ANGL: 7.3% Yield To Drive Outperformance Vs. Stocks

Summary

- The VanEck Fallen Angel High Yield Bond ETF has returned 6.4% annually over the past 11 years since inception, and the current yield of 7.3% suggests even stronger future returns.

- ANGL's underperformance relative to the S&P 500 over this period has been the result of rising equity valuation multiples, which now face downside risks.

- As we saw in 2008/09, Treasury yields and equity valuations are likely to move lower over the coming years as economic weakness intensifies, which should allow significant outperformance versus stocks.

- The main risk comes from a repeat of the late-1990s environment, where corporate bonds underperformed as Fed hikes kept bond prices low but failed to prevent further equity gains.

designer491

The VanEck Fallen Angel High Yield Bond ETF (NASDAQ:ANGL) has had a strong run over the past 11 years since its inception in 2012, generating returns of 6.4% annually over this period. With a yield to maturity of 7.3%, future returns are likely to be even stronger. The fund should be appealing to investors looking to take on market beta but also looking to lock in elevated yields thanks to high Treasury yields, and protect against downside in the event of renewed equity market declines. The ANGL is set to outperform US stocks significantly over the coming year under most plausible macroeconomic scenarios.

ANGL Vs SPX Total Return (Bloomberg)

The ANGL ETF

The VanEck Fallen Angel High Yield Bond ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the ICE US Fallen Angel High Yield 10% Constrained Index (H0CF), which is comprised of below investment grade corporate bonds denominated in US dollars, issued in the US domestic market and that were rated investment grade at the time of issuance. The average credit rating is BB, with 85% of issuers in this category, which explains the high yield to maturity of 7.3%. The weighted average maturity of the fund is 9.6 years, but the sensitivity to interest rate risk is relatively low, with an effective duration of 5.2 years. The expense fee is 0.35%.

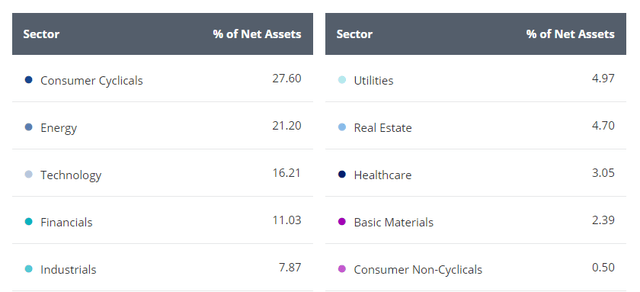

The ETF has outperformed most corporate bond funds over this period due to its outsized yield reflecting the non-investment grade nature of the fund, while its relatively low duration has allowed it to avoid the heavy losses seen in long-term corporate bond ETF such as the Vanguard Long-Term Corporate Bond ETF (VCLT). The fund's exposure to credit risk and has seen its performance closely track US stocks over this period, albeit with lower volatility, with a 0.45% beta to the S&P 500. In terms of sector weighting, consumer cyclicals dominate, although energy also has an outsized weighting, particularly relative to the S&P 500.

ANGL ETF Sector Weightings (Vaneck.com)

Significant Outperformance Likely Versus Stocks

The ANGL's underperformance relative to the S&P 500 over the past 11 years has primarily been the result of the expansion of equity valuation multiples. The S&P 500 has returned almost 13% annually over this period, which was driven broadly by a 5% annual rise in sales, a 6% rise in the price-to-sales ratio, and an average dividend yield of around 2%. The expansion in valuations fully explains the S&P 500's outperformance versus the ANGL.

The S&P 500 dividend yield is now at 1.7%, 5.6pp below the yield to maturity on the ANGL. With long-term breakeven inflation expectations having fallen back to 2%, and real GDP growth likely to average less than 1% over the coming years, investors are likely to see far stronger returns in ANGL than US stocks, while also suffering much less in the event of a credit crunch.

My core view is that US Treasury yields and equity valuations will move lower over the coming years in response to weakening growth, as we saw in the 2008/09 period. This should allow the ANGL to outperform the S&P 500 by high single digits annually.

A Repeat Of The Late-1990s Period Is The Main Risk

The main risk comes from a repeat of the late-1990s environment. Long-term prospective bond returns were incredibly attractive relative to stocks in the mid-1990s, with equity valuations and bond yields both elevated. However, despite the Fed driving up interest rates even further, equities continued to move higher, driven by a small number of technology stocks, and this forced the Fed to keep its focus on tightening, driving an even deeper wedge between the performance of stocks and Treasury bonds. As a result, the S&P 500 outperformed corporate bonds significantly from already-extreme levels.

We cannot rule out a repeat of this scenario. Equities have so far shrugged off the impact of rising real bond yields, with a small number of technology stocks driving the market higher. A renewed rise in inflation expectations would add to the risk of such an occurrence, as it would put upside pressure on Treasury yields and upside pressure on stocks. That said, with a yield of 7.3% and a duration of just 5.2 years, ANGL is highly likely to generate strong real returns unless we see a credit crunch drive up default risk. In such a scenario, the ANGL would likely outperform stocks significantly as we saw during the Covid crash.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ANGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.