Gerdau: A Good Income Stock, But Not The Right Moment To Buy

Summary

- Gerdau has robust fundamentals, excellent geographical diversification and trades at a forward price-to-earnings of roughly 5 times.

- The last earnings results showed a retraction in the company's top line due to the slowdown of the American market even though the steel market remains at stable levels.

- The low visibility of Gerdau together with its dividend yield instability affects the investment thesis as the fixed income market should continue to be a good alternative for retirement portfolios.

Editor's note: Seeking Alpha is proud to welcome Bernard Zambonin as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Lim Weixiang - Zeitgeist Photos

Gerdau S.A. (NYSE:GGB) is a Brazilian-based steel company that has a robust balance sheet, has been increasing its dividend payments for the last two years, and currently, in my view, has an attractive valuation when compared to its national and especially international peers.

I have been a Gerdau bull for a long time, but for now, I see that for those who have not yet added it to their portfolio, maybe waiting for some more time would be the best option. This is especially since the eventual slowdown of the global economy – as Gerdau already had a glimpse of in the last earnings results – should generate long-lasting impacts on steel demand.

Gerdau shares may suffer extra pressure throughout this year, since the scenario of high-interest rates, especially in Brazil, should disfavor investments in the civil construction sector. Therefore, there is a chance that the distribution of dividends may become less attractive than in previous years for investors wishing to add Gerdau to their portfolio as a high-yield stock.

Gerdau's Q4 Earnings

About two months ago, the Brazilian steel company Gerdau reported its March 1st earnings results below market expectations, missing both EPS by 12 cents and revenues by $171 million.

It was already expected that the company would face difficulties in the fourth quarter mainly due to the lockdowns in China that impacted the entire steel chain. However, the steel market in the past month was somewhat stable year-on-year, with a slight drop in production of about a 4.0 percent decrease compared to last year.

In the fourth quarter, Gerdau had total gross steel output of 2,866 metric tons, which comprised a 12.6% reduction on a year-on-year basis. Steel sales were reported at 2.672 million tonnes, a decline of 15.6% compared to the same period of the previous year.

This drop in volume however brought consequences for revenues, which were also lower in the period. In Q4, net revenues totaled R$17.9 billion ($3.31 billion), a drop of 16% year-on-year.

To make matters worse, in addition to lower revenues, there was also an increase in costs mainly due to reflections of high inflation concentrated in the US market under coal, petroleum coke, and natural gas. As a consequence, there was pressure on the company's margins in this period, reporting an operating margin of 12.9% compared to 22.1% YoY.

Business Fundamentals Remain at High Levels

Even though the company's latest quarterly results came in below expectations, Gerdau still presents robust results due to, in my view, good management in recent years. An example of this is mainly due to the geographical diversification that the company finds itself in through the expansion work developed in recent years.

Gerdau has expanded its innovation centers in Silicon Valley as well as in England, as well as other operational units in Latin American countries and Canada. Thus, today the Brazilian operation accounts for 42.2% while the American operation corresponds to 32.5%. The remainder is distributed between "specialty steels" and the South American operation.

Gerdau's revenues by geography (Gerdau IR)

This has meant that the company in recent quarters has had more robust results when compared to other national peers, for example. The interest rate of the Brazilian economy being at 13.75% has had an extra weight on the national demand and construction market for example in recent years.

When comparing Usinas Siderúrgicas de Minas Gerais S.A. (OTCPK:USNZY)(Usiminas) with Gerdau — its main peer in the Brazilian market — only 14% of its revenues come from international markets.

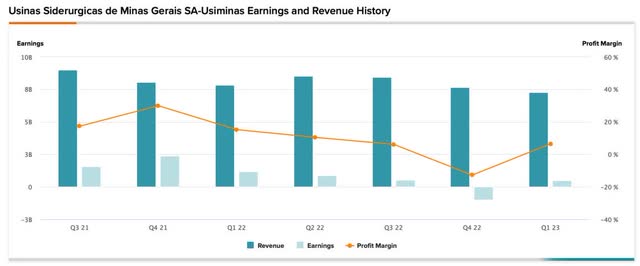

Notice by looking at the chart below that Usiminas has been struggling to generate earnings since the fourth quarter of 2021, mainly due to rising costs headed by high-interest rates mainly in Brazil.

Thus, according to the seasonality of the steel market, the lower diversification of sales geographically tends to have greater weight, as recent quarters have shown leaner earnings for Usiminas.

Usiminas' revenues, earnings, and profit margins since Q1'21 (TipRanks)

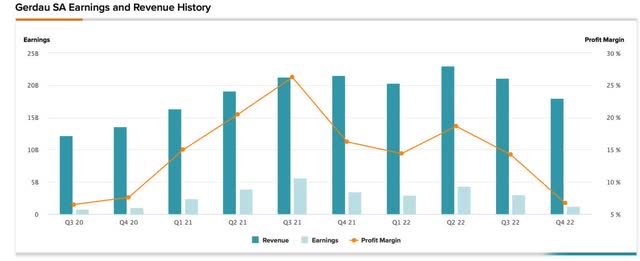

For Gerdau, although the company has also had difficulties reporting more expressive revenue, earnings, and margins figures in the last quarters, possibly the greater global diversification, in my view, has been key to keeping earnings at positive levels even in periods of low steel seasonality and high-interest rates in the Brazilian economy.

Gerdau's revenues, earnings, and profit margins since Q1'21 (TipRanks)

Valuations Look Cheap, At First Glance

Besides Gerdau's privileged position of geographic diversification, the company currently enjoys an attractive valuation, in my opinion, compared to its peers at first glance.

As we are no longer in an ultra-low interest rate scenario, based on Gerdau's relative non-GAAP forward price-to-earnings ratio, the Brazilian steel company trades at only 5.41 times.

It is noticeable how much of a discount Gerdau trades at when compared to its main domestic peer, Usiminas, which trades at a forward price-to-earnings non-GAAP ratio of 9.28 times. Now, comparing Gerdau to its major international peers, the discount is even greater.

The U.S. steel company Cleveland-Cliffs (CLF) has a similar market cap as Gerdau – about $7.6 billion market cap vs. $8.4 billion – and trades at a forward price-to-earnings non-GAAP ratio of 8.68 times. Even the Luxembourg-based company Ternium S.A. (TX), which also has a similar market cap, trades at a multiple of 5.67 times, also slightly above that of Gerdau.

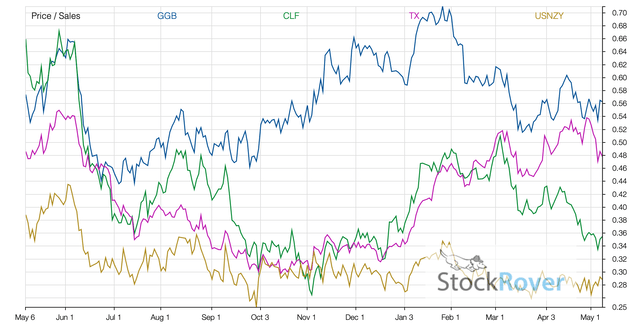

However, when we analyze the price-to-sales ratio, which compares Gerdau's market value to its revenues, even if by a small margin, Gerdau has higher multiples than its peers. See below.

Gerdau and peer's price-to-sales ratio within 1 year. (Compiled By Author using data from StockRover)

By noticing higher price-to-earnings multiples – 0.56 times Gerdau's – relative to its peers, and a lower forward price-to-earnings ratio than its peers, we can draw the following conclusions:

- As Gerdau has a lower forward price-to-earnings ratio and the higher price-to-sales ratio compared to its main peers, this can be an indication that the market is for the time being evaluating Gerdau on account of its generated revenue growth rather than its earnings.

- This can also be interpreted as a message that with a global economic slowdown affecting steel sales, rather than companies in the sector keeping up with their earnings, maintaining its revenue growth is the most important thing at the moment.

- Yet, it is possible to conclude with the case of Gerdau that if you put together a high P/S ratio and a low P/E ratio, this may indicate that the market is optimistic about Gerdau's potential revenue generation in comparison to its peers, but is also cautious about its ability to turn those sales into earnings. And as this becomes more evident in the coming quarters, if demand keeps slowing down, this should continue to put pressure on the company's share price, in my view.

Dividend Yield Instability and Lack of Visibility

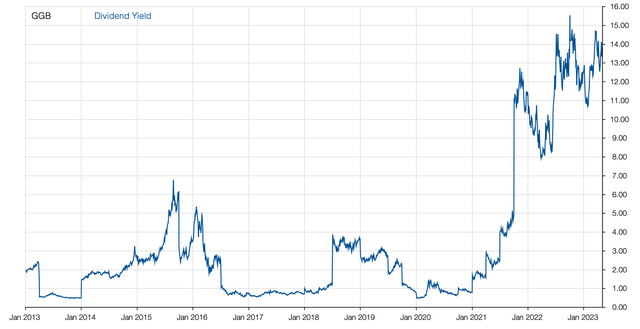

After mentioning a few of Gerdau's strengths, I see as the main yellow flags on behalf of the investment thesis that the company in the last decade has presented a very irregular dividend yield totaling an average of roughly 4% per year.

However, Gerdau currently has a dividend yield of 14.1% after growing dividends in the last two consecutive years.

Gerdau's dividend yield in 10 years. (Compiled By Author, using data from StockRover)

Gerdau has a dividend payment policy, according to its bylaws, of 30% of adjusted net income, and the company intends to maintain this form. Yet, the company must deal with an eventual slowdown in the global economy and continue to have its margins impacted.

Throughout this year, Gerdau's shares have been falling about 5%. In case the company's stock price remains under pressure and continues to fall, if the dividend payment remains the same, the dividend yield will increase. If the dividend yield falls due to a less robust net income, the dividend yield will decrease.

In other words, there are risks that the company will not repeat the high dividend yield of the past two years. Therefore, with the trend of rising interest rates continuing shortly, I see Gerdau becoming less and less interesting for investors looking to include the company in their retirement portfolios as a dividend income player.

Although the demand from the civil construction sector in Brazil — Gerdau's main market — has just reached record levels, for example in February of this year, when around ten thousand construction sites were opened, this is attributed to the demand from the industry still last year.

Gerdau's management itself has pinpointed that with the maintenance of high-interest rates in Brazil, it is only a matter of time before this impacts the purchasing power of other layers of society. Therefore, Gerdau's demand could be at risk in a scenario of prolonged high-interest rates in Brazil.

Finally, the other negative point that I see in Gerdau's investment thesis is due to its low visibility in the markets. The company somehow counts on a lack of attention and coverage from investors and analysts. With this, Gerdau shares have less attractive liquidity than other peers mainly in the American market.

The Bottom Line

Despite seeing Gerdau as a robust company in its fundamentals, with a wide advantage in the steel market due to its geographic exposure over its local peers and also with an attractive valuation, the current moment of the stock discourages an investment recommendation, in my opinion.

Critical factors such as the global slowdown and high-interest rates, especially in Brazil, leave the investment thesis in a dividend-paying company harmed – especially in the case of Gerdau, which faces an irregular trend to continue with its dividend yield growth at high levels. This, in my view, opens the door to more attractive fixed-income investments for now for investors with a more conservative profile looking for a retirement portfolio.

Even though I continue holding a long position in Gerdau for the long term especially due to its competitive position mainly in the Brazilian steel market along with its ability to continue paying good dividends in the long term, I believe that initiating a long position in the company at this moment may not be ideal. I would wait for a stronger indication of stabilization or reduction of interest rates mainly in Brazil or that Gerdau can even in this high-interest rate environment continue to generate demand in line with market expectations before recommending buying Gerdau shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GGB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.