Li Auto: Momentum In Premium Chinese EVs Can Send Shares Higher

Summary

- Li Auto reported Q1 earnings that beat expectations.

- The company is benefiting from strong demand in China for its latest plug-in hybrid SUVs.

- An expectation for earnings to accelerate alongside several growth catalysts keeps us bullish on the stock.

- Looking for a portfolio of ideas like this one? Members of Conviction Dossier get exclusive access to our subscriber-only portfolios. Learn More »

Fahroni/iStock via Getty Images

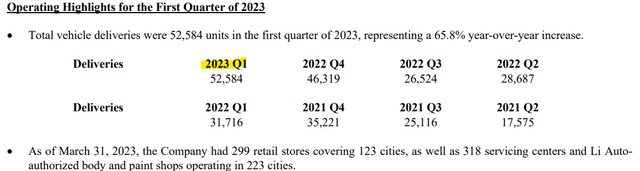

Li Auto Inc (NASDAQ:LI) stands out as a leader in the premium segment of electric vehicles in China. The company just reported its latest quarterly results, beating expectations as it reached 53k deliveries, a 66% increase over last year.

A big theme is the company's strong operating momentum, rebounding compared to the supply chain disruptions that defined 2022. The group's expanding lineup of range extender EVs "plug-in hybrids" has resonated with consumers, based on positive reviews and the convenience of the long driving range coupled with best-in-class technology.

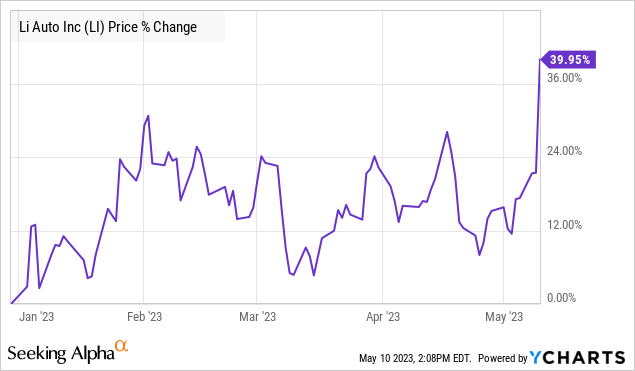

Even as shares of LI have rallied in recent months, we see room for more upside with an expectation that earnings accelerate. Several growth catalysts and overall solid fundamentals support a positive outlook for LI.

LI Earnings Recap

Li Auto posted a Q1 non-GAAP earnings per American depositary shares (EPADS) of $0.20, which beat the consensus estimate by $0.09. Revenues reached $2.7 billion, a 97% year-over-year increase capturing the ramp-up of deliveries for Li's newest models including the Li L7 that just launched in February. Higher average pricing with the new models commanding a premium based on more features has added to the top-line strength.

The gross profit climbed by 77% y/y to $558 million, despite some volatility in the vehicle margin at 19.8% compared to 22.4% in Q1 last year. A shifting product mix particularly during a period of rapid growth, is expected to lead to higher margins going forward as vehicle production and deliveries continue climbing.

Keep in mind that Li Auto is profitable, with a net income of $136 million in Q1, reversing a loss of -$1.7 million in the period last year. Free cash flow of $976 million added to the balance sheet cash position that ended the quarter at $9.5 billion, against $1.7 billion in debt.

Management projected optimism toward current trends during the conference call citing the Li L7 becoming the best seller in China in the large SUV category. This follows the six-seater subsegment where the L8 has maintained its leadership since its introduction.

For guidance, Li Auto is targeting Q2 deliveries to be around 78.5k, representing a sequential 48% increase just over this latest Q1. This could be enough to reach the forecasted revenue between $3.5 billion and $3.8 billion, representing an increase of 187% y/y at the midpoint.

What's Next For Li Auto?

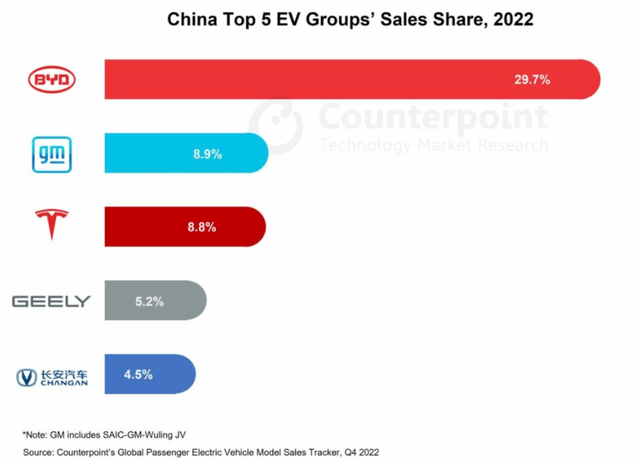

The attraction of Li Auto is that the brand has managed to differentiate itself from other Chinese EV manufacturers like NIO Inc (NIO), BYD Company (OTCPK:BYDDF), and XPeng Inc (XPEV) that are focusing more on budget-friendly and mass market options. For context, compared to the reported 26k deliveries LI in April, China is expected to sell more than 8 million EVs in 2023.

From its relatively small size, the opportunity for Li is to capture overall market share from what remains under 1% while consolidating its lead in the key premium SUV segments, representing a unique demographic of target customers.

Beyond the current sales momentum, the next big catalyst for the company will be the launch of a new full-battery electric vehicle (BEV) platform by next year. The goal is to expand the lineup to five hybrid models and five BEVs by 2025. Already approaching an annual run rate of over 120k vehicles, a separate new factory in Beijing is set to come online with an annual capacity of 100k vehicles of the flagship models, highlighting the growth runaway.

Separately, efforts to introduce autonomous driving capabilities while expanding a network of charging stations to reach 3,000 by 2025 are part of the company's strategic roadmap.

According to consensus estimates, Li Auto is expected to reach $13.4 billion in revenue this year, more than double the 2022 result. That tailwind should carry over into 2024 as production scales with 50% higher revenue. From the EPS forecast for 2023 at $0.35, the market sees earnings increasing again 76% in 2024.

There's a lot that can happen over the next two years, but we can hold some confidence that these figures are supported by the sales runway against the capacity headroom. Very impressive by any measure.

In terms of valuation, LI is trading at 71x 2023 consensus EPS, or 41x looking ahead to next year. While pricey, the multiples are consistent with the financial momentum. With a 1.3x enterprise value to forward revenue multiple, LI is at a premium to other Chinese EV makers like NIO and XPEV closer to 1.0x, but still a wide discount compared to Tesla Inc (TSLA) at 6x. We make the case that LI's valuation can benefit from some multiple expansion with an upside on the earnings side as it manages to push pricing in its category of EV SUVs.

LI Stock Price Forecast

We rate LI as a buy with a price target for the year ahead at $37.50, representing a 55x multiple on the current consensus 2024 EPS. With shares breaking out above what had been a relatively tight trading range in recent months, the setup here is for further positive momentum.

The monthly deliveries update along with China vehicle sales data are key monitoring points. Into the Q2 earnings, we'll want to see an uptick in the vehicle margins and the trends in cash flow.

On the downside, the main risk to consider with LI is that results begin to disappoint, based on weaker-than-expected sales or from a deteriorating macro environment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.