Datadog Q1 Earnings: First Signs Of Peak Cloud Optimization

Summary

- Datadog reported better-than-feared results for its 2023 Q1 quarter.

- Some fundamental trends and management comments suggested that the cloud optimization cycle could subside slowly. This could possibly lead to reaccelerating revenues in the second half of 2023.

- Long-term growth drivers remain still intact, while valuation is also reasonable at current levels.

borchee/E+ via Getty Images

Introduction

Worrisome comments from Amazon (AMZN) CEO, Andy Jassy scared investors in many cloud names at the end of April. Thanks to this, the bar was set quite low for Datadog’s (NASDAQ:DDOG) 2023 Q1 earnings. The company managed to jump this hurdle by beating expectations to a slight extent on the 4th of May. On the top of that, hints from management and some fundamental trends suggested that the sudden slowdown in topline growth the company experienced in recent quarters could soon come to an end. This news gave renewed momentum to shares, which could mark a long-term turnaround in my opinion after 1.5 years of lackluster performance.

Topline growth: Better-than-feared with early signs of a turnaround

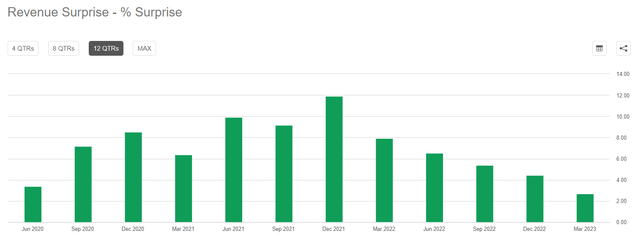

Datadog reported results for its 2023 Q1 quarter last week slightly beating analysts’ estimates. Revenues came in at $482 million (dragged down by $5 million resulting from a service outage) growing ~33% yoy resulting in a ~3% beat:

Although the magnitude of the beat has been lower than investors got used to previously, shares rose ~15% in the aftermath. I believe one reason behind this can be found in the company’s guidance for Q2, which was approximately in line with analysts’ estimates ($500 million at the midpoint vs $501 million). After Amazon CEO, Andy Jassy made some worrisome comments on AWS growth on the company’s earnings call on the 27th of April, stock prices of SaaS companies predominantly conducting business in the cloud began to fall sharply. I believe that after this intense selling pressure it was a relief that Datadog management didn’t provide any serious negative surprise with the Q2 guide, and in the top of that hinted on some improvement in Q1 compared to Q4 last year.

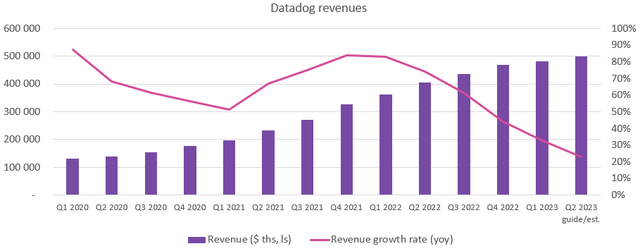

Looking at current top line growth trends based on the above we can see the following picture:

Created by author based on company filings

With the $500 million guide from management revenues would grow 23% yoy in the 2023 Q2 quarter, which would mean another steeper drop from 33% in Q1. However, if we factor in a ~4% beat on the topline revenues would grow 28%, making things look somewhat better. Based on the earnings call management provided a conservative guide for Q2, although they shared that the month of April hasn’t been characterized by further deterioration in business conditions. This could hint probably on further possible upside and suggest that peak cloud optimization is behind us.

Another sign that business conditions could stabilize in the upcoming quarters is the development in remaining performance obligations (RPOs). Although these commitments vary in duration from quarter-to-quarter Datadog expects to recognize all of them in the next 24 months, which makes them a good gauge for future business conditions. RPOs grew 33% yoy to $1.14 billion after growing 30%, and 31% in the 22 Q4 and 22 Q3 quarters, respectively. This could suggest that a slow turnaround could be on the corner and yoy revenue growth rates could possibly reaccelerate in the second half of the year when comps will be significantly easier to beat.

Further improving margins

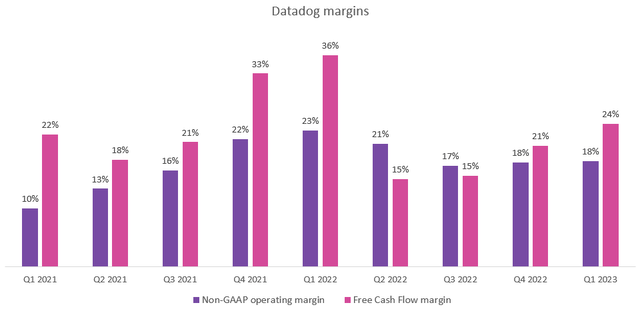

Besides stabilizing topline growth, margins at Datadog continued to impress in the Q1 quarter. Non-GAAP operating margin stayed at 18%, while FCF margin increased further to 24%:

Created by author based on company filings

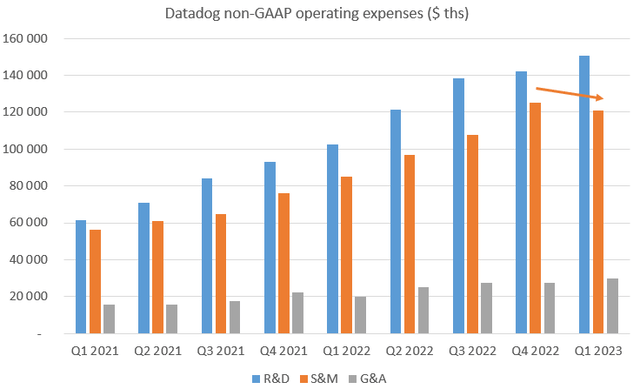

After increased investments during 2022 management suggested that in 2023 R&D and S&M spending will grow at a somewhat lower pace. Looking at the different expense categories we can see that this wasn’t just a promise:

Created by author based on company filings

While both R&D and S&M expenses continued to grow above the rate of revenues in the Q1 quarter, there was a qoq decrease in S&M spending suggesting conscious cost control in uncertain economic times. Although the impact of this on revenues remains to be seen, it’s a good sign that margins could have further room to grow in the upcoming quarters.

This is especially true in the light of fact that management shared the following information on the Q1 earnings call: “We now plan to grow our non-GAAP operating expenses excluding COGS in fiscal year 20 by approximately 30% year-over-year with an exit rate in Q4 in the low 20s percent year-over-year.” Currently, Non-GAAP Opex grew 45% yoy in the Q1 quarter, so a decrease to low 20s should significantly aid the bottom line in 2023.

If we calculate with revenues of $2.09 billion for 2023 (based on management's most recent guidance) and assume 30% yoy growth in non-GAAP Opex it would result in a non-GAAP operating margin of 16.5% for the year. If Datadog beats its own FY23 guidance by 5%, which is a realistic scenario in my opinion non-GAAP operating margin would jump to 19.6%. This shows that there is still leverage in the operating model of the company and margins could easily keep expanding for a while.

Strong long-term growth prospects

After surpassing the $2 billion ARR mark in the Q1 quarter it’s time to ask the question whether revenues of Datadog can grow dynamically further after reaching such a scale?

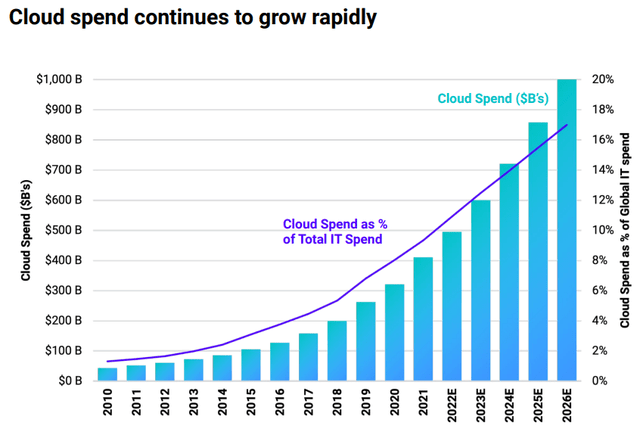

Taking a quick look at the usual earnings slides shows that there is still ample room grow. As an example, if we look at total cloud spending it could double from 2022 levels in the upcoming 4 years:

Datadog 23 Q1 earnings presentation

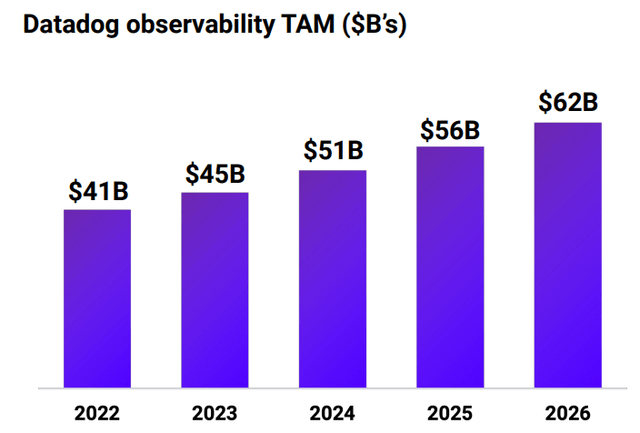

Taking a closer at Datadog’s core market, observability, a ~50% growth is forecasted for the upcoming 4 years:

Datadog 23 Q1 earnings presentation

Considering that the company reached ARR of $2 billion only this quarter there is a long runway for expanding further.

An important step in the company’s history has been the push into IT security in 2020, expanding its reach beyond observability. This has opened new opportunities, which I tried to quantify in my previous article on the company (Datadog: Rule of 50 for 12x EV/Sales, Finally Valued Fairly. Currently, already more than 5,000 customers of Datadog (~20% of total) use at least one security related product, which shows the success of this effort. As these customers increase in scale and others join them this pillar should be also an important growth driver on the longer run.

Finally, a few thoughts on AI, a currently unavoidable topic, especially when it comes to data monitoring. Datadog won’t be the major direct beneficiary from increased compute and storage requirements that are used to train machine learning models. However, the increasing amount of data, which supports these models needs to be observed, where the solutions of the company come into play. Another benefit for Datadog is that AI increases the productivity of developers, which results in faster and easier application development. Of course, these apps need to be observed as well.

One potential drawback of AI could be that some data which are currently observed by Datadog could be replaced by new technologies making the company’s involvement unnecessary. Based on the Q1 earnings there are no such signs until know, but it’s worth to look out for this in my opinion.

Valuation

Considering the company’s market cap of $25.6 billion, and 2023 expected revenue of $2.09 billion shares trade currently at a forward P/S multiple of 12.25. Although paying more than 10x sales for a stock could seem a lot, it’s worth to consider the company’s above average topline growth and improving margins.

If we look out a few years into the future we can see that for 2027 Datadog could reach revenues of $5.84 billion, almost 143% more than predicted by analysts for 2023. Assuming constant share price this would bring down the forward P/S ratio for the beginning of 2027 to ~5. Calculating with a net margin of 20% - which based on current 20%+ FCF margin is a realistic assumption for the longer run in my opinion – this would result in a forward P/E ratio of 25. I believe this would be a very conservative valuation for shares, as it would close to the S&P500 IT sector average of 23.7, consisting mostly of companies with much slimmer growth prospects. This makes me conclude that current valuation is not exaggerated and shouldn’t scare off investors to invest in the shares for the long run.

Conclusion

After 1.5 years of struggling Datadog shares could regain their old shine as a fundamental turnaround could be soon on the corner. Now could be a good time to buy the rumors even if it is associated with somewhat higher risks. Repricings like this used to happen quickly.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DDOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.