SCHM: Downward Earnings And Sales Revision Will Cause More Downside

Summary

- SCHM owns a portfolio of about 500 U.S. mid-cap stocks.

- Mid-Cap stocks have experienced a valuation contraction since 2022.

- However, the fund’s price may decline further given that a recession is likely to arrive in the second half of 2023.

NicoElNino

ETF Overview

Mid-cap stocks only represent about 10% of the total U.S. market. As a result, it is often overlooked. Should investors be owning mid-cap stocks now? In this article, we will analyze Schwab U.S. Mid-Cap ETF (NYSEARCA:SCHM) and provide our insights and suggestions.

Introduction

SCHM owns 500 mid-cap stocks in the United States. Although mid-cap stocks have experienced prices decline since 2022, this is likely not the end of the tunnel yet. Given that a recession is likely to arrive in the second half of 2023, many mid-cap stocks may still experience a significant decline in forward earnings and revenues. Therefore, SCHM’s fund price will likely continue to decline as the economy eventually enters a recession. At this moment, we think it is still premature to initiate a position. Investors should wait on the sidelines instead.

YCharts

Fund Analysis

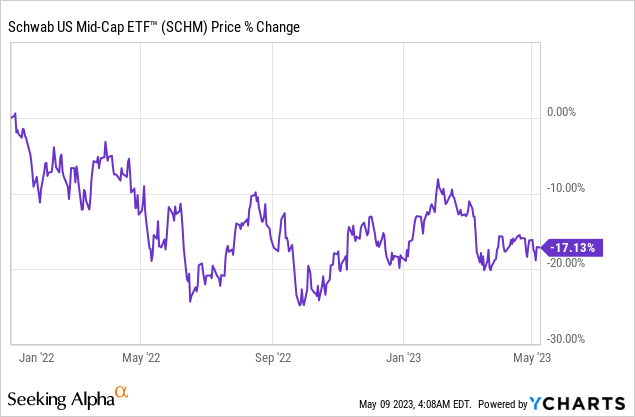

SCHM has stabilized after a dramatic decline last year

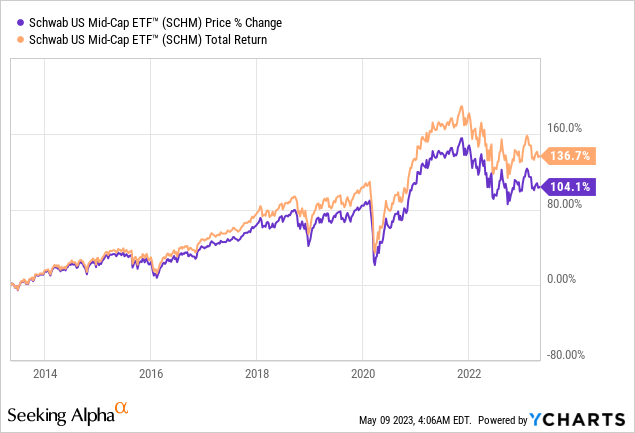

SCHM had an abysmal year in 2022 due to the Federal Reserve’s aggressive monetary tightening policy to combat inflation. The fund has delivered a peak to trough loss of nearly 25% from the beginning of 2022 to the low in October 2022. Fortunately, its fund price appears to have stabilized in 2023 and has recovered some of the losses. Still, the fund has delivered a loss of about 17.13% since January 2022.

YCharts

SCHM’s valuation has experienced significant contraction.

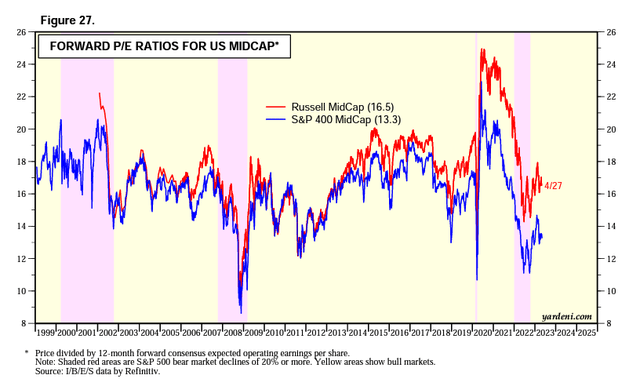

Below is a chart that shows the forward P/E ratios of the S&P 400 Mid-Cap and Russell Mid-Cap indexes. Stocks in these two indexes should provide a good representation of U.S. mid-cap stocks. Therefore, it should at least give us some sense of whether mid-cap stocks are overvalued or undervalued. As can be seen from the chart below, both two indexes have experienced significant valuation contractions since reaching their highs in 2020. As can be seen from the chart, the S&P 400 Mid-Cap’s valuation of 13.3x is now towards the low end of the historical range since 1999. In contrast, Russell Mid-Cap’s valuation of 16.5x is in the middle of its historical range.

What if there is going to be a recession coming up?

While the U.S. economy appears to be resilient with a strong job market, we believe there is a strong likelihood a recession will eventually be triggered. This is because persistently high inflation may force the Federal Reserve to keep the rate elevated for longer. Although the chance is slim, the Federal Reserve may even move the rate a lot higher in order to tame inflation. Given that the impact of the rate hike typically takes about 6 months to 12 months to ripple through the economy, we may soon see a decelerating economy. This should help bring down the inflation but also cause a recession.

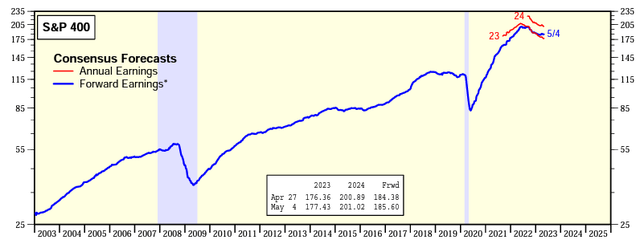

Below is the chart that shows the forward earnings of the S&P 400 Mid-Cap index in the past two decades. As can be seen from the chart, the index’s forward earnings have been revised significantly downward in the past two recessions. Although we are already seeing some earnings revisions lately, we believe there is still more room to be revised downward in the upcoming recession.

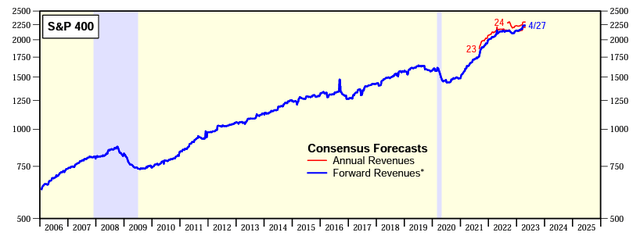

Below is another chart that shows the forward revenue of the S&P 400 Mid-Cap index in the past 20 years. As can be seen from the chart below, in the past two recessions (2008/2009, and 2020), forward revenues of mid-cap stocks in the S&P 400 index experienced revenue declines. This decline happened not before the recession but typically during it. Hence, it explains why that we have yet to see a forward revenue decline.

Both charts tell us that there were significant earnings and sales revision during the past two recessions. Since we are anticipating a recession coming very soon, we do expect forward earnings and sales to be revised downward. This will inevitably impact the prices of mid-cap stocks negatively.

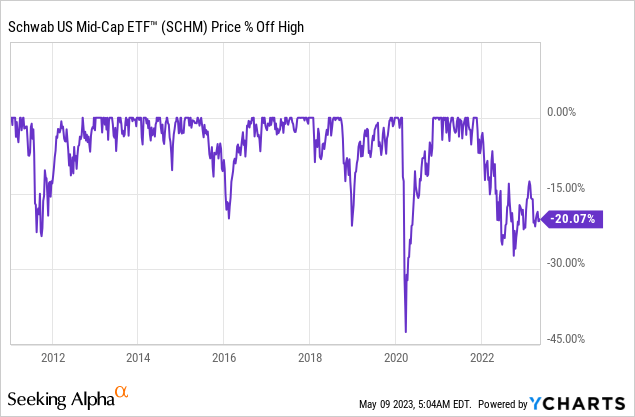

SCHM can decline significantly in an economic recession

We know that mid-cap stocks will experience significant earnings and revenue revisions. Here, we will look at how SCHM’s fund price will be impacted in a recession. As can be seen from the chart below, SCHM endured a loss of nearly 45% during the outbreak of 2020 pandemic. Since SCHM’s inception date was in 2011, we do not have the historical chart during the 2008/2009 recession. However, we do know that the S&P 400 Mid-Cap index declined by nearly 60% during the Great Recession in 2008/2009. Depending on the severity of the upcoming recession, we may likely see a decline of at least 30% if it is a mild recession and a decline more than 50% if it is a severe recession. Hence, there may be more room for SCHM to decline.

YCharts

Investor Takeaway

As we have analyzed in our article, we do not have a positive view of SCHM in the next 6 months due to the possibility of a recession. The likelihood of a further decline in SCHM’s fund price is very high. Therefore, we think it may be better to stay on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.