banking crisis, interest rate/inflation shocks, and potential recession looming, the entire consumer credit sector is rightfully being sold off with the market reflecting a higher risk premium to hold these types of stocks.

But Pagaya's direct exposure to the credit itself is minimal, meaning a spike in defaults should not cause meaningful losses to the company. While a decrease in consumer lending activity will dampen the Total Addressable Market (TAM) of loans for Pagaya to generate revenue from, their current market share is negligible and the growth of their market-leading product should outstrip the decline in overall loan volume. Arguably, higher defaults will cause primary lenders to be more concerned with the accuracy of their underwriting and rely on PGY even more. In short, I think the near term growth of their revenue stream and profits appears intact.

In addition, Pagaya's balance sheet is extremely robust, with the market cap trading near the company's cash and risk retention holdings. This provides a high margin-of-safety for the investor since the company, which has a negligible cash burn rate and little/no tail risk, shouldn't trade at a material discount to cash. The risk retention holdings have a low exposure to market/credit risk because a large portion has been resold via their Non-Controlling Interests line (Slide 28).

And lastly, Pagaya's stock trading metrics are disjointed from market reality. The company's short-borrow rate sits at 40% (meaning investors holding the stock can collect up to 40% in lending fees, annualized) by lending their shares to short sellers. The company's implied volatility is at 130%, which- especially on the downside given the company's balance sheet exposure, is nonsensical.

The Growth Story

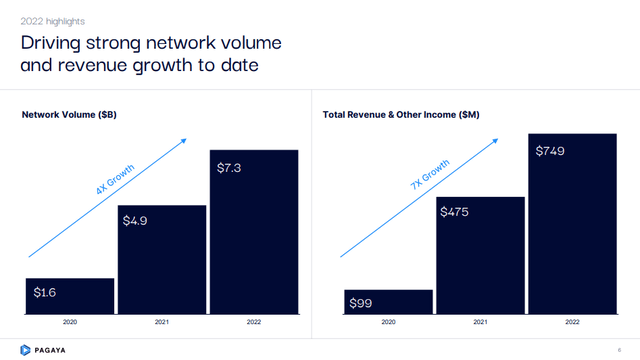

At a high level, Pagaya's revenue engine works by getting financial partners signed on to redirect loan requests to their AI credit scoring system. This is called their application volume evaluated. After reviewing the loans, Pagaya chooses to decline a large fraction of those because they're too risky, and accept those that it believes have a sufficiently high probability of repayment. This is defined as their "Network Volume" and as you can see in the graph below, has been growing at an extremely fast pace. The loans that are accepted are immediately sold (actually pre-sold) to institutional investors via their funding vehicles and Pagaya generates revenues from taking a spread between the interest charged to the borrower and interest paid to the lender. This spread (and fees associated with it) is their Total Revenue and Other Income. If the borrower defaults, Pagaya does not lose money, the investors in the funding vehicle do.

So their top line revenues are primarily based on the growth of applications evaluated, network volume, and their spread. Applications evaluated volumes grow via their partners increasing their loan activities (i.e. a car dealership selling more cars), or by signing on more partners (getting more car dealerships to use Pagaya). Network volume changes as a result of Pagaya consciously increasing or decreasing their conversion rate. And lastly revenues are affected by the spread that Pagaya can extract from completed financings. Obviously, they can't just increase the conversion rate indiscriminately, because that would lead to lending money too liberally and likely generate a high default rate, which would upset the investors in their funding vehicles.

Company Q4 Report

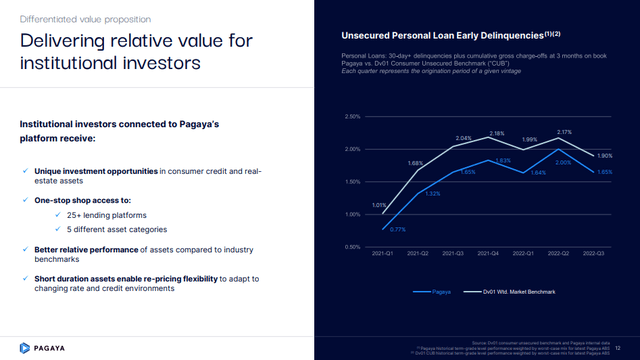

Ultimately Pagaya has shown that they have been extremely careful balancing the temptation to grow, with the risk that comes with increasing their conversion rate and fee structure. This is evidenced by the fact that their funding vehicles have historically shown aggregate default rates that are lower than industry averages:

Company Q4 Report

As per the image on the right, loans underwritten by Pagaya have an average default rate that is about 30 bps lower than their benchmark since 2021. This ultimately means that the investors that are funding their loan vehicles are suffering fewer delinquencies and generating excess returns, which in turn, means they'll continue to invest in more loans in the future. It also means that Pagaya likely has room to increase their conversion rate or spreads, taking on a little more risk, and generating more revenues/profits using existing network volume.

A potential threat to Pagaya's ability to increase their revenues comes from macroeconomic concerns that consumer lending is about to slow, perhaps dramatically. There are two major reasons why this shouldn't dramatically affect Pagaya:

- The company has been signing new partners onto their network, increasing their application volumes steadily. With the steady performance of Pagaya's business, I see no major obstacles preventing Pagaya from continuing to sign more partners.

- A large portion of the company's loan volume comes from the "second look" business, where the primary underwriter (i.e. car dealership) will decline the potential buyer for a car loan due to their crude scoring criteria, but then send the application to Pagaya who will be willing/able to underwrite the loan due to its AI model having higher predictive power. In a tighter credit environment, there will be an increased amount of second look flow.

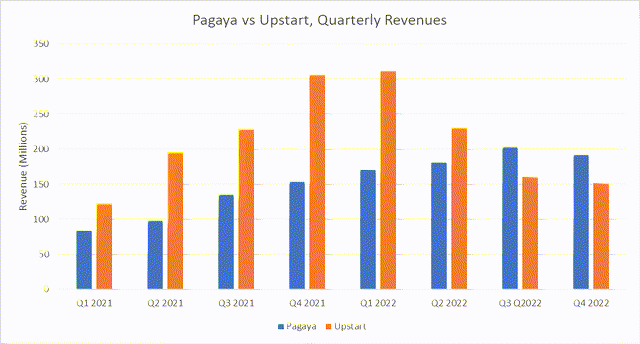

While their business models have differences, it's useful to contrast Pagaya's quarterly revenues against their main rival, Upstart's over the past two years:

Capital IQ

This graph helps illustrate Pagaya's more conservative, technology-enabled revenue growth profile versus their competitor. The primary differences being that Upstart often holds risk on their balance sheet via loans, and the performance of Upstart's loans have been faltering in recent quarters (in contrast with Pagaya's). This isn't to say that Pagaya's approach is particularly superior to Upstart's, but rather, that the approach is different and skewed to be less aggressive and more consistent. In the past year, Upstart has seen its funding partners pull back from supporting the company's underwritten book- in contrast Pagaya has steadily increased their external funding. This provides one more data point for expecting Pagaya's revenues to grow despite the shaky macro climate.

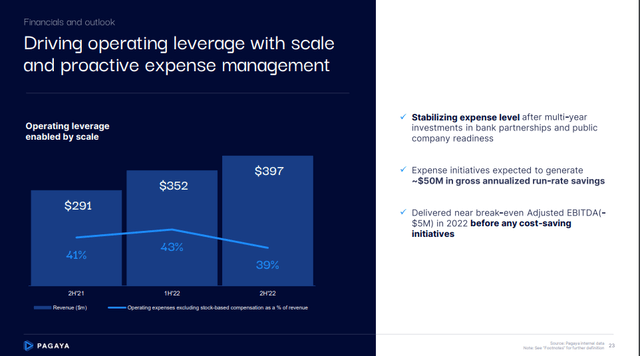

In regards to operating leverage, the company claims that we're seeing the early stages of a jump in profitability as they cross the inflection point of covering their fixed costs. While the data doesn't conclusively support this yet (they haven't made enough money for enough quarters to really show their operating leverage come into play), the intuition behind their fintech business does suggest significant economies to scale as they increase their loan volumes. In addition, the company is growing their breadth of product offerings (they recently acquired a single-family home rental business, Darwin Homes) which will further muddy the financial picture at an aggregate level.

Company Q4 Report

Seeing how the Q1 2023 numbers break down will be a critical metric in evaluating the progress on this front as I see no major expense anomalies immediately confronting the business.

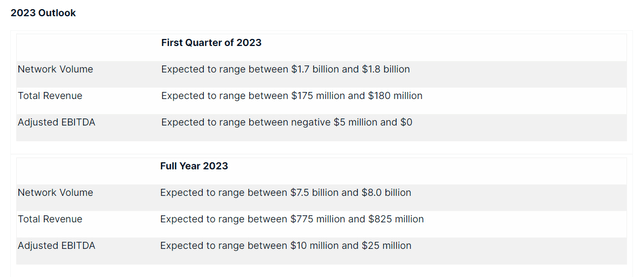

Q1 2023 Guidance

The company provided the following guidance when they released their Q4 earnings in February, 2023:

Company Press Release

Quite crucially, they have quietly updated their Q1 2023 earnings guidance as per a press release from the company on April 20th:

In addition, Pagaya now expects to be at the high end of or exceed its previously provided guidance for the first quarter of 2023 for Network Volume, Total Revenue and Other Income, and Adjusted EBITDA. This continues the Company's already strong start to 2023, including capital raised in the asset-backed securitization market of approximately $2.0 billion year-to-date, GIC's existing fund agreement extension for three more years, and an expanding and diversifying set of investors.

Source: Company Press Release

Despite being publicly announced, I do not think the market has priced in the earnings beat (and perhaps, accompanying guidance increase) and I see the stock reacting positively when the company reports Q1 on May 16th.

So aside from growing slower than previous exuberant (2021) guidance, there's really nothing negative to say about Pagaya's revenue growth story. The company is executing well, has access to great levers to control their growth, and has a product offering that should be resilient in the face of an uncertain future.

The possible downside

The two weaknesses I see in Pagaya's revenue stream is the threat of competition, and the underperformance of their AI algorithms.

On the surface, one could argue that their "underwriting middleware" position has a very low switching cost. Some other "smart AI underwriting company" could, in theory, build a better algorithm and then replace Pagaya's place in the market. They have no consumer brand affinity, and relatively low barriers to entry. Personally I dismiss this because I think it's extremely hard to "build a better mousetrap" in the credit world. But I do acknowledge that this is a business where the best mousetrap wins, vs other businesses that can survive and thrive with an awful end product due to their "sticky business model".

The second concern or threat that I see to Pagaya's business model is whether or not their AI underwriting model actually works or not. Given the data that we've seen to date, there is nothing to suggest that their models are not superior to existing risk methodologies. However, we know that tails exist in the world of credit, and it's plausible (but, unlikely) that Pagaya's entire advantage is a product of taking tail risks that weren't being surfaced over their relatively short time scale (7 years). I'd argue that exact situation is currently happening to their main competitor, Upstart, versus Pagaya's loans have shown significant resilience until now. I've mentioned that Pagaya has very little credit risk, but if their algorithm doesn't produce returns, nobody will buy their loans, and the businesses long term prospects become extremely bleak.

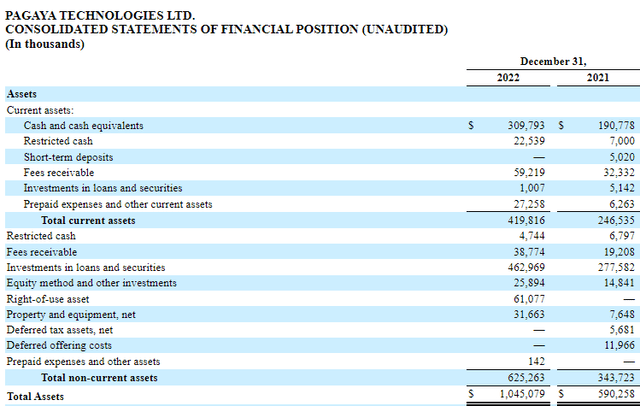

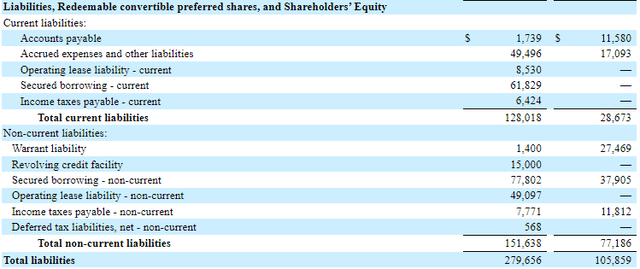

The Margin of Safety

The assets that the company holds are very tangible, and my primary focus is on the Cash (and equivalents) and their Investments in loans and securities. The $462M number is primarily their regulatory risk retention holdings that are mandated by the Dodd Frank act. On the surface, the composition of this line could mean anything (Illiquid poorly marked securities, etc.), but for Pagaya, these are a small portion of the securitized loan products that they've previously sold to investors. In fact, a portion of these have been subsequently resold to investors via the "Non-Controlling Interests" ($212M) line on their balance sheet, so the net amount of their Investments in Loans and Securities is more like $250M. From my talks with company IR, this residual can be treated as an extremely safe low risk asset (I'd think of it as cash, without immediate liquidity).

Based on this, if one needed to liquidate the entire business over time (not that you would, but just for arguments sake) you'd probably be able to pull about $700M dollars out of the balance sheet.

Company FY2022 6K

Meanwhile on the liability side of the balance sheet, the company owes about $280M.

Company FY2022 6K

That leaves $420M of value compared to the company's current market cap of $550M. Or in other words, the company is trading a mere 30% above its "liquidation value" of about $0.56 per share. While this calculation by itself doesn't necessarily justify making this a great investment, the context of this is important relative to the greater picture. At the very least, it supports a somewhat limited downside if the company's operations falter.

Pagaya as an Investment

At the current price of $0.80 per share, I see Pagaya as a medium-conviction buy. The company has more or less delivered exactly what they've always promised, and seem focused on execution. When the inflation and interest rates jumped, they responded aggressively by cutting their underwriting approval rates. They raised a significant amount of money via their SPAC when markets were frothy, and are now investing that capital in the business. It's hard to criticize management because they haven't made any mistakes.

That being said, they are still an early stage growth company that is finding their way in the market. I think investors have no idea how to value the company properly, and I'm not convinced that's going to change in the near term. The company has a fair bit of exposure to the overall economy, and they are in uncharted waters without history as a guide to dictate their future moves.

Despite these headwinds, I think the company currently trades at an abnormal discount to its fair value over a range of outcomes, and think it's worth owning as a small to medium position. What would move me into a high-conviction territory is if we see a couple of quarters of growth and profitability in 2023, and if the stock price is still below $1.00 (which I think is unlikely, because markets would likely have reacted to the positive information).

What is interesting is that I've been able to overlay my bullish view on the company, into what I think is a fantastic quantitative trade, and that segment follows:

The Trading Metrics

The last piece of the puzzle is the trading metrics that currently surround Pagaya's stock price and in my eyes, they are truly bizarre.

The stock-borrow rate for PGY is exceptionally high at 40%, and empirically this is a predictor of future negative stock returns. However, I believe this high rate is an anomaly given that the total short interest is less than 2% of the shares outstanding (or less than $6 million notional short). Contrast this with UPST that has a short interest of 30% ($300 million notional) and a borrow rate of 60%.

The 40% borrow rate does not reflect a particularly strong, high conviction view from the market that this stock will decline in price- rather, it's likely an artifact from a (strangely) very constrained lending market in the stock. This rate has persisted over many months, so it isn't a one time anomaly.

Interactive Brokers TWS

This is relevant because someone who buys and lends the stock, gets the upside exposure while simultaneously collecting the borrow (or some portion of it, depending on the brokerage split). Collecting the borrow rate is tricky and not possible for many investors, but this elevated rate likely filters into the options market.

The Implied Volatility of Pagaya's August options are a startling 130%. This means the put premiums are quite elevated, with the August $1 put quoting at $0.35 x $0.40, or $0.375 midmarket.

This value seems way too expensive to me. Given these levels, you can sell the put for $0.35 (we'll use the bid to be conservative), and you'll be required to post $0.65 of margin. If Pagaya's stock holds its current price of $0.80 through to August, you'll make $0.15 on the $0.65 invested for a 23% return in 3 months.

If the company manages to catch a bid and bounce, you have the potential of pocketing the entire $0.35 premium (if the stock goes above $1.00) for a 53% return.

On the downside, selling the put only starts to lose money if the stock falls below $0.65 (which is 20% lower than current stock levels), and if it were to fall to $0.50, you would lose $0.15 (essentially a 50:50 bet against the "stock stays flat" payout). But given the margin of safety analysis provided above, it seems difficult (obviously possible though) for the company to trade at a significant discount to its balance sheet value of $0.56 per share.

To summarize everything in a nutshell and contrast them:

- I think buying Pagaya as an investment is a decent bet, call it a 60/40 bet in favor of the investor. This is a bet worth taking.

- The market, via its high borrow rate, or the high implied volatilities, seems to be pricing Pagaya as a 70% chance of decline and 30% chance of increase. The difference between my view (in point 1) and the market pricing is very large, and I think this is an absolutely fantastic bet.

The different ways to express this in the market:

- Buy stock, lend the stock to short sellers, and sell covered calls against your stock.

- Short puts, which is the same as the covered call except you don't collect the borrow (for whatever reason the options market is pricing the borrow rate at 0% compared to the 40% spot rate).

Reasons for Mispricing

In order to have conviction behind a thesis, I typically want to be able to explain why something is likely mispriced. Here are contributing factors for why I think Pagaya trades at a significant discount to its fair value:

- The company's debut on the public market was via a SPAC. While management certainly shouldn't be blamed for this (they managed to raise a ton of growth capital at very high valuations, which is great for present day investors), it likely creates a negative institutional bias as many institutional investors explicitly avoid SPACs given their historic underperformance as a group.

- The company’s business model is complicated, making it very difficult for Retail investors to understand. Given that institutional investors don’t like to invest in SPACs, and retail investors don’t understand PGY, there isn’t much of an audience left to buy PGY stock.

- The company underwent a short squeeze (also entirely out of the company's control) shortly after the SPAC process. While this is fundamentally meaningless for the company's operations, it creates distortions in the company's asset price history (stock briefly touched $34.50) that makes it confusing for algorithms to understand, and unsavory for individuals doing a cursory review.

- The company is international and has fewer/different reporting requirements that make it more opaque than domestic companies.

- The company's stock price is sub $2, which makes it ineligible for many investors. Also it makes it not eligible for margin loans, which probably contributes to its low quantity of stock borrow available.

- The company's risk retention holdings (on the balance sheet as Investments in Loans and Securities) are rather opaque. If these were labelled "Cash" (which, although aggressive, they are cash-like given the type of ABS), I think the company would be looked at in a significantly different fashion.

- The company's stock is very illiquid, with typical daily notional trading of less than $1M. This makes it hard for institutions to want to get into a position given the difficulty of getting out of it.

- The company's primary bank (revolving line of credit) was with Silicon Valley Bank. This created a short-term scare in markets when the deposits were briefly at risk (turns out their deposits were safely held elsewhere, or at least moved away very quickly).

- The company's primary public-company comparable, Upstart (UPST) has had a much trickier time navigating the recent economic downturn. Upstart's Q4 2022 revenues were down over 50% YoY compared to Q4 2021 compared to Pagaya's that were up 23%.

- The company has previously had significant Stock Based Compensation expenses that were related to the public listing of the stock. In Q4'22, the SBC fell nearly 70% to $18M from $60M+ in the previous two quarters.

- The company is bundled with other consumer credit companies, which are facing significantly stronger headwinds and macro risks associated with potential waves of defaults if a deep recession hits.

Many of these factors causing mispricing are "sticky", as in, if an international company trades at a discount because it's international, it will always trade at a similar discount and no excess returns can be gained in the short term. However, the effect of many of these factors fade over time or outright disappear (i.e. if the stock trades above $2). But most importantly, it is my observation that most of these factors outright disappear when a company begins to generate meaningful cashflow. The reason is simple, cashflows are relatively easy to value and provide the solid underpinning for a reliable valuation estimate. Sensibly, until we have positive cashflows, these more tenuous factors are being used by the market.

The good news is that in the coming quarters (likely Q1), the company has guided to flip to have positive adjusted EBITDA and likely cashflow, which is the ultimate catalyst to cause a step up in the company's valuation. It is this step-up that I think investors can participate in over the next 3-12 months.

Short Term Catalysts

- Q1 Earnings Beat, technically already released but I think it will be a surprise to the market (It was buried in the company's recent Press Release, but not included in the official 6-K. Trading volumes after the release were not very high, indicating very little market reaction.)

- FY Guidance Increase

- Signing new loan partners

- Showing low Q4/Q1 delinquency rates (relative to benchmark)

Long Term Catalysts

- The company's "secret sauce" shows resilience in the current choppy macro climate and more financial institutions sign on

- The company gets more confidence in their dataset and increases their loan conversion rate to boost revenues (they temporarily reduced their conversion rate by 50% to be conservative)

- Company is bought by a PE firm/Financial Institutions/etc. because it's an easy market for them to understand and implement/scale.

Trade & Investment Summary

I like both the short and long term prospects of Pagaya, I think they're executing exceptionally well and that they've been unjustifiably sold off with the consumer lending sector.

Owning the common shares seems like a good bet due to the limited tail exposure they have to credit markets, as well as a strong balance sheet. Meanwhile the company's operations and growth prospects seem well positioned to thrive in the coming quarters, and their likely flip to profitability should be well received by markets. The company may experience a material step up in valuation as they show the resilience of their business model.

Selling Put options, or (owning stock + collecting borrow + selling call options) seems to be a 10-15% mispricing that lets you express a similar view as long stock with an even higher margin of safety at the cost of limited upside ("only" a 50% return in 3 months). I generally prefer this way to express the bet but note it requires a fair bit of maintenance, infrastructure and/or execution skill.

Misc Sidenotes

- This press release appears to have spooked markets. It's a financing vehicle that invests in Pagaya's loans, so it doesn't directly affect Pagaya as a company. However, halting/slowing redemptions is not an investor-friendly thing to do, so it could reduce investor demand for Pagaya loans in the future. I'll also note this is only one of many methods Pagaya offloads their loans, and should be contrasted with the $2 Billion dollars of securitized loans that investors have purchased from Pagaya in Q1 2023.

- The investment and long term deal with GIC (Singapore's Sovereign Wealth Fund) is very material, given that they've been a long term supporter (and end user) of Pagaya. The fact that they are continually buying Pagaya loan vehicles, and also investing in the equity, shows that they're very happy with the end product and believe in the company's algorithms.

- The $75M they received from Oak HC/FT is also very bullish since they already own a large portion of Pagaya, and are deploying funds to increase their exposure. The terms were very fair (vs. predatory), which shows Pagaya's not currently in a desperate situation with regards to cashflow.

- I have no view on their acquisition of Darwin Homes, it'll be interesting to see how that evolves.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Long PGY, short Aug Calls, Short Aug Puts

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.