Itochu: This Could Be The Year Of Outperformance

Summary

- With the lowest commodity focus among its peers, Itochu also has the smallest decline in expected profits in FY 2024.

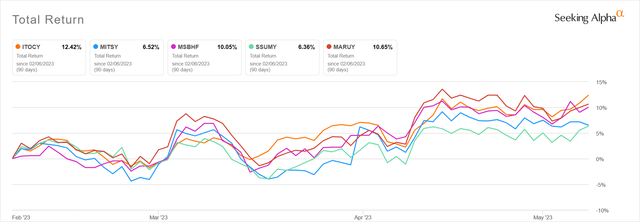

- The stock swung from worst to best performer among the trading companies last quarter. While more richly valued, it also has the highest return on equity and dividend growth.

- The run can continue if a weak commodity price environment persists.

winhorse/iStock Unreleased via Getty Images

Relative Performance Starting To Improve

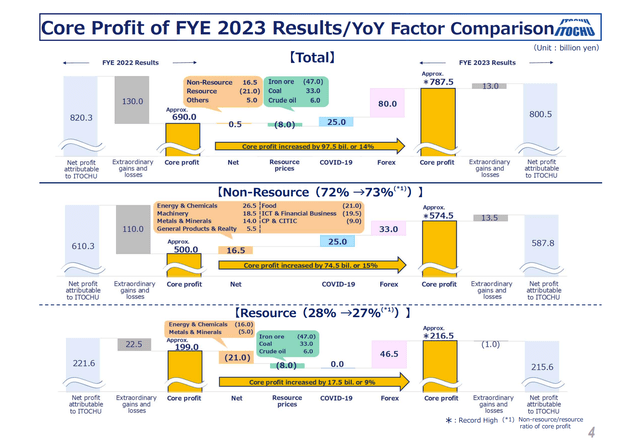

ITOCHU Corp. (OTCPK:ITOCY) (OTCPK:ITOCF) results for 4Q and FY 2023 came about as expected. The company earned ¥800.5 billion for the fiscal year, nearly even with the last forecast of ¥800 billion, and 2.4% below the FY 2022 result of ¥820.3 billion. As I noted last quarter, Itochu had unusually large extraordinary gains in FY 2022 from one-time events like asset sales that did not recur in FY 2023. Backing out these gains from both years, we see that core profit improved 14% in FY 2023, although most of this was due to foreign exchange effects from the weaker yen. Outside of forex, the non-resource businesses still had some growth, while the resource businesses declined. Weaker iron ore prices more than offset higher prices in coal and oil.

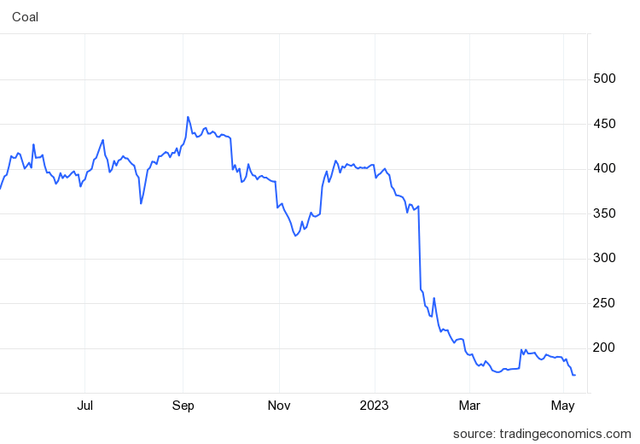

Last quarter, I rated Itochu a hold because commodity prices were at a level where all five trading companies could do well. In that environment, Itochu's lower commodity concentration is a relative disadvantage. Since then, many commodity prices have come down hard. Coal production was strong in China and India for most of the quarter. Demand from outside Asia is continuing its apparent secular decline for climate mitigation. Even a shutdown of some Chinese production recently to address safety issues, coal prices have hit a 52-week low.

Iron ore prices face a similar supply-demand imbalance. Other major producers like Rio Tinto (RIO) and Vale (VALE) increased production but construction starts in China fell 20% in calendar 1Q 2023. This caused iron ore prices to fall below last year's average of $117/ton to start the current quarter. There has been some rebound in April along with Chinese demand, but it is still unclear if this will continue.

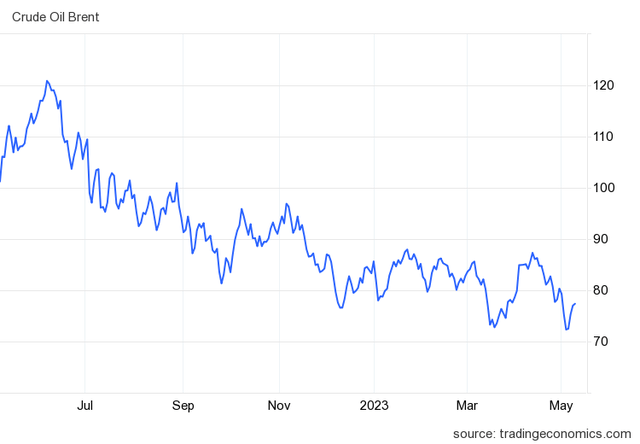

Crude prices have been trending sideways for several months in a range between $70 and $85/bbl (Brent). The futures curve is in backwardation, suggesting a slight downward drift for the rest of the year. This could change quickly if the macro outlook improves or if OPEC sticks to its planned cuts or goes further. Itochu's plan for the year is only $75 Brent, so although prices scrape along their lows, oil's downside to Itochu's profit forecast is probably limited.

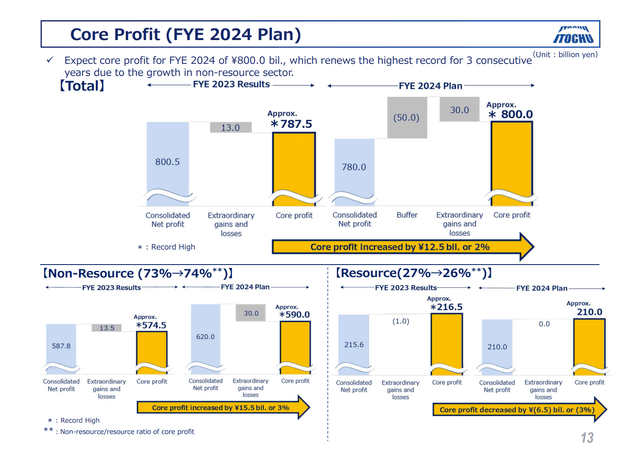

Looking ahead to FY 2024, core growth is expected to slow with the absence of forex effects and Covid-19 recovery seen in FY 2023. The non-resource businesses are only expected to grow 3% while the resource businesses decline 3% for an overall improvement of just 2%. Positives for the year include a stronger Japanese and Chinese consumer market benefitting Textiles, convenience store chain FamilyMart, food distribution, and technology and insurance businesses. Itochu will also benefit from newly acquired businesses including Hitachi Construction Machinery and iron ore assets in Canada. Weaknesses include the lower commodity prices as well as a moderating of last year's strong conditions in the automotive and North American construction machinery businesses.

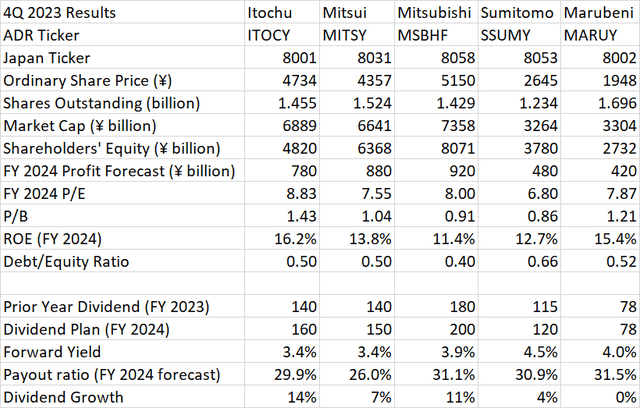

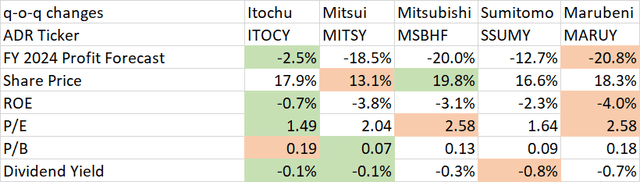

The overall profit forecast for Itochu in FY 2024 is ¥780 billion, a decline of 2.5%. This is in contrast to the slight increase in forecasted core profit because it includes a ¥50 billion loss "buffer", which is a negative overview to create a more conservative forecast. Even with the buffer, the small decline contrasts with its trading company peers where profit is expected to drop 10%-20% this year. Although I have been expecting it for a while, Itochu's lower concentration in commodities is now beginning to drive relative outperformance.

The stock has finally started to outperform as well, after several quarters of lagging behind peers. Since my last article, total return of Itochu ADR's in the US was 12.4%, the best of the group.

All five trading companies used the past few years to improve their balance sheets and returns on equity. Itochu remains the strongest of these despite a higher valuation on a P/E and P/B basis. In a weaker commodity price environment, Itochu stock should perform relatively better.

Valuation

Itochu's premium valuation compared to the other trading companies has narrowed, thanks to its smaller decline in forecasted FY2024 profits. The P/E of 8.83 is now just 1.28 points higher than the average of the other 4 companies, compared to 2 points higher last quarter. The P/B 1.43 is still the highest of the group, justified by the highest return on equity at 16.2%. Dividend growth at all 5 trading companies is slowing in FY 2024, but Itochu is slowing the least. The dividend in still growing 14% this year, to ¥160 from ¥140.

Comparing the quarter-on-quarter changes in key valuation metrics, Itochu is best-in-class on several of them. The much smaller decline in profits helps minimize the deterioration in ROE and P/E compared to peers. The higher growth in dividend payout means that the yield is barely down even though share prices have increased in the past quarter.

Capital Management

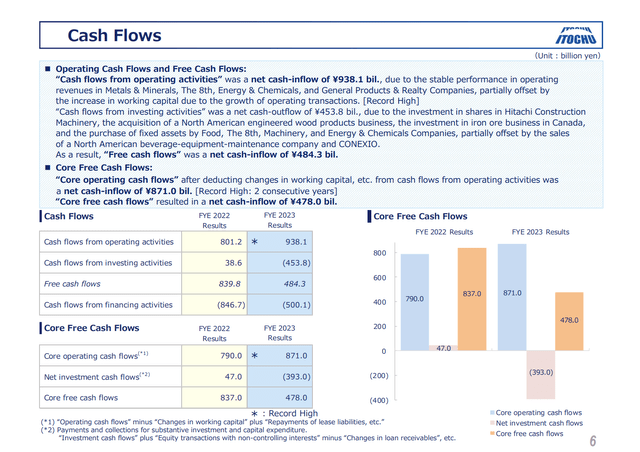

Itochu had record operating and core operating cash flows in FY 2023. The company had cash inflows from investing in FY 2022 due to asset sales, but this moved back to a more common investing cash outflow in FY 2023. Investing activities included both ¥166 billion for internal capex and ¥295 billion of acquisitions. The resulting core free cash flow of ¥478 billion covered dividends of ¥188 billion, buybacks of ¥60 billion, and lease liability repayments of ¥261 billion with just a small overall cash draw down.

For FY 2024, the dividend forecast is ¥160 per share as I expected, yielding 3.4%. This is a best-in-class growth of 14% and second-lowest payout ratio, just under 30%.

Conclusion

ITOCHU had record core profit in FY 2023 and plans to repeat in FY 2024, but growth will be slower without the tailwinds of a weaker yen and Covid recovery. Declining commodity prices will limit Itochu's growth in FY 2024, but not as much as at the trading company peers due to Itochu's lower commodity exposure.

After several quarters of relative underperformance, the market started to value Itochu's more diversified business mix this quarter, helping the stock outperform. Although the last few years of strong commodity prices have allowed all five trading companies to improve their balance sheets, Itochu is still the least impacted as commodities weaken.

Given the weak outlook for commodity prices this year, I now expect Itochu to be a relative outperformer among the trading companies. The risk is that it could underperform again if commodities strengthen. Warren Buffett, not known for making stock trades based on a macro outlook, continues to hold an equal percentage stake in all five Japanese trading companies. Such diversification is also a good idea for individual investors. However, for those who can't buy all five at once or want to try market timing, Itochu should be the relative outperformer this year in a weaker commodity environment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ITOCY, MITSY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.