IEV: Large-Cap European Stocks Offer Great Value

Summary

- IEV invests in large-cap European stocks across a range of developed markets in Europe.

- The fund is well diversified, both geographically and by sector, also offering an implicit USD hedge.

- On the basis of consensus earnings growth estimates, IEV offers a strong potential return profile.

- While global risks remain, I think markets are still priced pessimistically, and IEV should perform well over the long run.

FrankRamspott

Introduction

iShares Europe ETF (NYSEARCA:IEV) is an exchange-traded fund that provides investors with exposure to a broad range of European companies. The ETF's expense ratio is 0.58% as reported by iShares, with a median bid/ask spread of just 0.02%. The fund's benchmark is the S&P Europe 350 Index. In total, the fund had net assets under management of $1.9 billion as of May 8, 2023, spread across 362 holdings as at the same date. The ETF was launched July 25, 2000.

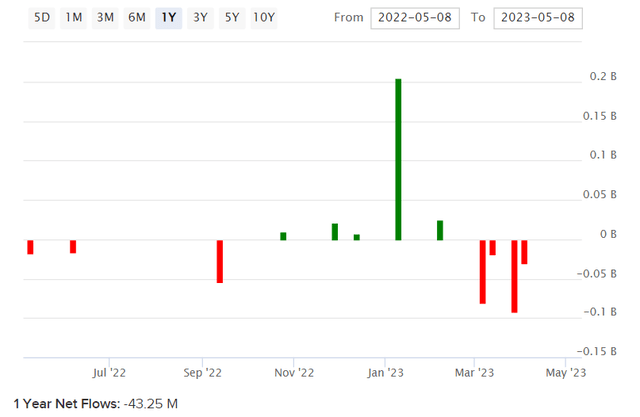

IEV's net fund flows (as pictured below) have been negative over the past twelve months, although they have been somewhat volatile as well. Net fund flows turned positive around and into 2023 (notwithstanding outflows most recently) with energy prices abating in the region (helping to provide some optimism to stem tepid investor sentiment).

ETFDB.com

I think it is worth reviewing IEV at this juncture, as European stocks might still offer some opportunity. The fund has appreciated by about 12.6% this year (excluding dividends) as compared to the S&P 500's 7.8% at the time of writing. There is no doubt regional political risk to consider. Nevertheless, riskier markets can provide opportunity if undue discounts are applied by the market. This ETF's benchmark, and thus the portfolio itself, is built on the 350 leading blue-chip companies drawn from 16 developed European markets, placing the fund in a lower-risk category in theory (bar political risk).

Holdings and Concentration

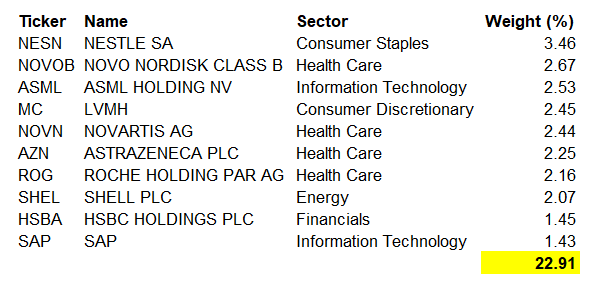

IEV's top 10 holdings are pictured below as of May 8, 2023. As you can see, the top 10 holdings represented only 22.91% of the fund, making the ETF's portfolio well diversified and not subject to any important level of concentration risk. There is also little focus on any particular sector.

Data from iShares.com

iShares do however tell me that IEV's key sector exposures (across the entire fund) are Financials (at 17%), Health Care (16%), Industrials (14%), Consumer Staples (13%), and Consumer Discretionary (12%). On the whole, the portfolio is not geared toward any particular phase of the business cycle, with a spread across cyclical, sensitive, and defensive sectors. In effect, the ETF is more attuned to "beta" rather than "alpha", although the fund is still potentially attractive as an opportunistic diversifier.

Return Profile

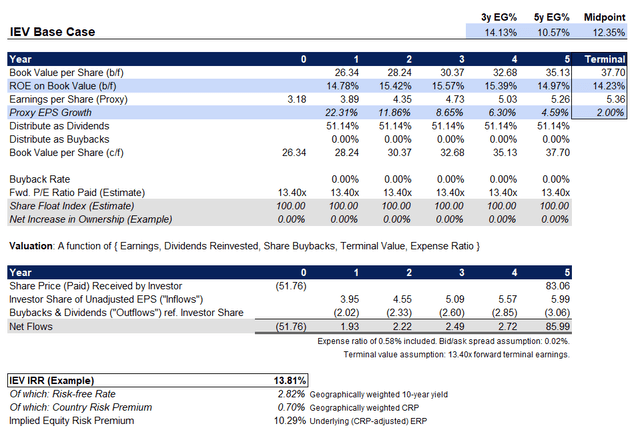

We can build a basic model by first referencing some important data, namely the IEV's benchmark (previously cited) as a proxy. The most recent factsheet for the fund's benchmark provides trailing and forward price/earnings ratios of 16.39x and 13.4x, respectively, as of April 28, 2023. The price/book ratio is stipulated as being 1.98x, with an indicative dividend yield of 3.12%, which I use to calculate earnings distribution rate of circa 51.1%.

Separately, Morningstar report a three- to five-year earnings growth expectation of 10.57%, with a similar forward price/earnings ratio and price/book ratio. This implies a forward return on equity of 14.1%, vs. the benchmark index's 14.78%, however I will build the model upon the index's values for consistency (the relative consistency between the two data sources provides support for the model). Ultimately, my model suggests that IEV offers a five-year IRR potential of some 13.8% per annum.

Author's Calculations

This is a strong return. I should also note that I have calculated the weighted risk-free weight by the geographical weightings of the portfolio using data from World Government Bonds. I referenced Professor Damodaran for country risk premia estimations. The top geographical exposures are currently the United Kingdom (23%), France (19%), Switzerland (16%), and Germany (13%). I also calculate IEV's fund beta (relative to my chosen benchmark, the U.S. S&P 500 index) as being 1.15x on a three-year basis. Nevertheless, the volatility-adjusted return is still strong, and the risk-adjusted underlying equity risk premium is about 10.29%, which is objectively high.

A typical equity risk premium for a mature market like the United States might be in the region of 3.2-5.5%, depending on your time frame and levels of short-term risk aversion. So, IEV's notably high ERP suggests mis-valuation with significant upside potential. Further, I did not adjust the forward price/earnings ratio of 13.40x. However, given the maturity of the sectors and high rate of earnings distributions it is probably worth holding this constant to be conservative rather than unintentionally generous.

If I were to almost halve the expected growth rate, the IRR would fall to about 9.1%, with an underlying ERP of 5.61%, which is (on a risk-adjusted basis) about fair value. It would seem as though the market is more pessimistic than analysts, but once again this provides plenty of upside potential should earnings meet longer-range consensus estimates. I would think the key is that inflationary pressures abate, leaving room for reductions in the long-run risk-free rates, but without further exacerbations on the political front (most pertinently the current Russo-Ukrainian War) and without a surprise recession.

Conclusion

Given that IEV is invested in blue-chip companies in a wide range of developed European markets, I think the fund offers great value. I also like the implicit FX hedge, as the fund owns mainly euro-denominated stocks (with notable GBP and CHF exposures as well, in the United Kingdom and Switzerland). Therefore, in summary and following my typical valuation process, I would take a bullish stance on this ETF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.