YOLO: Reintroduction Of SAFE Banking Act Creating New Opportunities For Cannabis ETFs

Summary

- YOLO invests in cannabis companies that are both pharmaceutical and recreational in nature.

- YOLO and similar funds have struggled to gain momentum during the past two years amid various financial and legal restrictions targeted at marijuana institutions.

- The Secure and Fair Enforcement (SAFE) Banking Act is pending review by the Senate after struggling to gain approval, which could raise the outlook for the cannabis industry.

- I rate YOLO a Hold as though the reintroduction of the SAFE Banking Act could reinstate some hope, cannabis could still very much be in the crosshairs of the legal system.

IRA_EVVA

The cannabis industry has shown in the past year to be capable of significant revenue with ample room for growth by the end of the decade. The problem during this same time was bringing in profits of the same caliber. Even with ongoing legalization of recreational marijuana, this market is burdened by various layers to profitability. One of the most prominent hurdles is cannabis businesses' limited access to traditional banking services, as marijuana is still a schedule 1 drug and therefore illegal on a federal level.

The Secure and Fair Enforcement (SAFE) Banking Act was introduced in 2019 as a response to financial barriers within cannabis companies. The SAFE Banking Act aims to provide legal protection to banks that wish to do business with cannabis institutions, sparing these banks the fear of being persecuted. This bill has failed to pass through several times at this point, but has recently been reintroduced. If the SAFE Banking Act were to pass through this time around, cannabis business would ideally be brought into the mainstream and allowed to operate, expand, and compete in the broader market. The outlook may be looking up for this industry, but success is still not guaranteed. On this note, I rate the AdvisorShares Pure Cannabis ETF (NYSEARCA:YOLO) a Hold.

For more than two years now, this ETF has primarily declined, which displays how hard it has been for cannabis institutions and startups to get up and stay on their feet. Though demand for marijuana products increased during this same time, many of these businesses are capital-intensive in nature, and were also operating on a cash-basis due to previously-described financial restrictions. However, the passing of the SAFE Banking Act could mark a new beginning for cannabis assets. Ongoing legalization as well as the elimination of funding barriers could prompt more mergers and acquisitions (M&A) and initial public offering (IPO) activity in the cannabis space. This could enhance the circulation of capital and ultimately drive up the price of YOLO.

Strategy

This ETF does not track a specific index, and holdings are instead actively picked by portfolio managers with the goal of fully capturing the growth potential of the cannabis industry. Qualifying companies must derive at least half of their net revenue from the marijuana and hemp business. This may also include companies registered with the Drug Enforcement Agency ("DEA") exclusively for the purpose of research and development towards marijuana products. YOLO's active management aspect allows this ETF to potentially capitalize on opportunities and trends that passively-managed funds would miss. However, this same component could also burden YOLO with higher fees compared to its passively-managed counterparts.

Holdings Analysis

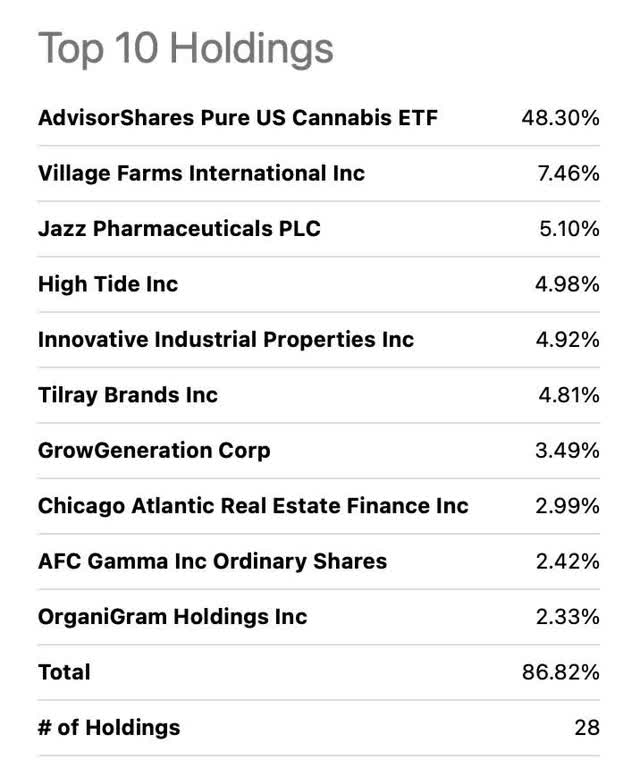

The majority of the holdings within this ETF identify as healthcare companies, which account for just over half of the total portfolio. In addition to healthcare, YOLO contains names within fields like real estate, consumer defensive, and consumer cyclical.

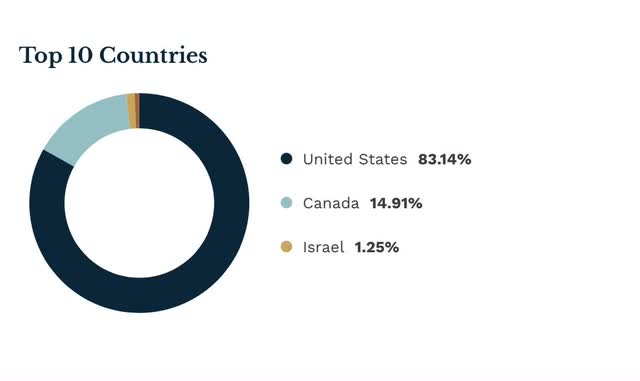

Companies held within YOLO primarily reside in the United States, with just over 15% of holdings appearing outside of the country.

On an individual holdings basis, POTX allocates nearly half of the entire portfolio to the AdvisorShares Pure US Cannabis ETF (MSOS). I believe this makes YOLO a somewhat hedged version of MSOS, as it is a highly-similar ETF with extra cushioning in the form of additional holdings. This may decrease the volatility of YOLO compared to MSOS.

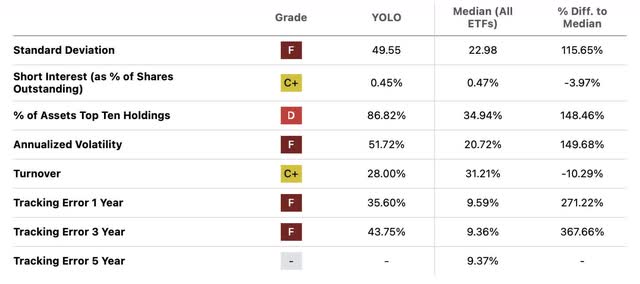

Depicted below is the risk profile for MSOS.

Depicted below is the risk profile for YOLO.

Although YOLO is still much less liquid than MSOS, it could be a less volatile alternative for more risk-averse investors that are looking to gain exposure to the cannabis scene. However, investors might also want to keep in mind that this unique composition makes YOLO very top-heavy.

Strengths

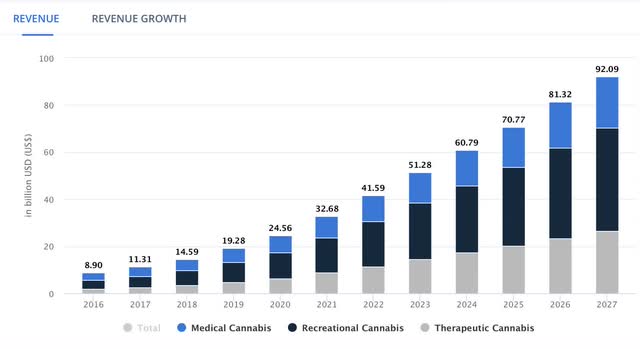

The cannabis market has ample room for growth, and knocking down specific barriers to profitability in the coming periods could unleash the beast. At a CAGR of roughly 16%, the global cannabis market could generate over $90B in revenue by 2027.

Global Cannabis Industry Growth Forecast (Statista )

Recreational marijuana businesses are projected to be the largest contributors to growth in the marijuana market, as these institutions have been on the rise. This is a result of the concurrent rise in demand for recreational marijuana, which could well continue down the road.

As a small fund tracking an emerging industry, this ETF could serve investors quite well during a market turnaround. As future rate hikes and a recession come into vision, the prospect of subsequent economic recovery also becomes more tangible. Therefore, I think that sooner rather than later, more investors could gravitate towards small-cap, volatile assets that have more room for growth. This aspect could serve YOLO well in the coming periods.

Weaknesses

Many of this ETF's metrics are rather subpar, which likely stem from its small-cap nature and general lack of momentum during the last two years. To start, YOLO has a rather high expense ratio at 0.88%. . This indicates that this ETF might require that investors pay substantial fees for a fund that generally produces lackluster and erratic returns. Additionally, this sets it apart from alternatives like the Global X Cannabis ETF (POTX), which has a similar objective, but for a little more than half the cost.

Though YOLO is statistically less volatile than MSOS, this ETF is still quite volatile. YOLO's standard deviation is almost 50 and its annualized volatility is slightly over 50%. Both of these metrics are drastically higher than that of the S&P, displaying how YOLO is prone to delivering erratic returns compared to the broader market. This ETF could test the patience and self-control of many, including those with high risk tolerance.

Opportunities

In addition to creating new job opportunities, increased corporate activity in the cannabis space could make way for new products and innovation. For example, THC beverages could become an alternative to alcoholic beverages as marijuana hits the mainstream. Such cannabis-infused beverages could be more attractive to many as they're often less fattening and harmful to the liver. In this regard, THC beverages could increasingly appear on store shelves if the SAFE Banking act succeeds. Furthermore, this same development could enhance cannabis delivery services and cannabis tourism, which could altogether drive up the price of YOLO.

Threats

One of the greatest outstanding concerns for this ETF and the broader cannabis market is the SAFE Banking Act failing this time around. Though the cannabis industry has gained ample support from society and local governments since then, this industry has many hurdles to jump. On top of limited access to funding, cannabis institutions are also subject to supply chain disruptions, strict quality control, and stigma related to health issues. All of these conditions alike could hinder the profits of cannabis companies and block momentum in YOLO.

The long term-health consequences of marijuana abuse are also still being researched and could in the blemish the image of recreational marijuana with time. For this same reason, the public's opinion of marijuana is still quite mixed. Until the public's opinion moves more unidirectionally, many investors may remain hesitant to dabble in cannabis ETFs like YOLO.

Conclusion

The cannabis industry has been fighting an uphill battle for the last few years even as legalization continues and recreational marijuana becomes more widely-accepted and used. For this reason, cannabis companies have struggled to gain momentum amid all the financial and legal barriers. Cannabis ETFs have suffered greatly as a result. However, the upcoming SAFE Banking Act hearing has reignited some hope in cannabis investors, and could provide YOLO with positive momentum if the bill passes. In the long-term, I could also see similar bills emerging, regardless of how the SAFE Banking Act hearing turns out in the meantime. For these reasons, I rate YOLO a Hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.