3 Important Takeaways From Enterprise Products Partners' Q1

Summary

- EPD recently reported Q1 results.

- We share three important takeaways from their Q1 report.

- We also share our updated outlook for EPD.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

zorazhuang

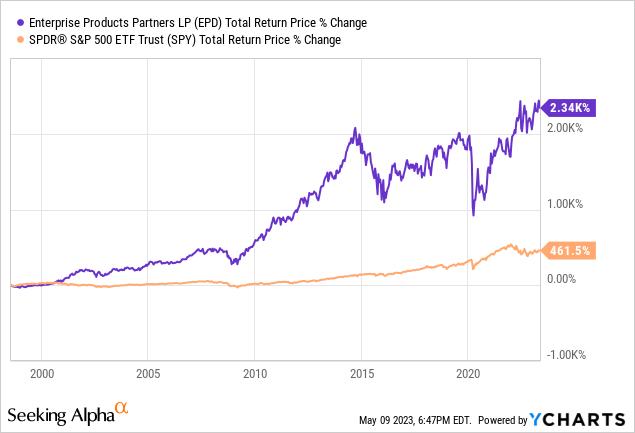

Enterprise Products Partners (NYSE:EPD) is one of the best - if not the very best - businesses in the midstream industry today. In addition to having a fantastic balance sheet (which we will discuss later on in this article), it has a well-diversified portfolio of high quality midstream assets that have generated consistently impressive returns on invested capital across macroeconomic cycles. As a result, it has substantially outperformed the market over time:

It has also generated very consistent distribution growth, recently reaching the quarter-century mark for year-over-year distribution per unit growth.

In this article, we will discuss three important takeaways from EPD's Q1 results and provide our updated outlook on the partnership.

#1. EPD's Growth Profile Is Robust

Something that really stood out from the earnings call was just how robust EPD's growth profile remains. In fact, the word "growth" was mentioned a whopping 21 times during the earnings call. Some of the highlights on this front are:

- The partnership has $6.1 billion in major growth projects that are sanctioned and under construction.

- It expects to spend between $2.4 and $2.8 billion on growth projects in 2023 alone, which includes possible expenditures associated with projects under development and not yet sanctioned.

With the strong balance sheet and liquidity that EPD has, it should be able to continue aggressively pursue growth opportunities whenever they come up, including M&A.

#2. EPD's Leverage Ratio Could Go Even Lower

What most sets EPD most apart from its peers is its extremely conservative balance sheet management.

EPD's leverage ratio came in at 3.0x at the end of Q1, right in the middle of its new, ultra-conservative leverage ratio target range. Moreover, its $4 billion in liquidity and 20-year weighted average term to maturity of its debt provides it with enormous financial flexibility. The financial strength of the partnership was recognized by S&P, which upgraded them from BBB+ to A-, giving them the best credit rating in the midstream sector.

Beyond the immense present balance sheet strength, EPD's leverage ratio could actually quite possibly move even lower in the coming quarters and years due to two major factors:

- EPD continues to retain a substantial amount of cash.

- EPD has some large capital projects coming online between 2023-2025. This surge in EBITDA will drive the leverage ratio lower. As was discussed on the earnings call by management:

when we get all these new growth capital projects coming online, and again, we've got a lot under construction now, I think we'll see more of that EBITDA, certainly full year of that EBITDA, show up in 2024, 2025.

An analyst then responded with:

It seems like you guys are more likely to break the bottom end than the top end [of your leverage ratio target range]. And so just if we'd see a ramp in distribution growth or buybacks if it looks like you all were drifting into, call it, mid-2s or even low 2s?

Management simply responded with:

I'd just hate to get the cart ahead of the horse. Let us get there first, and let us see what the situation looks like when that prevails. And I think we're going to do the responsible thing once we get to that point.

What this means is that at a minimum, EPD's leverage ratio is likely going to move lower than its already conservative range has been set at and then, once achieved, investors could be in for a surge of capital returns. This leads us to the third and final major takeaway from the earnings call...

#3. EPD's Capital Return Potential Has Never Been Stronger

Last, but not least, EPD's capital return potential has never been stronger. Management strongly hinted on the earnings call that they will be hiking the distribution for the second time this year sometime this summer and will likely be targeting a 4-6% annualized distribution growth rate moving forward. Moreover, they also plan to continue buying back units opportunistically moving forward. With the substantial leverage wiggle room that they have on their balance sheet, the only real constraint for buybacks is the valuation of the unit price compared to growth projects.

Moreover, as was already discussed, the large amount of EBITDA that management anticipates coming on line in the coming years will likely give them even more flexibility to rapidly accelerate capital returns to unitholders, which could take the form of faster quarterly distribution growth, a special distribution, a large buyback, or some combination of the three.

The bottom line is that, between the stellar balance sheet, strong growth, and attractive 7.73% current distribution yield, EPD's capital return potential is extremely attractive right now.

Investor Takeaway

Overall, it was another strong quarter for EPD, with management continuing to run the partnership in a very conservative manner while also returning generous amounts of capital to unitholders. EPD remains probably our single favorite holding in the Retirement Portfolio, as it epitomizes our goals for the portfolio: stable and growing highly attractive income alongside good long-term total return potential with low fundamental and balance sheet risk.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point and a Masters in Engineering from Texas A&M with a focus on Computational Engineering and Mathematics. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.